Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

May 31, 2023 |

May 31, 2022 |

May 31, 2021 |

| Pay vs Performance Disclosure |

|

|

|

| Pay vs Performance Disclosure, Table |

Commission rules adopted in 2022 pursuant to the Dodd-Frank Act require most companies with publicly traded stock in the United States to describe the relationship between compensation actually paid (“CAP”) to their named executive officers, as calculated in accordance with the Commission’s rules, and the Company’s performance represented by total stockholder return (“TSR”), net income and a Company-selected financial performance measure. To determine the executive compensation that is “actually paid” for the principal executive officer (the “PEO”) and non-PEO named executive officers (“non-PEO NEOs”) in a given year, companies are required to make certain adjustments to the total executive compensation reported in the summary compensation table (“SCT”) for pension and equity awards that are calculated in accordance with U.S. GAAP. For the pension adjustment, the aggregate change in the pension value as reflected in the SCT is deducted and the service cost and prior service cost for the year is included. For equity awards, the grant date value as reported in the SCT is subtracted and a new value is added, which is calculated as follows: the year-end fair value of awards granted in the current fiscal year plus or minus the annual change in fair value as of the year-end for any unvested awards or as of vesting for awards vested in the current year. We disclose below pay versus performance information, including the relationship between CAP, as calculated in accordance with the Commission’s rules, and performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of Initial Fixed $100

Investment Based on: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| 2023 |

|

|

$ 6,409,875 |

|

|

|

$ 2,455,691 |

|

|

|

$1,896,793 |

|

|

|

$ 899,192 |

|

|

|

$113 |

|

|

|

$129 |

|

|

|

$479 |

|

|

|

11.60 |

% |

| |

|

|

|

|

|

|

|

|

| 2022 |

|

|

$ 9,053,579 |

|

|

|

$ 7,302,470 |

|

|

|

$1,823,206 |

|

|

|

$1,182,894 |

|

|

|

$122 |

|

|

|

$141 |

|

|

|

$491 |

|

|

|

10.60 |

% |

| |

|

|

|

|

|

|

|

|

| 2021 |

|

|

$11,924,334 |

|

|

|

$27,144,470 |

|

|

|

$2,741,863 |

|

|

|

$5,185,029 |

|

|

|

$127 |

|

|

|

$156 |

|

|

|

$503 |

|

|

|

12.85 |

% |

| (1) |

The PEO for fiscal 2023, fiscal 2022 and fiscal 2021 was Mr. Sullivan, the Chief Executive Officer. In fiscal 2023, the non-PEO NEOs were Messrs. Gordon, Moore and Kinser and Ms. Kastner. In fiscal 2022, the non-PEO NEOs were Messrs. Gordon, Moore, Kinser and Michael Sullivan and Ms. Kastner. In fiscal 2021, the non-PEO NEOs were Messrs. Gordon, Moore and Michael Sullivan and Ms. Kastner. |

| (2) |

The following amounts were deducted from/added to Summary Compensation Table: total compensation in accordance with the Commission-mandated adjustments to calculate CAP to the Company’s PEO and average CAP to the Company’s non-PEO NEOs. The fair value of equity awards was determined using methodologies and assumptions developed in a manner substantively consistent with those used to determine the grant date fair value of such awards. | PEO SCT Total to CAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Deduction for Amounts Reported in the “Stock Awards” and “Option Awards” columns in the SCT for Applicable Fiscal Year |

|

($ |

4,010,379 |

) |

|

($ |

6,837,192 |

) |

|

($ |

9,115,861 |

) |

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year-End, Determined as of Applicable Fiscal Year-End |

|

$ |

5,376,078 |

|

|

$ |

8,879,834 |

|

|

$ |

15,693,015 |

|

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Vested During Applicable Fiscal Year, Determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal Year-End, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Applicable Fiscal Year-End |

