The Board of Directors of Natuzzi S.p.A. (NYSE: NTZ) (�Natuzzi� or

�the Company�), the world�s leading manufacturer of

leather-upholstered furniture, today announces the approval of the

consolidated financial statements for the third quarter 2006. NET

SALES Natuzzi third quarter 2006 total net sales were at EUR 158.5

million, or $ 202.0 million, up 7.7 percent as compared to third

quarter 2005. During the first nine months of the year, total net

sales increased by 13.1 percent with respect to the same period of

2005 at EUR 542.4 million, or $ 675.6 million. During the third

quarter 2006, upholstery net sales were at EUR 142.0 million, or $

180.9 million, up 8.8 percent over the third quarter of last year.

During the same period, total seats sold increased by 10.0 percent.

In the first nine months of 2006, the Company sold 2,236,121 seats,

11.4 percent more than the same comparable period of last year.

Other sales (principally living room accessories, and raw materials

produced by the Company and sold to third parties) decreased 1.2

percent to EUR 16.5 million, or $ 21.0 million, over the third

quarter of last year. During the three months ended on September

30, 2006, net sales in the Americas increased by 1.3 percent over

the third quarter 2005 at EUR 60.1 million, or $ 76.6 million, by

12.1 percent in Europe at EUR 68.8 million, or $ 87.7 million, by

33.7 percent in the rest of the world at EUR 13.1 million, or $

16.7 million. In the third quarter 2006, two new stores were opened

in China, whereas three stores were closed (one in Italy, one in UK

and one in Switzerland), thus bringing the total number of stores

to 278 as at September 30, 2006. In the same period, twelve

galleries were opened, so that the total number of Natuzzi

galleries was 560 as at September 30, 2006. Leather-upholstered

furniture net sales were at EUR 123.4 million, or $ 157.2 million,

up 11.7 percent over third quarter 2005, whereas fabric-upholstered

net sales were down 7.0 percent at EUR 18.6 million, or $ 23.7

million. During the third quarter 2006, net sales for the Natuzzi

branded products increased by 2.8 percent over the third quarter

2005 at EUR 83.8 million, or $ 106.8 million, and by 18.8 percent

for the Italsofa products at EUR 58.2 million, or $ 74.2 million.

GROSS PROFIT & OPERATING INCOME For the three months ended on

September 30, 2006, gross profit increased at EUR 51.1 million, or

$ 65.1 million, as compared to EUR 48.6 million, or $ 59.3 million,

reported for the third quarter of the previous year. Gross profit

margin slightly decreased at 32.2 percent, from 33.0 percent

reported for the third quarter of 2005, mainly due to the

unfavorable currency effect on upholstery net sales. The Company

reported an operating loss of EUR 1.1 million, or $ 1.4 million, as

compared to a break even in the third quarter 2005. FOREX &

TAXES During the quarter ended on September 30, 2006, the Company

reported a net foreign exchange loss of EUR 0.4 million, or a loss

of $ 0.5 million, as compared to a net foreign exchange loss of EUR

0.9 million, or a net foreign exchange loss of $ 1.1 million,

reported in the same comparable period of last year. For the third

quarter of 2006, the Company had income tax credit of EUR 0.2

million, or $ 0.3 million, versus income taxes of EUR 0.5 million,

or $ 0.6 million, reported last year. NET INCOME & EARNINGS PER

SHARE For the third quarter 2006, the Company reported net income

of EUR 0.8 million, or $ 1.0 million, versus net losses of EUR 2.0

million, or $ 2.4 million, reported in the same quarter of last

year. Earning per share (ADR) was EUR 0.01, or $ 0.01, as compared

to net loss per share of EUR 0.04, or $ 0.05, reported in third

quarter 2005. For the first nine months, in 2006 the Company

reported net earnings of EUR 17.5 million, or $ 21.8 million,

versus net losses of EUR 13.9 million, or $ 17.6 million, for the

same comparable period in 2005 CASH FLOW During the nine month

period ended on September 30, 2006, net cash flow from operations

increased at EUR 53.6 million, or $ 66.8 million, from EUR 16.9

million, or $ 21.3 million, generated for the same period in 2005.

