TOLEDO, Ohio, May 2 /PRNewswire-FirstCall/ -- Owens Corning

(NYSE:OC) today reported consolidated net sales of $1.324 billion

for the first quarter ending March 31, 2007, compared with $1.601

billion during the same period in 2006. First quarter sales

declined 17 percent. "As expected, our performance in the first

quarter reflected weaker volume in our building materials

businesses associated with the significant slowdown of new

residential construction in the U.S.," said Dave Brown, president

and chief executive officer. "We are focused on delivering value to

our customers through innovation, and our productivity initiatives

to drive operational performance in a weaker market. "Our Composite

Solutions business continues to deliver solid results," said Brown.

"Strong demand for glass fiber materials in North America and

Europe delivered improved margins that allowed us to offset cost

inflation. Our Japanese acquisition, completed in the second

quarter of 2006, also improved our top-line growth." When reviewing

the operating performance of the company with its Board of

Directors and employees, management makes adjustments to earnings

before interest and taxes ("EBIT") and diluted earnings per share.

To calculate "adjusted EBIT" and "adjusted diluted earnings per

share," management excludes certain items from net earnings and

earnings before interest and taxes, including those related to the

company's Chapter 11 proceedings, asbestos liabilities, and

restructuring and other activities, so as to improve comparability

over time (the "Comparability Items"). As described more fully in

the attached financial schedules, such Comparability Items amounted

to charges of $28 million in the first quarter of 2007 compared to

a credit of $1 million during the same period of 2006. Consolidated

First-Quarter Results -- EBIT in the first quarter of 2007 was $33

million, compared with $115 million during the same period of 2006.