|

($ |

4,697,588 |

) |

|

($ |

3,146,909 |

) |

|

$ |

7,854,849 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Vesting Date |

|

($ |

1.055,939 |

) |

|

($ |

1,090,453 |

) |

|

$ |

609,800 |

|

| |

|

|

|

| Reduction of Fair Value of Awards Granted During Prior Fiscal Year that were Forfeited During Applicable Fiscal Year, Determined as of Prior Fiscal Year-End |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Increase Based on Dividends or Other Earnings Paid During Applicable Fiscal Year Prior to Vesting Date |

|

$ |

450,583 |

|

|

$ |

411,565 |

|

|

$ |

252,236 |

|

| |

|

|

|

| Increase Based on Incremental Fair Value of Options/SARs Modified During Applicable Fiscal Year |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Reduction for Values Reported in “Change in Pension Value and Nonqualified Deferred Compensation Earnings” Column of the SCT for Applicable Fiscal Year |

|

($ |

46,539 |

) |

|

$ |

0 |

|

|

($ |

103,753 |

) |

| |

|

|

|

| Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans |

|

$ |

29,601 |

|

|

$ |

32,045 |

|

|

$ |

29,849 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-PEO NEO Average SCT Total to Average CAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Deduction for Amounts Reported in the “Stock Awards” and “Option Awards” columns in the SCT for Applicable Fiscal Year |

|

($ |

945,943 |

) |

|

($ |

933,522 |

) |

|

($ |

1,686,874 |

) |

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year-End, Determined as of Applicable Fiscal Year-End |

|

$ |

809,213 |

|

|

$ |

1,087,721 |

|

|

$ |

2,826,279 |

|

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Vested During Applicable Fiscal Year, Determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

131,758 |

|

|

$ |

0 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal Year-End, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Applicable Fiscal Year-End |

|

($ |

790,281 |

) |

|

($ |

461,164 |

) |

|

$ |

1,159,448 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Vesting Date |

|

($ |

147,791 |

) |

|

($ |

159,005 |

) |

|

$ |

157,683 |

|

| |

|

|

|

| Reduction of Fair Value of Awards Granted During Prior Fiscal Year that were Forfeited During Applicable Fiscal Year, Determined as of Prior Fiscal Year-End |

|

$ |

0 |

|

|

($ |

390,058 |

) |

|

$ |

0 |

|

| |

|

|

|

| Increase Based on Dividends or Other Earnings Paid During Applicable Fiscal Year Prior to Vesting Date |

|

$ |

74,626 |

|

|

$ |

54,300 |

|

|

$ |

42,184 |

|

| |

|

|

|

| Increase Based on Incremental Fair Value of Options/SARs Modified During Applicable Fiscal Year |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Reduction for Values Reported in “Change in Pension Value and Nonqualified Deferred Compensation Earnings” Column of the SCT for Applicable Fiscal Year |

|

($ |

22,684 |

) |

|

$ |

0 |

|

|

($ |

81,884 |

) |

| |

|

|

|

| Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans |

|

$ |

25,260 |

|

|

$ |

29,657 |

|

|

$ |

26,329 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) |

The Peer Group Index is comprised of Akzo Nobel N.V., Axalta Coating Systems Ltd., Carlisle Companies Inc., H.B. Fuller Company, Masco Corporation, PPG Industries, Inc., The Sherwin-Williams Company and Sika AG. |

| (4) |

Adjusted EBIT Margin % is a non-GAAP measure. EBIT is defined as earnings (loss) before interest and taxes, and Adjusted EBIT excludes certain items that are not indicative of the Company’s ongoing operations. See the Company’s July 26, 2023 Current Report on Form 8-K and Annual Report on Form 10-K for details. Adjusted EBIT Margin % is calculated for the periods presented by dividing Adjusted EBIT by revenues. |

|

|

|

| Company Selected Measure Name |

Adjusted EBIT Margin %

|

|

|

| Named Executive Officers, Footnote |

The PEO for fiscal 2023, fiscal 2022 and fiscal 2021 was Mr. Sullivan, the Chief Executive Officer. In fiscal 2023, the non-PEO NEOs were Messrs. Gordon, Moore and Kinser and Ms. Kastner. In fiscal 2022, the non-PEO NEOs were Messrs. Gordon, Moore, Kinser and Michael Sullivan and Ms. Kastner. In fiscal 2021, the non-PEO NEOs were Messrs. Gordon, Moore and Michael Sullivan and Ms. Kastner.