On per ADR basis, net operating cash flow was EUR 0.98, or $ 1.22,

up from EUR 0.31, or $ 0.39, generated during the first nine months

of 2005. Ernesto Greco, Chief Executive Officer of the Natuzzi

Group, commented: �As in the prior quarter, the positive net sales

performance has not been accompanied by a similar order flow. In

fact, in the last few months the Group has been reporting a

decrease in the order flow which could lead us to an adjustment of

the production level. This decrease is mainly due to the general

weak retail environment for home furnishing, confirmed at recent

High Point furniture market, accompanied by persisting unfavorable

currency conditions. Despite this, the Company expects to report

for the full year 2006 an high single digit increase in revenues

over year 2005 thanks to the existing order back log. In this

challenging environment, we continue to invest in the Natuzzi

brand. At the same time, we are focusing our efforts on an

extensive process reengineering program that should improve the

overall efficiency of the Group and on the reorganization of sales

activities so to better envisage customers� needs and improve their

satisfaction. Besides, we are finalizing a new exclusive spring

collection for which we expect to obtain a successful reception

from our customers at next January Cologne furniture fair. The

combination of the above initiatives � concluded Greco - should

better position the Group for future sales growth and profitability

recovery�. CONVERSION RATES The third quarter 2006 and 2005 dollar

figures presented in this announcement were converted at an average

noon buying rate of $1.2742 per EUR and $1.2196 per EUR,

respectively. The nine months figures for 2006 and 2005 were

converted at an average noon buying rate of $ 1.2455 per EUR and $

1.2628 per EUR, respectively. MONTELEONE RESIGNED FROM THE BOARD OF

DIRECTORS Gianluca Monteleone, Group Marketing Director until

October 31st, 2006, resigned today from the Board of Directors. For

the time being, he will not be replaced. THIRD QUARTER 2006

TELECONFERENCE Ernesto Greco, Chief Executive Officer, Filippo

Simonetti, Chief Financial Officer, and Nicola Dell�Edera, Finance

Director, will discuss financial results, followed by a question

and answer session, in a teleconference at 10:00 a.m. New York time

(3:00 p.m. London time � 4:00 p.m. Italian time) on Thursday

November 16, 2006. ABOUT NATUZZI S.P.A. Founded in 1959 by Pasquale

Natuzzi, Natuzzi S.p.A. designs and manufactures a broad collection

of leather-upholstered residential furniture. Italy�s largest

furniture manufacturer, Natuzzi is the global leader in the leather

segment, exporting its innovative, high-quality sofas and armchairs

to 123 markets on 5 continents. Since 1990, Natuzzi has sold its

furnishings in Italy through the popular Divani & Divani by

Natuzzi chain of 125 stores, and 1 Natuzzi Store. Outside Italy,

the Company sells to various furniture retailers, as well as

through 152 licensed Divani & Divani by Natuzzi and Natuzzi

Stores. Natuzzi S.p.A. was listed on the New York Stock Exchange on

May 13, 1993. The Company is ISO 9001 and 14001 certified.

FORWARD-LOOKING STATEMENTS Statements in this press release other

than statements of historical fact are �forward-looking

statements�. Forward�looking statements are based on management�s

current expectations and beliefs and therefore you should not place

undue reliance on them. These statements are subject to a number of

risks and uncertainties, including risks that may not be subject to

the Company�s control, that could cause actual results to differ

materially from those contained in any forward-looking statement.

These risks include, but are not limited to, fluctuations in

exchange rates, economic and weather factors affecting consumer

spending, competitive and regulatory environment, as well as other

political, economical and technological factors, and other risks

identified from time to time in the Company�s filings with the

Securities and Exchange Commission, particularly in the Company�s

annual report on Form 20-F. Forward looking statements speak as of

the date they were made, and the Company undertakes no obligation

to update publicly any of them in light of new information or

future events. NATUZZI S.P.A. AND SUBSIDIARIES Unaudited

Consolidated Statement of Earnings for the quarters ended on

September 30, 2006 and 2005 on the basis of Italian GAAP (Expressed

in millions of EUR except per share data) � � � � � � � � � Three

months ended on % Over Percentage of Sales � 30-Sep-06 30-Sep-05

(Under) 30-Sep-06 30-Sep-05 Upholstery net sales 142.0� 130.5� 8.8%

89.6% 88.7% Other sales 16.5� 16.7� ( 1.2)% 10.4% 11.3% Total Net

Sales 158.5� 147.2� 7.7% 100.0% 100.0% Purchases (69.6) (63.4) (

9.8)% ( 43.9)% ( 43.1)% Labor (24.0) (22.1) ( 8.6)% ( 15.1)% (

15.0)% Third-party Manufacturers (3.6) (5.2) 30.8% ( 2.3)% ( 3.5)%

Manufacturing Costs (8.3) (8.5) 2.4% ( 5.2)% ( 5.8)% Inventories,

net (1.9) 0.6� ( 416.7)% ( 1.2)% 0.4% Cost of Sales (107.4) (98.6)

( 8.9)% ( 67.8)% ( 67.0)% Gross Profit 51.1� 48.6� 5.1% 32.2% 33.0%

Selling Expenses (42.9) (39.3) ( 9.2)% ( 27.1)% ( 26.7)% General

and Administrative Expenses (9.3) (9.3) 0.0% ( 5.9)% ( 6.3)%

Operating Income (Loss) (1.1) 0.0� N.M. ( 0.7)% 0.0% Interest

Income, net 0.3� 0.0� 0.2% 0.0% Foreign Exchange, net (0.4) (0.9) (

0.3)% ( 0.6)% Other Income, net 1.7� (0.7) 1.1% ( 0.5)% Earnings

(Losses) before taxes and minority interest 0.5� (1.6) 131.3% 0.3%

( 1.1)% Income taxes 0.2� (0.5) 0.1% ( 0.3)% Earnings (Losses)

before minority interest 0.7� (2.1) 133.3% 0.4% ( 1.4)% Minority

Interest (0.1) (0.1) ( 0.1)% ( 0.1)% Net Earnings (Losses) 0.8�

(2.0) 140.0% 0.5% ( 1.4)% Earnings (Losses) Per Share 0.01� (0.04)

� � � Average Number of Shares Outstanding* 54,738,538� 54,681,628�

� � � (*) Net of shares repurchased N.M. = Not meaningful � � � � �

� � � � � � Key Figures in U.S. dollars (millions) Three months

ended on � � � September 30, 2006 � � September 30, 2005 � � Total

Net Sales 202.0� 179.5� Gross Profit 65.1� 59.3� Operating Income

(Loss) (1.4) 0.0� Net Earnings (Losses) 1.0� (2.4) Earnings

(Losses) per Share 0.01� (0.05) Average exchange rate (U.S. dollar

per Euro) � 1.2742� � � � 1.2196� � � NATUZZI S.P.A. AND

SUBSIDIARIES Unaudited Consolidated Statement of Earnings for nine

months ended on September 30, 2006 and 2005 on the basis of Italian

GAAP (Expressed in millions of EUR except per share data) � � � � �

� � � � Nine months ended on % Over Percentage of Sales � 30-Sep-06

30-Sep-05 (Under) 30-Sep-06 30-Sep-05 Upholstery net sales 486.1�

421.9� 15.2% 89.6% 88.0% Other sales 56.3� 57.5� ( 2.1)% 10.4%

12.0% Total Net Sales 542.4� 479.4� 13.1% 100.0% 100.0% Purchases

(232.7) (217.8) ( 6.8)% ( 42.9)% ( 45.4)% Labor (80.2) (78.3) (

2.4)% ( 14.8)% ( 16.3)% Third-party Manufacturers (15.4) (18.2)

