0001587732false☐☐☐☐00015877322023-11-292023-11-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| (Date of report) | November 29, 2023 |

| (Date of earliest event reported) | November 29, 2023 |

ONE Gas, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Oklahoma | | 001-36108 | | 46-3561936 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

15 East Fifth Street; Tulsa, OK

(Address of principal executive offices)

74103

(Zip code)

(918) 947-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.01 per share | | OGS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Item 7.01 | | Regulation FD Disclosure |

| | |

| | On November 29, 2023, we issued a news release announcing our 2024 financial guidance and updated five-year growth rates, and posted an investor presentation with additional information to our website.

The news release and the investor presentation are furnished as Exhibits 99.1 and 99.2, respectively, and are incorporated by reference herein. These materials are also available on our website, www.onegas.com.

The information disclosed in Item 7.01, including Exhibits 99.1 and 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing. |

| | |

| Item 9.01 | | Financial Statements and Exhibits |

| | |

| (d) | Exhibits |

| | |

Exhibit

Number | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | | ONE Gas, Inc. |

| | | |

| Date: | November 29, 2023 | By: | /s/ Caron A. Lawhorn |

| | | Caron A. Lawhorn

Senior Vice President and

Chief Financial Officer |

| | | | | | | | | | | |

| November 29, 2023 | | Analyst Contact: | Erin Dailey

918-947-7411 |

| | Media Contact: | Leah Harper

918-947-7123 |

ONE Gas Issues 2024 Financial Guidance

TULSA, Okla. - Nov. 29, 2023 - ONE Gas, Inc. (NYSE: OGS) today issued financial guidance for 2024.

“As we look to 2024, we remain focused on executing our business strategy, anchored by system reinforcements and a continued expansion of core capabilities to meet growing customer demand,” said Robert S. McAnnally, president and chief executive officer. “While rapidly altered macroeconomic conditions momentarily accentuate the lag inherent in our 100% regulated model, our focus remains on long-term value creation as we provide service to a region that is growing and values the integral role natural gas will play well into the future.”

2024 FINANCIAL GUIDANCE

ONE Gas (the "Company") expects 2024 net income to be in the range of $214 million to $231 million, with earnings per diluted share of $3.70 to $4.00. The midpoint of 2024 guidance is net income of $223 million and earnings per diluted share of $3.85.

The Company's 2024 earnings guidance includes the benefit of new rates and customer growth, offset by higher operating expenses, including employee-related and contractor costs, depreciation expense from capital investments, and interest expense due to higher interest rates. It also assumes normal weather.

Capital investments, including asset removal costs, are expected to be approximately $750 million in 2024, primarily targeted for system integrity and replacement projects. Capital investments for extensions to new customers are expected to be approximately $170 million, primarily as a result of continued growth opportunities in Texas and Oklahoma. The anticipated average rate base for 2024 is $5.55 billion, calculated consistent with utility ratemaking in each jurisdiction.

ONE Gas Issues 2024 Financial Guidance

Nov. 29, 2023

Page 2

FIVE-YEAR FINANCIAL GROWTH RATES

For the five years ending 2028, capital investments, including asset removal costs, are expected to be in the range of $750 million to $950 million per year, or approximately $4.25 billion for the five-year period, including growth capital of approximately $1.10 billion. The increase in capital supports estimated average rate base growth of 7% to 9% per year through 2028.

Net income is expected to increase by an average of 7% to 9% annually through 2028, with diluted earnings per share of 4% to 6%.

Operating costs over the five years are expected to increase on average approximately 5% per year.

The Company estimates total net long-term financing needs for the period 2024 through 2028 of approximately $2.3 billion, of which approximately 45% to 50% is expected to be equity. The Company expects to settle approximately 1.69 million shares and 2.9 million shares of forward equity sales by year-end 2023 and 2024, respectively, with anticipated net proceeds of approximately $130 million and $220 million. The forward equity sales already secured for 2024 settlement are in support of the Company’s articulated five-year equity financing needs.

