0000893538false00008935382023-08-022023-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 2, 2023

SM Energy Company

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-31539 | 41-0518430 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 1700 Lincoln Street, Suite 3200 | | 80203 |

Denver, Colorado | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant's telephone number, including area code: (303) 861-8140

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common stock, $0.01 par value | SM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

In accordance with General Instruction B.2. of Form 8-K, the following information, including Exhibit 99.1, shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On August 2, 2023, SM Energy Company (“Company”) issued a press release announcing its financial results for the second quarter of 2023, as well as providing an operational update and announcing its planned participation in an upcoming investor conference and the related details. As indicated in the press release, the Company scheduled a webcast and conference call for August 3, 2023, at 8:00 a.m. Mountain time/10:00 a.m. Eastern time to answer questions. The conference call is publicly accessible via webcast and telephone (available live and for replay), and the press release includes instructions for accessing the webcast via the Company's website and dial-in information for the call. A replay of the call will be available on the Company’s website beginning approximately one hour after the call until August 17, 2023. Availability of the webcast and the conference call on the Company’s website is at the Company’s discretion and may be discontinued at any time. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | SM ENERGY COMPANY |

| | | |

| Date: | August 2, 2023 | By: | /s/ PATRICK A. LYTLE |

| | | Patrick A. Lytle |

| | | Vice President - Chief Accounting Officer and Controller |

| | | (Principal Accounting Officer) |

EXHIBIT 99.1

SM ENERGY REPORTS SECOND QUARTER 2023 RESULTS:

STRONG OPERATIONAL EXECUTION AND INCREASED RETURN OF CAPITAL;

CLOSED TRANSACTIONS ADDING 22,800 NET MIDLAND ACRES

DENVER, CO August 2, 2023 - SM Energy Company (the “Company”) (NYSE: SM) today announced operating and financial results for the second quarter 2023 and provided certain full year and third quarter 2023 guidance.

Highlights include:

•Solid profitability. In the second quarter 2023, net income was $149.9 million, or $1.25 per diluted common share, down from $2.60 per diluted common share in the prior year period, predominantly due to lower commodity prices. Adjusted net income(1) was $1.28 per diluted common share. Net cash provided by operating activities was $383.3 million and Adjusted EBITDAX(1) was $390.2 million.

•Operational execution and well performance. Production for the second quarter 2023 was 14.1 MMBoe, or 154.4 MBoe/d, at 42% oil, exceeding guidance. As previously reported, production exceeded expectations driven by higher oil, natural gas and NGL volumes from both new and existing wells in the Company’s South Texas program.

•Increased capital returns to stockholders. The Company repurchased and retired 2,550,706 shares of its common stock during the second quarter. In combination with the $0.15 per share quarterly dividend paid May 5, 2023, return of capital to stockholders totaled $86.8 million in the quarter. Since announcing the return of capital program in September 2022, the Company has repurchased approximately 5.3 million shares and returned approximately $221 million to stockholders, inclusive of dividends and common stock repurchases.

•Acreage acquisitions support growth in production and inventory. The Company acquired approximately 20,000 net acres located in Dawson and north Martin Counties, Texas for $90.6 million, net of purchase price adjustments and closing conditions. The acquisition was funded with cash and includes approximately 1,250 Boe/d net production that is approximately 90% oil, plus undeveloped acreage. The Company plans to add a rig to this location in the fourth quarter. The Company also leased an additional 2,800 net acres near its first quarter leasehold acquisition of 6,300 net acres in the Midland Basin, for which the location and purchase price are undisclosed.

•Reduced expected 2023 capital expenditures. Second quarter capital expenditures of $309.3 million, adjusted for a decrease in capital accruals of $42.7 million, totaled

$266.7 million.(1) As previously announced, cost deflation and lower facilities expenditures result in a $50 million reduction to the Company’s expected full year capital expenditures, net of the cost of adding a fourth rig to the Midland Basin in the fourth quarter.

•Stewardship and social impact recognition. SM Energy ranked second for lowest methane intensity among Permian Basin operators by Basinwide Independent Methane Emissions Insights, and SM Energy received the Mile High United Way Community Champion award recognizing the Company for engaging with the Mile High United Way year-round to inspire employees to give, volunteer, advocate and lead.

President and Chief Executive Officer Herb Vogel comments: “We put forth three core strategic objectives for 2023: deliver increased return of capital to stockholders; focus on operational execution, including

ESG stewardship; and continue to build top-tier inventory. The SM Energy team is exceeding expectations on all fronts. As a result, we recently increased 2023 production guidance and lowered 2023 capital expenditure guidance, and we expect to continue to build inventory in 2023 and grow production by mid-single digits in 2024. SM Energy generated $94.8 million of Adjusted free cash flow(1) in the second quarter and returned 92% to stockholders.”

| | | | | | | | | | | |

| SECOND QUARTER PRODUCTION BY OPERATING AREA | |

| |

| Midland Basin | South Texas | Total |

Oil (MBbl / MBbl/d) | 4,175 / 45.9 | 1,696 / 18.6 | 5,871 / 64.5 |

Natural Gas (MMcf / MMcf/d) | 14,767 / 162.3 | 18,944 / 208.2 | 33,711 / 370.4 |

NGLs (MBbl / MBbl/d) | 8 / - | 2,557 / 28.1 | 2,565 / 28.2 |

Total (MBoe / MBoe/d) | 6,644 / 73.0 | 7,410 / 81.4 | 14,054 / 154.4 |

| Note: Totals may not calculate due to rounding. | | |

Second quarter production volumes were 14.1 MMBoe, or 154.4 MBoe/d. Volumes were approximately 47% from the Midland Basin and 53% from South Texas, and were 42% oil. South Texas production exceeded expectations as a result of strong well performance from both new and existing Austin Chalk wells, and benefited from the build-out of oil handling facilities that is expected to resolve the need for periodic curtailment of production when large, oil-rich pads are brought on-line.

| | | | | | | | | | | |

| SECOND QUARTER PRICES BY OPERATING AREA | | |

| |

| Midland Basin | South Texas | Total (Pre/Post-hedge)(1) |

Oil ($/Bbl) | $72.55 | $71.07 | $72.12 / $72.04 |

Natural Gas ($/Mcf) | $2.49 | $1.74 | $2.07 / $2.50 |

NGLs ($/Bbl) | nm | $20.81 | $20.83 / $21.44 |

| Per Boe | $51.16 | $27.89 | $38.89 / $40.00 |

| Note: Totals may not calculate due to rounding. | | |

The second quarter average realized price before the effect of hedges was $38.89 per Boe, and the average realized price after the effect of hedges was $40.00 per Boe.(1)

•Benchmark pricing for the quarter included NYMEX WTI at $73.78/Bbl, NYMEX Henry Hub natural gas at $2.10/MMBtu and OPIS Composite NGLs at $25.21/Bbl.

