0000893538false00008935382024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 1, 2024

SM Energy Company

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-31539 | 41-0518430 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 1700 Lincoln Street, Suite 3200 | | 80203 |

Denver, Colorado | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant's telephone number, including area code: (303) 861-8140

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common stock, $0.01 par value | SM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

In accordance with General Instruction B.2. of Form 8-K, the following information, including Exhibit 99.1, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On February 1, 2024, SM Energy Company (“Company”) issued a press release announcing certain estimated 2023 operating and financial results, as well as announcing the Company’s planned schedule for year-end 2023 reporting. As indicated in the press release, after market close on February 21, 2024, the Company plans to issue its fourth quarter and full year 2023 financial and operating results and 2024 operating plan, which will include an earnings release, a pre-recorded webcast discussing fourth quarter and full year 2023 financial and operating results and the Company’s 2024 operating plan, and an associated presentation, all of which will be posted to the Company’s website at sm-energy.com/investors. In addition, the Company scheduled a webcast and conference call for February 22, 2024, at 8:00 a.m. Mountain time/10:00 a.m. Eastern time to answer questions. The conference call is publicly accessible via webcast (available live and for replay) and telephone, and the press release includes instructions for accessing the webcast via the Company's website and dial-in information for the call. Availability of the webcast on the Company’s website is at the Company’s discretion and may be discontinued at any time. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | SM ENERGY COMPANY |

| | | |

| Date: | February 1, 2024 | By: | /s/ PATRICK A. LYTLE |

| | | Patrick A. Lytle |

| | | Vice President - Chief Accounting Officer and Controller |

| | | (Principal Accounting Officer) |

EXHIBIT 99.1

SM ENERGY REPORTS PRODUCTION BEAT ON LOWER CAPITAL COSTS

AND SCHEDULES YEAR-END 2023 EARNINGS RELEASE AND CALL

DENVER, CO February 1, 2024 - SM Energy Company (the “Company”) (NYSE: SM) today announced certain estimated 2023 results, including production, pricing, capital expenditures, return of capital and certain financial metrics. Highlights include:

•Production exceeded expectations. Production for the full year 2023 was 55.5 MMBoe or 152.0 MBoe/d, up 5% from 2022. Fourth quarter production was 14.1 MMBoe, or 153.5 MBoe/d, at 43% oil, which exceeded the high end of guidance.

•Capital efficiencies and discipline resulted in lower costs. Estimated capital expenditures of $989 million plus increased capital expenditure accruals and other of $81 million totaled $1,070 million(1) for the full year 2023. Fourth quarter estimated capital expenditures of $223 million plus increased capital expenditure accruals and other of $45 million totaled $268 million,(1) below the low end of the guidance range.

•Balance sheet is further strengthened. At year-end 2023, the outstanding principal amount of the Company’s long-term debt was $1,585 million and cash and cash equivalents were $616 million. This results in net debt(1) of approximately $969 million and is expected to contribute to a favorable improvement in the Company’s leverage ratio at year-end compared with September 30, 2023.

•Return of capital to stockholders increased to nearly $300 million in 2023. The Company repurchased and retired 6,930,835 shares of its common stock in 2023, including 614,729 shares in the fourth quarter. Return of capital to stockholders in 2023 totaled $299.6 million, inclusive of share repurchases and dividends paid. The Company ended 2023 with 115.7 million shares outstanding and approximately $215 million remaining under its authorized stock repurchase program.

Chief Executive Officer Herb Vogel comments: “2023 production and capital activity reflect well on our long-term track record of performance and commitment to operational excellence. I commend the SM Energy team for exceptional performance and delivering on key metrics in 2023! As we enter 2024 and an environment of increased macro uncertainty, we have prioritized a strong balance sheet that provides financial flexibility. We are well positioned for another great year given our low leverage, top tier asset portfolio and operational execution, as well as the ability to deliver meaningful capital returns to stockholders through the previously announced increased dividend and continued share repurchases. We look forward to presenting our full operating and financial results as well as our 2024 plan later this month.”

