Natuzzi S.p.A. (NYSE: NTZ): -- 4Q&FY05 FINANCIAL HIGHLIGHTS --

2005 NET SALES AT EUR 669.9 MILLION FROM EUR 753.4 REPORTED IN 2004

-- 2005 LOSSES PER SHARE AT EUR 0.31 VS EARNINGS PER SHARE OF EUR

0.34 IN 2004 -- FULL YEAR 2004 CASH FLOW FROM OPERATIONS AT EUR

23.2 MILLION The Board of Directors of Natuzzi S.p.A. (NYSE: NTZ)

('Natuzzi' or 'the Company'), the world's leading manufacturer of

leather-upholstered furniture, today announces the approval of the

financial results for the fourth quarter and fiscal year ended on

December 31, 2005. NET SALES In fourth quarter ended on December

31, 2005, Natuzzi total net sales decreased by 1.5 percent to EUR

190.6 million, or $226.6 million, down from EUR 193.6 million, or

$251.5 million reported for the same quarter of 2004. During the

same period total seats sold increased by 4.1 percent. Considering

the twelve months ended on December 31, 2005, total net sales

decreased 11.1 percent from 2004 at EUR 669.9 million, or $ 834.0

million, and units sold by 8.4 percent. During the last three

months of 2005, upholstery net sales were up 3.0 percent at EUR

173.0, or $205.7 million, from EUR 167.9 million, or $ 218.1

million, reported for the same period last year. Other sales

(principally living-room accessories and raw materials produced by

the Company and sold to third parties) decreased by 31.5 percent to

EUR 17.6 million, or $ 20.9 million. In the fourth quarter 2005 net

sales in the Americas were at EUR 64.9 million, or $ 77.2 million,

up by 19.7 percent from EUR 54.2 million, or $ 70.4 million in 2004

fourth quarter. In Europe sales were at EUR 96.9 million, or $

115.2 million, down by 4.6 percent from EUR 101.6 million, or $

132.0 million, reported in the same quarter last year, and in the

rest of the world net sales were down 7.4 percent at EUR 11.2

million, or $ 13.3 million, from EUR 12.1 million, or $ 15.7

million, reported in the previous year comparable period. In the

quarter ended on December 31, 2005, total net sales to our chains

Divani & Divani by Natuzzi stores, Natuzzi stores, and Kingdom

of Leather stores were at EUR 32.3 million, or $ 38.4 million, down

by 21.0 percent as compared to EUR 40.9 million, or $ 53.1 million

reported one year ago. During the same quarter nine new stores were

opened (4 in Australia and one each in France, Denmark, Czech

Republic, Latvia, and Saudi Arabia), whereas 3 stores were closed

(2 in Italy, and one in China), therefore the total number of

stores was 290 as at December 31, 2005. At the same date there were

605 galleries, 80 more than one year earlier. Leather-upholstered

furniture sales in the fourth quarter 2005 were at EUR 147.4

million, or $ 175.3 million, increasing 6.4 percent over last

year's fourth quarter, whereas during the same period

fabric-upholstered furniture were at EUR 25.6 million, or $ 30.4

million, down by 12.9 percent with respect to last year comparable

period. Fourth quarter 2005 net sales for the Natuzzi branded

products, representing 61.5 percent of total upholstery net sales,

were at EUR 106.4 million, or $ 126.5 million, 18.2 percent down

with respect to the last year's comparable quarter, whereas, over

the same period, sales for the Italsofa products increased by 75.7

percent to EUR 66.6 million, or $ 79.2 million. GROSS PROFIT &

OPERATING INCOME For the three months ended December 31, 2005,

Natuzzi's gross profit was at EUR 55.0 million, or $ 65.4 million,

14.9 percent down from EUR 64.6 million, or $ 83.9 million,

reported one year earlier. As a percentage of sales, gross profit

margin decreased at 28.9 percent from 33.4 percent recorded one

year ago. Over the same period, the Company reported an operating

loss of EUR 5.4 million, or $ 6.4 million, versus an operating

income of EUR 2.8 million, or $ 3.6 million, reported in 2004

fourth quarter. FOREX & TAXES During the last quarter of 2005

the Company had a net foreign exchange gain of EUR 2.4 million, or

$ 2.9 million, versus a net foreign exchange loss of EUR 0.5

million, or $ 0.6 million, reported in last year's comparable

period. Over the same period, Company's income taxes were at EUR

4.1 million, or $ 4.9 million, as compared to EUR 6.1 million, or $