•The effect of commodity derivative settlements for the second quarter was a gain of $1.11 per Boe, or $15.6 million.

For additional operating metrics and regional detail, please see the Financial Highlights section below and the accompanying slide deck.

NET INCOME, NET INCOME PER SHARE AND NET CASH PROVIDED BY OPERATING ACTIVITIES

Second quarter 2023 net income was $149.9 million, or $1.25 per diluted common share, compared with net income of $323.5 million, or $2.60 per diluted common share, for the same period in 2022. The current year period was affected by a 29% decline in the average realized price per Boe after derivative settlements, partially offset by a 5% increase in production, lower interest expense and a (non-cash) net derivative gain. The higher prior year period total oil, gas, and NGL production revenue and other income was partially offset by a (non-cash) net derivative loss. For the first six months of 2023, net income was $348.4 million, or $2.88 per diluted common share, compared with net income of $372.2 million, or $3.00 per diluted common share, for the same period in 2022.

Second quarter 2023 net cash provided by operating activities of $383.3 million before net change in working capital of $(21.8) million totaled $361.5 million(1) compared with net cash provided by operating activities of $542.6 million before net change in working capital of $(28.2) million that totaled $514.4 million(1) for the same period in 2022. The $152.9 million, or 30%, decline in the current year period is primarily due to decreased realized prices for natural gas and NGLs after the effect of derivative settlements and reduced oil volumes. For the first six months of 2023, net cash provided by operating activities of $714.9 million before net change in working capital of $4.4 million totaled $719.3 million,(1) which was down from $994.4 million(1) for the same period in 2022.

ADJUSTED EBITDAX,(1) ADJUSTED NET INCOME,(1) AND NET DEBT-TO-ADJUSTED EBITDAX(1)

Second quarter 2023 Adjusted EBITDAX(1) was $390.2 million, down $169.5 million, or 30%, from $559.7 million for the same period in 2022, primarily due to decreased realized prices for natural gas and NGLs after the effect of derivative settlements and reduced oil volumes. For the first six months of 2023, Adjusted EBITDAX(1) was $791.6 million compared with $1,084.3 million for the same period in 2022.

Second quarter 2023 Adjusted net income(1) was $153.8 million, or $1.28 per diluted common share, which compares with Adjusted net income(1) of $272.8 million, or $2.19 per diluted common share, for the same period in 2022. For the first six months of 2023, Adjusted net income(1) was $316.0 million, or $2.61 per diluted common share, compared with an Adjusted net income(1) of $518.8 million, or $4.17 per diluted common share, for the same period in 2022.

At June 30, 2023, Net debt-to-Adjusted EBITDAX(1) was 0.7 times.

FINANCIAL POSITION, LIQUIDITY, CAPITAL EXPENDITURES AND ADJUSTED FREE CASH FLOW(1)

On June 30, 2023, the outstanding principal amount of the Company’s long-term debt was $1.6 billion with zero drawn on the Company’s senior secured revolving credit facility, and cash and cash equivalents were $378.2 million. Net debt(1) was $1.2 billion.

Second quarter 2023 capital expenditures adjusted for decreased capital accruals were $266.7 million.(1) Capital activity during the quarter included drilling 17 net wells, of which 12 were in South Texas and 5 were in the Midland Basin, and adding 25 net flowing completions, of which 8 were in South Texas and 17 were in the Midland Basin. Subsequent to quarter-end, as planned, the remaining wells on the 20-well Guitar Consolidated pads located in the RockStar area have been turned-in-line.

Second quarter 2023 net cash provided by operating activities before net change in working capital totaled $361.5 million,(1) and capital expenditures adjusted for decreased capital accruals totaled

$266.7 million,(1) delivering Adjusted free cash flow of $94.8 million.(1) Capital expenditures include the undisclosed leasehold acquisition cost of certain acreage.

COMMODITY DERIVATIVES

As entered into as of July 21, 2023, commodity derivative positions for the second half of 2023 include:

SWAPS AND COLLARS:

•Oil: Approximately 30% of expected second half 2023 oil production is hedged at an average price of $76.21/Bbl (weighted-average of collar floors and swaps, excludes basis swaps).

•Natural gas: Approximately 30% of second half 2023 expected natural gas production is hedged at an average price of $4.00/MMBtu (weighted-average of collar floors and swaps, excludes basis swaps).

BASIS SWAPS:

•Oil, Midland Basin differential: Approximately 2,700 MBbls are hedged to the local price point at a weighted-average $0.88/Bbl basis.

•Gas, WAHA differential: Approximately 5,800 BBtu are hedged to WAHA at a weighted-average ($0.97)/MMBtu basis.

A detailed schedule of these and additional derivative positions are provided in the 2Q23 accompanying slide deck.

2023 OPERATING PLAN AND GUIDANCE

The Company is unable to provide a reconciliation of forward-looking non-GAAP capital expenditures because components of the calculation are inherently unpredictable, such as changes to, and timing of, capital accruals. The inability to project certain components of the calculation would significantly affect the accuracy of a reconciliation.

