UPDATE: China's Global Education Closes Up 16% Post-IPO

October 08 2010 - 5:03PM

Dow Jones News

Foreign-language training specialist Global Education and

Technology Group Ltd. (GEDU) wrapped up another week of U.S.

initial public offerings of Chinese companies with double-digit

percentage gains Friday.

The company's stock closed at $12.20 a share on the Nasdaq, up

16.2% from its initial public offering price of $10.50. The company

sold 6.4 million American Depositary shares at the high end of its

expected range of $8.50 to $10.50.

Global Education focuses on foreign-language training and test

preparation in China, and claims to be the leading test-prep

company in China for the International English Language Testing

System, or IELTS, with the largest market share in terms of revenue

and student enrollments in 2009.

IELTS has become the most widely taken test of English-language

proficiency for Chinese studying abroad. IELTS scores are used in

the United Kingdom, Australia and New Zealand, and increasingly in

the U.S., which historically has relied on the Test of English as a

Foreign Language, or TOEFL.

Global Education is capitalizing on the increasing interest

among Chinese students to study abroad, and the need to demonstrate

proficiency in a foreign language, especially English. The number

of IELTS test takers in China has increased to about 320,000 in

2009 from about 90,000 in 2005, and Global Education has expanded

its network of centers since opening its first in Beijing in 2001.

It now has 292 owned and franchised learning centers focused on the

IELTS, 144 devoted to helping children learn English, and 30 that

specialize in science, non-English languages or after-school

tutoring.

The company has started online training and test-prep courses,

with more than one million registered members as of June 30.

Total net revenue increased at the company throughout the

economic downturn. Net income grew in 2008 and 2009, but was down

26% in the first half of 2010 compared to the same period of 2009.

The decline in profits stemmed from foreign-exchange losses, and a

change in fair value related to an acquisition.

Global Education faces a lot of competition in its space,

including from New Oriental Education and Technology Group Inc.

(EDU), which went public in the U.S. in 2006.

Credit Suisse Group (CS) and Bank of America-Merrill Lynch (BAC)

managed Global Education's offering.

Also trading for the first time Friday were shares from

Ellington Financial LLC (EFC), a specialty-finance company that

invests in mortgage-backed securities.

The stock closed at $21.75 on the New York Stock Exchange, down

3.3% from its IPO price of $22.50. The company sold 4.5 million

shares at the lower end of its expected range of $22 to $24, which

was set by underwriters Deutsche Bank AG (DB) and Cantor

Fitzgerald.

Connecticut-based Ellington Financial was formed in 2007 and

specializes in acquiring and managing mortgage-related assets, such

as residential mortgage-backed securities.

As of June 30, 2010, Ellington held residential mortgage-backed

securities with a net value of about $157.2 million, derivatives

contracts with a net value of $128.1 million, and had total

shareholders' equity of approximately $294.4 million. Its net

increase in shareholders' equity from operations for the six months

ended June 30, 2010, and 2009 was $11.3 million and $50.4 million,

respectively. The majority of the period-over-period decline was

due primarily to a reduction in net realized and unrealized gains

related to mortgage securities it held that aren't backed by

government-sponsored agencies such as Fannie Mae (FNMA) and Freddie

Mac (FMCC).

-By Lynn Cowan, Dow Jones Newswires; 301-270-0323;

lynn.cowan@dowjones.com

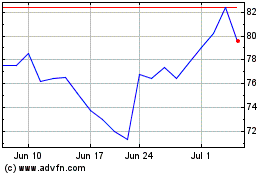

New Oriental Education a... (NYSE:EDU)

Historical Stock Chart

From May 2024 to Jun 2024

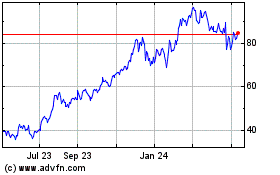

New Oriental Education a... (NYSE:EDU)

Historical Stock Chart

From Jun 2023 to Jun 2024