The Company expects to achieve an average annual dividend growth rate of 1% to 2% through 2028, subject to board of directors’ approval, with a target dividend payout ratio of 55% to 65% of net income.

CONFERENCE CALL, WEBCAST AND INVESTOR PRESENTATION

The ONE Gas executive management team will conduct a conference call on Thursday, Nov. 30, 2023, at 8 a.m. Eastern Standard Time (7 a.m. Central Standard Time). The call also will be carried live on the ONE Gas website.

To participate in the telephone conference call, dial 833-470-1428, passcode 242602, or log on to www.onegas.com/investors and select Events and Presentations.

If you are unable to participate in the conference call or the webcast, a replay will be available on the ONE Gas website, www.onegas.com, for 30 days. A recording will be available by phone for seven days. The playback call may be accessed at 866-813-9403, passcode 169828.

Additional information can be found in the 2024 Financial Guidance investor presentation on the ONE Gas website at https://www.onegas.com/investors/financials-and-filings/guidance.

Guidance estimates may be impacted by the variables in the forward-looking statements listed

below.

---------------------------------------------------------------------------------------------------------------------

ONE Gas, Inc. (NYSE: OGS) is a 100% regulated natural gas utility, and trades on the New York Stock Exchange under the symbol “OGS.” ONE Gas is included in the S&P MidCap 400 Index and is one of the largest natural gas utilities in the United States.

ONE Gas Issues 2024 Financial Guidance

Nov. 29, 2023

Page 3

Headquartered in Tulsa, Oklahoma, ONE Gas provides a reliable and affordable energy choice to more than 2.3 million customers in Kansas, Oklahoma and Texas. Its divisions include Kansas Gas Service, the largest natural gas distributor in Kansas; Oklahoma Natural Gas, the largest in Oklahoma; and Texas Gas Service, the third largest in Texas, in terms of customers.

For more information and the latest news about ONE Gas, visit onegas.com and follow its social channels: @ONEGas, Facebook, LinkedIn and YouTube.

Some of the statements contained and incorporated in this news release are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. The forward-looking statements relate to our anticipated financial performance, liquidity, management’s plans and objectives for our future operations, our business prospects, the outcome of regulatory and legal proceedings, market conditions and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. The following discussion is intended to identify important factors that could cause future outcomes to differ materially from those set forth in the forward-looking statements.

Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of our operations and other statements contained or incorporated in this news release identified by words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "should," "goal," "forecast," "guidance," "could," "may," "continue," "might," "potential," "scheduled," "likely," and other words and terms of similar meaning.

One should not place undue reliance on forward-looking statements, which are applicable only as of the date of this news release. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. Those factors may affect our operations, markets, products, services and prices. In addition to any assumptions and other factors referred to specifically in connection with the forward-looking statements, factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement include, among others, the following:

•our ability to recover costs, income taxes and amounts equivalent to the cost of property, plant and equipment, regulatory assets and our allowed rate of return in our regulated rates or other recovery mechanisms;

•cyber-attacks, which, according to experts, continue to increase in volume and sophistication, or breaches of technology systems that could disrupt our operations or result in the loss or exposure of confidential or sensitive customer, employee, vendor or Company information; further, increased remote working arrangements have required enhancements and modifications to our information technology infrastructure (e.g. Internet, Virtual Private Network, remote collaboration systems, etc.), and any failures of the technologies, including third-party service providers, that facilitate working remotely could limit our ability to conduct ordinary operations or expose us to increased risk or effect of an attack;

•our ability to manage our operations and maintenance costs;

•the concentration of our operations in Oklahoma, Kansas and Texas;

•changes in regulation of natural gas distribution services, particularly those in Oklahoma, Kansas and Texas;

•the economic climate and, particularly, its effect on the natural gas requirements of our residential and commercial customers;

•the length and severity of a pandemic or other health crisis which could significantly disrupt or prevent us from operating our business in the ordinary course for an extended period;