15.4% ( 2.8)% ( 3.8)% Manufacturing Costs (24.4) (24.7) 1.2% (

4.5)% ( 5.2)% Inventories, net (3.3) 15.0� ( 122.0)% ( 0.6)% 3.1%

Cost of Sales (356.0) (324.0) ( 9.9)% ( 65.6)% ( 67.6)% Gross

Profit 186.4� 155.4� 19.9% 34.4% 32.4% Selling Expenses (137.3)

(133.7) ( 2.7)% ( 25.3)% ( 27.9)% General and Administrative

Expenses (29.2) (31.0) 5.8% ( 5.4)% ( 6.5)% Operating Income (Loss)

19.9� (9.3) 314.0% 3.7% ( 1.9)% Interest Income, net 0.8� 0.0� 0.1%

0.0% Foreign Exchange, net (2.0) (3.9) ( 0.4)% ( 0.8)% Other

Income, net 4.9� (1.7) 0.9% ( 0.4)% Earnings (Losses) before taxes

and minority interest 23.6� (14.9) 258.4% 4.4% ( 3.1)% Income taxes

(6.1) 0.9� ( 1.1)% 0.2% Earnings (Losses) before minority interest

17.5� (14.0) 225.0% 3.2% ( 2.9)% Minority Interest 0.0� (0.1) 0.0%

0.0% Net Earnings (Losses) 17.5� (13.9) 225.9% 3.2% ( 2.9)%

Earnings (Losses) Per Share 0.32� (0.25) � � � Average Number of

Shares Outstanding* 54,738,538� 54,681,628� � � � (*) Net of shares

repurchased � � � � � � � � � � � � Key Figures in U.S. dollars

(millions) Nine months ended on � � � September 30, 2006 � �

September 30, 2005 � � Total Net Sales 675.6� 605.4� Gross Profit

232.2� 196.2� Operating Income (Loss) 24.8� (11.7) Net Earnings

(Losses) 21.8� (17.6) Earnings (Losses) per Share 0.40� (0.32)

Average exchange rate (U.S. dollar per Euro) � 1.2455� � � �

1.2628� � � GEOGRAPHIC BREAKDOWN � � � � � � � � � � � � Sales*

Seat Units Three months ended on % Over Three months ended on %

Over � 30-Sep-06 30-Sep-05 (Under) 30-Sep-06 30-Sep-05 (Under)

Americas 60.1� 59.3� 1.3% 357,752� 326,633� 9.5% % of total 42.3%

45.5% 52.0% 52.2% Europe 68.8� 61.4� 12.1% 274,427� 261,848� 4.8% %

of total 48.5% 47.0% 39.9% 41.9% Rest of the world 13.1� 9.8� 33.7%

55,392� 36,816� 50.5% % of total 9.2% 7.5% � 8.1% 5.9% � TOTAL

142.0� � 130.5� � 8.8% 687,571� � 625,297� � 10.0% * Expressed in

millions of EUR � � � � � � � � � � � � � � BREAKDOWN BY COVERING �

� � � � � � � � � � � Sales* Seat Units Three months ended on %

Over Three months ended on % Over � 30-Sep-06 30-Sep-05 (Under)