7.9 million, of last year fourth quarter. Considering the whole

2005, income taxes were EUR 3.2 million, or $ 4.0 million, versus

EUR 17.6 million, or $ 21.9 million, in 2004 NET INCOME &

EARNINGS PER SHARE For the quarter ended on December 31, 2005, the

Company reported net losses of EUR 2.8 million, or net losses of $

3.3 million, from a net loss of EUR 9.3 million, or $ 12.1 million,

reported in the same quarter of last year. Losses per share (ADR)

were EUR 0.05, or $ 0.06, from EUR 0.17 losses per share, or $

0.22, for the fourth quarter of 2004. In 2005 the Company recorded

net losses of EUR 16.7 million, or net losses of $ 20.8 million,

whereas one year earlier it reported net earnings of EUR 18.4

million, or $ 22.9 million. On ADR basis net losses for 2005

totaled EUR 0.31, or $ 0.39, down from earnings per share of EUR

0.34, or $ 0.42, reported for the whole 2004. CASH FLOW For the

full 2005, cash flow from operations were EUR 23.2 million, or $

28.9 million, down from EUR 68.3 million, or $ 85.0 million,

generated in 2004. On a per ADR basis, net operating cash flow was

EUR 0.42, or $ 0.52, versus EUR 1.25, or $ 1.55 generated in 2004.

OUTLOOK Pasquale Natuzzi, Chairman and Chief Executive Officer,

commented: "We are encouraged by the earnings before taxes reported

in the fourth quarter 2005 after four quarters in a row of losses.

In 2006 we will continue to be focused on the initiatives that

should make our operations more efficient and profitable. At the

same time, we have to take into consideration that the industry and

currency scenario for 2006 appears to be characterized by the same

uncertainties experienced last year. In light of the above, we

confirm the previously announced targets for 2006 with a positive

net profit margin at most at 3 percent together with an increase in

units sold of about 5 percent." In consideration of the negative

results reported in the period, the Directors will not propose the

distribution of dividends at the annual Shareholders' meeting, to

be held on April 28th, 2006 (on first call), and if necessary, on

April 29th, 2006 (on second call). CONVERSION RATES The fourth

quarter 2005 and 2004 dollar figures presented in this announcement

were converted at an average noon buying rate of $ 1.1890 per EUR

and $ 1.2991 per EUR, respectively. The 2005 and 2004 figure were

converted at an average noon buying rate of $ 1.2449 per EUR and $

1.2438 per EUR, respectively. FOURTH QUARTER AND FULL YEAR 2005

TELECONFERENCE Pasquale Natuzzi, Chief Executive Officer and

Chairman, Daniele Tranchini, Chief Sales & Marketing Officer,

Nicola Dell'Edera, Chief Financial Officer a.i., and Fred Starr,

Chief Executive Officer and President of Natuzzi Americas, will

discuss financial results, followed by a question and answer

session, in a teleconference at 10:00 a.m. New York time (4:00 p.m.

London time - 5:00 p.m. Italian time) on March 30, 2006. Replay of

this event will be available on our web-site, www.natuzzi.com,

starting from 15:00 Italian time on March 31, 2006. About NATUZZI

S.p.A. Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. designs

and manufactures a broad collection of leather-upholstered

residential furniture. Italy's largest furniture manufacturer,

Natuzzi is the global leader in the leather segment, exporting its

innovative, high-quality sofas and armchairs to 124 markets on 5

continents. Cutting-edge design, superior Italian craftsmanship,

and advanced, vertically-integrated manufacturing operations

underpin the Company's market leadership. Since 1990, Natuzzi has

sold its furnishings in Italy through the popular Divani &

Divani by Natuzzi chain of 132 stores, which it licenses to

qualified furniture dealers. Outside Italy, the Company sells to

various furniture retailers, as well as through 147 licensed

Divani& Divani by Natuzzi and Natuzzi stores. Natuzzi S.p.A.

was listed on the New York Stock Exchange on May 13, 1993. The

Company is ISO 9001 and 14001 certified. FORWARD-LOOKING STATEMENTS

Statements in this press release other than statements of

historical fact are "forward-looking statements". Forward-looking

statements are based on management's current expectations and

beliefs and therefore you should not place undue reliance on them.