FOURTH QUARTER AND FULL YEAR 2023 RESULTS

| | | | | | | | | | | |

| PRODUCTION BY OPERATING AREA | | |

| Fourth Quarter 2023 |

| Midland Basin | South Texas | Total |

Oil (MBbl / MBbl/d) | 4,553 / 49.5 | 1,523 / 16.5 | 6,075 / 66.0 |

Natural Gas (MMcf / MMcf/d) | 15,187 / 165.1 | 18,309 / 199.0 | 33,496 / 364.1 |

NGLs (MBbl / MBbl/d) | 5 / - | 2,455 / 26.7 | 2,460 / 26.7 |

Total (MBoe / MBoe/d) | 7,088 / 77.0 | 7,029 / 76.4 | 14,118 / 153.5 |

| Note: Totals may not calculate due to rounding. | | |

•Fourth quarter production volumes were 14.1 MMBoe (153.5 MBoe/d) and were 43% oil.

•Higher than expected production volumes are a result of outperformance in South Texas, including a higher oil content.

| | | | | | | | | | | |

| Full Year 2023 |

| Midland Basin | South Texas | Total |

Oil (MBbl / MBbl/d) | 17,515 / 48.0 | 6,261 / 17.2 | 23,776 / 65.1 |

Natural Gas (MMcf / MMcf/d) | 59,814 / 163.9 | 72,555 / 198.8 | 132,369 / 362.7 |

NGLs (MBbl / MBbl/d) | 24 / - | 9,628 / 26.4 | 9,652 / 26.4 |

Total (MBoe / MBoe/d) | 27,508 / 75.4 | 27,982 / 76.7 | 55,490 / 152.0 |

| Note: Totals may not calculate due to rounding. | | |

•Full year production volumes of 55.5 MMBoe (152.0 MBoe/d) were up 5% from 2022.

•Production volumes were 50% from the Midland Basin and 50% from South Texas. Volumes were 43% oil, 17% NGLs and 40% natural gas.

| | | | | | | | | | | |

| COMMODITY PRICES BY OPERATING AREA | |

| Fourth Quarter 2023 |

| Midland Basin | South Texas | Total (Pre/Post-hedge)(1) |

Oil ($/Bbl) | $77.96 | $75.79 | $77.41 / $76.31 |

Natural Gas ($/Mcf) | $2.86 | $2.14 | $2.47 / $2.81 |

NGLs ($/Bbl) | nm | $21.91 | $21.92 / $22.57 |

| Per Boe | $56.21 | $29.65 | $42.99 / $43.45 |

| Note: Totals may not calculate due to rounding. | | |

| | | | | | | | | | | |

| |

| Full Year 2023 |

| Midland Basin | South Texas | Total (Pre/Post-hedge)(1) |

Oil ($/Bbl) | $76.95 | $74.43 | $76.28 / $75.15 |

Natural Gas ($/Mcf) | $2.93 | $2.10 | $2.48 / $2.85 |

NGLs ($/Bbl) | nm | $23.01 | $23.02 / $23.51 |

| Per Boe | $55.39 | $30.03 | $42.60 / $43.09 |

| Note: Totals may not calculate due to rounding. | | |

•In the fourth quarter, the average realized price before the effect of hedges was $42.99 per Boe, and the average realized price after the effect of hedges was $43.45 per Boe.(1) For the full year, the average realized price before the effect of hedges was $42.60 per Boe, and the average realized price after the effect of hedges was $43.09 per Boe.(1)

•In the fourth quarter, benchmark pricing included NYMEX WTI at $78.32/Bbl, NYMEX Henry Hub natural gas at $2.88/MMBtu and OPIS Composite NGLs at $26.89/Bbl. For the full year, benchmark pricing included NYMEX WTI at $77.62/Bbl, NYMEX Henry Hub natural gas at $2.74/MMBtu and OPIS Composite NGLs at $27.71/Bbl.