|

|

|

| Peer Group Issuers, Footnote |

The Peer Group Index is comprised of Akzo Nobel N.V., Axalta Coating Systems Ltd., Carlisle Companies Inc., H.B. Fuller Company, Masco Corporation, PPG Industries, Inc., The Sherwin-Williams Company and Sika AG.

|

|

|

| PEO Total Compensation Amount |

$ 6,409,875

|

$ 9,053,579

|

$ 11,924,334

|

| PEO Actually Paid Compensation Amount |

$ 2,455,691

|

7,302,470

|

27,144,470

|

| Adjustment To PEO Compensation, Footnote |

PEO SCT Total to CAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Deduction for Amounts Reported in the “Stock Awards” and “Option Awards” columns in the SCT for Applicable Fiscal Year |

|

($ |

4,010,379 |

) |

|

($ |

6,837,192 |

) |

|

($ |

9,115,861 |

) |

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year-End, Determined as of Applicable Fiscal Year-End |

|

$ |

5,376,078 |

|

|

$ |

8,879,834 |

|

|

$ |

15,693,015 |

|

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Vested During Applicable Fiscal Year, Determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal Year-End, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Applicable Fiscal Year-End |

|

($ |

4,697,588 |

) |

|

($ |

3,146,909 |

) |

|

$ |

7,854,849 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Vesting Date |

|

($ |

1.055,939 |

) |

|

($ |

1,090,453 |

) |

|

$ |

609,800 |

|

| |

|

|

|

| Reduction of Fair Value of Awards Granted During Prior Fiscal Year that were Forfeited During Applicable Fiscal Year, Determined as of Prior Fiscal Year-End |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Increase Based on Dividends or Other Earnings Paid During Applicable Fiscal Year Prior to Vesting Date |

|

$ |

450,583 |

|

|

$ |

411,565 |

|

|

$ |

252,236 |

|

| |

|

|

|

| Increase Based on Incremental Fair Value of Options/SARs Modified During Applicable Fiscal Year |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Reduction for Values Reported in “Change in Pension Value and Nonqualified Deferred Compensation Earnings” Column of the SCT for Applicable Fiscal Year |

|

($ |

46,539 |

) |

|

$ |

0 |

|

|

($ |

103,753 |

) |

| |

|

|

|

| Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans |

|

$ |

29,601 |

|

|

$ |

32,045 |

|

|

$ |

29,849 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,896,793

|

1,823,206

|

2,741,863

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 899,192

|

1,182,894

|

5,185,029

|

| Adjustment to Non-PEO NEO Compensation Footnote |

Non-PEO NEO Average SCT Total to Average CAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Deduction for Amounts Reported in the “Stock Awards” and “Option Awards” columns in the SCT for Applicable Fiscal Year |

|

($ |

945,943 |

) |

|

($ |

933,522 |

) |

|

($ |

1,686,874 |

) |

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal Year-End, Determined as of Applicable Fiscal Year-End |

|

$ |

809,213 |

|

|

$ |

1,087,721 |

|

|

$ |

2,826,279 |

|

| |

|

|

|

| Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Vested During Applicable Fiscal Year, Determined as of Vesting Date |

|

$ |

0 |

|

|

$ |

131,758 |

|

|

$ |

0 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal Year-End, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Applicable Fiscal Year-End |

|

($ |

790,281 |

) |

|

($ |

461,164 |

) |

|

$ |

1,159,448 |

|

| |

|

|

|

| Change in Fair Value of Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year, Determined Based on Change in Fair Value from Prior Fiscal Year-End to Vesting Date |

|

($ |

147,791 |

) |

|

($ |

159,005 |

) |

|

$ |

157,683 |

|

| |

|

|

|

| Reduction of Fair Value of Awards Granted During Prior Fiscal Year that were Forfeited During Applicable Fiscal Year, Determined as of Prior Fiscal Year-End |

|

$ |

0 |

|

|

($ |

390,058 |

) |

|

$ |

0 |

|

| |

|

|

|

| Increase Based on Dividends or Other Earnings Paid During Applicable Fiscal Year Prior to Vesting Date |