GUIDANCE FULL YEAR 2023:

•Production: 53.5-55.5 MMBoe, or 147-152 MBoe/d at 43%-44% oil

•Capital expenditures (net of the change in capital accruals),(1) excluding acquisitions: $1,050 million

•LOE: $5.25-$5.50 per Boe

•Exploration expense: ~$60 million, inclusive of additional geologic and geophysical expenses associated with acquisitions

•Unchanged: Transportation per Boe at ~$2.50; production and ad valorem taxes per Boe at $2.90-$3.00; G&A ~$120 million, including $15-20 million for non-cash compensation; and, DD&A $12-$13 per Boe

GUIDANCE THIRD QUARTER 2023:

•Capital expenditures (net of the change in capital accruals),(1) excluding acquisitions: approximately $235-240 million. In the third quarter of 2023, the Company expects to drill

approximately 22 net wells, of which 10 are planned for South Texas and 12 are planned for the Midland Basin, and turn-in-line approximately 28 net wells, of which 11 are planned for South Texas and 17 are planned for the Midland Basin.

•Production: Approximately 14.0 MMboe or 152 MBoe/d, at approximately 44% oil and 60%-61% liquids.

UPCOMING EVENTS

EARNINGS Q&A WEBCAST AND CONFERENCE CALL

August 3, 2023 – Please join SM Energy management at 8:00 a.m. Mountain time/10:00 a.m. Eastern time for the second quarter 2023 financial and operating results Q&A session. This discussion will be accessible via webcast (available live and for replay) on the Company’s website at ir.sm-energy.com or by telephone. To join the live conference call, please register at the link below for dial-in information.

•Live Conference Call Registration: https://conferencingportals.com/event/pAjDSntN

•Replay (conference ID 11299) - Domestic toll free/International: 800-770-2030/647-362-9199

The call replay will be available approximately one hour after the call and until August 17, 2023.

CONFERENCE PARTICIPATION

•August 15, 2023 - EnerCom Denver. President and Chief Executive Officer Herb Vogel will present at 8:50 a.m. Mountain time/10:50 a.m. Eastern time. The event webcast replay will be available the following day, accessible from the Company’s website and available for a limited period. The Company plans to post an investor presentation to its website the morning of the event.

DISCLOSURES

FORWARD LOOKING STATEMENTS

This release contains forward-looking statements within the meaning of securities laws. The words “estimate,” "expect," "goal," "generate," “plan,” "target," “believes,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this release include, among other things: projections for the full year and third quarter 2023, including guidance for capital expenditures, production, production costs, DD&A, exploration expense and G&A; the percent of future production to be hedged; our expectations to continue to build inventory in 2023 and grow production in 2024; our expectation that the build-out of oil handling facilities in South Texas will resolve the need for periodic production curtailment; the number of wells the Company plans to drill and complete in 2023; and plans to add a rig in the Midland Basin in the fourth quarter of 2023. These statements involve known and unknown risks, which may cause SM Energy's actual results to differ materially from results expressed or implied by the forward-looking statements. Future results may be impacted by the risks discussed in the Risk Factors section of SM Energy's most recent Annual Report on Form 10-K, and such risk factors may be updated from time to time in the Company's other periodic reports filed with the Securities and Exchange Commission. The forward-looking statements contained herein speak as of the date of this release. Although SM Energy may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so, except as required by securities laws.

FOOTNOTE 1

Indicates a non-GAAP measure or metric. Please refer below to the section "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" in Financials Highlights for additional information.

ABOUT THE COMPANY

SM Energy Company is an independent energy company engaged in the acquisition, exploration, development, and production of oil, gas, and NGLs in the state of Texas. SM Energy routinely posts important information about the Company on its website. For more information about SM Energy, please visit its website at www.sm-energy.com.

SM ENERGY INVESTOR CONTACTS

Jennifer Martin Samuels, jsamuels@sm-energy.com, 303-864-2507

| | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

|

| Condensed Consolidated Balance Sheets | | | |

| (in thousands, except share data) | June 30, | | December 31, |

| ASSETS | 2023 | | 2022 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 378,238 | | | $ | 444,998 | |

| Accounts receivable | 217,794 | | | 233,297 | |

| Derivative assets | 74,138 | | | 48,677 | |

| Prepaid expenses and other | 8,815 | | | 10,231 | |

| Total current assets | 678,985 | | | 737,203 | |

| Property and equipment (successful efforts method): | | | |

| Proved oil and gas properties | 10,824,717 | | | 10,258,368 | |

| Accumulated depletion, depreciation, and amortization | (6,494,068) | | | (6,188,147) | |

Unproved oil and gas properties, net of valuation allowance of $37,904 and $38,008, respectively | 524,693 | | | 487,192 | |

| Wells in progress | 332,609 | | | 287,267 | |

| | | |

Other property and equipment, net of accumulated depreciation of $58,203 and $56,512, respectively | 43,276 | | | 38,099 | |

| Total property and equipment, net | 5,231,227 | | | 4,882,779 | |

| Noncurrent assets: | | | |

| Derivative assets | 12,077 | | | 24,465 | |

| Other noncurrent assets | 70,337 | | | 71,592 | |

| Total noncurrent assets | 82,414 | | | 96,057 | |

| Total assets | $ | 5,992,626 | | | $ | 5,716,039 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 530,459 | | | $ | 532,289 | |

| Derivative liabilities | 22,210 | | | 56,181 | |

| Other current liabilities | 11,319 | | | 10,114 | |

| Total current liabilities | 563,988 | | | 598,584 | |

| Noncurrent liabilities: | | | |

| Revolving credit facility | — | | | — | |

| Senior Notes, net | 1,573,772 | | | 1,572,210 | |

| Asset retirement obligations | 113,999 | | | 108,233 | |

| | | |

| Deferred income taxes | 375,063 | | | 280,811 | |

| Derivative liabilities | 5,894 | | | 1,142 | |

| Other noncurrent liabilities | 61,443 | | | 69,601 | |

| Total noncurrent liabilities | 2,130,171 | | | 2,031,997 | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value - authorized: 200,000,000 shares; issued and outstanding: 118,112,105 and 121,931,676 shares, respectively | 1,181 | | | 1,219 | |