Adjusted EBIT for the first quarter of 2007 was $61 million,

compared with $114 million during the same period in 2006. The

decline was primarily due to lower sales as the weakening new

residential construction market impacted demand for building

materials, and higher material and delivery costs. -- Gross margin

as a percentage of consolidated net sales was 14.6 percent during

the first quarter, compared with 16.8 percent during the same

period of 2006, a decrease of 2.2 percentage points. The decline

was due to lower sales volume in building materials, which was

partially offset by a higher gross margin in the Composite

Solutions segment due to increased sales volume, productivity and

improved margins. -- Diluted earnings per share for the first

quarter of 2007 were $0.01. Adjusted diluted earnings per share for

the first quarter of 2007 were $0.14. -- Marketing and

administrative expenses, as a percentage of consolidated net sales,

were 10.3 percent, compared with 8.2 percent during the same period

in 2006. This increase was primarily due to decreased sales and the

impact of approximately $11 million in transaction costs incurred

during the first quarter of 2007 associated with the proposed OCV

Reinforcements joint venture with Saint-Gobain. Business

Highlights: -- Weakened demand in Insulating Systems and Roofing

and Asphalt, combined with seasonal slowdowns in the building

materials market, resulted in continued production curtailments at

selected manufacturing facilities during the first quarter. --

Demand for glass fiber reinforcement products was robust in the

first quarter, leading to higher capacity utilization and improved

productivity. -- At the end of the first quarter of 2007, the

company had $2.063 billion of short- and long-term debt, compared

with $2.736 billion at the end of 2006. The company's debt at the

end of 2006 included a note payable to the 524(g) Trust of $1.390

billion, plus interest, which was paid in full on January 4, 2007,

a portion of which was funded by borrowing $600 million under the

company's delayed draw senior-term loan facility during the first

quarter of 2007. -- Owens Corning announced a share buy-back

program in the first quarter under which the company is authorized

to repurchase up to 5 percent of Owens Corning's outstanding common

stock. The company did not repurchase any shares during the first

quarter. -- Owens Corning's continued focus on safety resulted in a

26 percent reduction in injuries through the first three months of

the year as compared with our December 31, 2006 rate. -- On April

18, 2007, CEO Dave Brown announced his plans to retire by the end

of 2007. CFO Mike Thaman was selected to succeed Mr. Brown as chief

executive officer. Mr. Thaman will remain Chairman of the Board of

Directors. Update: Proposed Owens Corning and Saint-Gobain Joint

Venture On February 20, 2007, Owens Corning and Saint-Gobain

announced that they signed a joint-venture agreement to merge their

respective reinforcements and composites businesses, thereby

creating a global company in reinforcements and composite fabrics

products with worldwide revenues of approximately $1.8 billion and

10,000 employees. The new company, to be named "OCV

Reinforcements," will serve customers with improved technology, an

expanded product range and a strengthened presence in both

developed and emerging markets. The transaction, which has been

approved by the Boards of Directors of both parent companies, is

subject to customary closing conditions and regulatory and

antitrust approvals. Given the timing of regulatory and antitrust

review, the joint venture is targeted to close during the second

half of 2007. Update: Strategic Business Review: Siding Solutions

Business & Fabwel Unit Consistent with Owens Corning's ongoing

review of its businesses, the company announced during the first

quarter that it will explore strategic alternatives for its Siding

Solutions business, which includes its vinyl siding manufacturing

operations and Norandex/Reynolds distribution business, and the

company's Fabwel unit, the leading producer and fabricator of

components and sidewalls for recreational vehicles and cargo

trailers. The company expects a midyear completion of this review

process. 2007 Outlook Based on current estimates by the National

Association of Home Builders (NAHB), the slow down in U.S. housing

starts is expected to carry well into 2007, which will continue to

impact the company's Insulating Systems business. Demand for Owens

Corning's Roofing and Asphalt products is driven primarily by the

repair of residential roofs, with lesser demand coming from housing

starts. Owens Corning is assuming a more normal level of demand

associated with storm activity in 2007. To help offset the

softening in housing-related demand, the company has developed

product offerings and marketing programs that are intended to

expand the use of Owens Corning products in residential, acoustical

and commercial insulation markets. The company will also continue

to focus on managing capacity to meet the needs of its customers

while improving productivity. Owens Corning expects that the

Composite Solutions segment will benefit from strong global demand

for glass fiber materials throughout 2007. In addition, the recent

introduction of new products has the potential to positively impact

this segment in 2007. Owens Corning will continue a balanced

approach to the use of free cash flow. Strong operational cash flow

is intended to fuel company growth and innovation, with a focus on

return on net assets. Capital expenditures for infrastructure,

maintenance and productivity initiatives are forecast to total

approximately $250 million in 2007. Depreciation and amortization

for the year is now estimated to total approximately $300 million,

up from earlier estimates of $280 - $290 million, compared with

reported D&A of $278 million in 2006. The increase is the

result of a revised estimate for the impact of asset revaluation as

a part of Fresh Start Accounting. Upon emergence and the subsequent

distribution of contingent stock and cash to the 524(g) Trust in

January 2007, Owens Corning generated a significant U.S. Federal

tax net operating loss of approximately $2.8 billion. Based on

current estimates, the company believes its cash taxes will be

about 10 to 15 percent of pre-tax income for the next five to seven

years. Owens Corning anticipates that its effective tax rate will

be approximately 36.5 percent for 2007. Allowing for continued

uncertainty and based upon the NAHB's current 2007 estimate of 1.45