These statements are subject to a number of risks and

uncertainties, including risks that may not be subject to the

Company's control, that could cause actual results to differ

materially from those contained in any forward-looking statement.

These risks include, but are not limited to, fluctuations in

exchange rates, economic and weather factors affecting consumer

spending, competitive and regulatory environment, as well as other

political, economical and technological factors, and other risks

identified from time to time in the Company's filings with the

Securities and Exchange Commission, particularly in the Company's

annual report on Form 20-F. Forward looking statements speak as of

the date they were made, and the Company undertakes no obligation

to update publicly any of them in light of new information or

future events. -0- *T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited

Consolidated Statement of Earnings for the fourth quarter ended

December 31, 2005 and 2004 on the basis of Italian GAAP (Expressed

in millions of EUR except per share data)

-------------------------------------------------------------------

Three months ended on % Over Percentage of Sales 31-Dec-05

31-Dec-04 (Under) 31-Dec-05 31-Dec-04 --------------- -----------

----------- --------- -------- -------- Upholstery net sales 173.0

167.9 3.0% 90.8% 86.7% Other sales 17.6 25.7 ( 31.5)% 9.2% 13.3%

--------------- ----------- ----------- --------- -------- --------

Net Sales 190.6 193.6 ( 1.5)% 100.0% 100.0% ---------------

----------- ----------- --------- -------- -------- Purchases

(77.5) (97.1) 20.2% 40.7% 50.2% Labor (30.1) (29.4) ( 2.4)% 15.8%

15.2% Third-party Manufacturers (7.2) (5.3) ( 35.8)% 3.8% 2.7%

Manufacturing Costs (8.9) (8.3) ( 7.2)% 4.7% 4.3% Inventories, net

(11.9) 11.1 ( 207.2)% 6.2% ( 5.7)% Cost of Sales (135.6) (129.0) (

5.1)% 71.1% 66.6% --------------- ----------- ----------- ---------

-------- -------- Gross Profit 55.0 64.6 ( 14.9)% ( 28.9)% ( 33.4)%

--------------- ----------- ----------- --------- -------- --------

Selling Expenses (48.4) (50.1) 3.4% 25.4% 25.9% General and

Administrative Expenses (12.0) (11.7) ( 2.6)% 6.3% 6.0% Operating

Income (Loss) (5.4) 2.8 ( 292.9)% ( 2.8)% 1.4% ---------------

----------- ----------- --------- -------- -------- Interest

Income, net 0.0 (0.4) 0.0% ( 0.2)% Foreign Exchange, net 2.4 (0.5)

1.3% ( 0.3)% Other Income, net 4.2 (5.1) 2.2% ( 2.6)% Earnings

(Losses) before taxes and minority interest 1.2 (3.2) 137.5% 0.6% (

1.7)% --------------------------- ----------- --------- --------

-------- Income taxes (4.1) (6.1) ( 2.2)% ( 3.2)% Earnings (Losses)

before minority interest (2.9) (9.3) 68.8% ( 1.5)% ( 4.8)%

--------------------------- ----------- --------- -------- --------

Minority Interest (0.1) 0.0 ( 0.1)% 0.0% Net Earnings (Losses)

(2.8) (9.3) 69.9% ( 1.5)% ( 4.8)% --------------- -----------

----------- --------- -------- -------- Earnings (Losses) Per Share

(0.05) (0.17) ( 0.0)% ( 0.1)% --------------- -----------

----------- --------- -------- -------- Average Number of Shares

Outstanding* 54,681,628 54,681,628 --------------- -----------

----------- --------- -------- -------- (*) Net of shares

repurchased 1 EUR = 1,936.27 ITL

-------------------------------------------------------------------

Key Figures in U.S. dollars Three months ended on (millions)

31-Dec-05 31-Dec-04 ---------------------------

--------------------- ----------------- Net Sales 226.6 251.5 Gross

Profit 65.4 83.9 Operating Income (Loss) (6.4) 3.6 Net Earnings

(Losses) (3.3) (12.1) Earnings (Losses) per Share (0.06) (0.22)