| Additional paid-in capital | 1,680,080 | | | 1,779,703 | |

| Retained earnings | 1,621,202 | | | 1,308,558 | |

| Accumulated other comprehensive loss | (3,996) | | | (4,022) | |

| Total stockholders’ equity | 3,298,467 | | | 3,085,458 | |

| Total liabilities and stockholders’ equity | $ | 5,992,626 | | | $ | 5,716,039 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

|

| Condensed Consolidated Statements of Operations |

| (in thousands, except per share data) | For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating revenues and other income: | | | | | | | |

| Oil, gas, and NGL production revenue | $ | 546,555 | | | $ | 990,377 | | | $ | 1,117,333 | | | $ | 1,849,098 | |

| | | | | | | |

| Other operating income | 4,199 | | | 1,725 | | | 6,926 | | | 2,780 | |

| Total operating revenues and other income | 550,754 | | | 992,102 | | | 1,124,259 | | | 1,851,878 | |

| Operating expenses: | | | | | | | |

| Oil, gas, and NGL production expense | 145,588 | | | 165,593 | | | 287,936 | | | 310,284 | |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 157,832 | | | 154,823 | | | 312,021 | | | 314,304 | |

Exploration (1) | 14,960 | | | 20,868 | | | 33,388 | | | 29,914 | |

| | | | | | | |

| | | | | | | |

General and administrative (1) | 27,500 | | | 28,291 | | | 55,169 | | | 53,287 | |

Net derivative (gain) loss (2) | (11,674) | | | 104,236 | | | (63,003) | | | 522,757 | |

| Other operating expense, net | 7,197 | | | 5,485 | | | 17,350 | | | 6,790 | |

| Total operating expenses | 341,403 | | | 479,296 | | | 642,861 | | | 1,237,336 | |

| Income from operations | 209,351 | | | 512,806 | | | 481,398 | | | 614,542 | |

| Interest expense | (22,148) | | | (35,496) | | | (44,607) | | | (74,883) | |

| Loss on extinguishment of debt | — | | | (67,226) | | | — | | | (67,605) | |

| Other non-operating income (expense), net | 4,763 | | | 112 | | | 9,233 | | | (233) | |

| Income before income taxes | 191,966 | | | 410,196 | | | 446,024 | | | 471,821 | |

| Income tax expense | (42,092) | | | (86,711) | | | (97,598) | | | (99,572) | |

| Net income | $ | 149,874 | | | $ | 323,485 | | | $ | 348,426 | | | $ | 372,249 | |

| | | | | | | |

| Basic weighted-average common shares outstanding | 119,408 | | | 121,910 | | | 120,533 | | | 121,909 | |

| Diluted weighted-average common shares outstanding | 120,074 | | | 124,343 | | | 121,175 | | | 124,267 | |

| Basic net income per common share | $ | 1.26 | | | $ | 2.65 | | | $ | 2.89 | | | $ | 3.05 | |

| Diluted net income per common share | $ | 1.25 | | | $ | 2.60 | | | $ | 2.88 | | | $ | 3.00 | |

| Dividends per common share | $ | 0.15 | | | $ | — | | | $ | 0.30 | | | $ | 0.01 | |

| | | | | | | |

(1) Non-cash stock-based compensation included in: | | | | | | | |

| Exploration expense | $ | 896 | | | $ | 974 | | | $ | 1,847 | | | $ | 1,965 | |

| General and administrative expense | 3,267 | | | 3,505 | | | 6,634 | | | 6,788 | |

| Total non-cash stock-based compensation | $ | 4,163 | | | $ | 4,479 | | | $ | 8,481 | | | $ | 8,753 | |

| | | | | | | |

(2) The net derivative (gain) loss line item consists of the following: | | | | | | | |

| Derivative settlement (gain) loss | $ | (15,636) | | | $ | 240,598 | | | $ | (20,712) | | | $ | 408,781 | |

| (Gain) loss on fair value changes | 3,962 | | | (136,362) | | | (42,291) | | | 113,976 | |

| Total net derivative (gain) loss | $ | (11,674) | | | $ | 104,236 | | | $ | (63,003) | | | $ | 522,757 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

| | | | | | | | | | | |

| Condensed Consolidated Statements of Stockholders' Equity |

| (in thousands, except share data and dividends per share) |

|

| | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders’ Equity |

| Common Stock | | | | |

| Shares | | Amount | | | | |

| Balances, December 31, 2022 | 121,931,676 | | | $ | 1,219 | | | $ | 1,779,703 | | | $ | 1,308,558 | | | $ | (4,022) | | | $ | 3,085,458 | |

| Net income | — | | | — | | | — | | | 198,552 | | | — | | | 198,552 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 13 | | | 13 | |

Cash dividends declared, $0.15 per share | — | | | — | | | — | | | (18,078) | | | — | | | (18,078) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 4,318 | | | — | | | — | | | 4,318 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | (1,413,758) | | | (14) | | | (40,454) | | | — | | | — | | | (40,468) | |

| Balances, March 31, 2023 | 120,517,918 | | | $ | 1,205 | | | $ | 1,743,567 | | | $ | 1,489,032 | | | $ | (4,009) | | | $ | 3,229,795 | |

| Net income | — | | | — | | | — | | | 149,874 | | | — | | | 149,874 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 13 | | | 13 | |

Cash dividends, $0.15 per share | — | | | — | | | — | | | (17,704) | | | — | | | (17,704) | |

| Issuance of common stock under Employee Stock Purchase Plan | 68,210 | | | 1 | | | 1,815 | | | — | | | — | | | 1,816 | |

| Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings | 774 | | | — | | | (7) | | | — | | | — | | | (7) | |

| Stock-based compensation expense | 56,872 | | | 1 | | | 4,162 | | | — | | | — | | | 4,163 | |

| | | | | | | | | | | |

| Purchase of shares under Stock Repurchase Program | (2,550,706) | | | (26) | | | (69,457) | | | — | | | — | | | (69,483) | |

| Other | 19,037 | | | — | | | — | | | — | | | — | | | — | |

| Balances, June 30, 2023 | 118,112,105 | | | $ | 1,181 | | | $ | 1,680,080 | | | $ | 1,621,202 | | | $ | (3,996) | | | $ | 3,298,467 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | |

|

|

| | | Additional Paid-in Capital | | | | Accumulated Other Comprehensive Loss | | Total Stockholders’ Equity |

| Common Stock | | | Retained Earnings | | |

| Shares | | Amount | | | | |

| Balances, December 31, 2021 | 121,862,248 | | | $ | 1,219 | | | $ | 1,840,228 | | | $ | 234,533 | | | $ | (12,849) | | | $ | 2,063,131 | |

| Net income | — | | | — | | | — | | | 48,764 | | | — | | | 48,764 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 182 | | | 182 | |