|

$ |

74,626 |

|

|

$ |

54,300 |

|

|

$ |

42,184 |

|

| |

|

|

|

| Increase Based on Incremental Fair Value of Options/SARs Modified During Applicable Fiscal Year |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

| Reduction for Values Reported in “Change in Pension Value and Nonqualified Deferred Compensation Earnings” Column of the SCT for Applicable Fiscal Year |

|

($ |

22,684 |

) |

|

$ |

0 |

|

|

($ |

81,884 |

) |

| |

|

|

|

| Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans |

|

$ |

25,260 |

|

|

$ |

29,657 |

|

|

$ |

26,329 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

As shown in the chart below, the PEO’s and the Non-PEO NEOs’ CAP amounts are aligned with the Company’s TSR for the periods presented which reflects the Company’s weighting toward equity incentives, which are tied directly to stock price and the Company’s financial performance.

|

|

|

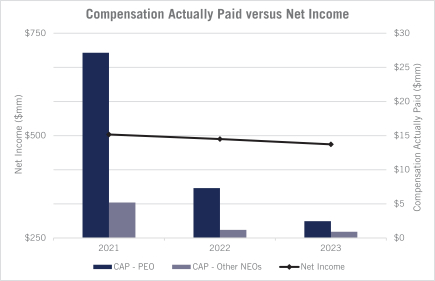

| Compensation Actually Paid vs. Net Income |

The chart below shows the PEO’s and the Non-PEO NEOs’ CAP amounts and the Company’s net income for the periods presented.

|

|

|

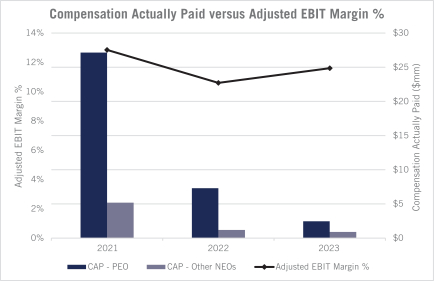

| Compensation Actually Paid vs. Company Selected Measure |

The chart below compares the PEO’s and the other non-PEO NEOs’ CAP to the Company’s selected measure, Adjusted EBIT Margin % and indicates that there is a strong relationship between EBIT Margin % and CAP. This is primarily due to the Company’s use of equity incentives, the value of which is tied directly to stock price and the Company’s financial performance.

|

|

|

| Total Shareholder Return Vs Peer Group |

As shown in the chart below, the PEO’s and the Non-PEO NEOs’ CAP amounts are aligned with the Company’s TSR for the periods presented which reflects the Company’s weighting toward equity incentives, which are tied directly to stock price and the Company’s financial performance.

|

|

|

| Tabular List, Table |

Tabular List of Financial Performance Measures The three items listed below represent the most important performance metrics the Company uses to determine CAP for fiscal 2023.

|

|

Most Important Performance Measures |

|

|

|

|

| Total Shareholder Return Amount |

$ 113

|

122

|

127

|

| Peer Group Total Shareholder Return Amount |

129

|

141

|

156

|

| Net Income (Loss) |

$ 479,000,000

|

$ 491,000,000

|

$ 503,000,000

|

| Company Selected Measure Amount |

11.6

|

10.6

|

12.85

|

| PEO Name |

Mr. Sullivan

|

|

|

| Measure:: 1 |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Name |

Adjusted EBIT Margin %

|

|

|

| Non-GAAP Measure Description |

Adjusted EBIT Margin % is a non-GAAP measure. EBIT is defined as earnings (loss) before interest and taxes, and Adjusted EBIT excludes certain items that are not indicative of the Company’s ongoing operations. See the Company’s July 26, 2023 Current Report on Form 8-K and Annual Report on Form 10-K for details. Adjusted EBIT Margin % is calculated for the periods presented by dividing Adjusted EBIT by revenues.

|

|

|

| Measure:: 2 |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Name |

Revenue Growth

|

|

|

| Measure:: 3 |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Name |

Working Capital Ratio

|

|

|

| PEO | Deduction for Amounts Reported in the Stock Awards and Option Awards columns in the SCT for Applicable Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

