UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of November, 2020

Commission

File Number 1-15106

PETRÓLEO

BRASILEIRO S.A. – PETROBRAS

(Exact

name of registrant as specified in its charter)

Brazilian

Petroleum Corporation – PETROBRAS

(Translation

of Registrant's name into English)

Avenida

República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras

releases teaser of E&P

assets in Bahia

—

Rio de Janeiro, November 4, 2020 - Petróleo

Brasileiro S.A. – Petrobras informs that it has started the opportunity disclosure stage (teaser), referring to the sale

of all of its stakes in a set of twenty-eight onshore production field concessions, with integrated facilities, located in the

Recôncavo and Tucano Basins, in different municipalities of the state of Bahia, jointly called the Bahia Terra Cluster.

The teaser, which includes key information

about the opportunity, as well as the eligibility criteria for selection of potential participants, is available on the Petrobras

website: https://www.investidorpetrobras.com.br/en/results-and-notices/teasers.

The main subsequent stages of the project

will be reported to the market in due course.

This disclosure is in accordance with Petrobras'

internal rules and with the provisions of the special procedure for assignment of rights to exploration, development and production

of oil, natural gas and other fluid hydrocarbons, provided for in Decree 9,355/2018.

This transaction is aligned

with the strategy of portfolio optimization and the improvement of the company's capital allocation, concentrating increasingly

its resources on world-class assets in deep and ultra-deep waters, where Petrobras has demonstrated great competitive edge over

the years.

About Bahia Terra Cluster

The Bahia Terra Cluster comprises

28 onshore production concessions, located in different municipalities of the state of Bahia, and includes access to processing,

logistics, storage, transportation and outflow infrastructure for oil and natural gas.

It has about 1,700 wells

in operation, 19 collection stations, 12 collection points, 2 oil treatment stations, 6 collection and compressor stations, 4 water

injection stations, approximately 980 km of gas and oil pipelines, besides the administrative bases of Taquipe, Santiago, Buracica,

Araçás and Fazenda Balsamo.

There are also two oil storage

and handling parks at the Bahia Terra Cluster with all the infrastructure for receiving, storing and draining oil for the Landulfo

Alves Refinery (RLAM). In addition, the Cluster includes the NGPU of Catu and 10 electrical substations.

The average production of

the Cluster from January to August 2020 was around 14 thousand barrels of oil per day and 642 thousand m3/day of gas. Petrobras

is the operator of these fields, with 100% stake.

It is important to note that

the concessions corresponding to the Miranga and/or Recôncavo Clusters (referenced in the releases of 08/28/2017 and 06/03/2019,

respectively) may be included in the sale process of the Bahia Terra Cluster, which will be disclosed in due course.

This material is being provided pursuant

to Brazilian regulatory requirements, does not constitute an offering, under the U.S. securities laws, and is not a solicitation,

invitation or offer to buy or sell any securities. The information on our website is not and shall not be deemed part of this report

on Form 6-K.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts within

the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: November 4, 2020

PETRÓLEO BRASILEIRO

S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and

Investor Relations Officer

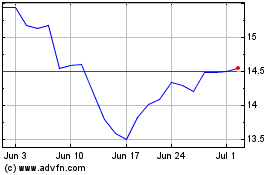

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

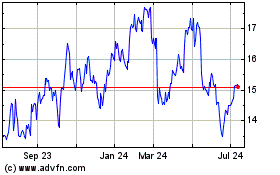

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024