Navios Maritime Partners L.P. Announces Delivery of Three Container Vessels

December 16 2013 - 9:00AM

Marketwired

Navios Maritime Partners L.P. Announces Delivery of Three Container

Vessels

MONACO--(Marketwired - Dec 16, 2013) - Navios Maritime Partners

L.P. ("Navios Partners") (NYSE: NMM) an owner and operator of dry

cargo vessels, announced today that the Hyundai Tokyo, the Hyundai

Shanghai and the Hyundai Busan, all 2006-built container vessels of

6,800 TEU each, were delivered to Navios Partners' owned fleet on

December 10, 13 and 16, 2013 respectively.

Following the acquisition of these vessels, Navios Partners has

taken delivery of a total of five container vessels of 6,800 TEU

each and this completes the acquisition of the container vessels as

previously announced. All five vessels have been chartered out to

an investment grade counterparty for ten years (with Navios

Partners' option to terminate after year seven), at a rate of

$30,150 net per day per vessel. The vessels are expected to

generate approximately $39.5 million annual EBITDA and $386.5

million aggregate EBITDA for the ten years of the charter period.

EBITDA estimates assume expenses approximating current operating

costs and 360 revenue days per year.

Fleet Update Following the delivery of the above vessels, Navios

Partners has 28 vessels in the water and two to be delivered by Q1

2014.

Navios Partners has contracted 60.5% of its available days on a

charter-out basis for 2014.

About Navios Maritime Partners L.P. Navios Partners (NYSE: NMM)

is a publicly traded master limited partnership which owns and

operates dry cargo vessels. For more information, please visit our

website at www.navios-mlp.com.

Forward-Looking Statements This press release contains

forward-looking statements (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended) concerning future

events and Navios Partners' growth strategy and measures to

implement such strategy; including expected vessel acquisitions and

entering into further time charters. Words such as "may,"

"expects," "intends," "plans," "believes," "anticipates," "hopes,"

"estimates," and variations of such words and similar expressions

are intended to identify forward-looking statements. Such

statements include comments regarding expected revenue and time

charters. Although the Navios Partners believes that the

expectations reflected in such forward-looking statements are

reasonable, no assurance can be given that such expectations will

prove to have been correct. These statements involve known and

unknown risks and are based upon a number of assumptions and

estimates which are inherently subject to significant uncertainties

and contingencies, many of which are beyond the control of Navios

Partners. Actual results may differ materially from those expressed

or implied by such forward-looking statements. Factors that could

cause actual results to differ materially include, but are not

limited to changes in the demand for dry bulk vessels, competitive

factors in the market in which Navios Partners operates; risks

associated with operations outside the United States; and other

factors listed from time to time in the Navios Partners' filings

with the Securities and Exchange Commission. Navios Partners

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in Navios Partners'

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

Public & Investor Relations Contact: Navios Maritime

Partners L.P. +1.212.906.8645

Investors@navios-mlp.com Nicolas Bornozis Capital Link, Inc.

+1.212.661.7566

naviospartners@capitallink.com

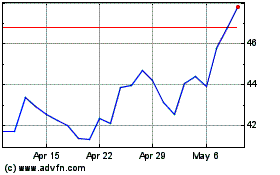

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Oct 2024 to Nov 2024

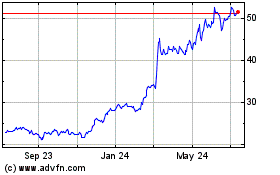

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Nov 2023 to Nov 2024