•competition from alternative forms of energy, including, but not limited to, electricity, solar power, wind power, geothermal energy and biofuels;

•adverse weather conditions and variations in weather, including seasonal effects on demand and/or supply, the occurrence of severe storms in the territories in which we operate, and climate change, and the related effects on supply, demand, and costs;

•indebtedness could make us more vulnerable to general adverse economic and industry conditions, limit our ability to borrow additional funds and/or place us at competitive disadvantage compared with competitors;

•our ability to secure reliable, competitively priced and flexible natural gas transportation and supply, including decisions by natural gas producers to reduce production or shut-in producing natural gas wells and expiration of existing supply and transportation and storage arrangements that are not replaced with contracts with similar terms and pricing;

•our ability to complete necessary or desirable expansion or infrastructure development projects, which may delay or prevent us from serving our customers or expanding our business;

•operational and mechanical hazards or interruptions;

•adverse labor relations;

ONE Gas Issues 2024 Financial Guidance

Nov. 29, 2023

Page 4

•the effectiveness of our strategies to reduce earnings lag, revenue protection strategies and risk mitigation strategies, which may be affected by risks beyond our control such as commodity price volatility, counterparty performance or creditworthiness and interest rate risk;

•the capital-intensive nature of our business, and the availability of and access to, in general, funds to meet our debt obligations prior to or when they become due and to fund our operations and capital expenditures, either through (i) cash on hand, (ii) operating cash flow, or (iii) access to the capital markets and other sources of liquidity;

•our ability to obtain capital on commercially reasonable terms, or on terms acceptable to us, or at all;

•limitations on our operating flexibility, earnings and cash flows due to restrictions in our financing arrangements;

•cross-default provisions in our borrowing arrangements, which may lead to our inability to satisfy all of our outstanding obligations in the event of a default on our part;

•changes in the financial markets during the periods covered by the forward-looking statements, particularly those affecting the availability of capital and our ability to refinance existing debt and fund investments and acquisitions to execute our business strategy;

•actions of rating agencies, including the ratings of debt, general corporate ratings and changes in the rating agencies’ ratings criteria;

•changes in inflation and interest rates;

•our ability to recover the costs of natural gas purchased for our customers and any related financing required to support our purchase of natural gas supply;

•impact of potential impairment charges;

•volatility and changes in markets for natural gas and our ability to secure additional and sufficient liquidity on reasonable commercial terms to cover costs associated with such volatility;

•possible loss of local distribution company franchises or other adverse effects caused by the actions of municipalities;

•payment and performance by counterparties and customers as contracted and when due, including our counterparties maintaining ordinary course terms of supply and payments;

•changes in existing or the addition of new environmental, safety, tax and other laws to which we and our subsidiaries are subject, including those that may require significant expenditures, significant increases in operating costs or, in the case of noncompliance, substantial fines or penalties;

•the effectiveness of our risk-management policies and procedures, and employees violating our risk-management policies;

•the uncertainty of estimates, including accruals and costs of environmental remediation;

•advances in technology, including technologies that increase efficiency or that improve electricity’s competitive position relative to natural gas;

•population growth rates and changes in the demographic patterns of the markets we serve, and economic conditions in these areas’ housing markets;

•acts of nature and the potential effects of threatened or actual terrorism and war, including recent events in Europe and the Middle East;

•the sufficiency of insurance coverage to cover losses;

•the effects of our strategies to reduce tax payments;

•changes in accounting standards;

•changes in corporate governance standards;

•existence of material weaknesses in our internal controls;

•our ability to comply with all covenants in our indentures and the ONE Gas Credit Agreement, a violation of which, if not cured in a timely manner, could trigger a default of our obligations;

•our ability to attract and retain talented employees, management and directors, and shortage of skilled-labor;

•unexpected increases in the costs of providing health care benefits, along with pension and postemployment health care benefits, as well as declines in the discount rates on, declines in the market value of the debt and equity securities of, and increases in funding requirements for, our defined benefit plans; and

•our ability to successfully complete merger, acquisition or divestiture plans, regulatory or other limitations imposed as a result of a merger, acquisition or divestiture, and the success of the business following a merger, acquisition or divestiture.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other factors could also have material adverse effects on our future results. These and other risks are described in greater detail in Part 1, Item 1A, Risk Factors, in our Annual Report. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Other than as required under securities laws, we undertake no obligation to update publicly any forward-looking statement whether as a result of new information, subsequent events or change in circumstances, expectations or otherwise.