30-Sep-06 30-Sep-05 (Under) Leather 123.4� 110.5� 11.7% 582,950�

504,545� 15.5% % of total 86.9% 84.7% 84.8% 80.7% Fabric 18.6�

20.0� (7.0%) 104,621� 120,752� (13.4%) % of total 13.1% 15.3% 15.2%

19.3% Total � 142.0� � 130.5� � 8.8% 687,571� � 625,297� � 10.0% *

(Expressed in millions of EUR) � � � � � � � � � � � � � �

BREAKDOWN BY BRAND � � � � � � � � � � � � Sales* Seat Units Three

months ended on % Over Three months ended on % Over � 30-Sep-06

30-Sep-05 (Under) 30-Sep-06 30-Sep-05 (Under) Natuzzi 83.8� 81.5�

2.8% 316,702� 291,659� 8.6% % of total 59.0% 62.5% 46.1% 46.6%

Italsofa 58.2� 49.0� 18.8% 370,869� 333,638� 11.2% % of total 41.0%

37.5% 53.9% 53.4% TOTAL 142.0� � 130.5� � 8.8% 687,571� � 625,297�

� 10.0% * (Expressed in millions of EUR) GEOGRAPHIC BREAKDOWN � � �

� � � � � � � � � Sales* Seat Units Nine months ended on % Over

Nine months ended on % Over � 30-Sep-06 30-Sep-05 (Under) 30-Sep-06

30-Sep-05 (Under) Americas 186.9� 176.8� 5.7% 1,036,001� 1,019,390�

1.6% % of total 38.4% 41.9% 46.3% 50.8% Europe 264.4� 216.4� 22.2%

1,055,359� 870,393� 21.3% % of total 54.4% 51.3% 47.2% 43.3% Rest

of the world 34.8� 28.7� 21.3% 144,761� 118,325� 22.3% % of total

7.2% 6.8% � 6.5% 5.9% � TOTAL � 486.1� � 421.9� � 15.2% 2,236,121�

� 2,008,108� � 11.4% * (Expressed in millions of EUR) � � � � � � �

� � � � � � � BREAKDOWN BY COVERING � � � � � � � � � � � � Sales*

Seat Units Nine months ended on % Over Nine months ended on % Over

� 30-Sep-06 30-Sep-05 (Under) 30-Sep-06 30-Sep-05 (Under) Leather

420.6� 351.6� 19.6% 1,874,148� 1,571,230� 19.3% % of total 86.5%

83.3% 83.8% 78.2% Fabric 65.5� 70.3� (6.8%) 361,973� 436,878�

(17.1%) % of total 13.5% 16.7% 16.2% 21.8% Total � 486.1� � 421.9�

� 15.2% 2,236,121� � 2,008,108� � 11.4% * (Expressed in millions of

EUR) � � � � � � � � � � � � � � BREAKDOWN BY BRAND � � � � � � � �

� � � � Sales* Seat Units Nine months ended on % Over Nine months

ended on % Over � 30-Sep-06 30-Sep-05 (Under) 30-Sep-06 30-Sep-05

(Under) Natuzzi 307.3� 284.5� 8.0% 1,107,774� 1,066,735� 3.8% % of

total 63.2% 67.4% 49.5% 53.1% Italsofa 178.8� 137.4� 30.1%

1,128,347� 941,373� 19.9% % of total 36.8% 32.6% 50.5% 46.9% TOTAL

� 486.1� � 421.9� � 15.2% 2,236,121� � 2,008,108� � 11.4% *

(Expressed in millions of EUR) NATUZZI S.P.A. AND SUBSIDIARIES

Unaudited Consolidated Balance Sheet as of September 30, 2006 and

December 31, 2005 (Expressed in millions of EUR) � � � 30-Sep-06

31-Dec-05 ASSETS Current Assets: Cash and cash equivalents 123.7�

89.7� Marketable debt securities 0.0� 0.0� Trade receivables, net

110.5� 123.6� Other receivables 42.0� 46.3� Inventories 112.3�

115.7� Unrealized foreign exchange gains 1.8� 0.0� Prepaid expenses

and accrued income 2.6� 2.6� Deferred income taxes 9.0� 6.6� Total

current assets 401.9� 384.5� Non-Current Assets: Net property,

plant and equipment 250.1� 262.8� Treasury shares 0.0� 0.0� Other

assets 17.2� 16.6� � Deferred income taxes 1.1� 1.1� TOTAL ASSETS

670.3� 665.0� LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities: Short-term borrowings 4.1� 7.7� Current portion of

long-term debt 1.2� 0.4� Accounts payable-trade 70.7� 73.5�

Accounts payable-other 25.4� 24.2� Accounts payable shareholders

for dividends 0.6� 0.6� Unrealized foreign exchange losses 0.0�

4.8� Income taxes 3.9� 2.9� Salaries, wages and related liabilities

21.1� 22.1� Total current liabilities 127.0� 136.2� Long-Term

Liabilities: Employees� leaving entitlement 34.1� 32.3� Long-term

debt 2.2� 3.6� Deferred income taxes 0.0� 0.0� Deferred income for

capital grants 14.0� 14.8� � Other liabilities 5.8� 4.4� Minority

Interest 0.7� 0.7� Shareholders� Equity: Share capital 54.7� 54.7�

Reserves 42.3� 42.3� Additional paid-in capital 8.3� 8.3� Retained

earnings 381.2� 367.7� Total shareholders� equity 486.5� 473.0�

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 670.3� 665.0� NATUZZI

S.P.A. AND SUBSIDIARIES Unaudited Consolidated Statements of Cash

Flows as of September 30, 2006 and 2005 (Expressed in millions of

EUR) 30-Sep-06 30-Sep-05 Cash flows from operating activities: Net

earnings (losses) 17.5� (13.9) Adjustments to reconcile net income

to net cash provided by operating activities: Depreciation and

amortization 23.1� 21.9� Employees' leaving entitlement 1.8� 1.9�

Deferred income taxes (2.3) (5.7) Minority interest 0.0� (0.1)

(Gain) loss on disposal of assets 0.4� 0.6� Unrealized foreign

exchange (losses) / gain (6.6) 12.1� Deferred income for capital

grants (0.8) 0.0� Change in assets and liabilities: Receivables,

net 13.1� 31.2� Inventories 3.5� (14.1) Prepaid expenses and

accrued income (0.1) 0.4� Other assets 4.2� 3.3� Accounts payable

(2.9) (21.2) Income taxes 1.0� (0.6) Salaries, wages and related

liabilities (1.0) 1.0� Other liabilities 2.7� 0.1� � Total

adjustments 36.1� 30.8� � NET CASH PROVIDED BY OPERATING ACTIVITIES

53.6� 16.9� � Cash flows from investing activities: Property, plant

and equipment: Additions (11.8) (19.6) Disposals 0.2� 0.4�

Government grants received 0.0� 0.0� Marketable debt securities:

Proceeds from sales 0.0� 0.0� Purchase of business, net of cash

acquired (3.1) (0.3) Disposal of business 0.0� 0.0� NET CASH USED

IN INVESTING ACTIVITIES (14.7) (19.5) Cash flows from financing

activities: Long term debt: Proceeds 0.0� 0.3� Repayments (0.6)

(0.5) Short-term borrowings (3.6) 1.6� Dividends paid to

shareholders 0.0� (3.8) Dividends paid to minority shareholders

0.0� (0.1) NET CASH USED IN FINANCING ACTIVITIES (4.2) (2.5) Effect

of translation adjustments on cash (0.7) 3.5� INCREASE (DECREASE)

IN CASH AND CASH EQUIVALENTS 34.0� (1.6) Cash and cash equivalents,

beginning of the year 89.7� 87.3� CASH AND CASH EQUIVALENTS, END OF

THE PERIOD 123.7� 85.7� The Board of Directors of Natuzzi S.p.A.

(NYSE: NTZ) ('Natuzzi' or 'the Company'), the world's leading

manufacturer of leather-upholstered furniture, today announces the

approval of the consolidated financial statements for the third

quarter 2006. NET SALES Natuzzi third quarter 2006 total net sales

were at EUR 158.5 million, or $ 202.0 million, up 7.7 percent as

compared to third quarter 2005. During the first nine months of the

year, total net sales increased by 13.1 percent with respect to the

same period of 2005 at EUR 542.4 million, or $ 675.6 million.