Cash dividends declared, $0.01 per share | — | | | — | | | — | | | (1,218) | | | — | | | (1,218) | |

| | | | | | | | | | | |

| Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings | 1,929 | | | — | | | (24) | | | — | | | — | | | (24) | |

| Stock-based compensation expense | — | | | — | | | 4,274 | | | — | | | — | | | 4,274 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balances, March 31, 2022 | 121,864,177 | | | $ | 1,219 | | | $ | 1,844,478 | | | $ | 282,079 | | | $ | (12,667) | | | $ | 2,115,109 | |

| Net income | — | | | — | | | — | | | 323,485 | | | — | | | 323,485 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 182 | | | 182 | |

| | | | | | | | | | | |

| Issuance of common stock under Employee Stock Purchase Plan | 65,634 | | | 1 | | | 1,644 | | | — | | | — | | | 1,645 | |

| | | | | | | | | | | |

| Stock-based compensation expense | 29,471 | | | — | | | 4,479 | | | — | | | — | | | 4,479 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balances, June 30, 2022 | 121,959,282 | | | $ | 1,220 | | | $ | 1,850,601 | | | $ | 605,564 | | | $ | (12,485) | | | $ | 2,444,900 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

|

| Condensed Consolidated Statements of Cash Flows | | | | | | |

| (in thousands) | For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 149,874 | | | $ | 323,485 | | | $ | 348,426 | | | $ | 372,249 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 157,832 | | | 154,823 | | | 312,021 | | | 314,304 | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation expense | 4,163 | | | 4,479 | | | 8,481 | | | 8,753 | |

| Net derivative (gain) loss | (11,674) | | | 104,236 | | | (63,003) | | | 522,757 | |

| Derivative settlement gain (loss) | 15,636 | | | (240,598) | | | 20,712 | | | (408,781) | |

| Amortization of debt discount and deferred financing costs | 1,372 | | | 3,597 | | | 2,743 | | | 7,607 | |

| Loss on extinguishment of debt | — | | | 67,226 | | | — | | | 67,605 | |

| Deferred income taxes | 44,278 | | | 81,000 | | | 94,246 | | | 92,948 | |

| Other, net | (10) | | | 16,107 | | | (4,305) | | | 16,967 | |

| Net change in working capital | 21,780 | | | 28,214 | | | (4,436) | | | (109,748) | |

| Net cash provided by operating activities | 383,251 | | | 542,569 | | | 714,885 | | | 884,661 | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| Capital expenditures | (309,334) | | | (215,618) | | | (550,046) | | | (365,745) | |

| Acquisition of proved and unproved oil and gas properties | (88,834) | | | — | | | (88,834) | | | — | |

| Other, net | 350 | | | — | | | 657 | | | — | |

| Net cash used in investing activities | (397,818) | | | (215,618) | | | (638,223) | | | (365,745) | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cash paid to repurchase Senior Notes | — | | | (480,176) | | | — | | | (584,946) | |

| Repurchase of common stock | (68,795) | | | — | | | (108,863) | | | — | |

| Net proceeds from sale of common stock | 1,815 | | | 1,645 | | | 1,815 | | | 1,645 | |

| Dividends paid | (18,077) | | | (1,218) | | | (36,367) | | | (1,218) | |

| Other, net | (7) | | | — | | | (7) | | | (24) | |

| Net cash used in financing activities | (85,064) | | | (479,749) | | | (143,422) | | | (584,543) | |

| | | | | | | |

| Net change in cash, cash equivalents, and restricted cash | (99,631) | | | (152,798) | | | (66,760) | | | (65,627) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 477,869 | | | 419,887 | | | 444,998 | | | 332,716 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 378,238 | | | $ | 267,089 | | | $ | 378,238 | | | $ | 267,089 | |

| | | | | | | |

| Supplemental schedule of additional cash flow information: | | | | | | | |

| Operating activities: | | | | | | | |

| Cash paid for interest, net of capitalized interest | $ | (8,798) | | | $ | (26,671) | | | $ | (42,680) | | | $ | (90,875) | |

| Net cash paid for income taxes | $ | (6,087) | | | $ | (10,452) | | | $ | (6,137) | | | $ | (10,502) | |

| Investing activities: | | | | | | | |

| Increase (decrease) in capital expenditure accruals and other | $ | (42,653) | | | $ | 22,153 | | | $ | 24,220 | | | $ | 37,780 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

DEFINITIONS OF NON-GAAP MEASURES AND METRICS AS CALCULATED BY THE COMPANY

To supplement the presentation of its financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company provides certain non-GAAP measures and metrics, which are used by management and the investment community to assess the Company’s financial condition, results of operations, and cash flows, as well as compare performance from period to period and across the Company’s peer group. The Company believes these measures and metrics are widely used by the investment community, including investors, research analysts and others, to evaluate and compare recurring financial results among upstream oil and gas companies in making investment decisions or recommendations. These measures and metrics, as presented, may have differing calculations among companies and investment professionals and may not be directly comparable to the same measures and metrics provided by others. A non-GAAP measure should not be considered in isolation or as a substitute for the most directly comparable GAAP measure or any other measure of a company’s financial or operating performance presented in accordance with GAAP. A reconciliation of the Company’s non-GAAP measures to the most directly comparable GAAP measure is presented below. These measures may not be comparable to similarly titled measures of other companies.