###

November 2023 2024 FINANCIAL GUIDANCE Delivering Reliable & Affordable Energy

FORWARD LOOKING STATEMENTS | 2FORWARD LOOKING STATEMENTS | 2 Investor Information Contact Information and forward-looking statements Statements contained in this presentation that include or refer to Company expectations, our business outlook, our future plans or predictions relating to any matters should be considered forward-looking statements that are covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the Securities Act of 1933 and the Securities and Exchange Act of 1934, each as amended. All statements, other than statements of historical facts, included in this presentation are forward-looking statements. Words such as “anticipates,” “expects,” “projects,” “intends,” “goals,” “plans,” “potential,” “might,” “believes,” “target,” “objective,” “strategy,” “opportunity,” “pursue,” “budgets,” “outlook,” “trends,” “focus,” “on schedule,” “on track,” “poised,” “slated,” “seeks,” “estimates,” “forecasts,” “guidance,” “scheduled,” “continues,” “may,” “will,” “would,” “should,” “could,” “likely,” and variations of such words and similar expressions are intended to identify such forward-looking statements. One should not place undue reliance on forward-looking statements. In addition, statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to market opportunities, future products or processes and the expected availability and benefits of such products or processes, and anticipated trends in our businesses or the markets relevant to them, including those developments relating to regulation and litigation trends and developments, also identify forward-looking statements. Such statements are based on management's expectations as of the date of this investor presentation, unless an earlier date is indicated, and involve many risks and uncertainties, known and unknown, that could cause actual results, performance or achievements to differ materially from those expressed or implied in these forward-looking statements. It is important to note that the actual results could differ materially from those projected in such forward-looking statements. Important risks and uncertainties that could cause actual results to differ materially from the company's expectations include, but are not limited to, our ability to recover, manage and maintain costs; the concentration of our operations in Oklahoma, Kansas and Texas; regulatory or legislative changes in the jurisdictions in which we operate; the length and severity of unpredictable events, including, but not limited to, pandemics, threatened terrorism, war or cyber-attacks or breaches, or extreme weather events, including those related to climate change; the competitive implications of alternative sources of energy and efforts to conserve energy; our competitive position, including, but not limited to our ability to secure competitive sourcing and pricing and our ability to compete with respect to expansion and infrastructure; the economic climate and our comparable economic position; our access to capital and the restrictions that result from our current capital arrangements; the effectiveness of our risk mitigation and compliance efforts; the uncertainties of any estimates or assumptions we use in our projections; our strategic and transactional efforts and future plans; and costs and uncertainties relating to our workforce, and other risks and uncertainties, including those that are set forth in ONE Gas’ earnings release dated Oct. 30, 2023, which is included as an exhibit to ONE Gas’ Form 8-K furnished to the SEC on such date. For additional information regarding these and other factors that could cause actual results to differ materially from such forward-looking statements, refer to ONE Gas’ Securities and Exchange Commission filings., including the Company's most recent reports on Forms 10-K and 10-Q. Copies of the Company’s Form 10-K, 10-Q and 8-K reports may be obtained by visiting our “Investors” website under “Financials & Filings” at https://www.onegas.com/investors/financials-and-filings/quarterly-results/default.aspx or the SEC’s website at www.sec.gov. Other unpredictable or unknown factors not discussed in this presentation could also have material adverse effects on the Company, its operations or the outcomes described in the forward-looking statements in this presentation or in the Company’s filings with the Securities and Exchange Commission. All future cash dividends discussed in this presentation are subject to the approval of the ONE Gas board of directors. All references in this presentation to guidance are based on news releases or disclosures issued on or before Nov. 29, 2023, and are not being updated or affirmed by this presentation. ONE Gas does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law. ONE Gas, Inc. 15 E 5th Street Tulsa, OK 74103 www.onegas.com Erin Dailey Director, Investor Relations and Sustainability (918) 947-7411 erin.dailey@onegas.com

