0001392972false00013929722023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 23, 2023

PROS Holdings, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Delaware |

(State or Other Jurisdiction of Incorporation) |

| | | | |

001-33554 | | | | 76-0168604 |

(Commission File Number) | | | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

3200 Kirby Drive, Suite 600 | Houston | TX | | | | | 77098 | |

(Address of Principal Executive Offices) | | | | | (Zip Code) | |

| | | | | | |

Registrant’s telephone number, including area code | (713) | 335-5151 | |

| | | | | | | | |

| | | | | | | | |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock $0.001 par value per share | | PRO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement |

Exchange Agreements

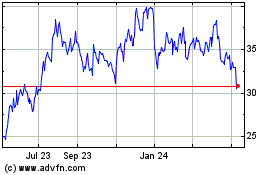

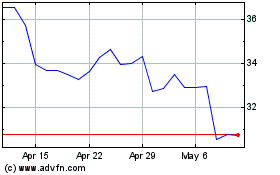

On August 23, 2023, PROS Holdings, Inc. (the “Company”) entered into privately-negotiated agreements (the “Exchange Agreements”) with a limited number of existing holders of the Company’s 1.00% Convertible Senior Notes due 2024 (the “2024 Notes”) who are institutional “accredited investors” (within the meaning of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”)) and “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) (such existing holders, the “Exchange Participants”) to exchange approximately $122 million aggregate principal amount of the Exchange Participants’ existing 2024 Notes for an amount of the Company’s previously-issued 2.250% Convertible Senior Notes due 2027 (the “2027 Notes”) at an exchange ratio to be determined based on the volume-weighted average trading price of the Company’s common stock over a thirty-day period beginning August 24, 2023 (such exchange transactions, the “Exchange”). The 2027 Notes issued in the Exchange will constitute a further issuance of, and form a single series with, and be fungible with the existing 2027 Notes.

The 2027 Notes are unsecured, unsubordinated obligations of the Company and will pay interest semiannually at an annual rate of 2.250% and will be convertible into cash, shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election, based on the applicable conversion rate at such time. The 2027 Notes have an initial conversion rate of 23.9137 shares of the Company’s common stock per $1,000 principal amount of 2027 Notes (which is equivalent to an initial conversion price of approximately $41.82 per share of the Company’s common stock). The conversion rate is subject to adjustment in certain circumstances, including in connection with specified fundamental changes. Holders of the 2027 Notes will have the right to require the Company to repurchase all or a portion of their notes upon the occurrence of a fundamental change (as defined in the indenture governing the 2027 Notes) at a purchase price of 100% of their principal amount plus any accrued and unpaid interest. The 2027 Notes will mature on September 15, 2027, unless converted, redeemed or repurchased in accordance with their terms prior to such date. Prior to June 15, 2027, the 2027 Notes will be convertible only upon the satisfaction of certain conditions and during certain periods, and thereafter, at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date regardless of these conditions.

The description of the Exchange Agreements is qualified in its entirety by reference to the full and complete terms of the form of Exchange Agreement, which is attached hereto as Exhibit 10.1, and incorporated herein by reference.

Capped Call Transactions

In connection with the Exchange, on August 23, 2023, the Company entered into additional capped call transactions (the “Additional Capped Call Transactions”) with certain option counterparties (the “Option Counterparties”). The Company will pay a premium to the Option Counterparties for the Additional Capped Call Transactions in an amount to be determined based on the volume-weighted average trading price of the Company’s common stock over a reference period beginning August 24, 2023. Initial funding of the Additional Capped Call Transactions is anticipated to occur on August 25, 2023, and final funding of the Additional Capped Call Transactions is anticipated to occur concurrently with the settlement of the Exchange, whereby the Company will either make cash payments to, or receive cash payments, from the Option Counterparties depending on the final premium for the Additional Capped Call Transactions. The Additional Capped Call Transactions will cover, subject to customary anti-dilution adjustments, a number of shares of the Company’s common stock approximately corresponding with the number of shares of the Company’s common stock underlying the additional 2027 Notes issued in the Exchange, at a strike price that corresponds to the conversion price of the 2027 Notes, also subject to adjustment in accordance with the terms of the Additional Capped Call Confirmations. The capped call transactions entered into by the Company in connection with the issuances of the 2027 Notes are intended to reduce potential dilution to the Company’s common stock and/or offset any cash payments the Company will be required to make in excess of the principal amount upon any conversion of the 2027 Notes, with such reduction or offset subject to a cap. The strike price of the Additional Capped Call Transactions is initially $41.817 and the cap price of the Additional Capped Call Transactions is initially $78.90, in each case, subject to adjustment in accordance with the terms of the Additional Capped Call Confirmations.

The Company will not be required to make any cash payments to the Option Counterparties upon the exercise of the options that are evidenced by any of the capped call transactions entered into in connection with the issuances of the 2027 Notes, including the Additional Capped Call Transactions.

The Option Counterparties or their respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to the Company’s common stock or purchasing or selling the Company’s common stock in secondary market transactions following their entry into the Additional Capped Call Transactions and prior to the maturity of the 2027 Notes (and are likely to do so during the relevant valuation period under the Additional Capped Call Transactions or following any repurchase of the 2027 Notes by the Company on any fundamental change repurchase date, any

redemption date or otherwise, in each case if the Company exercises its option to terminate the relevant portion of the Additional Capped Call Transactions). This activity could also cause or avoid an increase or decrease in the market price of the Company’s common stock or the 2027 Notes, which could affect the holders’ ability to convert the 2027 Notes and, to the extent the activity occurs during any observation period related to a conversion of the 2027 Notes, it could affect the amount and value of the consideration that the holder will receive on conversion of such 2027 Notes.

The description of the Additional Capped Call Transactions contained herein is qualified in its entirety by reference to the form of Additional Capped Call Confirmations, which is attached as Exhibit 10.2 to this Current Report on Form 8-K.

| | | | | |

| Item 2.03 | Creating of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information set forth in Item 1.01 is incorporated herein by reference into this Item 2.03.

| | | | | |

| Item 3.02 | Unregistered Sales of Equity Securities |

The 2027 Notes are expected to be issued to the Exchange Participants in a private placement in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. The Company is relying on this exemption from registration based in part on representations made by the Exchange Participants in the Exchange Agreements. The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| | |

| Exhibit No. | | Exhibit Description |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| PROS HOLDINGS, INC. |

| | |

| August 23, 2023 | | /s/ Damian W. Olthoff |

| | Damian W. Olthoff |

| | General Counsel and Secretary |

PROS Holdings, Inc.

Exchange Agreement

August 23, 2023

Table of Contents

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | |

| | | | | | |

| | |

| | | | | | |

| | |

| (a) | Generally | |

| (b) | The Closing | |

| | |

| (a) | Due Formation, Valid Existence and Good Standing: Power to Perform Obligations | |

| (b) | Deliver Free of Liens | |

| (c) | Listing of Common Stock | |

| (d) | Securities Act Matters | |

| (e) | Enforceability of New Notes | |

| (f) | Enforceability of 2027 Notes Indenture | |

| (g) | Common Stock Issuable Upon Conversion of 2027 Notes | |

| (h) | Trust Indenture Act | |

| (i) | Non-Contravention | |

| (j) | No Consents | |

| (k) | Authorization, Execution and Delivery of This Exchange Agreement | |

| (l) | Investment Company Act | |

| (m) | Accuracy of Covered SEC Filings | |

| (n) | The Closing | |

| | |

| (a) | Power to Perform Obligations and Bind Accounts; Survival of Authority | |