Adjusted EBITDAX: Adjusted EBITDAX is calculated as net income (loss) before interest expense, interest income, income taxes, depletion, depreciation, amortization and asset retirement obligation liability accretion expense, exploration expense, property abandonment and impairment expense, non-cash stock-based compensation expense, derivative gains and losses net of settlements, gains and losses on divestitures, gains and losses on extinguishment of debt, and certain other items. Adjusted EBITDAX excludes certain items that the Company believes affect the comparability of operating results and can exclude items that are generally non-recurring in nature or whose timing and/or amount cannot be reasonably estimated. Adjusted EBITDAX is a non-GAAP measure that the Company believes provides useful additional information to investors and analysts, as a performance measure, for analysis of the Company’s ability to internally generate funds for exploration, development, acquisitions, and to service debt. The Company is also subject to financial covenants under the Company’s Credit Agreement, a material source of liquidity for the Company, based on Adjusted EBITDAX ratios. Please reference the Company’s second quarter 2023 Form 10-Q and the most recent Annual Report on Form 10-K for discussion of the Credit Agreement and its covenants.

Adjusted net income and adjusted net income per diluted common share: Adjusted net income (loss) and adjusted net income (loss) per diluted common share excludes certain items that the Company believes affect the comparability of operating results, including items that are generally non-recurring in nature or whose timing and/or amount cannot be reasonably estimated. These items include non-cash and other adjustments, such as derivative gains and losses net of settlements, impairments, net (gain) loss on divestiture activity, gains and losses on extinguishment of debt, and accruals for non-recurring matters. The Company uses these measures to evaluate the comparability of the Company's ongoing operational results and trends and believes these measures provide useful information to investors for analysis of the Company's fundamental business on a recurring basis.

Adjusted free cash flow: Adjusted free cash flow is calculated as net cash provided by operating activities before net change in working capital less capital expenditures before increase (decrease) in capital expenditure accruals and other. The Company uses this measure as representative of the cash from operations, in excess of capital expenditures that provides liquidity to fund discretionary obligations such as debt reduction, returning cash to stockholders or expanding the business.

Net debt: Net debt is calculated as the total principal amount of outstanding senior notes plus amounts drawn on the revolving credit facility less cash and cash equivalents (also referred to as total funded debt). The Company uses net debt as a measure of financial position and believes this measure provides useful additional information to investors to evaluate the Company's capital structure and financial leverage.

Net debt-to-Adjusted EBITDAX: Net debt-to-Adjusted EBITDAX is calculated as Net Debt (defined above) divided by Adjusted EBITDAX (defined above) for the trailing twelve-month period (also referred to as leverage ratio). A variation of this calculation is a financial covenant under the Company’s Credit Agreement. The Company and the investment community may use this metric in understanding the Company’s ability to service its debt and identify trends in its leverage position. The Company reconciles the two non-GAAP measure components of this calculation.

Post-hedge: Post-hedge is calculated as the average realized price after the effects of commodity derivative settlements. The Company believes this metric is useful to management and the investment community to understand the effects of commodity derivative settlements on average realized price.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

| | | | | | | | | | | | | | | | | | | |

| Production Data | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | Percent Change

Between | | For the Six Months Ended | | Percent Change Between Periods |

| June 30, | | March 31, | | June 30, | | 2Q23 & 1Q23 | | | | | | 2Q23 & 2Q22 | | June 30, | | June 30, | |

| 2023 | | 2023 | | 2022 | | | | | | | | 2023 | | 2022 | |

| Realized sales price (before the effect of derivative settlements): |

| Oil (per Bbl) | $ | 72.12 | | | $ | 74.31 | | | $ | 108.64 | | | (3) | % | | | | | | (34) | % | | $ | 73.19 | | | $ | 101.15 | | | (28) | % |

| Gas (per Mcf) | $ | 2.07 | | | $ | 2.91 | | | $ | 7.66 | | | (29) | % | | | | | | (73) | % | | $ | 2.48 | | | $ | 6.54 | | | (62) | % |

| NGLs (per Bbl) | $ | 20.83 | | | $ | 26.24 | | | $ | 42.08 | | | (21) | % | | | | | | (50) | % | | $ | 23.29 | | | $ | 40.25 | | | (42) | % |

| Equivalent (per Boe) | $ | 38.89 | | | $ | 43.31 | | | $ | 74.23 | | | (10) | % | | | | | | (48) | % | | $ | 41.03 | | | $ | 68.14 | | | (40) | % |

| Realized sales price (including the effect of derivative settlements): |

| Oil (per Bbl) | $ | 72.04 | | | $ | 73.21 | | | $ | 79.45 | | | (2) | % | | | | | | (9) | % | | $ | 72.61 | | | $ | 76.67 | | | (5) | % |

| Gas (per Mcf) | $ | 2.50 | | | $ | 3.26 | | | $ | 5.96 | | | (23) | % | | | | | | (58) | % | | $ | 2.87 | | | $ | 5.26 | | | (45) | % |

| NGLs (per Bbl) | $ | 21.44 | | | $ | 26.24 | | | $ | 37.96 | | | (18) | % | | | | | | (44) | % | | $ | 23.62 | | | $ | 35.32 | | | (33) | % |

| Equivalent (per Boe) | $ | 40.00 | | | $ | 43.70 | | | $ | 56.20 | | | (8) | % | | | | | | (29) | % | | $ | 41.79 | | | $ | 53.08 | | | (21) | % |

Net production volumes: (1) |

| Oil (MMBbl) | 5.9 | | | 5.7 | | | 6.1 | | | 4 | % | | | | | | (4) | % | | 11.5 | | | 12.6 | | | (8) | % |

| Gas (Bcf) | 33.7 | | | 32.2 | | | 31.5 | | | 5 | % | | | | | | 7 | % | | 65.9 | | | 62.9 | | | 5 | % |

| NGLs (MMBbl) | 2.6 | | | 2.1 | | | 1.9 | | | 20 | % | | | | | | 32 | % | | 4.7 | | | 4.1 | | | 16 | % |

| Equivalent (MMBoe) | 14.1 | | | 13.2 | | | 13.3 | | | 7 | % | | | | | | 5 | % | | 27.2 | | | 27.1 | | | — | % |