million housing starts, the company continues to project that 2007

adjusted EBIT should exceed $415 million, not including the impact

of the proposed Owens Corning - Vetrotex joint venture or other

strategic organizational changes. This forecast will be updated and

communicated quarterly. First-Quarter Business Segment Highlights

Insulating Systems -- Net sales for the first quarter of 2007 were

$419 million, a 20 percent decrease from $522 million during the

same period in 2006. The decrease was primarily due to lower volume

as a result of a decline in demand in the United States housing and

remodeling markets. -- EBIT for the first quarter was $53 million,

compared with $122 million during the same period in 2006. Results

were unfavorably impacted by a decline in sales volumes, changes in

product mix, idle facility costs resulting from production

curtailments, and increases in material and labor costs. In

addition, results were negatively impacted by $11 million,

primarily related to depreciation and amortization costs, resulting

from the adoption of Fresh Start Accounting. -- During the first

quarter of 2007, weaker housing activity combined with seasonal

slow downs resulted in additional production curtailments at

selected Owens Corning insulation manufacturing facilities in North

America. Composite Solutions -- Net sales for the first quarter of

2007 were $403 million, an 8 percent increase from $373 million

during the same period in 2006. The increase in sales was primarily

attributable to the acquisition of a composites business in Japan

during the second quarter of 2006, along with increases in demand

in North America and Europe and increased selling prices. -- EBIT

for the first quarter of 2007 was $26 million, compared with $14

million during the same period in 2006. The improvement was

primarily the result of stronger demand, manufacturing

productivity, improved margins and lower marketing and

administrative costs. Results for the first quarter of 2006 also

included approximately $6 million in expense resulting from

downtime to repair and expand the company's Taloja, India

manufacturing facility, and $8 million of gains on the sale of

metal. Results were negatively impacted by $1 million resulting

from the adoption of Fresh Start Accounting. Roofing and Asphalt --

Net sales for the first quarter of 2007 were $306 million, a 34

percent decrease from a record $461 million during the same period

in 2006. The decrease was primarily due to the absence of

storm-related demand and a decline in volume related to lower North

American new residential construction activity. -- EBIT for the

first quarter was a loss of $8 million, compared with record first

quarter earnings of $29 million during the same period in 2006. The

decrease was primarily driven by lower volume resulting from

declines in new construction activity in North America, combined

with lower storm-related demand and the impact of higher material

costs. Results were negatively impacted by $1 million resulting

from the adoption of Fresh Start Accounting. Other Building

Materials and Services -- Net sales for the first quarter of 2007

were $232 million, a 21 percent decrease from $295 million during

the same period in 2006. The decrease was primarily the result of

lower sales in the Siding Solutions Business and sales declines

resulting from the closure of the HOMExperts portion of the

company's construction services business. -- EBIT for the first

quarter of 2007 was a loss of $1 million, compared with a loss of

$3 million during the same period in 2006. The improvement was

primarily due to increased earnings in the company's Cultured

Stone(R) business. The adoption of Fresh Start Accounting had no

significant impact on this segment during the first quarter of

2007. Second quarter 2007 results are currently scheduled to be

announced on August 1, 2007. Conference Call Wednesday, May 2, 2007

11 a.m. Eastern Daylight Time All Callers Live dial-in telephone

number: 1-800-561-2718 or 1-617-614-3525 (Please dial in 10 minutes

before conference call start time) Passcode: 85464364 Live Webcast:

http://www.owenscorning.com/investors A telephone replay will be

available through May 9, 2007 at 888-286-8010 or 617-801-6888.

Passcode: 21825555. A replay of the web cast will also be available

at http://www.owenscorning.com/investors. About Owens Corning Owens

Corning is a world leader in building materials systems and

composite solutions. A Fortune 500 company for more than 50 years,

Owens Corning people redefine what is possible each day to deliver

high-quality products and services ranging from insulation,

roofing, siding and stone, to glass composite materials used in

transportation, electronics, telecommunications and other

high-performance applications. Founded in 1938, Owens Corning is a

market-leading innovator of glass-fiber technology with sales of

$6.5 billion in 2006 and 19,000 employees in 26 countries.

Additional information is available at

http://www.owenscorning.com/. This news release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those projected in these

statements. Further information on factors that could affect the

company's financial and other results is included in the company's

Forms 10-Q and 10-K, filed with the Securities and Exchange

Commission. Table 1 Owens Corning and Subsidiaries Consolidated

Statements of Earnings (Unaudited) (in millions, except per share

amounts) Successor Predecessor Three Months Ended Three Months

Ended March 31, March 31, 2007 2006 NET SALES $1,324 $1,601 COST OF

SALES 1,131 1,332 Gross margin 193 269 OPERATING EXPENSES Marketing

and administrative expenses 136 131 Science and technology expenses

14 16 Restructuring credits (2) -- Chapter 11 related

reorganization items 3 10 Asbestos litigation recoveries - Owens

Corning -- (3) Employee emergence equity program 8 -- Loss on sale

of fixed assets and other 1 -- Total operating expenses 160 154

EARNINGS BEFORE INTEREST AND TAXES 33 115 Interest expense, net 32

65 EARNINGS BEFORE TAXES 1 50 Income tax benefit -- (10) EARNINGS

BEFORE MINORITY INTEREST AND EQUITY IN NET EARNINGS OF AFFILIATES 1

60 Minority interest and equity in net earnings of affiliates -- 3

NET EARNINGS $1 $63 EARNINGS PER COMMON SHARE Basic net earnings

per share $0.01 $1.14 Diluted net earnings per share $0.01 $1.05

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING AND COMMON

EQUIVALENT SHARES DURING THE PERIOD Basic 128.1 55.3 Diluted 131.1

59.9 Table 2 Owens Corning and Subsidiaries Reconciliation

Schedules (Unaudited) (in millions, except per share amounts)

