Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 24 2020 - 7:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of November, 2020

Commission

File Number 1-15106

PETRÓLEO

BRASILEIRO S.A. – PETROBRAS

(Exact

name of registrant as specified in its charter)

Brazilian

Petroleum Corporation – PETROBRAS

(Translation

of Registrant's name into English)

Avenida

República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on More Value Program

—

Rio de Janeiro, November 24, 2020 - Petrobras

informs that it has launched the More Value Program (Programa Mais Valor), a new financial solution tool for suppliers.

The pilot started last week and, in November 30th, the tool will be opened to companies interested in anticipating invoices

with more competitive rates.

The program seeks to stimulate the oil

and gas production chain in Brazil, hit by the coronavirus pandemic, offering suppliers the opportunity to anticipate the invoices

of goods and services already delivered or performed, in addition to increasing competitiveness in company procurement.

The new solution will increase companies'

access to working capital operations at more competitive rates with partner banks, using Petrobras´ payment risk (drawee

risk). Around 10 thousand companies that integrate the supplier base will be able to join the program.

Petrobras CFO, Andrea Marques de Almeida,

says that the "More Value" opens a market space that brings together suppliers and the financial sector in the same tool.

"We evaluate that the program will have a positive impact on the cash flow of suppliers that, like the company, are going

through the crisis. We will follow the adhesion, but the volume of transactions has potential to reach R$ 3 billion per month",

estimates.

The CFO declares yet that the new program

is part of a financial solutions agenda which has the purpose of bringing robustness to the supply chain and the construction of

productive relationships so that the company can implement its projects in a more agile and economic way. "We are also holding

conversations with financial institutions to evaluate solutions in which these agents can directly provide the most capital-intensive

segments, such as the construction of platforms and subsea systems".

ww.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: November 24, 2020

PETRÓLEO BRASILEIRO

S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and

Investor Relations Officer

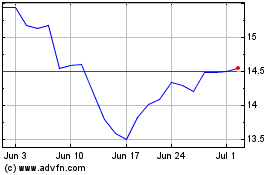

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

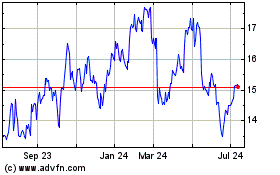

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024