Average net daily production: (1) |

| Oil (MBbl per day) | 64.5 | | | 62.9 | | | 67.5 | | | 3 | % | | | | | | (4) | % | | 63.7 | | | 69.6 | | | (8) | % |

| Gas (MMcf per day) | 370.4 | | | 358.1 | | | 346.3 | | | 3 | % | | | | | | 7 | % | | 364.3 | | | 347.4 | | | 5 | % |

| NGLs (MBbl per day) | 28.2 | | | 23.8 | | | 21.4 | | | 18 | % | | | | | | 32 | % | | 26.0 | | | 22.4 | | | 16 | % |

| Equivalent (MBoe per day) | 154.4 | | | 146.4 | | | 146.6 | | | 5 | % | | | | | | 5 | % | | 150.5 | | | 149.9 | | | — | % |

| Per Boe data: | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Lease operating expense | $ | 4.98 | | | $ | 5.16 | | | $ | 5.11 | | | (3) | % | | | | | | (3) | % | | $ | 5.07 | | | $ | 4.67 | | | 9 | % |

| Transportation costs | $ | 2.89 | | | $ | 2.81 | | | $ | 2.87 | | | 3 | % | | | | | | 1 | % | | $ | 2.85 | | | $ | 2.80 | | | 2 | % |

| Production taxes | $ | 1.66 | | | $ | 2.02 | | | $ | 3.75 | | | (18) | % | | | | | | (56) | % | | $ | 1.84 | | | $ | 3.33 | | | (45) | % |

| Ad valorem tax expense | $ | 0.83 | | | $ | 0.81 | | | $ | 0.69 | | | 2 | % | | | | | | 20 | % | | $ | 0.82 | | | $ | 0.63 | | | 30 | % |

General and administrative (2) | $ | 1.96 | | | $ | 2.10 | | | $ | 2.12 | | | (7) | % | | | | | | (8) | % | | $ | 2.03 | | | $ | 1.96 | | | 4 | % |

| Derivative settlement gain (loss) | $ | 1.11 | | | $ | 0.39 | | | $ | (18.03) | | | 185 | % | | | | | | 106 | % | | $ | 0.76 | | | $ | (15.06) | | | 105 | % |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | $ | 11.23 | | | $ | 11.70 | | | $ | 11.60 | | | (4) | % | | | | | | (3) | % | | $ | 11.46 | | | $ | 11.58 | | | (1) | % |

| | | | | | | | | | | | | | | | | | | |

(1) Amounts and percentage changes may not calculate due to rounding. |

(2) Includes non-cash stock-based compensation expense per Boe of $0.23, $0.26, and $0.26 for the three months ended June 30, 2023, March 31, 2023, and June 30, 2022, respectively, and $0.24 and $0.25 for the six months ended June 30, 2023 and 2022, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

| | |

Adjusted EBITDAX Reconciliation (1) | | | | | | | | | |

| (in thousands) | | | | | | | | | |

| | | | | | | | | |

Reconciliation of net income (GAAP) and net cash provided by operating activities (GAAP) to Adjusted EBITDAX (non-GAAP): | For the Three Months Ended June 30, | | For the Six Months Ended June 30, | | For the Trailing Twelve Months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | 2023 |

| Net income (GAAP) | $ | 149,874 | | | $ | 323,485 | | | $ | 348,426 | | | $ | 372,249 | | | $ | 1,088,129 | |

| Interest expense | 22,148 | | | 35,496 | | | 44,607 | | | 74,883 | | | 90,070 | |

Interest income (2) | (4,994) | | | (496) | | | (9,696) | | | (534) | | | (14,936) | |

| Income tax expense | 42,092 | | | 86,711 | | | 97,598 | | | 99,572 | | | 281,844 | |

| Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 157,832 | | | 154,823 | | | 312,021 | | | 314,304 | | | 601,497 | |

Exploration (3) | 14,064 | | | 19,894 | | | 31,541 | | | 27,949 | | | 54,570 | |

| | | | | | | | | |

| Stock-based compensation expense | 4,163 | | | 4,479 | | | 8,481 | | | 8,753 | | | 18,500 | |

| Net derivative (gain) loss | (11,674) | | | 104,236 | | | (63,003) | | | 522,757 | | | (211,748) | |

| Derivative settlement gain (loss) | 15,636 | | | (240,598) | | | 20,712 | | | (408,781) | | | (281,207) | |

| Loss on extinguishment of debt | — | | | 67,226 | | | — | | | 67,605 | | | — | |

| Other, net | 1,079 | | | 4,459 | | | 927 | | | 5,522 | | | (1,096) | |

| Adjusted EBITDAX (non-GAAP) | $ | 390,220 | | | $ | 559,715 | | | $ | 791,614 | | | $ | 1,084,279 | | | $ | 1,625,623 | |

| Interest expense | (22,148) | | | (35,496) | | | (44,607) | | | (74,883) | | | (90,070) | |

Interest income (2) | 4,994 | | | 496 | | | 9,696 | | | 534 | | | 14,936 | |

| Income tax expense | (42,092) | | | (86,711) | | | (97,598) | | | (99,572) | | | (281,844) | |

Exploration (3)(4) | (14,473) | | | (7,911) | | | (22,654) | | | (15,966) | | | (43,498) | |

| Amortization of debt discount and deferred financing costs | 1,372 | | | 3,597 | | | 2,743 | | | 7,607 | | | 5,417 | |

| Deferred income taxes | 44,278 | | | 81,000 | | | 94,246 | | | 92,948 | | | 270,355 | |

| Other, net | (680) | | | (335) | | | (14,119) | | | (538) | | | (17,538) | |

| Net change in working capital | 21,780 | | | 28,214 | | | (4,436) | | | (109,748) | | | 33,249 | |

| Net cash provided by operating activities (GAAP) | $ | 383,251 | | | $ | 542,569 | | | $ | 714,885 | | | $ | 884,661 | | | $ | 1,516,630 | |

| | | | | | | | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

(2) Interest income is included within other non-operating income (expense), net line item on the unaudited condensed consolidated statements of operations. |