FINANCIAL OUTLOOK

FINANCIAL OUTLOOK | 4 Five-Year Financial Guidance: 2024 – 2028 The Company’s outlook remains anchored by proactive investments in system integrity, pipeline replacement, and durable customer growth rooted in regional economic development. The fundamental shifts in baseline economic conditions which emerged in 2022 have persisted and will impact the front-end of our guidance range before being fully reflected in our rates: – While natural gas prices have softened and materials inflation has moderated, wage inflation continues, and interest rates have moved sharply beyond their year-ago forecasts and are likely to remain higher for longer. – These temporary but impactful shifts in financial conditions accentuate the lag intrinsic to our 100% regulated business model. We will be strategic about the sequence and timing of regulatory activities so that operating and financing realities are appropriately reflected in our rates. Safety, reliability and affordability remain central to our long-term strategy. Overview

FINANCIAL OUTLOOK | 5 Current Economic Backdrop The Federal Reserve has rapidly raised interest rates and is working to shrink its balance sheet to rein in decades-high inflation. In the US, the principal economic tension has been between these Fed actions and a historically tight labor market, ongoing federal deficit spending, and a population whose mindset and priorities have been altered by the recent pandemic. Full employment, continued deficit spending, and a restrictive Fed Note: “Change/Delta” denote basis point movements between periods for items listed as percentages. Red coloration signifies a changes which is negative while black coloration denotes a positive change. Source: Bloomberg 11/1/22 11/1/23 CHANGE 10-YR AVG CHANGE 11/1/22 11/1/23 CHANGE 10-YR AVG CHANGE Federal Reserve Balance Sheet (T$) 8.7 7.9 (9.8%) 5.7 37.8% 90-Day Commercial Paper 4.45% 5.54% 109 1.46% 408 US Government Debt (T$) 31.2 33.6 7.8% 23.4 43.6% 2-Year US Treasury 4.54% 4.94% 40 1.57% 338 Fed Funds Rate 3.08% 5.33% 225 1.22% 411 10-Year US Treasury 4.04% 4.73% 69 2.30% 244 US Unemployment 3.70% 3.90% 20 4.69% (79) 30-Year US Treasury 4.09% 4.93% 84 2.81% 211 US Wage Growth 6.40% 5.20% (120) 3.81% 139 US Average Retail Electricity (¢/kWh) 15.99 15.68 (1.9%) 13.36 17.4% Consumer Price Index 7.70% 3.20% (450) 2.72% 48 NYMEX Natural Gas ($/MMBtu) $5.71 $3.49 (38.9%) $3.33 5.1% Producer Price Index 8.20% 1.30% (690) 2.69% (139) WTI Crude Oil ($/Bbl) $88.37 $80.44 (9.0%) $63.94 25.8% NASDAQ Composite 10,891 13,061 19.9% US Average Regular Gasoline ($/gal) $3.77 $3.45 (8.4%) $2.83 21.9% S&P 500 3,856 4,238 9.9% US Average Diesel Fuel ($/gal) $5.31 $4.44 (16.4%) $3.25 36.7% US Utility Sector ETF (UTY) 869 770 (11.5%) US Energy Select ETF (XLE) 91 85 (6.5%) METRIC METRIC In te re st R at e s Eq u it y M ar ke ts C o m m o d it ie s G o ve rn m e n t C o n su m e r