$ (4,010,379)

|

$ (6,837,192)

|

$ (9,115,861)

|

| PEO | Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal YearEnd, Determined as of Applicable Fiscal Year End [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

5,376,078

|

8,879,834

|

15,693,015

|

| PEO | Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Vested During Applicable Fiscal Year, Determined as of Vesting Date [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

| PEO | Change in Fair Value of Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal YearEnd, Determined Based on Change in Fair Value from Prior Fiscal YearEnd to Applicable Fiscal YearEnd [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(4,697,588)

|

(3,146,909)

|

7,854,849

|

| PEO | Change in Fair Value of Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year, Determined Based on Change in Fair Value from Prior Fiscal YearEnd to Vesting Date [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(1,055.939)

|

(1,090,453)

|

609,800

|

| PEO | Reduction of Fair Value of Awards Granted During Prior Fiscal Year that were Forfeited During Applicable Fiscal Year, Determined as of Prior Fiscal YearEnd [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

| PEO | Increase Based on Dividends or Other Earnings Paid During Applicable Fiscal Year Prior to Vesting Date [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

450,583

|

411,565

|

252,236

|

| PEO | Increase Based on Incremental Fair Value of OptionsSARs Modified During Applicable Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

| PEO | Reduction for Values Reported in Change in Pension Value and Nonqualified Deferred Compensation Earnings Column of the SCT for Applicable Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(46,539)

|

0

|

(103,753)

|

| PEO | Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

29,601

|

32,045

|

29,849

|

| PEO | Total Adjustments [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(3,954,184)

|

(1,751,109)

|

15,220,136

|

| Non-PEO NEO | Deduction for Amounts Reported in the Stock Awards and Option Awards columns in the SCT for Applicable Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(945,943)

|

(933,522)

|

(1,686,874)

|

| Non-PEO NEO | Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Remain Unvested as of Applicable Fiscal YearEnd, Determined as of Applicable Fiscal Year End [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

809,213

|

1,087,721

|

2,826,279

|

| Non-PEO NEO | Increase in Fair Value of Awards Granted During Applicable Fiscal Year that Vested During Applicable Fiscal Year, Determined as of Vesting Date [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

131,758

|

0

|

| Non-PEO NEO | Change in Fair Value of Awards Granted During Prior Fiscal Year that were Outstanding and Unvested as of Applicable Fiscal YearEnd, Determined Based on Change in Fair Value from Prior Fiscal YearEnd to Applicable Fiscal YearEnd [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(790,281)

|

(461,164)

|

1,159,448

|

| Non-PEO NEO | Change in Fair Value of Awards Granted During Prior Fiscal Year that Vested During Applicable Fiscal Year, Determined Based on Change in Fair Value from Prior Fiscal YearEnd to Vesting Date [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(147,791)

|

(159,005)

|

157,683

|

| Non-PEO NEO | Reduction of Fair Value of Awards Granted During Prior Fiscal Year that were Forfeited During Applicable Fiscal Year, Determined as of Prior Fiscal YearEnd [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

(390,058)

|

0

|

| Non-PEO NEO | Increase Based on Dividends or Other Earnings Paid During Applicable Fiscal Year Prior to Vesting Date [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

74,626

|

54,300

|

42,184

|

| Non-PEO NEO | Increase Based on Incremental Fair Value of OptionsSARs Modified During Applicable Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

| Non-PEO NEO | Reduction for Values Reported in Change in Pension Value and Nonqualified Deferred Compensation Earnings Column of the SCT for Applicable Fiscal Year [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

(22,684)

|

0

|

(81,884)

|

| Non-PEO NEO | Increase for Service Cost and, if Applicable, Prior Service Cost for Pension Plans [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

25,260

|

29,657

|

26,329

|

| Non-PEO NEO | Total Adjustments [Member] |

|

|

|

| Pay vs Performance Disclosure |

|

|

|

| Adjustment to Compensation, Amount |

$ (997,600)

|

$ (640,312)

|

$ 2,443,166

|