| (b) | Ownership of Existing Notes | |

| (c) | Rule 144 Matters | |

| (d) | Passage of Good Title: No Liens | |

| (e) | Non-Contravention | |

| (f) | Jurisdiction of Residence | |

| (g) | Compliance with Certain Laws; No Consents | |

| (h) | Acknowledgement of Risks; Investment Sophistication | |

| (i) | No View to Distribution; No Registration | |

| (j) | Information Provided | |

| (k) | No Investment, Tax or Other Advice | |

| (l) | Investment Decision Matters | |

| (m) | Due Diligence | |

| (n) | No Regulatory Agency Recommendation or Approval | |

| (o) | Qualified Institution Buyer Status | |

| (p) | Mutual Negotiation | |

| (q) | Financial Adviser Fee | |

| (r) | Additional Documentation | |

| (s) | Bring-Down of Representations and Warranties | |

| | | | | | | | | | | | | | | | | | | | |

| (t) | New York Stock Exchange Matters | |

| (u) | Settlement Instructions | |

| (v) | Wall-Cross Matters | |

| (w) | No Reliance on Matthews South | |

| (x) | Concurrent Private Placement | |

| | |

| (a) | Conditions to the Company's Obligations | |

| (b) | Conditions to the Investor's Obligations | |

| | |

| | | | | | |

| | |

| | | | | | |

| | |

| (a) | Waiver; Amendments | |

| (b) | Assignability | |

| (c) | Further Instruments and Acts | |

| (d) | Waiver of Jury Trial | |

| (e) | Governing Law | |

| (f) | Section and Other Headings | |

| (g) | Counterparts | |

| (h) | Notices | |

| (i) | Binding Effect | |

| (j) | Notification of Changes | |

| (k) | Severability | |

| (l) | Entire Agreement | |

| (m) | Reliance by Matthews South | |

| | | | | | |

| EXHIBITS | | |

| Exhibit A: | Exchanging Investor Information | A-1 |

| Exhibit B: | Exchange Procedures | B-1 |

| Exhibit C: | Tax Matters | C-1 |

Exchange Agreement

EXCHANGE AGREEMENT, dated as of August 23, 2023, between PROS Holdings, Inc., a Delaware corporation (the “Company”), and the undersigned investor (the “Investor”), on its own behalf and on behalf of each of the beneficial owners listed on Exhibit A hereto (each, an “Account”) for whom the Investor holds contractual and investment authority (each Account, including the Investor if it is exchanging Existing Notes in the Exchange (each, as defined below) on its own behalf, an “Exchanging Investor”). If there is only one Account or Exchanging Investor, then each reference thereto in this Exchange Agreement will be deemed to refer to such Account or Exchanging Investor, as applicable, in the singular, mutatis mutandis.

WHEREAS, the Company and each Exchanging Investor desire to engage in the Exchange on the terms set forth in this Exchange Agreement.

WHEREAS, the Company intends to partially unwind those certain base and additional capped call transactions, dated May 1, 2019 and May 3, 2019, respectively, entered into in connection with the issuance of the Existing Notes, by entering into one or more partial termination agreements with the counterparties thereto.

WHEREAS, the Company intends to enter into one or more capped call transactions with certain financial institutions in connection with the Exchange.

THEREFORE, the Company, the Investor and each Exchanging Investor agree as follows.

Section 1. Definitions

“2027 Notes Indenture” means that certain Indenture, dated as of September 15, 2020 between the Company and the 2027 Notes Trustee.

“2027 Notes Trustee” means Wilmington Trust, National Association, in its capacity as trustee under the 2027 Notes Indenture.

“2027 Notes” means the Old 2027 Notes and the New 2027 Notes, collectively.

“Account” has the meaning set forth in the first paragraph of this Exchange Agreement.

“Closing” has the meaning set forth in Section 3(b)(i).

“Closing Date” has the meaning set forth in Section 3(b)(i).

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Stock” means the common stock, $0.001 par value per share, of the Company.

“Company” has the meaning set forth in the first paragraph of this Exchange Agreement.

“Conversion Shares” has the meaning set forth in Section 4(g).

“Covered SEC Filings” means each of the following documents, in the form they were filed with the SEC and including any amendments thereto filed with the SEC: (a) the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022; (b) the Company’s Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023 and June 30, 2023; (c) those portions of the Company’s 2023 Proxy Statement on Schedule 14A that are incorporated by reference into the Annual Report referred to in clause (a) above; and (d) the Company’s Current Reports on Form 8-K (excluding any Current Reports or portions thereof that are furnished, and not filed, pursuant to Item 2.02 or Item 7.01 of Form 8-K, and any related exhibits) filed with the SEC after December 31, 2022.

“Daily 10b-18 VWAP” means for each Trading Day in the Reference Period, the composite volume weighted average price per share of Common Stock of Rule 10b-18 eligible trades for the regular trading session (including any extensions thereof) of the Exchange on the Trading Day (without regard to pre-open or after hours trading outside of such regular trading session for such Trading Day) as published by Bloomberg at 4:15 P.M. New York City time (or 15 minutes following the end of any extension of the regular trading session) on such Trading Day, on Bloomberg page “PRO <Equity> AQR SEC” (or any successor thereto), or if such price is not so reported on such Trading Day for any reason or the Company determines that such price is clearly erroneous, such Daily 10b-18 VWAP Price shall be as determined by the Company.

“Daily Exchange Ratio” means a percentage determined based on the Daily 10b-18 VWAP by reference to the grid set forth in Schedule A. If the Daily Exchange Ratio is not specified on such grid, the Exchange Consideration shall be determined by the Company based on a straight-line interpolation between the Daily Exchange Ratios or extrapolation from the Daily Exchange Ratios (as the case may be) specified on such grid.

“DTC” means The Depository Trust Company.

“DWAC” means DTC’s Deposits and Withdrawal at Custodian program.

“DWAC Withdrawal” has the meaning set forth in Section 3(b)(iii)(1).

“Exchange” has the meaning set forth in Section 3(a).

“Exchange Consideration” means, with respect to the Existing Notes of any Exchanging Investor to be exchanged in the Exchange, (i) New 2027 Notes having an aggregate principal amount equal to the Exchange Ratio multiplied by the principal amount of such Existing Notes, rounded to up to the nearest $1,000 principal amount and (ii) an amount of cash equal to the Interest Amount.

“Exchange Ratio” means the sum of the Daily Exchange Ratios for each Trading Day in the Reference Period.

“Exchanging Investor” has the meaning set forth in the first paragraph of this Exchange Agreement.

“Existing Indenture” means that certain Indenture, dated as of May 7, 2019 between the Company and the Existing Notes Trustee.

“Existing Notes” means the Company’s 1.00% Convertible Senior Notes due 2024 issued pursuant to the Existing Indenture.

“Existing Notes Trustee” means Wilmington Trust, National Association, in its capacity as trustee under the Existing Indenture.

"Interest Amount" means an amount to be determined by the Company equal to the greater of (a) zero and (b)(i) the accrued interest on the Existing Notes from, and including, May 15, 2023 to, but excluding, the Closing Date, calculated in accordance with the Existing Indenture, minus (ii) the accrued interest on the 2027 Notes from, and including, September 15, 2023 to, but excluding the Closing Date, calculated in accordance with the 2027 Notes Indenture.

“Investor” has the meaning set forth in the first paragraph of this Exchange Agreement.

“IRS” means the Internal Revenue Service.

“Liens” means any mortgages, liens, pledges, charges, security interests, encumbrances, title retention agreements, options, preemptive rights, equity or other adverse claims.

“Matthews South” means Matthews South LLC.

“New 2027 Notes” means the Company’s 2.250% Convertible Senior Notes due 2027 being issued in the Exchange.

“New Notes DWAC Deposit” has the meaning set forth in Section 3(b)(iii)(2).

“Old 2027 Notes” means the Company’s outstanding 2.250% Convertible Senior Notes due 2027, CUSIP No. 74346Y AG8, previously issued under the 2027 Notes Indenture on September 15, 2020.

“Reference Period” means the period of 30 consecutive Trading Days commencing on the first Trading Day following the date hereof.

“Release Time” hast the meaning set forth in Section 7.

“Resale Restriction Termination Date” has the meaning set forth in Section 2.05(c) of the 2027 Notes Indenture.

“SEC” means the Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Trading Day” has the meaning set forth for purposes of determining amounts due upon conversion in Section 1.01 of the 2027 Notes Indenture.

