Exelon Acquiring Constellation - Analyst Blog

April 28 2011 - 8:30AM

Zacks

Exelon Corporation

(EXC) entered into a definite agreement to acquire

Constellation Energy Group Inc. (CEG), for about

$7.9 billion. Exelon is expected to issue 0.93 of its shares for

every share of Constellation owned by the latter’s

shareholders.

The exchange ratio agreed upon

represents an 18.1% premium to the 30-day average closing stock

prices of Exelon and Constellation as of April 27, 2011. Following

the completion of the merger Exelon shareholders will have 78%

ownership of the combined company, while the rest will belong to

Constellation shareholders.

The merger is approved by the

shareholders of both the companies and the union is subject to

overcoming some regulatory hurdles. The companies expect to close

the merger by early 2012.

Baltimore based Constellation

Energy is a supplier of power, natural gas and energy products and

services for homes and businesses across the continental United

States.

Benefits

Nuclear power plants are the major

source of power generation for Exelon. As the deal was finally

chalked out, Exelon will have access to Constellation’s nuclear

power plants in New York and Maryland. This will come as a big

boost to its generation capacity.

This merger will create the

nation’s number one competitive energy products and services

supplier by load and customers as well as the biggest competitive

power generator having the largest nuclear fleet in the U.S. The

consolidated entity will also produce power at much lower costs,

helping them to jointly work on fuel innovation, increase

efficiency and provide better options and rates to customers.

Success after Failed

Attempts?

Despite obvious positives to be

reaped from such a consolidation, the deal came after both the

companies showing a dubious track record of failing to acquire or

be acquired by other companies. On a few occasions, Exelon has made

unsuccessful attempts to clinch acquisitions. The target companies,

for instance, were NRG Energy Inc. (NRG) in 2008,

Public Service Enterprise Group Inc. (PEG) in 2004

and Illinois Power Co. in 2003.

Constellation Energy came close to

be acquired twice before both the deals fell through.

NextEra Energy Inc.'s (NEE) attempt to buy

Constellation was thwarted in 2005 by the interference of state

officials. Another deal to be acquired by Berkshire Hathaway failed

in 2008.

Recent Merger in the Power

Sector

In a climate of mergers and power

deals this year, another U.S. energy company, The AES

Corporation (AES), announced in April that it has entered

into a definite merger agreement with DPL Inc.

(DPL) and the transaction is valued at $4.7 billion.

Actual &

Estimates

Exelon reported strong first

quarter 2011 results surpassing the Zacks Consensus Estimates for

both the top and bottom lines. Going forward, the company expects

its operating earnings for 2011 in a range of $3.90 – $4.20 per

share, while the second quarter 2011 earnings are pegged in the

range of 90 cents to $1.00 per share.

The Zacks Consensus Estimates for

second-quarter 2011, fiscal year 2011 and fiscal year 2012 are

presently 98 cents per share, $4.03 per share and $3.04 per share,

respectively.

To Conclude

The Exelon-Constellation merger

allows concentration of nuclear power generation and brings

economies of scale. This is important in the aftermath of the

Fukushima Dai-Ichi plant atomic disaster in Japan, which has raised

questions about nuclear safety and is sure to inhibit the pace of

future construction.

Definitely heartening is the news

that the U.S. Nuclear Regulatory Commission has recently approved

Exelon’s request to boost its nuclear generation capacity in two of

its units. This in a way suggests that the nuclear plants were

properly run by Exelon and it can safely add more generation to its

existing nuclear capacity.

We appreciate this prudent and

beneficial merger agreement as it will create the nation’s cleanest

power generation fleet, explore opportunities in commercial solar

energy development and also focus on efficiency.

Exelon Corporation currently

retains a Zacks #3 Rank (short-term Hold rating). We maintain a

longer-term Neutral recommendation on Exelon.

Based in Chicago, Illinois, Exelon

Corporation, a utility services holding company, engages in the

generation, transmission, distribution and sale of electricity to

residential, commercial, industrial and wholesale customers.

AES CORP (AES): Free Stock Analysis Report

CONSTELLATN EGY (CEG): Free Stock Analysis Report

DPL INC (DPL): Free Stock Analysis Report

EXELON CORP (EXC): Free Stock Analysis Report

NEXTERA ENERGY (NEE): Free Stock Analysis Report

NRG ENERGY INC (NRG): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

Zacks Investment Research

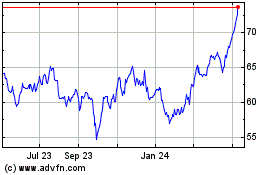

Public Service Enterprise (NYSE:PEG)

Historical Stock Chart

From May 2024 to Jun 2024

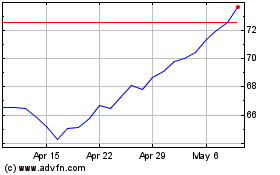

Public Service Enterprise (NYSE:PEG)

Historical Stock Chart

From Jun 2023 to Jun 2024