Successor Predecessor Three Months Ended Three Months Ended March

31, March 31, 2007 2006 RECONCILIATION TO ADJUSTED EARNINGS BEFORE

INTEREST AND TAXES: NET EARNINGS $1 $63 Minority interest and

equity in net earnings of affiliates -- 3 EARNINGS BEFORE MINORITY

INTEREST AND EQUITY IN NET EARNINGS OF AFFILIATES 1 60 Income tax

benefit -- (10) EARNINGS BEFORE TAXES 1 50 Interest expense, net 32

65 EARNINGS BEFORE INTEREST AND TAXES 33 115 Adjustments to remove

items impacting comparability: Provison for asbestos litigation --

(3) Chapter 11 related reorganization items 3 10 Restructuring

credits and other credits (2) (8) Employee emergence equity program

8 -- OCV Reinforcements joint venture transaction costs 11 --

Losses resulting from exiting HOMExperts service line 8 -- Total

adjustments to remove items impacting comparability 28 (1) ADJUSTED

EARNINGS BEFORE INTEREST AND TAXES $61 $114 RECONCILIATION TO

ADJUSTED DILUTED EARNINGS PER SHARE: DILUTED EARNINGS PER SHARE

$0.01 $1.05 Total adjustments to remove items impacting

comparability 0.21 (0.02) Tax effect of adjustments at 36.5%

effective rate (0.08) 0.01 ADJUSTED DILUTED EARNINGS PER SHARE

$0.14 $1.04 Diluted Shares 131.1 59.9 Table 3 Owens Corning and

Subsidiaries Condensed Consolidated Balance Sheets (Unaudited) (in

millions) Successor March 31, December 31, 2007 2006 ASSETS Current

Cash and cash equivalents $93 $1,089 Receivables, net 689 573

Inventories 845 749 Other current assets 151 141 Total current

1,778 2,552 Other Deferred income taxes 552 549 Goodwill and other

intangible assets 2,607 2,611 Other noncurrent assets 239 237 Total

other 3,398 3,397 Net plant and equipment 2,506 2,521 TOTAL ASSETS

$7,682 $8,470 LIABILITIES AND STOCKHOLDERS' EQUITY Current Accounts

payable and accrued liabilities $948 $1,081 Accrued interest 54 39

Short-term debt and current portion of long-term debt 48 1,440

Total current 1,050 2,560 Long-term debt 2,015 1,296 Other

long-term liabilities 861 884 Minority interest 44 44 Stockholders'

equity 3,712 3,686 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$7,682 $8,470 Table 4 Owens Corning and Subsidiaries Condensed

Consolidated Statements of Cash Flows (Unaudited) (in millions)

Successor Predecessor Three Months Ended Three Months Ended March

31, March 31, 2007 2006 NET CASH FLOW USED FOR OPERATING ACTIVITIES

Net earnings $1 $63 Adjustments to reconcile net earnings cash used

for operating activities: Depreciation and amortization 77 60

Change in deferred taxes (9) (25) Employee emergence equity program

8 -- Provision for post-petition interest/ fees on pre- petition

obligations -- 66 Payments related to Chapter 11 filings (8) --

Changes in receivables, inventories, accounts payable and accrued

liabilities (350) (312) Other (5) 1 Net cash flow used for

operating activities (286) (147) NET CASH FLOW USED FOR INVESTING

ACTIVITIES Additions to plant and equipment (42) (62) Investment in

affiliates and subsidiaries, net of cash acquired (1) (1) Proceeds

from the sale of assets or affiliate 12 10 Net cash flow used for

investing activities (31) (53) NET CASH FLOW USED FOR FINANCING

ACTIVITIES Payments on long-term debt (6) (1) Proceeds from

long-term debt 609 -- Payment of Note Payable to 524(g) Trust

(1,390) -- Proceeds from revolving credit facility 110 -- Net

increase (decrease) in short-term debt (2) 1 Net cash flow used for

financing activities (679) -- Effect of exchange rate changes on

cash -- 1 NET DECREASE IN CASH AND CASH EQUIVALENTS (996) (199)

Cash and cash equivalents at beginning of period 1,089 1,559 CASH

AND CASH EQUIVALENTS AT END OF PERIOD $93 $1,360 Table 5 Owens

Corning and Subsidiaries Business Segment Information (Unaudited)

(in millions) Successor Predecessor Three Months Ended Three Months

Ended March 31, March 31, 2007 2006 NET SALES Insulating Systems

$419 $522 Roofing and Asphalt 306 461 Other Building Materials and

Services 232 295 Composite Solutions 403 373 Total reportable

segments 1,360 1,651 Corporate Eliminations (36) (50) Consolidated

$1,324 $1,601 EARNINGS (LOSS) BEFORE INTEREST AND TAXES Insulating

Systems $53 $122 Roofing and Asphalt (8) 29 Other Building

Materials and Services (1) (3) Composite Solutions 26 14 Total

reportable segments $70 $162 RECONCILIATION TO CONSOLIDATED

EARNINGS BEFORE INTEREST AND TAXES Chapter 11 related

reorganization items $(3) $(10) Asbestos litigation recoveries -

Owens Corning -- 3 Restructuring credits 2 -- OCV Reinforcements

transaction costs (11) -- Losses related to the exit of our

HOMExperts service line (8) -- Employee emergence equity program

(8) -- General corporate expense (9) (40) CONSOLIDATED EARNINGS

BEFORE INTEREST AND TAXES $33 $115 DATASOURCE: Owens Corning

CONTACT: Media, Jason Saragian, +1-419-248-8987; Investors, Scott

Deitz, +1-419-248-8935, both of Owens Corning Web site:

http://www.owenscorning.com/ Company News On-Call:

http://www.prnewswire.com/comp/677350.html

Copyright

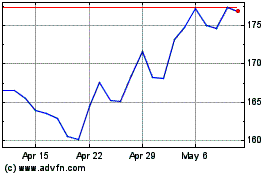

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jun 2024 to Jul 2024

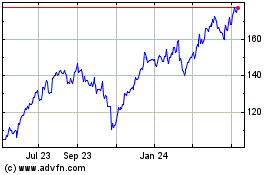

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jul 2023 to Jul 2024