Section 2. Rules of Construction. For purposes of this Agreement:

(a) “or” is not exclusive;

(b) “including” means “including without limitation”;

(c) “will” expresses a command;

(d) words in the singular include the plural and in the plural include the singular, unless the context requires otherwise;

(e) “herein,” “hereof” and other words of similar import refer to this Agreement as a whole and not to any particular Section or other subdivision of this Agreement, unless the context requires otherwise;

(f) references to currency mean the lawful currency of the United States of America, unless the context requires otherwise; and

(g) the exhibits, schedules and other attachments to this Agreement are deemed to form part of this Agreement.

Section 3. The Exchange.

(a) Generally. Subject to the other terms of this Exchange Agreement, each of the Investor and each other Exchanging Investor, if any, agrees to exchange (the “Exchange”), with the Company the aggregate principal amount of Existing Notes, CUSIP No. 74346Y AH6, set forth in Exhibit A hereto that it beneficially owns for Exchange Consideration in kind and amount corresponding to such principal amount of Existing Notes.

(b) The Closing.

(i) Closing Date and Location. The closing of the Exchange (the “Closing”) will take place at the offices of DLA Piper LLP (US), 303 Colorado Street, Suite 3000, Austin, TX 78701, at 10:00 a.m., New York City time, on the later of (1) the second business day following the last day of the Reference Period; (2) such date as the conditions to Closing set forth in Section 6 are satisfied or waived; and (3) such other time and place as the Company and the Investor may agree (such later date, the “Closing Date”).

(ii) Conveyance of Title; Release of Claims. Subject to the other terms and conditions of this Exchange Agreement, the Investor hereby, for itself and on behalf of each Exchanging Investor, sells, assigns and transfers to, or upon the order of, the Company, all right, title and interest in such portion of the Existing Notes as indicated on Exhibit A hereto, waives any and all other rights with respect to such Existing Notes and the Existing Indenture and releases and discharges the Company from any and all claims the Investor and any other Exchanging Investor may now have, or may have in the future, arising out of, or related to, such Existing Notes, including any claims arising from any existing or past defaults under the Existing Indenture, or any claims that the Investor or any Exchanging Investor is entitled to receive additional, special or default interest with respect to the Existing Notes.

(iii) Delivery of Existing Notes and Exchange Consideration.

(1) DWAC Withdrawal. Subject to satisfaction of the applicable conditions precedent specified in this Exchange Agreement, at or prior to 9:30 a.m., New York City time, on the Closing Date, the Investor agrees to direct the eligible DTC participant through which each Exchanging Investor holds a beneficial interest in the Existing Notes to submit a DWAC withdrawal instruction (the “DWAC Withdrawal”) to the Existing Notes Trustee for the aggregate principal amount of the Existing Notes to be exchanged by such Exchanging Investor pursuant to this Exchange Agreement.

(2) New Notes DWAC Deposit. DTC will act as securities depositary for the New 2027 Notes. Subject to satisfaction of the applicable conditions precedent specified in this Exchange Agreement, at or prior to 9:30 a.m. New York City time on the Closing Date, the Investor agrees to direct an eligible DTC participant to submit, separately for each Exchanging Investor, a DWAC deposit instruction (the “New Notes DWAC Deposit”) to the 2027 Notes Trustee, for the aggregate principal amount of New 2027 Notes that such Exchanging Investor is entitled to receive pursuant to this Exchange Agreement, or comply with such other settlement procedures mutually agreed in writing by the Investor and the Company.

(3) Delivery of Exchange Consideration. The Exchange Consideration will not be delivered until a valid DWAC Withdrawal of the Existing Notes has been received and accepted by the Existing Notes Trustee. If the Closing does not occur, then any Existing Notes submitted for DWAC Withdrawal will be returned to the DTC participant that submitted the DWAC Withdrawal instruction in accordance with the procedures of DTC. On the Closing Date, subject to satisfaction of the conditions precedent specified in this Exchange Agreement, and the prior receipt of a valid DWAC Withdrawal conforming with the aggregate principal amount of the Existing Notes to be exchanged by each Exchanging Investor a valid New Notes DWAC Deposit conforming with the aggregate principal amount of the New 2027 Notes to be issued to such Exchanging Investor in the Exchange, the Company will (A) pay the Interest Amount to such Exchanging Investor by wire transfer to the account in the United States of such Exchanging Investor set forth in Exhibit A to this Exchange Agreement and (B) execute such New 2027 Notes, and direct the 2027 Notes Trustee to authenticate and, by acceptance of the New Notes DWAC Deposit, deliver, such New 2027 Notes (or comply with such other settlement procedures mutually agreed in writing by the Company and the 2027 Notes Trustee), in each case to the DTC account specified on Exhibit A to this Exchange Agreement.

(4) Acknowledgment of DWAC Posting Expiration; Delivery Instructions. Each of the Investor and each other Exchanging Investor, if any, acknowledges that each of the DWAC Withdrawal and the New Notes DWAC Deposit must be posted on the Closing Date and that if it is posted before the Closing Date, then it will expire unaccepted and must be resubmitted on the Closing Date. For the convenience of each Exchanging Investor, attached hereto as Exhibit B is a summary of the delivery instructions that must be followed to settle the Exchange through DTC.

(5) Other Exchanges. Each of the Investor and each other Exchanging Investor, if any, acknowledges that other investors are participating in similar exchanges, each of which contemplates a DWAC Withdrawal and a New Notes DWAC Deposit. The Company intends to complete the New Notes DWAC Deposit concurrently for all investors who have submitted valid DWAC Withdrawals and New Notes DWAC Deposits by the deadline above. In the event that the Investor complies with the deadline above for the DWAC Withdrawal and other investors do not, the Company will use its commercially reasonable efforts to ensure that the New 2027 Notes are delivered to the Investor pursuant to the New Notes DWAC Deposit on the Closing Date. However, in the event that such New 2027 Notes are not delivered on the Closing Date, the Company will use its commercially reasonable efforts to ensure that the same will be delivered on the business day immediately following the Closing Date or as soon as reasonably practicable thereafter.

(6) Delay of Closing. If (A) the Existing Notes Trustee is unable to locate the DWAC Withdrawal or (B) the 2027 Notes Trustee is unable to locate the New Notes DWAC Deposit or (C) such DWAC Withdrawal does not conform to the Existing Notes to be exchanged in the Exchange or such New Notes DWAC Deposit does not conform to the New 2027 Notes to be issued in the Exchange, then the Company will promptly notify the Investor. If, because of the occurrence of an event described in clause (A), (B) or (C) of the preceding sentence, the New 2027 Notes are not delivered on the Closing Date, then such New 2027 Notes will be delivered on the first business day following the Closing Date (or as soon as reasonably practicable thereafter) on which all applicable conditions set forth in clauses (A), (B) or (C) of the first sentence of this paragraph have been cured.

(iv) Questions as to Form. All questions as to the form of all documents and the validity and acceptance of the Existing Notes will be determined by the Company, in its reasonable discretion, which determination will be final and binding.

Section 4. Representations, Warranties and Covenants of the Company. The Company represents and warrants to the Exchanging Investors and covenants that:

(a) Due Formation, Valid Existence and Good Standing; Power to Perform Obligations. The Company is duly formed, validly existing and in good standing under the laws of the State of Delaware, with full power and authority to conduct its business as it is currently being conducted and to own its assets. The Company has full power and authority to consummate the Exchange and to enter into this Exchange Agreement and perform all of its obligations hereunder.

(b) Delivery Free of Liens. Upon the Company’s delivery of the New 2027 Notes to any Exchanging Investor pursuant to the Exchange, such New 2027 Notes will be free and clear of all Liens created by the Company other than those created under the Existing Indenture.

(c) Listing of Common Stock. At or before the Closing, the Company will have submitted to the New York Stock Exchange a Supplemental Listing Application with respect to the Conversion Shares. The Company will use its commercially reasonable efforts to maintain the listing of the Conversion Shares on the New York Stock Exchange for so long as the Common Stock is then so listed.