•The effect of commodity derivative settlements for the fourth quarter and full year was a gain of $0.46 per Boe, or $6.5 million, and a gain of $0.49 per Boe, or $26.9 million, respectively.

FOURTH QUARTER 2023 EARNINGS RELEASE AND Q&A CALL

February 21, 2024 – After market close, the Company plans to issue its fourth quarter and full year 2023 financial and operating results and 2024 operating plan, which will include an earnings release, a pre-recorded webcast discussing fourth quarter and full year 2023 financial and operating results and the Company’s 2024 operating plan, and an associated presentation, all of which will be posted to the Company’s website at sm-energy.com/investors.

February 22, 2024 – Please join SM Energy management at 8:00 a.m. Mountain time/10:00 a.m. Eastern time for the 2023 financial and operating results/2024 operating plan Q&A session. This discussion will be accessible via:

•Webcast (available live and for replay) - on the Company’s website at sm-energy.com/investors (replay accessible approximately 1 hour after the live call); or

•Telephone - join the live conference call by registering at http://event.choruscall.com/mediaframe/webcast.html?webcastid=KBkYnF9t. Dial-in for domestic toll free/International is 877-407-6050 / +1 201-689-8022.

DISCLOSURES

FORWARD LOOKING STATEMENTS

This release contains forward-looking statements within the meaning of securities laws. The words “demonstrate,” “expects,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this release include, among other things, the expectation for 2023 results

to present lower leverage. These statements involve known and unknown risks, which may cause SM Energy's actual results to differ materially from results expressed or implied by the forward-looking statements. Future results may be impacted by the risks discussed in the Risk Factors section of SM Energy's most recent Annual Report on Form 10-K, as such risk factors may be updated from time to time in the Company's other periodic reports filed with the Securities and Exchange Commission. The forward-looking statements contained herein speak as of the date of this release. Although SM Energy may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so, except as required by securities laws.

FOOTNOTE 1

Indicates a non-GAAP measure or metric.

To supplement this presentation of certain financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company has provided the non-GAAP measure and metric, net debt and post-hedge pricing, respectively, which are used by management and the investment community to understand financial leverage and the effects of commodity derivative settlements on average realized price, respectively. The Company believes this measure and metric are widely used by the investment community, including investors, research analysts and others, to evaluate and compare financial leverage and pricing, respectively, among upstream oil and gas companies in making investment decisions or recommendations. The measure and metric, as presented, may have differing calculations among companies and investment professionals and may not be directly comparable to the same measure and metric provided by others.

Net debt is calculated as the total principal amount of outstanding senior notes plus amounts drawn on the revolving credit facility less cash and cash equivalents.

Post-hedge is calculated as the average realized price after the effects of commodity derivative settlements.

ABOUT THE COMPANY

SM Energy Company is an independent energy company engaged in the acquisition, exploration, development, and production of oil, gas, and NGLs in the state of Texas. SM Energy routinely posts important information about the Company on its website. For more information about SM Energy, please visit its website at www.sm-energy.com.

SM ENERGY INVESTOR CONTACTS

Jennifer Martin Samuels, jsamuels@sm-energy.com, 303-864-2507

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

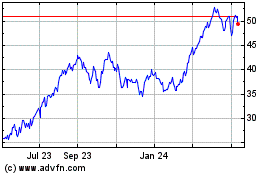

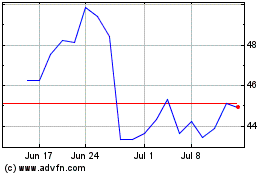

SM Energy (NYSE:SM)

Historical Stock Chart

From Mar 2024 to Apr 2024

SM Energy (NYSE:SM)

Historical Stock Chart

From Apr 2023 to Apr 2024