FINANCIAL OUTLOOK | 6 Federal Funds Rate Futures Consensus rate expectations have moved meaningfully higher this year 11.01.2022 Peak Fed Funds rate of 4.70% expected in March 2023 with cuts in 2H23 producing a 1Q24 rate expectation of roughly 4.00%, declining to 3.00% by 1Q25. 05.01.2023 Peak Fed Funds rate of 5.25% expected in July 2023 with cuts in 2H23 producing a 1Q24 rate expectation of 4.70%, declining to 3.35% by 1Q25. 11.01.2023 Peak Fed Funds rate of 5.50% expected in 1Q24 with cuts in 2024-25 yielding a 1Q25 rate expectation of 4.00%. Source: Bloomberg ~30% of our recourse debt is maturing in 1Q24

FINANCIAL OUTLOOK | 7 Modeling Assumptions • A gradual contraction in the Commercial Paper 10-year rate spread over the course of 2024-2025, with parity achieved in 2026. • A contangoed curve reemerging in 2027 as the Fed’s balance sheet returns to pre-COVID levels, allowing its policy rate to be meaningfully reduced. • The 10-year Treasury rate normalizing at 4.00% with normalized Commercial Paper rates at 3.00%, in-line with historical spreads. • Inflation and customer growth expectations consistent with this rate projection (i.e., reduced inflation, accelerating growth over time). Given heightened market volatility and consensus rate forecasts which have shifted dramatically over the past two years, we believe there is value in sharing the following modeling assumptions:

FINANCIAL OUTLOOK | 8 Favorable Regional Growth Dynamics Growing Demand for Natural Gas Provides Long-Term Growth Opportunity Key drivers • Durable residential and commercial development, anchored to economic growth, is driving system expansion • Strong support for natural gas with energy choice legislation in all jurisdictions • Projecting five-year compound annual customer growth of 0.9% – Texas – 1.2% – Oklahoma – 1.0% – Kansas – 0.4% – Moderated near-term customer growth is reflective of higher interest rates; upside potential as builder activity reignites I-35 Corridor • I-35 corridor fastest growing population in the U.S. • ONE Gas positioned in KS, OK and TX with 5 of the main metro areas in the corridor • Largest warehouse labor force in the country - expected to grow 20% over next decade due to location along primary NAFTA transport route • El Paso is also growing significantly but not considered in the I-35 corridor Source: Bureau of Labor & Statistics EMSI/QCEW Data

FINANCIAL OUTLOOK | 9 Constructing a Foundation for Growth and Long-term Affordability Meaningful customer growth positively impacts affordability • Robust backlog of future meter sets • New customer connections have slowed compared to 2022 but are commensurate with 2021 levels • New meter sets for October 2023 were the highest ever for that month, despite 30-year mortgage rates cresting 8% in the period, highlighting the stability of regional growth Operating investments support capturing long-term growth • Increasing operating capacities and capabilities, including additional in-sourcing of work • Addressing labor pressures through competitive market wage adjustments • Inflationary pressures impact 3rd party contracts but have been addressed through contract riders Building Operational Capacity

FINANCIAL OUTLOOK | 10 Regional Focus on Economic Development Attracting large-scale manufacturing Enel North America (Inola, OK) – Announced May 2023 • $1.0 billion solar cell and panel manufacturing plant, largest economic development project in Oklahoma history • 1,800 construction jobs and 1,000 new permanent jobs by 2025, another 900 permanent jobs possible by 2027 Integra Technologies (Wichita, KS) – Announced February 2023 • $1.8 billion investment in outsourced semiconductor assembly and test (OSAT) operations • ~2,000 direct jobs and ~3,100 additional jobs to be created by suppliers and business communities EMP Shield (Coffey County, KS) – Announced February 2023 • $1.9 billion investment in new computer chip manufacturing facility • ~1,200 direct jobs and 235,000 square feet of new facilities Panasonic Energy Co., Ltd. (De Soto, KS) – Announced July 2022 • $4.0 billion investment in a new electric vehicle (EV) battery manufacturing facility • ~4,000 direct jobs created and an expectation for 4,000 additional supplier and community jobs to be supported Samsung Electronics Co., Ltd. (Taylor, TX) – Announced November 2021 • $17 billion investment in new semiconductor manufacturing facility • ~2,000 direct jobs created; facility expected to be operational in 2H24 • Reports indicate future regional investments of up to $200B to support 11 new semiconductor plants