(d) Securities Act Matters. Assuming the accuracy of the representations and warranties of the Investor, made on behalf of itself and the Exchanging Investors, (i) the issuance of the New 2027 Notes in exchange for the Existing Notes pursuant to this Exchange Agreement is exempt from the registration requirements of the Securities Act; (ii) when issued pursuant to this Exchange Agreement, the New 2027 Notes will be freely transferable without restrictions as to volume and manner of sale pursuant to Rule 144 under the Securities Act; and (iii) based on applicable laws and regulations as of the Closing Date, if and when issued in accordance with the 2027 Notes Indenture, the Conversion Shares will be freely transferable without restrictions as to volume and manner of sale pursuant to Rule 144 under the Securities Act by any Investor that is not, at such time or at any time during the immediately preceding three months, an “affiliate” (as defined in Rule 144 under the Securities Act) of the Company. The Resale Restriction Termination Date for the 2027 Notes occurred on September 29, 2021. When issued pursuant to this Exchange Agreement, (i) the New 2027 Notes will be issued with the same “unrestricted” CUSIP number as the Old 2027 Notes and will not be subject to any restriction on transfer imposed by the Company or under the Securities Act by persons who are not, and who have not been at any time during the preceding three months, an “affiliate” of the Company within the meaning of Rule 144 under the Securities Act; (ii) the New 2027 Notes will be fungible with the Old 2027 Notes for U.S. federal income tax purposes and securities law purposes; and (iii) the New 2027 Notes issued pursuant to this Exchange Agreement will be issued in compliance with Section 2.10 of the 2027 Notes Indenture with the same CUSIP number as the Old 2027 Notes.

(e) Enforceability of New 2027 Notes. Each New 2027 Note to be issued pursuant to this Exchange Agreement has been duly authorized by the Company and, when issued, authenticated and delivered in the manner provided for in the 2027 Notes Indenture and this Exchange Agreement, will be validly issued, will constitute a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or similar laws affecting creditors’ rights generally or by equitable principles relating to enforceability, including principles of commercial reasonableness, good faith and fair dealing, regardless of whether enforcement is sought in a proceeding at law or in equity, and will be entitled to the benefits of the 2027 Notes Indenture.

(f) Enforceability of 2027 Notes Indenture. The 2027 Notes Indenture has been duly authorized, executed and delivered in accordance with its terms by the Company and constitutes a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or similar laws affecting creditors’ rights generally or by equitable principles relating to enforceability, including principles of commercial reasonableness, good faith and fair dealing, regardless of whether enforcement is sought in a proceeding at law or in equity.

(g) Common Stock Issuable Upon Conversion of 2027 Notes. Subject to the terms of the 2027 Notes Indenture, the 2027 Notes will be convertible into shares of Common Stock, cash or a combination of shares of Common Stock and cash, at the Company’s election. The Company has duly authorized and reserved a number of shares of Common Stock for issuance upon conversion of the 2027 Notes equal to the maximum number of such shares issuable upon conversion (assuming “Physical Settlement” of the 2027 Notes upon conversion and the maximum increase to the “Conversion Rate” in connection with any “Make-Whole Fundamental Change” (each, as defined in the 2027 Notes Indenture) applies) (the “Conversion Shares”), and, when such Conversion Shares are issued upon conversion of the 2027 Notes in accordance with the terms of the 2027 Notes and the 2027 Notes Indenture, such Conversion Shares will be validly issued, fully paid and non-assessable, and the issuance of any such Conversion Shares will not be subject to any preemptive or similar rights.

(h) Trust Indenture Act. Assuming the accuracy of the representations and warranties of the Investor, made on behalf of itself and the Exchanging Investors, it is not necessary to qualify the 2027 Notes Indenture under the Trust Indenture Act of 1939, as amended, in connection with the Exchange.

(i) Non-Contravention. The Exchange and the other transactions contemplated thereby will not (i) contravene any law, rule or regulation binding on the Company or any subsidiary thereof or any judgment or order of any court or arbitrator or governmental or regulatory authority applicable to the Company or any such subsidiary; (ii) constitute a breach or violation or result in a default under any loan agreement, mortgage, lease or other agreement or instrument to which the Company or any of its subsidiaries is a party or by which it is bound; or (iii) constitute a breach or violation or result in a default under the organizational documents of the Company or any subsidiary thereof, except, in the case of clauses (i) and (ii) above, for such contraventions, conflicts, violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a material adverse effect on the business, properties, management, financial position, stockholders’ equity or results of operations of the Company and its subsidiaries taken as a whole or on the performance by the Company of its obligations under this Exchange Agreement.

(j) No Consents. No consent, approval, authorization, order, license, registration or qualification of or with any court or governmental or regulatory authority is required for the execution, delivery and performance by the Company of its obligations under this Exchange Agreement, the 2027 Notes Indenture and the 2027 Notes and the consummation of the transactions contemplated by this Exchange Agreement, the 2027 Notes Indenture and the 2027 Notes, except such as have been obtained or made (or will, at the Closing, have been obtained or made) by the Company.

(k) Authorization, Execution and Delivery of This Exchange Agreement. This Exchange Agreement has been duly authorized, executed and delivered by the Company.

(l) Investment Company Act. The Company is not and, after giving effect to the transactions contemplated by this Exchange Agreement, will not be required to register as an “investment company” within the meaning of the Investment Company Act of 1940, as amended, and the rules and regulations of the SEC thereunder.

(m) Accuracy of Covered SEC Filings. The Covered SEC Filings (as defined above), taken as a whole (with the more recent such reports and documents deemed to amend inconsistent statements contained in any earlier such reports and documents), as of the date of the latest Covered SEC Filing, did not include an untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading.

Section 5. Representations, Warranties and Covenants of the Investor and the Exchanging Investors. The Investor, for itself and on behalf of each Exchanging Investor, represents and warrants to the Company and covenants that:

(a) Power to Perform Obligations and Bind Accounts; Survival of Authority. The Investor, for itself and on behalf of each Exchanging Investor, has full power and authority to exchange, sell, assign and transfer the Existing Notes to be exchanged pursuant to, and to enter into, this Exchange Agreement and perform all obligations required to be performed by the Investor or such Exchanging Investor under this Exchange Agreement. If the Investor is exchanging any Existing Notes or acquiring any of the Exchange Consideration as a fiduciary or agent for one or more Accounts (including any Accounts that are Exchanging Investors), it represents that it has (i) the requisite investment discretion with respect to each such Account necessary to effect the Exchange; (ii) full power to make the representations, warranties and covenants set forth in this Section 5 on behalf of such Account; and (iii) contractual authority with respect to each such Account. All authority conferred in this Exchange Agreement will survive the dissolution of the Investor, and any representation, warranty, undertaking and obligation of the Investor under this Exchange Agreement will be binding upon the trustees in bankruptcy, legal representatives, successors and assigns of the Investor.

(b) Ownership of Existing Notes. Each of the Exchanging Investors is and, immediately before the Closing, will be the beneficial owner of the Existing Notes set forth on Exhibit A and has held the Existing Notes since August 21, 2023.

(c) Rule 144 Matters. Neither the Investor nor any other Exchanging Investor is, as of the date of this Exchange Agreement, or, at the Closing, will be, and, at no time during the three months preceding the date of this Exchange Agreement or preceding the Closing, was or will any of them be, a “person” that is an “affiliate” of the Company (as such terms are defined in Rule 144 under the Securities Act).

(d) Passage of Good Title; No Liens. When the Existing Notes are exchanged pursuant to this Exchange Agreement, the Company will acquire good, marketable and unencumbered title to the Existing Notes, free and clear of all Liens.

(e) Non-Contravention. The Exchange will not (i) contravene any law, rule or regulation binding on the Investor or any of the Exchanging Investors or any investment guideline or restriction applicable to the Investor or any of the Exchanging Investors; or (ii) constitute a breach or violation or result in a default under the organizational documents of the Investor or any Exchanging Investor or any material loan agreement, mortgage, lease or other agreement or instrument to which the Investor or any Exchanging Investor is a party or by which it is bound.