During the third quarter 2006, upholstery net sales were at EUR

142.0 million, or $ 180.9 million, up 8.8 percent over the third

quarter of last year. During the same period, total seats sold

increased by 10.0 percent. In the first nine months of 2006, the

Company sold 2,236,121 seats, 11.4 percent more than the same

comparable period of last year. Other sales (principally living

room accessories, and raw materials produced by the Company and

sold to third parties) decreased 1.2 percent to EUR 16.5 million,

or $ 21.0 million, over the third quarter of last year. During the

three months ended on September 30, 2006, net sales in the Americas

increased by 1.3 percent over the third quarter 2005 at EUR 60.1

million, or $ 76.6 million, by 12.1 percent in Europe at EUR 68.8

million, or $ 87.7 million, by 33.7 percent in the rest of the

world at EUR 13.1 million, or $ 16.7 million. In the third quarter

2006, two new stores were opened in China, whereas three stores

were closed (one in Italy, one in UK and one in Switzerland), thus

bringing the total number of stores to 278 as at September 30,

2006. In the same period, twelve galleries were opened, so that the

total number of Natuzzi galleries was 560 as at September 30, 2006.

Leather-upholstered furniture net sales were at EUR 123.4 million,

or $ 157.2 million, up 11.7 percent over third quarter 2005,

whereas fabric-upholstered net sales were down 7.0 percent at EUR

18.6 million, or $ 23.7 million. During the third quarter 2006, net

sales for the Natuzzi branded products increased by 2.8 percent

over the third quarter 2005 at EUR 83.8 million, or $ 106.8

million, and by 18.8 percent for the Italsofa products at EUR 58.2

million, or $ 74.2 million. GROSS PROFIT & OPERATING INCOME For

the three months ended on September 30, 2006, gross profit

increased at EUR 51.1 million, or $ 65.1 million, as compared to

EUR 48.6 million, or $ 59.3 million, reported for the third quarter

of the previous year. Gross profit margin slightly decreased at

32.2 percent, from 33.0 percent reported for the third quarter of

2005, mainly due to the unfavorable currency effect on upholstery

net sales. The Company reported an operating loss of EUR 1.1

million, or $ 1.4 million, as compared to a break even in the third

quarter 2005. FOREX & TAXES During the quarter ended on

September 30, 2006, the Company reported a net foreign exchange

loss of EUR 0.4 million, or a loss of $ 0.5 million, as compared to

a net foreign exchange loss of EUR 0.9 million, or a net foreign

exchange loss of $ 1.1 million, reported in the same comparable

period of last year. For the third quarter of 2006, the Company had

income tax credit of EUR 0.2 million, or $ 0.3 million, versus

income taxes of EUR 0.5 million, or $ 0.6 million, reported last

year. NET INCOME & EARNINGS PER SHARE For the third quarter

2006, the Company reported net income of EUR 0.8 million, or $ 1.0

million, versus net losses of EUR 2.0 million, or $ 2.4 million,

reported in the same quarter of last year. Earning per share (ADR)

was EUR 0.01, or $ 0.01, as compared to net loss per share of EUR

0.04, or $ 0.05, reported in third quarter 2005. For the first nine

months, in 2006 the Company reported net earnings of EUR 17.5

million, or $ 21.8 million, versus net losses of EUR 13.9 million,

or $ 17.6 million, for the same comparable period in 2005 CASH FLOW

During the nine month period ended on September 30, 2006, net cash

flow from operations increased at EUR 53.6 million, or $ 66.8

million, from EUR 16.9 million, or $ 21.3 million, generated for

the same period in 2005. On per ADR basis, net operating cash flow

was EUR 0.98, or $ 1.22, up from EUR 0.31, or $ 0.39, generated

during the first nine months of 2005. Ernesto Greco, Chief

Executive Officer of the Natuzzi Group, commented: "As in the prior

quarter, the positive net sales performance has not been

accompanied by a similar order flow. In fact, in the last few

months the Group has been reporting a decrease in the order flow

which could lead us to an adjustment of the production level. This

decrease is mainly due to the general weak retail environment for

home furnishing, confirmed at recent High Point furniture market,

accompanied by persisting unfavorable currency conditions. Despite

this, the Company expects to report for the full year 2006 an high

single digit increase in revenues over year 2005 thanks to the

existing order back log. In this challenging environment, we

continue to invest in the Natuzzi brand. At the same time, we are

focusing our efforts on an extensive process reengineering program

that should improve the overall efficiency of the Group and on the

reorganization of sales activities so to better envisage customers'

needs and improve their satisfaction. Besides, we are finalizing a

new exclusive spring collection for which we expect to obtain a

successful reception from our customers at next January Cologne

furniture fair. The combination of the above initiatives -

concluded Greco - should better position the Group for future sales

growth and profitability recovery". CONVERSION RATES The third

quarter 2006 and 2005 dollar figures presented in this announcement

were converted at an average noon buying rate of $1.2742 per EUR

and $1.2196 per EUR, respectively. The nine months figures for 2006

and 2005 were converted at an average noon buying rate of $ 1.2455

per EUR and $ 1.2628 per EUR, respectively. MONTELEONE RESIGNED

FROM THE BOARD OF DIRECTORS Gianluca Monteleone, Group Marketing

Director until October 31st, 2006, resigned today from the Board of

Directors. For the time being, he will not be replaced. THIRD

QUARTER 2006 TELECONFERENCE Ernesto Greco, Chief Executive Officer,

Filippo Simonetti, Chief Financial Officer, and Nicola Dell'Edera,

Finance Director, will discuss financial results, followed by a

question and answer session, in a teleconference at 10:00 a.m. New

York time (3:00 p.m. London time - 4:00 p.m. Italian time) on

Thursday November 16, 2006. ABOUT NATUZZI S.P.A. Founded in 1959 by

Pasquale Natuzzi, Natuzzi S.p.A. designs and manufactures a broad

collection of leather-upholstered residential furniture. Italy's

largest furniture manufacturer, Natuzzi is the global leader in the

leather segment, exporting its innovative, high-quality sofas and

armchairs to 123 markets on 5 continents. Since 1990, Natuzzi has

sold its furnishings in Italy through the popular Divani &

Divani by Natuzzi chain of 125 stores, and 1 Natuzzi Store. Outside

Italy, the Company sells to various furniture retailers, as well as

through 152 licensed Divani & Divani by Natuzzi and Natuzzi

Stores. Natuzzi S.p.A. was listed on the New York Stock Exchange on

May 13, 1993. The Company is ISO 9001 and 14001 certified.