FINANCIAL OUTLOOK | 11 Financing Requirements Dividends and capital investments primarily funded by cash flow from operations of approximately $525 - $575 million1 – Expected 2024 short- and long-term financing need of $350 - $375 million, exclusive of two first-quarter maturities: $300 million of 3.6% notes and $473 million of 1.1% notes ~$2.3 billion net long-term financing needs through 2028, of which 45 - 50% is expected to be equity issuances – Assumes settlement of ~$129 million2 forward equity sales by year-end 2023 – Forward sale agreements covering ~2.9 million shares have already been executed for 2024 settlement at prices averaging approximately $76.40/share ($222 million3 in total) Retaining Balance Sheet Strength 1 2024 expectation, before changes in working capital. See non-GAAP information in Appendix 2 Expected net proceeds of ~$129.2M had all the shares settled as of Sept. 30, 2023 3 Expected net proceeds of ~$222.0M had all the shares settled as of Sept. 30, 2023

FINANCIAL OUTLOOK | 12 Five-Year Financial Highlights Capital Investments & Rate Base • Capital investments of approximately $4.25 billion – $3.0 billion investment in system integrity and replacement projects – Growth capital of approximately $1.1 billion • Estimated average 2024 rate base* of $5.55 billion • Average annual rate base growth of 7 – 9% Investing in a Growing System Average Annual Growth Rates • Net income growth of 7 – 9% - In addition to capital investment, key drivers include: • Regulatory outcomes • Annual sales customer CAGR of 0.9%, led by Texas with 1.2% • Operating cost increases averaging ~5% annually • Earnings per diluted share growth of 4 – 6% • Dividend growth of 1 – 2%* - Balances shareholder returns with internal investment in growth - Holds payout ratio proximate to our 55 – 65% target * For definition of average rate base, see Appendix. * Subject to Board approval.

FINANCIAL OUTLOOK | 13 2024 Guidance Summary* Earnings and Dividends Outlook • Net income for 2024 in a range of $214 - $231 million • EPS range of $3.70 - $4.00 per diluted share • Anticipate dividend growth of 1% to 2% in 2024, subject to board approval • Assumes 57.8 million of diluted shares outstanding Capital Investments • 2024 capital investments of $750 million, with approximately $170 million attributed to customer growth • Average rate base of $5.55 billion in 2024 Financing Activities • Two debt maturities totaling $773 million in the first quarter 2024; the next maturity not until 2030 • Forward sale agreements covering ~2.9M shares are already in place for 2024 settlement at prices averaging $76.40/share • Increased credit facility and commercial paper program to $1.2 billion Managing near-term impacts while preserving long-term opportunities *Issued Nov. 29, 2023

Appendix

APPENDIX | 15 $360 $383 $449 $525 $552 $135 $138 $177 $175 $172 $20 $21 $32 $25 $26 $191 $202 $216 $234 $252 2020 2021 2022 2023G 2024G CAPITAL INVESTMENTS (MILLIONS) System Integrity Customer Growth Other/IT Depreciation $5151 $542 $658 $7252 ~$750 Well-Defined Capital Investment Plan Investments ~3x Depreciation Kansas $169 Oklahoma $293 Texas $288 2024G CAPITAL INVESTMENTS BY STATE (MILLIONS) Note: Capital investments include asset removal costs and accruals 1 2020 depreciation includes $3 million of expenses unallocated to the three divisions 2 Represents updated CapEx forecast as of Sept. 30, 2023