(f) Jurisdiction of Residence. The Investor and each Exchanging Investor is a resident of the jurisdiction set forth on Exhibit A attached to the Exchange Agreement.

(g) Compliance with Certain Laws; No Consents. The Investor and each Exchanging Investor will comply with all applicable laws and regulations in effect in any jurisdiction in which the Investor or any of the Exchanging Investors acquires any New 2027 Notes pursuant to the Exchange and there are no consents, approvals or permissions required for such purchases, acquisitions or sales under the laws and regulations of any jurisdiction to which the Investor or any of the Exchanging Investors is subject or in which the Investor or any Exchanging Investor acquires any New 2027 Notes pursuant to the Exchange.

(h) Acknowledgement of Risks; Investment Sophistication. The Investor and each Exchanging Investor understands and accepts that the New 2027 Notes to be acquired in the Exchange involve risks. Each of the Investor and the Exchanging Investors has such knowledge, skill and experience in business, financial and investment matters that such person is capable of evaluating the merits and risks of the Exchange and an investment in the 2027 Notes. With the assistance of each Exchanging Investor’s own professional advisors, to the extent that the Exchanging Investor has deemed appropriate, each Exchanging Investor has made its own legal, tax, accounting and financial evaluation of the merits and risks of an investment in the 2027 Notes and the consequences of the Exchange and this Exchange Agreement. Each Exchanging Investor has considered the suitability of the 2027 Notes as an investment in light of its own circumstances and financial condition, and each of the Investor and the Exchanging Investor is able to bear the risks associated with an investment in the 2027 Notes.

(i) No View to Distribution; No Registration. Each Exchanging Investor is acquiring the New 2027 Notes solely for such Exchanging Investor’s own beneficial account, for investment purposes, and not with a view to, or for resale in connection with, any distribution of the 2027 Notes in violation of the Securities Act. Each of the Investor and the Exchanging Investors understands that the offer and sale of the 2027 Notes have not been registered under the Securities Act or any state securities laws by reason of specific exemptions under the provisions thereof that depend in part upon the investment intent of the Investor and the Exchanging Investors and the accuracy of the other representations made by the Investor, for itself and on behalf of each Exchanging Investor, in this Exchange Agreement. Each of the Investor and the Exchanging Investors understands that the Company and its affiliates are relying upon the representations and agreements contained in this Exchange Agreement (and any supplemental information) for the purpose of determining whether the Exchange meets the requirements for such exemptions.

(j) Information Provided. The Investor and each Exchanging Investor acknowledges that no person has been authorized to give any information or to make any representation concerning the Company or the Exchange other than as contained in this Exchange Agreement, and the Covered SEC Filings. The Company takes no responsibility for, and provides no assurance as to the reliability of, any other information that others may provide to the Investor or any Exchanging Investor.

(k) No Investment, Tax or Other Advice. The Investor confirms that it and each Exchanging Investor is not relying on any statement (written or oral), representation or warranty made by, or on behalf of, the Company, Matthews South or any of their respective affiliates as investment, tax or other advice or as a recommendation to participate in the Exchange and receive the Exchange Consideration in exchange for Existing Notes. The Investor confirms that it and each Exchanging Investor has read the 2027 Notes Indenture and has not relied on any statement (written or oral) of the Company, Matthews South or any of their respective affiliates as to the terms of the 2027 Notes. Neither the Company, Matthews South nor any of their respective affiliates is acting or has acted as an advisor to the Investor or any Exchanging Investor in deciding whether to participate in the Exchange and to exchange Existing Notes for the Exchange Consideration.

(l) Investment Decision Matters. The Investor confirms that none of the Company, Matthews South or any of their respective affiliates have (i) given any guarantee or representation as to the potential success, return, effect or benefit (either legal, regulatory, tax, financial, accounting or otherwise) of an investment in the 2027 Notes; or (ii) made any representation to the Investor or any Exchanging Investor regarding the legality of an investment in the 2027 Notes under applicable investment guidelines, laws or regulations. In deciding to participate in the Exchange, each of the Investor and the Exchanging Investors is not relying on the advice or recommendations of the Company or Matthews South, or their respective affiliates, and has made its own independent decision that the terms of the Exchange and the investment in the 2027 Notes are suitable and appropriate for it.

(m) Due Diligence. Each of the Investor and the Exchanging Investors is familiar with the business and financial condition and operations of the Company and has had the opportunity to conduct its own investigation of the Company and the 2027 Notes. Each of the Investor and the Exchanging Investors has had access to and reviewed the Covered SEC Filings and such other information concerning the Company and the 2027 Notes it deems necessary to enable it to make an informed investment decision concerning the Exchange. Each of the Investor and the Exchanging Investors has been offered the opportunity to ask questions of the Company and received answers thereto, as it deems necessary to enable it to make an informed investment decision concerning the Exchange.

(n) No Regulatory Agency Recommendation or Approval. Each of the Investor and the Exchanging Investors understands that no federal or state agency has passed upon the merits or risks of an investment in the 2027 Notes or made any recommendation or endorsement, or made any finding or determination concerning the fairness or advisability, of such investment or the consequences of the Exchange and this Exchange Agreement.

(o) Qualified Institutional Buyer Status. Each Exchanging Investor and each Account for which it is acting is a “qualified institutional buyer” as defined in Rule 144A under the Securities Act. Each of the Investor and the Exchanging Investors agrees to furnish any additional information requested by the Company or any of its affiliates to assure compliance with applicable U.S. federal and state securities laws in connection with the Exchange.

(p) Mutual Negotiation. The Investor acknowledges that the terms of the Exchange have been mutually negotiated between the Investor and the Company. The Investor was given a meaningful opportunity to negotiate the terms of the Exchange. The Investor had a sufficient amount of time to consider whether to participate in the Exchange, and neither the Company nor Matthews South, nor any of their respective affiliates or agents, has placed any pressure on the Investor to respond to the opportunity to participate in the Exchange. The Investor’s and each Exchanging Investor’s participation in the Exchange was not conditioned by the Company on the Investor or any Exchanging Investor’s exchange of a minimum principal amount of Existing Notes for the Exchange Consideration.

(q) Financial Adviser Fee. The Investor acknowledges that it and each Exchanging Investor understands that the Company intends to pay Matthews South a fee in respect of the Exchange.

(r) Additional Documentation. The Investor will, upon request, execute and deliver, for itself and on behalf of any Exchanging Investor, any additional documents that the Company, the Existing Notes Trustee or the 2027 Notes Trustee may reasonably request to complete the Exchange.

(s) Bring-Down of Representations and Warranties. The Investor understands that, unless the Investor notifies the Company in writing to the contrary at or before the Closing, each of the Investor’s representations and warranties, on behalf of itself and each Exchanging Investor, contained in this Exchange Agreement will be deemed to have been reaffirmed and confirmed as of the Closing, taking into account all information received by the Investor and each Exchanging Investor.

(t) New York Stock Exchange Matters. Neither the Investor nor any Exchanging Investor has an ownership interest equal to or greater than either 5% of the number of shares of Common Stock of the Company or 5% of the voting power outstanding of the Company, in each case, before the initial issuance of the securities issued in the Exchange.

(u) Settlement Instructions. No later than one (1) business day after the date hereof, the Investor agrees to deliver to the Company settlement instructions substantially in the form of Exhibit A attached to the Exchange Agreement for each of the Exchanging Investors.

(w) Wall-Cross Matters. The Investor acknowledges and agrees that it and each Exchanging Investor has not transacted, and will not transact, in any securities of the Company, including, but not limited to, any hedging transactions, from the time the Investor was first contacted by the Company or Matthews South with respect to the transactions contemplated by this Exchange Agreement until after the Release Time. Solely for purposes of this Section 5(v), subject to the Investor’s compliance with its obligations under U.S. federal securities laws and the Investor’s internal policies, (i) “Investor” will not include any employees or affiliates of the Investor that are effectively walled off by appropriate “Fire Wall” information barriers approved by the Investor’s legal or compliance department, and (ii) the foregoing representations and covenants of this Section 5(v) will not apply to any transaction by or on behalf of an Account that was effected without the advice or participation of, or such Account’s receipt of information regarding the transactions contemplated hereby provided by, the Investor.