FORWARD-LOOKING STATEMENTS Statements in this press release other

than statements of historical fact are "forward-looking

statements". Forward-looking statements are based on management's

current expectations and beliefs and therefore you should not place

undue reliance on them. These statements are subject to a number of

risks and uncertainties, including risks that may not be subject to

the Company's control, that could cause actual results to differ

materially from those contained in any forward-looking statement.

These risks include, but are not limited to, fluctuations in

exchange rates, economic and weather factors affecting consumer

spending, competitive and regulatory environment, as well as other

political, economical and technological factors, and other risks

identified from time to time in the Company's filings with the

Securities and Exchange Commission, particularly in the Company's

annual report on Form 20-F. Forward looking statements speak as of

the date they were made, and the Company undertakes no obligation

to update publicly any of them in light of new information or

future events. -0- *T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited

Consolidated Statement of Earnings for the quarters ended on

September 30, 2006 and 2005 on the basis of Italian GAAP (Expressed

in millions of EUR except per share data)

----------------------------------------------------- Three months

ended on % Over Percentage of Sales 30-Sep-06 30-Sep-05 (Under)

30-Sep-06 30-Sep-05 --------------- ----------- -----------

--------- --------- --------- Upholstery net sales 142.0 130.5 8.8%

89.6% 88.7% Other sales 16.5 16.7 ( 1.2)% 10.4% 11.3% Total Net

Sales 158.5 147.2 7.7% 100.0% 100.0% --------------- -----------

----------- --------- --------- --------- Purchases (69.6) (63.4) (

9.8)% ( 43.9)% ( 43.1)% Labor (24.0) (22.1) ( 8.6)% ( 15.1)% (

15.0)% Third-party Manufacturers (3.6) (5.2) 30.8% ( 2.3)% ( 3.5)%

Manufacturing Costs (8.3) (8.5) 2.4% ( 5.2)% ( 5.8)% Inventories,

net (1.9) 0.6 ( 416.7)% ( 1.2)% 0.4% Cost of Sales (107.4) (98.6) (

8.9)% ( 67.8)% ( 67.0)% --------------- ----------- -----------

--------- --------- --------- Gross Profit 51.1 48.6 5.1% 32.2%

33.0% --------------- ----------- ----------- --------- ---------

--------- Selling Expenses (42.9) (39.3) ( 9.2)% ( 27.1)% ( 26.7)%

General and Administrative Expenses (9.3) (9.3) 0.0% ( 5.9)% (

6.3)% Operating N.M. Income (Loss) (1.1) 0.0 ( 0.7)% 0.0%

--------------- ----------- ----------- --------- ---------

--------- Interest Income, net 0.3 0.0 0.2% 0.0% Foreign Exchange,

net (0.4) (0.9) ( 0.3)% ( 0.6)% Other Income, net 1.7 (0.7) 1.1% (

0.5)% Earnings (Losses) before taxes and minority interest 0.5

(1.6) 131.3% 0.3% ( 1.1)% --------------------------- -----------

--------- --------- --------- Income taxes 0.2 (0.5) 0.1% ( 0.3)%

Earnings (Losses) before minority interest 0.7 (2.1) 133.3% 0.4% (

1.4)% --------------------------- ----------- --------- ---------

--------- Minority Interest (0.1) (0.1) ( 0.1)% ( 0.1)% Net

Earnings (Losses) 0.8 (2.0) 140.0% 0.5% ( 1.4)% ---------------

----------- ----------- --------- --------- --------- Earnings

(Losses) Per Share 0.01 (0.04) --------------- -----------

----------- --------- --------- --------- Average Number of Shares

Outstanding* 54,738,538 54,681,628 ---------------------------

----------- --------- --------- --------- (*) Net of shares

repurchased N.M. = Not meaningful

---------------------------------------------------------------------

Key Figures in U.S. dollars (millions) Three months ended on

September September 30, 2006 30, 2005 ---------------------------

--------------------- ------------------- Total Net Sales 202.0

179.5 Gross Profit 65.1 59.3 Operating Income (Loss) (1.4) 0.0 Net

Earnings (Losses) 1.0 (2.4) Earnings (Losses) per Share 0.01 (0.05)

Average exchange rate (U.S. dollar per Euro) 1.2742 1.2196

---------------------------------------------------------------------

*T -0- *T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated

Statement of Earnings for nine months ended on September 30, 2006

and 2005 on the basis of Italian GAAP (Expressed in millions of EUR

except per share data)

----------------------------------------------------- Nine months

ended on % Over Percentage of Sales 30-Sep-06 30-Sep-05 (Under)

30-Sep-06 30-Sep-05 --------------- ----------- -----------

--------- --------- --------- Upholstery net sales 486.1 421.9

15.2% 89.6% 88.0% Other sales 56.3 57.5 ( 2.1)% 10.4% 12.0% Total

Net Sales 542.4 479.4 13.1% 100.0% 100.0% ---------------

----------- ----------- --------- --------- --------- Purchases

(232.7) (217.8) ( 6.8)% ( 42.9)% ( 45.4)% Labor (80.2) (78.3) (

2.4)% ( 14.8)% ( 16.3)% Third-party Manufacturers (15.4) (18.2)

