Form 8-K - Current report

July 25 2023 - 6:17AM

Edgar (US Regulatory)

0001818502FALSE00018185022023-07-192023-07-190001818502us-gaap:CommonClassAMember2023-07-192023-07-190001818502us-gaap:WarrantMember2023-07-192023-07-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 19, 2023

OppFi Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39550 | 85-1648122 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

130 E. Randolph Street, Suite 3400

Chicago, Illinois 60601

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (312) 212-8079

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

Class A common stock, $0.0001 par

value per share | OPFI | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share | OPFI WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 19, 2023 (the “Restatement Date”), Opportunity Financial, LLC, a Delaware limited liability company (“OppFi-LLC”) and subsidiary of OppFi Inc., a Delaware corporation (the “Company”), and Opportunity Funding SPE V, LLC, a Delaware limited liability company and wholly owned subsidiary of OppFi-LLC (“OF V Borrower”), entered into an Amended and Restated Revolving Credit Agreement (the “A&R Credit Agreement”), which amends and restates that certain Revolving Credit Agreement, dated as of April 15, 2019 (as amended, supplemented or otherwise modified prior to the Restatement Date, the “Existing Credit Agreement”), by and among OppFi-LLC, OF V Borrower, Opportunity Funding SPE VII, LLC, the other credit parties and guarantors thereto, Midtown Madison Management LLC as administrative agent and collateral agent, and the lenders party thereto.

The A&R Credit Agreement amends the Existing Credit Agreement to, among other things, increase the size of the facility under the Existing Credit Agreement from $200 million to $250 million, remove Opportunity Funding SPE VII, LLC, a Delaware limited liability company and indirect wholly owned subsidiary of OppFi-LLC, as a borrower and remove the concept of pledging OppFi Card receivables under the A&R Credit Agreement, including removing OppWin Card, LLC as a seller. The $250 million of availability under the A&R Credit Agreement is comprised of $125 million under the existing Tranche B and $125 million under a new Tranche C. In addition, OF V Borrower may request, at any time during the Tranche C commitment period, one (1) increase in the Tranche C committed amount in an amount equal to $25 million, resulting in an aggregate Tranche C commitment equal to $150 million. Loans under Tranche C bear interest at the Term Secured Overnight Financing Rate plus 7.5% with a commitment period until July 19, 2026 and a maturity date of July 19, 2027. A portion of the proceeds of the A&R Credit Agreement were used to repay in full the outstanding Tranche A loans under the Existing Credit Agreement and the remainder of the proceeds are intended to be used to finance receivables growth.

The foregoing description of the A&R Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the A&R Credit Agreement, which will be filed as an exhibit to the Company’s quarterly report on Form 10-Q for the quarter ending September 30, 2023.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information regarding the A&R Credit Agreement set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.03.

Item 7.01 Regulation FD Disclosure.

On July 25, 2023, the Company issued a press release announcing the A&R Credit Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

This information in this Item 7.01 and in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Index

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page tags are embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| Date: July 25, 2023 | OppFi Inc. |

| | |

| By: | /s/ Pamela D. Johnson |

| | Pamela D. Johnson |

| | Chief Financial Officer |

NEWS RELEASE OppFi Upsizes Revolving Credit Facility with A�liates of Atalaya Capital Management to $250 Million 7/25/2023 CHICAGO--(BUSINESS WIRE)-- OppFi Inc. (NYSE:OPFI) (“OppFi” or the “Company”), a mission-driven �ntech platform that helps everyday Americans gain access to credit with digital specialty �nance products, today announced the Company has increased its existing revolving credit facility with a�liates of Atalaya Capital Management (“Atalaya”) to $250 million. “We appreciate Atalaya’s con�dence in OppFi and the strengthening of our business relationship,” said Todd Schwartz, Chief Executive O�cer and Executive Chairman of OppFi. “We expect the additional funding capacity under this facility to generate incremental pro�table growth.” OppFi increased its capacity under this revolving credit facility from $200 million to $250 million, with a new tranche that matures in 2027. The expanded commitment is intended to fund receivables growth. About OppFi OppFi (NYSE: OPFI) is a mission-driven �ntech platform that helps everyday Americans gain access to credit with digital specialty �nance products. Through its unwavering commitment to customer service, the Company supports consumers, who are turned away by mainstream options, to build better �nancial health. OppLoans by OppFi maintains a 4.5/5.0 star rating on Trustpilot with more than 3,900 reviews, making the Company one of the top consumer-rated �nancial platforms online. For more information, please visit opp�.com. Forward-Looking Statements 1

This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may di�er from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "possible," "continue," and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations with respect to its full year 2023 guidance, the future performance of OppFi’s platform, and expectations for OppFi’s growth and future �nancial performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve signi�cant risks and uncertainties that could cause the actual results to di�er materially from the expected results. Most of these factors are outside OppFi’s control and are di�cult to predict. Factors that may cause such di�erences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, in�ation, interest rate changes, recessions, and tightening of credit markets on OppFi’s business; the impact of COVID-19 on OppFi’s business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s �nancing sources will continue to �nance the purchase of participation rights in loans originated by OppFi’s bank partners in California; the impact that events involving �nancial institutions or the �nancial services industry generally, such as actual concerns or events involving liquidity, defaults, or non- performance, may have on OppFi’s business; risks related to the material weakness in OppFi’s internal controls over �nancial reporting; the risk that the business combination disrupts current plans and operations; the ability to recognize the anticipated bene�ts of the business combination, which may be a�ected by, among other things, competition, the ability of OppFi to grow and manage growth pro�tably and retain its key employees; risks related to new products; concentration risk; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely a�ected by other economic, business, and/or competitive factors; risks related to management transitions; risks related to the restatement of OppFi’s �nancial statements and any accounting de�ciencies or weaknesses related thereto; and other risks and uncertainties indicated from time to time in OppFi’s �lings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to re�ect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. 2

Investor Relations: investors@opp�.com Media Relations: media@opp�.com Source: OppFi 3

v3.23.2

Cover Page

|

Jul. 19, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 19, 2023

|

| Entity Registrant Name |

OppFi Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39550

|

| Entity Tax Identification Number |

85-1648122

|

| Entity Address, Address Line One |

130 E. Randolph Street

|

| Entity Address, Address Line Two |

Suite 3400

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60601

|

| City Area Code |

312

|

| Local Phone Number |

212-8079

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001818502

|

| Amendment Flag |

false

|

| Common Class A |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, $0.0001 parvalue per share

|

| Trading Symbol |

OPFI

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

OPFI WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

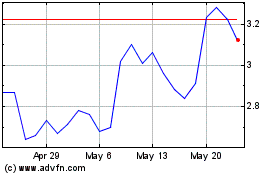

OppFi (NYSE:OPFI)

Historical Stock Chart

From Apr 2024 to May 2024

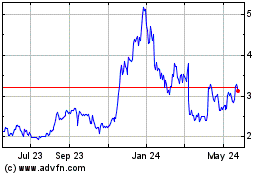

OppFi (NYSE:OPFI)

Historical Stock Chart

From May 2023 to May 2024