(w) No Reliance on Matthews South. The Investor acknowledges and agrees that Matthews South has not acted as a financial advisor or fiduciary to the Investor or any Exchanging Investor and that Matthews South and its respective directors, officers, employees, representatives and controlling persons have no responsibility for making, and have not made, any independent investigation of the information contained herein or in the Company’s SEC filings and make no representation or warranty to the Investor or any Exchanging Investor, express or implied, with respect to the Company, the Existing Notes or the Exchange Consideration or the accuracy, completeness or adequacy of the information provided to the Investor or any Exchanging Investor or any other publicly available information, nor will any of the foregoing persons be liable for any loss or damages of any kind resulting from the use of the information contained therein or otherwise supplied to the Investor or any Exchanging Investor.

(x) Authorization, Execution and Delivery of This Exchange Agreement. This Exchange Agreement has been duly authorized, executed and delivered by the Investor.

Section 6. Conditions to Obligations of the Company, the Investor and the Exchanging Investors.

(a) Conditions to the Company’s Obligations. The obligation of the Company to deliver the Exchange Consideration is subject to the satisfaction at or prior to the Closing of each of the following conditions precedent: (i) the representations, warranties and covenants of the Investor, for itself and on behalf of the Exchanging Investors, in Section 5 hereof are true and correct as of the Closing in all respects with the same effect as though such representations and warranties had been made as of the Closing; (ii) and all covenants of the Investor or any Exchanging Investor in Section 5 to be performed at or before the Closing have been performed; and (iii) the conditions precedent set forth in Section 3(b)(iii)(3) and the receipt by the Company of a valid DWAC Withdrawal and New Notes DWAC Deposit conforming to the requirements set forth in this Exchange Agreement.

(b) Conditions to the Investor’s Obligations. The obligation of the Investor, on behalf of the Exchanging Investors, to deliver (or cause to be delivered) the Existing Notes is subject to the satisfaction at or prior to the Closing of each of the following conditions precedent: (i) the representations, warranties and covenants of the Company in Section 4 are true and correct as of the Closing in all respects with the same effect as though such representations and warranties had been made as of the Closing; and (ii) all covenants of the Company in Section 4 to be performed at or before the Closing have been performed.

Section 7. The Release Time.

(a) As of the date of this Exchange Agreement, the Company is not aware of, and has not provided to the Investor, any material non-public information regarding the Company or its securities, other than any material non-public information relating to the Exchange; and

(b) the Company agrees to publicly disclose at or before 8:30 a.m., New York City time, on the first business day after the date of this Exchange Agreement (such time and date, the “Release Time”), the exchange of the Existing Notes contemplated by this Exchange Agreement and similar exchange agreements in a Current Report on Form 8-K. The Company acknowledges and agrees that, as of the Release Time, none of the information provided by or on behalf of the Company to the Investor or any Exchanging Investor in connection with the Exchange will constitute material non-public information.

Section 8. Tax Matters.

The Investor acknowledges that, if an Exchanging Investor is a United States person for U.S. federal income tax purposes, either (a) the Company must be provided with a correct taxpayer identification number (generally, a person’s social security or federal employer identification number) and certain other information on a properly completed and executed IRS Form W-9, which is provided herein on Exhibit C attached to this Exchange Agreement; or (b) another basis for exemption from backup withholding must be established. The Investor further acknowledges that, if an Exchanging Investor is not a United States person for U.S. federal income tax purposes, the Company must be provided with the appropriate properly completed and executed IRS Form W-8, attesting to that non-U.S. Exchanging Investor’s foreign status and certain other information, including information establishing an exemption from withholding under Sections 1471 through 1474 of the Code. The Investor further acknowledges that any Exchanging Investor may be subject to 30% U.S. federal withholding or 24% U.S. federal backup withholding on certain payments or deliveries made to such Exchanging Investor unless such Exchanging Investor properly establishes an exemption from, or a reduced rate of, such withholding or backup withholding.

Section 9. Miscellaneous.

(a) Waiver; Amendment. Neither this Exchange Agreement nor any provisions hereof may be modified, changed, discharged or terminated except by an instrument in writing, signed by the party against whom any waiver, change, discharge or termination is sought.

(b) Assignability. Neither this Exchange Agreement nor any right, remedy, obligation or liability arising hereunder or by reason hereof will be assignable by either the Company, on the one hand, or the Investor or any Exchanging Investor, on the other hand, without the prior written consent of the other party.

(c) Further Instruments and Acts. Each of the parties to this Exchange Agreement agrees to execute and deliver such further instruments and do such further acts as may be reasonably necessary or proper to more effectively carry out the purposes of this Exchange Agreement.

(d) Waiver of Jury Trial. EACH OF THE COMPANY, THE INVESTOR AND THE EXCHANGING INVESTORS IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY WITH RESPECT TO ANY LEGAL PROCEEDING ARISING OUT OF THE TRANSACTIONS CONTEMPLATED BY THIS EXCHANGE AGREEMENT.

(e) Governing Law. This Exchange Agreement will be governed by and construed in accordance with the internal laws of the State of New York.

(f) Section and Other Headings. The section and other headings contained in this Exchange Agreement are for reference purposes only and will not affect the meaning or interpretation of this Exchange Agreement.

(g) Counterparts. This Exchange Agreement may be executed in any number of counterparts, each of which when so executed and delivered will be deemed to be an original and all of which together will be deemed to be one and the same agreement. Delivery of an executed signature page to this Exchange Agreement by facsimile or other electronic transmission (including pdf format) will be effective as delivery of a manually executed counterpart hereof.

(h) Notices. All notices and other communications to the Company provided for herein will be in writing and will be deemed to have been duly given if delivered personally or sent by nationally recognized overnight courier service or by registered or certified mail, return receipt requested, postage prepaid to the following addresses (or such other address as either party may have hereafter specified by notice in writing to the other): (i) if to the Company, PROS Holdings, Inc., 3200 Kirby Drive, Suite 600, Houston, TX 77098, Attention: Legal Department; and (ii) if to the Investor, the address provided on the signature page below.

(i) Binding Effect.. The provisions of this Exchange Agreement will be binding upon and accrue to the benefit of the parties hereto and the Exchanging Investors and their respective heirs, legal representatives, successors and permitted assigns.

(j) Notification of Changes. The Investor hereby covenants and agrees to notify the Company upon the occurrence of any event prior to the Closing that would cause any representation, warranty, or covenant of the Investor, made on behalf of itself and each Exchanging Investor, contained in this Exchange Agreement to be false or incorrect.

(k) Severability. If any term or provision of this Exchange Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other term or provision of this Exchange Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

(l) Entire Agreement. This Exchange Agreement, including all Exhibits hereto, constitutes the entire agreement of the parties hereto with respect to the specific subject matter covered hereby, and supersedes in their entirety all other agreements or understandings between or among the parties with respect to such specific subject matter.

(m) Reliance by Matthews South. Matthews South, acting as financial advisor to the Company, may rely on each representation and warranty of the Company and of the Investor, made on behalf of itself and each Exchanging Investor, herein or pursuant to the terms hereof with the same force and effect as if such representation or warranty were made directly to Matthews South. Matthews South will be a third-party beneficiary of this Exchange Agreement to the extent provided in this Section 9(m).