15.4% ( 2.8)% ( 3.8)% Manufacturing Costs (24.4) (24.7) 1.2% (

4.5)% ( 5.2)% Inventories, net (3.3) 15.0 ( 122.0)% ( 0.6)% 3.1%

Cost of Sales (356.0) (324.0) ( 9.9)% ( 65.6)% ( 67.6)%

--------------- ----------- ----------- --------- ---------

--------- Gross Profit 186.4 155.4 19.9% 34.4% 32.4%

--------------- ----------- ----------- --------- ---------

--------- Selling Expenses (137.3) (133.7) ( 2.7)% ( 25.3)% (

27.9)% General and Administrative Expenses (29.2) (31.0) 5.8% (

5.4)% ( 6.5)% Operating Income (Loss) 19.9 (9.3) 314.0% 3.7% (

1.9)% --------------- ----------- ----------- --------- ---------

--------- Interest Income, net 0.8 0.0 0.1% 0.0% Foreign Exchange,

net (2.0) (3.9) ( 0.4)% ( 0.8)% Other Income, net 4.9 (1.7) 0.9% (

0.4)% Earnings (Losses) before taxes and minority interest 23.6

(14.9) 258.4% 4.4% ( 3.1)% --------------------------- -----------

--------- --------- --------- Income taxes (6.1) 0.9 ( 1.1)% 0.2%

Earnings (Losses) before minority interest 17.5 (14.0) 225.0% 3.2%

( 2.9)% --------------------------- ----------- --------- ---------

--------- Minority Interest 0.0 (0.1) 0.0% 0.0% Net Earnings

(Losses) 17.5 (13.9) 225.9% 3.2% ( 2.9)% ---------------

----------- ----------- --------- --------- --------- Earnings

(Losses) Per Share 0.32 (0.25) --------------- -----------

----------- --------- --------- --------- Average Number of Shares

Outstanding* 54,738,538 54,681,628 ---------------------------

----------- --------- --------- --------- (*) Net of shares

repurchased

---------------------------------------------------------------------

Key Figures in U.S. dollars (millions) Nine months ended on

September September 30, 2006 30, 2005 ---------------------------

--------------------- ------------------- Total Net Sales 675.6

605.4 Gross Profit 232.2 196.2 Operating Income (Loss) 24.8 (11.7)

Net Earnings (Losses) 21.8 (17.6) Earnings (Losses) per Share 0.40

(0.32) Average exchange rate (U.S. dollar per Euro) 1.2455 1.2628

---------------------------------------------------------------------

*T -0- *T GEOGRAPHIC BREAKDOWN --------- -----------------------

------------------------------- Sales* Seat Units Three months

Three months ended ended on % Over on % Over 30- 30- Sep- Sep- 06

05 (Under) 30-Sep-06 30-Sep-05 (Under) ====== ====== ======

========= ========= ========== ========== Americas 60.1 59.3 1.3%

357,752 326,633 9.5% % of total 42.3% 45.5% 52.0% 52.2% Europe 68.8

61.4 12.1% 274,427 261,848 4.8% % of total 48.5% 47.0% 39.9% 41.9%

Rest of the world 13.1 9.8 33.7% 55,392 36,816 50.5% % of total

9.2% 7.5% 8.1% 5.9% --------- ------ ------ --------- ---------

---------- ---------- TOTAL 142.0 130.5 8.8% 687,571 625,297 10.0%

--------- ----------------------- ------------------------------- *

Expressed in millions of EUR ---------- -----------------------

------------------------------- BREAKDOWN BY COVERING ---------

----------------------- ------------------------------- Sales* Seat

Units Three months Three months ended ended on % Over on % Over 30-

30- Sep- Sep- 06 05 (Under) 30-Sep-06 30-Sep-05 (Under) ======

====== ====== ========= ========= ========== ========== Leather

123.4 110.5 11.7% 582,950 504,545 15.5% % of total 86.9% 84.7%

84.8% 80.7% Fabric 18.6 20.0 (7.0%) 104,621 120,752 (13.4%) % of

total 13.1% 15.3% 15.2% 19.3% Total 142.0 130.5 8.8% 687,571

625,297 10.0% --------- -----------------------

------------------------------- * (Expressed in millions of EUR)

---------- ----------------------- -------------------------------

BREAKDOWN BY BRAND --------- -----------------------

------------------------------- Sales* Seat Units Three months

Three months ended ended on % Over on % Over 30- 30- Sep- Sep- 06

05 (Under) 30-Sep-06 30-Sep-05 (Under) ====== ====== ======

========= ========= ========== ========== Natuzzi 83.8 81.5 2.8%

316,702 291,659 8.6% % of total 59.0% 62.5% 46.1% 46.6% Italsofa

58.2 49.0 18.8% 370,869 333,638 11.2% % of total 41.0% 37.5% 53.9%

53.4% TOTAL 142.0 130.5 8.8% 687,571 625,297 10.0% ---------

----------------------- ------------------------------- *

(Expressed in millions of EUR) *T -0- *T GEOGRAPHIC BREAKDOWN

--------------------------------- -------------------------------

Sales* Seat Units Nine months % Over Nine months ended on % Over

ended on 30- 30- Sep- Sep- 06 05 (Under) 30-Sep-06 30-Sep-05

(Under) ========== ====== ====== ======== ========== ==========

========= Americas 186.9 176.8 5.7% 1,036,001 1,019,390 1.6% % of

total 38.4% 41.9% 46.3% 50.8% Europe 264.4 216.4 22.2% 1,055,359

870,393 21.3% % of total 54.4% 51.3% 47.2% 43.3% Rest of the world

34.8 28.7 21.3% 144,761 118,325 22.3% % of total 7.2% 6.8% 6.5%

5.9% ---------- ------ ------ -------- ---------- ----------

--------- TOTAL 486.1 421.9 15.2% 2,236,121 2,008,108 11.4%

--------------------------------- ------------------------------- *

(Expressed in millions of EUR) ----------------------------------

------------------------------- BREAKDOWN BY COVERING

--------------------------------- -------------------------------

Sales* Seat Units Nine months ended on % Over Nine months ended on

% Over 30- 30- Sep- Sep- 06 05 (Under) 30-Sep-06 30-Sep-05 (Under)