(3) Stock-based compensation expense is a component of the exploration expense and general and administrative expense line items on the unaudited condensed consolidated statements of operations. Therefore, the exploration line items shown in the reconciliation above will vary from the amount shown on the unaudited condensed consolidated statements of operations for the component of stock-based compensation expense recorded to exploration expense. |

(4) For the three and six months and the trailing twelve months ended June 30, 2023, amount excludes certain capital expenditures related to unsuccessful exploration activity for one well that experienced technical issues during the drilling phase. For the three and six months ended June 30, 2022 and for the trailing twelve months ended June 30, 2023, amounts exclude certain capital expenditures related to unsuccessful exploration efforts outside of the Company’s core areas of operation. |

| | | | | | | | | | | | | | | | | | | | | | | |

| SM ENERGY COMPANY |

| FINANCIAL HIGHLIGHTS (UNAUDITED) |

| June 30, 2023 |

|

Adjusted Net Income Reconciliation (1) | | | | | | | |

| (in thousands, except per share data) | | | | | | | |

| | | | | | | |

Reconciliation of net income (GAAP) to adjusted net income (non-GAAP): | For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (GAAP) | $ | 149,874 | | | $ | 323,485 | | | $ | 348,426 | | | $ | 372,249 | |

| Net derivative (gain) loss | (11,674) | | | 104,236 | | | (63,003) | | | 522,757 | |

| Derivative settlement gain (loss) | 15,636 | | | (240,598) | | | 20,712 | | | (408,781) | |

| | | | | | | |

| Loss on extinguishment of debt | — | | | 67,226 | | | — | | | 67,605 | |

| Other, net | 1,079 | | | 4,458 | | | 927 | | | 5,522 | |

Tax effect of adjustments (2) | (1,094) | | | 14,035 | | | 8,976 | | | (40,601) | |

| | | | | | | |

| Adjusted net income (non-GAAP) | $ | 153,821 | | | $ | 272,842 | | | $ | 316,038 | | | $ | 518,751 | |

| | | | | | | |

| Diluted net income per common share (GAAP) | $ | 1.25 | | | $ | 2.60 | | | $ | 2.88 | | | $ | 3.00 | |

| Net derivative (gain) loss | (0.10) | | | 0.84 | | | (0.52) | | | 4.21 | |

| Derivative settlement gain (loss) | 0.13 | | | (1.93) | | | 0.17 | | | (3.29) | |

| | | | | | | |

| Loss on extinguishment of debt | — | | | 0.54 | | | — | | | 0.54 | |

| Other, net | 0.01 | | | 0.03 | | | 0.01 | | | 0.04 | |

Tax effect of adjustments (2) | (0.01) | | | 0.11 | | | 0.07 | | | (0.33) | |

| | | | | | | |

| Adjusted net income per diluted common share (non-GAAP) | $ | 1.28 | | | $ | 2.19 | | | $ | 2.61 | | | $ | 4.17 | |

| | | | | | | |

| Basic weighted-average common shares outstanding | 119,408 | | | 121,910 | | | 120,533 | | | 121,909 | |

| Diluted weighted-average common shares outstanding | 120,074 | | | 124,343 | | | 121,175 | | | 124,267 | |

| | | | | | | |

| Note: Amounts may not calculate due to rounding. | | | | | | | |

| | | | | | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

(2) The tax effect of adjustments for each of the three and six months ended June 30, 2023, and 2022, was calculated using a tax rate of 21.7%. This rate approximates the Company's statutory tax rate for the respective periods, as adjusted for ordinary permanent differences. |

| | | | | |

|

|

|

|

Reconciliation of Total Principal Amount of Debt to Net Debt (1) | |

| (in thousands) | |

| As of June 30, 2023 |

| |

Principal amount of Senior Notes (2) | $ | 1,585,144 | |

Revolving credit facility (2) | — | |

| Total principal amount of debt (GAAP) | 1,585,144 | |

| Less: Cash and cash equivalents | 378,238 | |

| Net Debt (non-GAAP) | $ | 1,206,906 | |

| |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

(2) Amounts are from Note 5 - Long-term Debt in Part I, Item I of the Company's Form 10-Q as of June 30, 2023. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Free Cash Flow (1) | | | | | | | | | | |

| (in thousands) | | | | | | | | | | |

| | For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Net cash provided by operating activities (GAAP) | | $ | 383,251 | | | $ | 542,569 | | | $ | 714,885 | | | $ | 884,661 | | | |

| Net change in working capital | | (21,780) | | | (28,214) | | | 4,436 | | | 109,748 | | | |

| Cash flow from operations before net change in working capital (non-GAAP) | | 361,471 | | | 514,355 | | | 719,321 | | | 994,409 | | | |

| | | | | | | | | | |

| Capital expenditures (GAAP) | | 309,334 | | | 215,618 | | | 550,046 | | | 365,745 | | | |

| Increase (decrease) in capital expenditure accruals and other | | (42,653) | | | 22,153 | | | 24,220 | | | 37,780 | | | |

| Capital expenditures before accruals and other (non-GAAP) | | 266,681 | | | 237,771 | | | 574,266 | | | 403,525 | | | |

| | | | | | | | | | |

| Adjusted free cash flow (non-GAAP) | | $ | 94,790 | | | $ | 276,584 | | | $ | 145,055 | | | $ | 590,884 | | | |

| | | | | | | | | | |

(1) See "Definitions of non-GAAP Measures and Metrics as Calculated by the Company" above. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

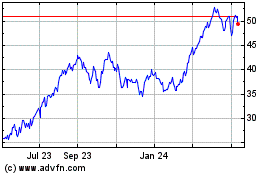

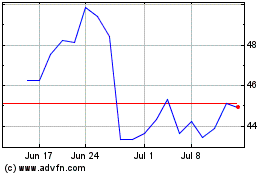

SM Energy (NYSE:SM)

Historical Stock Chart

From Mar 2024 to Apr 2024

SM Energy (NYSE:SM)

Historical Stock Chart

From Apr 2023 to Apr 2024