[The Remainder of This Page Intentionally Left Blank; Signature Pages Follow]

IN WITNESS WHEREOF, the parties to this Exchange Agreement have caused this Exchange Agreement to be duly executed as of the date first written above.

| | | | | | | | | | | | | | | | | |

| | | Investor: | |

| | | | | |

| | | | | |

| | | Legal Name | |

| | | | | |

| | | By: | | |

| | | | Name: | |

| | | | Title | |

| | | | | |

| | | | | |

| Investor Address: | | | Taxpayer Identification Number: |

| | | | | |

| | | | | |

| | | | | |

| | | Telephone Number: |

| | | | | |

| | | | | |

| | | | | |

| Country (and, if applicable, State) of Residence: | | | |

| | | | | |

| | | | | |

| | | | | |

Aggregate Principal Amount of Existing Notes to be Exchanged by All Exchanging Investors (must be an integral multiple of $1,000): |

| | | | | |

| $ | | ,000 | | | |

[Signature Page to Exchange Agreement]

| | | | | | | | | | | | | | | | | |

| | | PROS HOLDINGS, INC. | |

| | | | | |

| | By: | | | |

| | | Name: | |

| | | Title: | | |

[Signature Page to Exchange Agreement]

SCHEDULE A

| | | | | |

| Daily 10b-18 VWAP | Daily Exchange Ratio |

| $45.00 | 0.02700 |

| $44.00 | 0.02739 |

| $43.00 | 0.02780 |

| $42.00 | 0.02821 |

| $41.00 | 0.02864 |

| $40.00 | 0.02909 |

| $39.00 | 0.02954 |

| $38.00 | 0.03002 |

| $37.00 | 0.03050 |

| $36.00 | 0.03101 |

| $34.97 | 0.03154 |

| $34.00 | 0.03207 |

| $33.00 | 0.03262 |

| $32.00 | 0.03320 |

| $31.00 | 0.03380 |

| $30.00 | 0.03442 |

| $29.00 | 0.03506 |

| $28.00 | 0.03573 |

| $27.00 | 0.03642 |

| $26.00 | 0.03714 |

| $25.00 | 0.03789 |

If the Daily 10b-18 VWAP is above $45.00 or below $25.00, the Daily Exchange Ratio

will be determined with linear extrapolation from the top two rows of the above table, or bottom two rows of the above table, respectively.

For example, at $47.00, the Daily Exchange Ratio will be 0.02622, and at $23.00 the Daily Exchange Ratio will be 0.03939.

EXHIBIT A

| | | | | | | | | | | | | | | | | | | | |

| Exchanging Investor Information | | |

| (Complete the Following Form for Each Exchanging Investor) | | |

| | | | | | |

| Legal Name of Exchanging Holder: | | | | | |

| | | | | | |

| Aggregate principal amount of Existing Notes to be exchanged | | | | | |

| (must be an integral multiple of $1,000): | | $ | | ,000 | |

| | | | | | |

| Exchanging Holder's Address: | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Telephone: | | | | | | |

| | | | | |

| | | | | | |

Country (and, if applicable, State) of Residence: | | | |

| | | | | | |

| Taxpayer Identification Number: | | | | | |

| | | | | | |

| Account for Existing Notes | | Account for New 2027 Notes | | Wire Instructions for Interest Amount |

| | | | | | |

| DTC Participant Number: | | DTC Participant Number | | Bank Routing #: |

| | | | | | |

| | | | | | |

| | | | | | |

| DTC Participant Name: | | DTC Participant Name: | | SWIFT Code: |

| | | | | | |

| | | | | | |

| | | | | | |

| DTC Participant Phone Number: | | DTC Participant Phone Number: | | Bank address: |

| | | | | | |

| | | | | | |

| | | | | | |

| DTC Participant Contact Email: | | DTC Participant Contact Email: | | Account Number: |

| | | | | | |

| | | | | | |

| | | | | | |

| | | Account # at DTC Participant: | | Account Name: |

| | | | | | |

| | | | | | |

EXHIBIT B

Exchange Procedures

NOTICE TO INVESTOR

Attached are Investor Exchange Procedures for the settlement of the exchange (the “Exchange”) of 1.00% Convertible Senior Notes due 2024, CUSIP 74346Y AH6 (the “Existing Notes”) of PROS Holdings, Inc. (the “Company”) for the Company’s 2.250% Convertible Senior Notes due 2027 (the “New 2027 Notes”) (the “Exchange Consideration”), pursuant to the Exchange Agreement, dated as of August 23, 2023 (the “Exchange Agreement”), between you and the Company, which is expected to occur on the Closing Date (as defined in the Exchange Agreement). To ensure timely settlement, please follow the instructions for the Exchange as set forth on the following page.

Your failure to comply with the attached instructions may delay your receipt of the Exchange Consideration.

If you have any questions, please contact Bryan Goldstein of Matthews South LLC at (xxx) xxx-xxxx.

Thank you.

Delivery of the Existing Notes

You must direct the eligible DTC participant through which you hold a beneficial interest in the Existing Notes to post on the Closing Date, no later than 9:30 a.m., New York City time, withdrawal instructions through DTC via DWAC for the aggregate principal amount of Existing Notes (CUSIP #74346Y AH6) set forth in Exhibit A of the Exchange Agreement to be exchanged. It is important that this instruction be submitted and the DWAC posted on Closing Date; if it is posted before the Closing Date, then it will expire unaccepted and will need to be re-posted on the Closing Date.

To Receive the New 2027 Notes

You must direct your eligible DTC participant through which you wish to hold a beneficial interest in the New 2027 Notes to post on the Closing Date, no later than 9:30 a.m., New York City time, a deposit instruction through DTC via DWAC for the aggregate principal amount of New 2027 Notes to which you are entitled pursuant to the Exchange. It is important that this instruction be submitted and the DWAC posted on the Closing Date; if it is posted before the Closing Date, then it will expire unaccepted and will need to be re-posted on the Closing Date.

Closing

On the Closing Date, after the Company receives your Existing Notes and your delivery instructions as set forth above, and subject to the satisfaction of the conditions to Closing as set forth in your Exchange Agreement, the Company will deliver the New 2027 Notes in accordance with the delivery instructions above.

EXHIBIT C

Tax Matters

Under U.S. federal income tax law, an Exchanging Investor who exchanges Existing Notes for the Exchange Consideration generally must provide such Exchanging Investor’s correct taxpayer identification number (“TIN”) on IRS Form W-9 (attached hereto) or otherwise establish a basis for exemption from backup withholding. A TIN is generally an individual holder’s social security number or an Exchanging Investor’s employer identification number. If the correct TIN is not provided, the Exchanging Investor may be subject to a $50 penalty imposed by the IRS. In addition, certain payments made to holders may be subject to U.S. backup withholding tax (currently set at 24% of the payment). If an Exchanging Investor is required to provide a TIN but does not have the TIN, the Exchanging Investor should consult its tax advisor regarding how to obtain a TIN. Certain holders are not subject to these backup withholding and reporting requirements. Non-U.S. Holders generally may establish their status as exempt recipients from backup withholding by submitting a properly completed applicable IRS Form W-8 (available from the Company or the IRS at www.irs.gov), signed, under penalties of perjury, attesting to such Exchanging Investor’s exempt foreign status. U.S. backup withholding is not an additional tax. Rather, the U.S. federal income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund may be obtained provided that the required information is timely furnished to the IRS. the Exchanging Investors are urged to consult their tax advisors regarding how to complete the appropriate forms and to determine whether they are exempt from backup withholding or other withholding taxes.

[Dealer name and address]

| | | | | |

| To: | PROS Holdings, Inc. 3200 Kirby Dr., Suite 600 Houston, Texas 77098 |

| From: | [Dealer] |

| Re: | Capped Call Transaction |

| Ref. No: | [__________]1 |

| Date: | [•], 2023 |

Dear Ladies and Gentlemen:

The purpose of this communication (this “Confirmation”) is to set forth the terms and conditions of the above-referenced transaction entered into on the Trade Date specified below (the “Transaction”) between [Dealer] (“Dealer”) and PROS Holdings, Inc. (“Counterparty”). The additional terms of the Transaction are as set forth in the Trade Notification in the form of Schedule D hereto (the “Trade Notification”), which shall reference this Confirmation and supplement, form a part of, and be subject to this Confirmation. This letter agreement, as supplemented by the Trade Notification, constitutes a “Confirmation” as referred to in the ISDA Master Agreement specified below.