========== ====== ====== ======== ========== ========== =========

Leather 420.6 351.6 19.6% 1,874,148 1,571,230 19.3% % of total

86.5% 83.3% 83.8% 78.2% Fabric 65.5 70.3 (6.8%) 361,973 436,878

(17.1%) % of total 13.5% 16.7% 16.2% 21.8% Total 486.1 421.9 15.2%

2,236,121 2,008,108 11.4% ---------------------------------

------------------------------- * (Expressed in millions of EUR)

---------------------------------- -------------------------------

BREAKDOWN BY BRAND ---------------------------------

------------------------------- Sales* Seat Units Nine months ended

on % Over Nine months ended on % Over 30- 30- Sep- Sep- 06 05

(Under) 30-Sep-06 30-Sep-05 (Under) ========== ====== ======

======== ========== ========== ========= Natuzzi 307.3 284.5 8.0%

1,107,774 1,066,735 3.8% % of total 63.2% 67.4% 49.5% 53.1%

Italsofa 178.8 137.4 30.1% 1,128,347 941,373 19.9% % of total 36.8%

32.6% 50.5% 46.9% TOTAL 486.1 421.9 15.2% 2,236,121 2,008,108 11.4%

--------------------------------- ------------------------------- *

(Expressed in millions of EUR) *T -0- *T NATUZZI S.P.A. AND

SUBSIDIARIES Unaudited Consolidated Balance Sheet as of September

30, 2006 and December 31, 2005 (Expressed in millions of EUR)

30-Sep-06 31-Dec-05 ----------------------------------------

--------- --------- ASSETS Current Assets: Cash and cash

equivalents 123.7 89.7 Marketable debt securities 0.0 0.0 Trade

receivables, net 110.5 123.6 Other receivables 42.0 46.3

Inventories 112.3 115.7 Unrealized foreign exchange gains 1.8 0.0

Prepaid expenses and accrued income 2.6 2.6 Deferred income taxes

9.0 6.6 Total current assets 401.9 384.5

---------------------------------------- --------- ---------

Non-Current Assets: Net property, plant and equipment 250.1 262.8

Treasury shares 0.0 0.0 Other assets 17.2 16.6 Deferred income

taxes 1.1 1.1 ---------------------------------------- ---------

--------- TOTAL ASSETS 670.3 665.0

---------------------------------------- --------- ---------

LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities:

Short-term borrowings 4.1 7.7 Current portion of long-term debt 1.2

0.4 Accounts payable-trade 70.7 73.5 Accounts payable-other 25.4

24.2 Accounts payable shareholders for dividends 0.6 0.6 Unrealized

foreign exchange losses 0.0 4.8 Income taxes 3.9 2.9 Salaries,

wages and related liabilities 21.1 22.1 Total current liabilities

127.0 136.2 ---------------------------------------- ---------

--------- Long-Term Liabilities: Employees' leaving entitlement

34.1 32.3 Long-term debt 2.2 3.6 Deferred income taxes 0.0 0.0

Deferred income for capital grants 14.0 14.8 Other liabilities 5.8

4.4 ---------------------------------------- --------- ---------

Minority Interest 0.7 0.7 ----------------------------------------

--------- --------- Shareholders' Equity: Share capital 54.7 54.7

Reserves 42.3 42.3 Additional paid-in capital 8.3 8.3 Retained

earnings 381.2 367.7 Total shareholders' equity 486.5 473.0

---------------------------------------- --------- --------- TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY 670.3 665.0

-------------------------------------------------- --------- *T -0-

*T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated

Statements of Cash Flows as of September 30, 2006 and 2005

(Expressed in millions of EUR) 30-Sep-06 30-Sep-05 ---------

--------- Cash flows from operating activities: Net earnings

(losses) 17.5 (13.9) Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 23.1 21.9 Employees' leaving entitlement 1.8 1.9

Deferred income taxes (2.3) (5.7) Minority interest 0.0 (0.1)

(Gain) loss on disposal of assets 0.4 0.6 Unrealized foreign

exchange (losses) / gain (6.6) 12.1 Deferred income for capital

grants (0.8) 0.0 Change in assets and liabilities: Receivables, net

13.1 31.2 Inventories 3.5 (14.1) Prepaid expenses and accrued

income (0.1) 0.4 Other assets 4.2 3.3 Accounts payable (2.9) (21.2)

Income taxes 1.0 (0.6) Salaries, wages and related liabilities

(1.0) 1.0 Other liabilities 2.7 0.1 Total adjustments 36.1 30.8 NET

CASH PROVIDED BY OPERATING ACTIVITIES 53.6 16.9

------------------------------------------------ ---------

--------- Cash flows from investing activities: Property, plant and

equipment: Additions (11.8) (19.6) Disposals 0.2 0.4 Government

grants received 0.0 0.0 Marketable debt securities: Proceeds from

sales 0.0 0.0 Purchase of business, net of cash acquired (3.1)

(0.3) Disposal of business 0.0 0.0 NET CASH USED IN INVESTING

ACTIVITIES (14.7) (19.5)

------------------------------------------------ ---------

--------- Cash flows from financing activities: Long term debt:

Proceeds 0.0 0.3 Repayments (0.6) (0.5) Short-term borrowings (3.6)

1.6 Dividends paid to shareholders 0.0 (3.8) Dividends paid to

minority shareholders 0.0 (0.1) NET CASH USED IN FINANCING

ACTIVITIES (4.2) (2.5)

------------------------------------------------ ---------

--------- Effect of translation adjustments on cash (0.7) 3.5

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 34.0 (1.6)

------------------------------------------------ ---------

--------- Cash and cash equivalents, beginning of the year 89.7

87.3 CASH AND CASH EQUIVALENTS, END OF THE PERIOD 123.7 85.7

------------------------------------------------ ---------

--------- *T

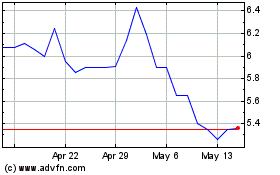

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

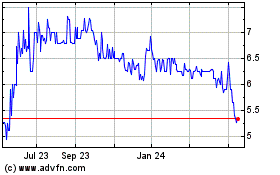

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024