APPENDIX | 16 $1.41 billion $2.35 billion $1.79 billion 2024G AVERAGE RATE BASE1 BY STATE TOTAL: $5.55 BILLION Kansas Oklahoma Texas Rate Base ~8% Growth Expected in 2024 $3.91 $4.25 $4.69 $5.15 $5.55 2020 2021 2022 2023G 2024G AVERAGE RATE BASE1 (BILLIONS) 1 See Slide 19 for definition

APPENDIX | 17 Capital Investments $129 $139 $159 $186 $169 $68 $72 $75 $78 $83 2020 2021 2022 2023G 2024G KANSAS 2023G: 2.4X DEPRECIATION $191 $198 $215 $257 $293 $76 $82 $88 $93 $100 2020 2021 2022 2023G 2024G OKLAHOMA Depreciation 2023G: 2.76X DEPRECIATION $188 $188 $242 $253 $288 $44 $48 $53 $63 $69 2020 2021 2022 2023G 2024G TEXAS 2023G: 4.0X DEPRECIATION (M IL L IO N S ) Note: Capital investments include asset removal costs and accruals

APPENDIX | 18 Authorized Rate Base $1,475 $1,616 $1,726 $1,854 $2,067 2019 2020 2021 2022 2023 OKLAHOMA2 1 Kansas Gas Service’s most recent rate case, approved in February 2019, was settled without a determination of rate base and reflects Kansas Gas Service’s estimate of rate base contained within the settlement; these amounts are not necessarily indicative of current or future rate base. GSRS filing approved and new rate base effective Dec. 1, 2023. 2 Reflects authorized rate base as of Dec. 1, 2023. Amounts are not necessarily indicative of current or future rate bases. (M IL L IO N S ) $1,068 $1,133 $1,197 $1,261 $1,339 2019 2020 2021 2022 2023 KANSAS1,2 $986 $1,047 $1,239 $1,366 $1,510 2019 2020 2021 2022 2023 TEXAS2

APPENDIX | 19 Rate Base Definition Authorized Rate Base $4.92 billion (effective Dec. 1, 2023) • Includes capital investments authorized in most recent rate cases and interim filings • Excludes any capital investments since last approved rate cases or filings 2024 Estimated Average Rate Base $5.55 billion • Average of rate base per book at beginning and end of year • Includes capital investments and other changes in rate base not yet approved for recovery

APPENDIX | 20 (MILLIONS) 2024 GUIDANCE* Net income $ 223 Depreciation and amortization 267 Deferred taxes 32 Other 23 Cash flow from operations before changes in working capital $ 545 Non-GAAP Reconciliation Cash Flow From Operations Before Changes in Working Capital * Amounts shown are estimated midpoints as contemplated in 2024 guidance

APPENDIX | 21 Non-GAAP Information ONE Gas has disclosed in this presentation cash flow from operations before changes in working capital, which is a non-GAAP financial measure. Cash flow from operations before changes in working capital is used as a measure of the company's financial performance. Cash flow from operations before changes in working capital is defined as net income adjusted for depreciation and amortization, deferred income taxes, and certain other noncash items. This non-GAAP financial measure is useful to investors as an indicator of financial performance of the company to generate cash flows sufficient to support our capital expenditure programs and pay dividends to our investors. ONE Gas cash flow from operations before changes in working capital should not be considered in isolation or as a substitute for net income or any other measure of financial performance presented in accordance with GAAP. This non-GAAP financial measure excludes some, but not all, items that affect net income. Additionally, this calculation may not be comparable with similarly titled measures of other companies. A reconciliation of cash flow from operations before changes in working capital to the most directly comparable GAAP measure are included in this presentation.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

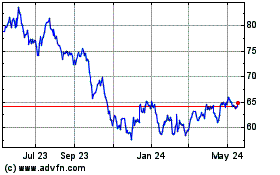

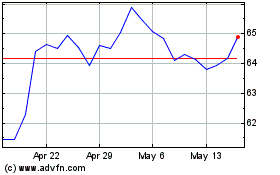

ONE Gas (NYSE:OGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

ONE Gas (NYSE:OGS)

Historical Stock Chart

From Apr 2023 to Apr 2024