1.This Confirmation and the Trade Notification are subject to, and incorporate, the definitions and provisions of the 2006 ISDA Definitions (the “2006 Definitions”) and the definitions and provisions of the 2002 ISDA Equity Derivatives Definitions (the “Equity Definitions”, and together with the 2006 Definitions, the “Definitions”), in each case as published by the International Swaps and Derivatives Association, Inc. (“ISDA”). In the event of any inconsistency between the 2006 Definitions and the Equity Definitions, the Equity Definitions will govern and in the event of any inconsistency between terms defined in the Equity Definitions and this Confirmation and the Trade Notification, this Confirmation and the Trade Notification shall govern.

This Confirmation and the Trade Notification evidence a complete and binding agreement between Dealer and Counterparty as to the terms of the Transaction to which this Confirmation and the Trade Notification relate. This Confirmation and the Trade Notification shall be subject to an agreement (the “Agreement”) in the form of the ISDA 2002 Master Agreement as if Dealer and Counterparty had executed an agreement in such form on the Trade Date (but without any Schedule except for (i) the election of the laws of the State of New York as the governing law (without reference to choice of law doctrine), [(ii) the election of an executed guarantee of [__________] (“Guarantor”) dated as of the Trade Date in substantially the form attached hereto as Schedule 1 as a Credit Support Document, (iii) the election of Guarantor as Credit Support Provider in relation to Dealer and (iv)]2 [and (ii)] the election that the “Cross Default” provisions of Section 5(a)(vi) of the Agreement shall apply to Dealer, (a) [with a “Threshold Amount” of 3% of the shareholders’ equity of [Dealer] [[__] [(“Dealer Parent”)]3 on the Trade Date, (b) “Specified Indebtedness” having the meaning set forth in Section 14 of the Agreement, except that it shall not include any obligation in respect of deposits received in the ordinary course of Dealer's banking business, (c) the phrase “, or becoming capable at such time of being declared,” shall be deleted from clause (1) of such Section 5(a)(vi) of the Agreement, and (d) the following sentence shall be added to the end of Section 5(a)(vi) of the Agreement: “Notwithstanding the foregoing, such provisions shall exclude any default that results solely from wire transfer difficulties or an error or omission of an administrative or operational nature, but only if funds were available to enable the relevant party to make payment when due and the payment is made within two Local Business Days of such party’s receipt of written notice of its failure to pay.”.

1 If applicable

2 Requested if Dealer is not the highest rated entity in group, typically from Parent.

3 Include as applicable

All provisions contained in, or incorporated by reference to, the Agreement will govern this Confirmation except as expressly modified herein. In the event of any inconsistency between provisions of the Agreement, this Confirmation, and the Trade Notification, the following will prevail for purpose of the Transaction to which this Confirmation relates in the order of precedence indicated: (i) the Trade Notification, (ii) this Confirmation and (iii) the Agreement.

The Transaction hereunder shall be the sole transaction under the Agreement. If there exists any ISDA Master Agreement between Dealer and Counterparty or any confirmation or other agreement between Dealer and Counterparty pursuant to which an ISDA Master Agreement is deemed to exist between Dealer and Counterparty, then notwithstanding anything to the contrary in such ISDA Master Agreement, such confirmation or agreement or any other agreement to which Dealer and Counterparty are parties, the Transaction shall not constitute a “Transaction” or “Specified Transaction” as defined in any such existing or deemed to be existing ISDA Master Agreement between Dealer and Counterparty, and the occurrence of an Event of Default, Termination Event or other event under this Transaction shall not, by itself, give rise to any right or obligation under any other ISDA Master Agreement or other agreement or deemed agreement.

2.The Transaction constitutes a Share Option Transaction for purposes of the Equity Definitions. The terms of the particular Transaction to which this Confirmation relates are as follows:

General Terms:

| | | | | |

| Trade Date: | [•] |

| Effective Date: | [•], or such other date as agreed by the parties in writing. |

| Components: | The Transaction will be divided into individual Components, each with the terms set forth in this Confirmation, and, in particular, with the Expiration Date set forth in Schedule A to this Confirmation and the Number of Options set forth in Schedule A to this Confirmation. The exercise, valuation and settlement of the Transaction will be effected separately for each Component as if each Component were a separate Transaction under the Agreement. |

| Option Style: | “European”, as described under “Procedures for Exercise” below. |

| Option Type: | Call |

| Seller: | Dealer |

| Buyer: | Counterparty |

| Shares: | Common Stock of Counterparty, par value USD$0.001 (Ticker Symbol: “PRO”). |

| Number of Options: | For each Component, as provided in Schedule A to this Confirmation.4 |

| Option Entitlement: | One Share Per Option |

| Strike Price: | USD 41.817 |

| Cap Price: | USD 78.90; provided that in no event shall the Cap Price be reduced to an amount less than the Strike Price in connection with any adjustment by the Calculation Agent under this Confirmation. |

| Number of Shares: | As of any date, a number of Shares equal to the product of (i) the Number of Options and (ii) the Option Entitlement. |

| Initial Premium: | [ ] |

4 The total (allocated across each participating Dealer) should be equal to (i) the [estimated] number of Convertible Securities in principal amount of $1,000 issued in the exchange multiplied by (ii) the initial conversion rate.

| | | | | |

| Initial Premium Payment Date: | The Currency Business Day one Settlement Cycle after the Trade Date. On the Initial Premium Payment Date, Counterparty shall pay the Initial Premium to Dealer. |

| Final Premium: | An amount in USD as set forth in the Trade Notification, to be equal to the Premium minus the Initial Premium. If the Final Premium is positive, Counterparty shall pay the Final Premium to Dealer on the Final Premium Date. If the Final Premium is negative, Dealer shall pay the absolute value of the Final Premium to Counterparty on the Final Premium Payment Date. Dealer and Counterparty hereby agree that notwithstanding anything to the contrary herein or in the Agreement, following the payment of the Final Premium, no Early Termination Amount or amount determined pursuant to Sections 12.2, 12.3, 12.6, 12.7, 12.8 or 12.9 of the Equity Definitions, or otherwise under the Equity Definitions, shall be payable by Counterparty to Dealer |

| Premium: | An amount in USD as set forth in the Trade Notification, to be equal to the product of (i) the Average Per-Share Premium and (ii) the sum of the Number of Options for all Components. Notwithstanding anything to the contrary in the Equity Definitions, the obligation of Counterparty to pay the Premium to Dealer on the Premium Payment Date shall be fully satisfied by the payment of the Initial Premium and, if applicable, the Final Premium on the Initial Premium Payment Date and Final Premium Payment Date, as applicable. |

| Per-Share Premium: | For each Relevant Date during the Hedge Period, the “Per-Share Premium” set forth in the grid in Schedule B hereto corresponding to the 10b-18 VWAP Price; provided that (i) if the 10b-18 VWAP Price is between “10b-18 VWAP Prices” set forth in such grid, the “Per-Share Premium” shall be determined by linear interpolation between the “Per-Share Premium” set forth in such grid corresponding to such “10b-18 VWAP Prices” and (ii) if the 10b-18 VWAP Price is less than the lowest “10b-18 VWAP Price” or greater than the highest “10b-18 VWAP Price”, as applicable, set forth in such grid, the Per-Share Premium will be determined by the Calculation Agent in a commercially reasonable manner consistent with the methodology used in creating such grid. |

| Average Per-Share Premium: | An amount in USD as set forth in the Trade Notification, to be equal to the arithmetic average of the Per-Share Premiums for each Relevant Date during the Hedge Period. |

| Final Premium Payment Date: | The Currency Business Day immediately following the Hedge Period End Date. |

| Exchange: | The New York Stock Exchange |

| Related Exchange: | All Exchanges; provided that Section 1.26 of the Equity Definitions shall be amended to add the words “United States” before the word “exchange” in the tenth line of such Section. |

| Initial Hedging: | |

| Hedge Period: | The period from and including the Hedge Period Start Date to and including the Hedge Period End Date. Promptly following the Hedge Period End Date, Dealer shall deliver the Trade Notification to Counterparty. |

| Hedge Period Start Date: | [ ] |

| Hedge Period End Date: | [ ] |