Average exchange rate (U.S. dollar per Euro) 1.1890 1.2991

-------------------------------------------------------------------

*T -0- *T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated

Statement of Earnings for the full year ended December 31, 2005 and

2004 on the basis of Italian GAAP (Expressed in millions of EUR

except per share data) Twelve months ended on % Over Percentage of

Sales 31-Dec-05 31-Dec-04 (Under) 31-Dec-05 31-Dec-04

------------------ ----------- ----------- --------- -------

--------- Upholstery net sales 594.8 665.5 ( 10.6)% 88.8% 88.3%

Other sales 75.1 87.9 ( 14.6)% 11.2% 11.7% Net Sales 669.9 753.4 (

11.1)% 100.0% 100.0% ------------------ ----------- -----------

----------------- --------- Purchases (295.3) (335.4) 12.0% 44.1%

44.5% Labor (108.3) (107.2) ( 1.0)% 16.2% 14.2% Third-party

Manufacturers (25.3) (26.9) 5.9% 3.8% 3.6% Manufacturing Costs

(33.6) (30.1) ( 11.6)% 5.0% 4.0% Inventories, net 3.1 15.1 ( 79.5)%

( 0.5)% ( 2.0)% Cost of Sales (459.4) (484.5) 5.2% 68.6% 64.3%

------------------ ----------- ----------- -----------------

--------- Gross Profit 210.5 268.9 ( 21.7)% 31.4% 35.7%

------------------ ----------- ----------- -----------------

--------- Selling Expenses (182.2) (188.2) 3.2% 27.2% 25.0% General

and Administrative Expenses (43.0) (40.7) ( 5.7)% 6.4% 5.4%

Operating Income (Loss) (14.7) 40.0 ( 136.8)% ( 2.2)% 5.3%

------------------ ----------- ----------- -----------------

--------- Interest Income, net 0.0 (0.6) 0.0% ( 0.1)% Foreign

Exchange, net (1.6) 2.3 ( 0.2)% 0.3% Other Income, net 2.5 (5.6)

0.4% ( 0.7)% Earnings (Losses) before taxes and minority interest

(13.8) 36.1 ( 138.2)% ( 2.1)% 4.8% ------------------------------

----------- ----------------- --------- Income taxes (3.2) (17.6) (

0.5)% ( 2.3)% Earnings (Losses) before minority interest (17.0)

18.5 ( 191.9)% ( 2.5)% 2.5% ------------------ -----------

----------- ----------------- --------- Minority Interest (0.3) 0.1

( 0.0)% 0.0% Net Earnings (Losses) (16.7) 18.4 ( 190.8)% ( 2.5)%

2.4% ------------------ ----------- ----------- -----------------

--------- Earnings (Losses) per Share (0.31) 0.34 ( 0.0)% 0.0%

------------------ ----------- ----------- --------- -------

--------- Average Number of Shares Outstanding* 54,681,628

54,681,628 ------------------------------ ----------- ---------

------- --------- (*) Net of shares repurchased 1 EUR = 1,936.27

ITL

----------------------------------------------------------------------

Key Figures in U.S. dollars Twelve months ended on (millions)

31-Dec-05 31-Dec-04 ------------------------------ ------------

----------------- Net Sales 834.0 937.1 Gross Profit 262.1 334.5

Operating Income (Loss) (18.3) 49.8 Net Earnings (Losses) (20.8)

22.9 Earnings (Losses) per Share (0.39) 0.42 Average exchange rate

(U.S. dollar per Euro) 1.2449 1.2438

----------------------------------------------------------------------

*T -0- *T GEOGRAPHIC BREAKDOWN

----------------------------------------------------------------------

Sales* Seat Units 4th Quarter % Over 4th Quarter % Over 2005 2004

(Under) 2005 2004 (Under) ====================== ====== ======

======= ======== ======== ======= Americas 64.9 54.2 19.7% 366,939

313,370 17.1% % of total 37.5% 32.3% 45.7% 40.6% Europe 96.9 101.6

(4.6%) 392,494 410,917 (4.5%) % of total 56.0% 60.5% 48.8% 53.2%

Rest of world 11.2 12.1 (7.4%) 44,198 48,042 (8.0%) % of total 6.5%

7.2% 5.5% 6.2% ---------------------- ------ ------ -------

-------- -------- ------- TOTAL 173.0 167.9 3.0% 803,631 772,329

4.1% --------------------------------------------

------------------------- * Expressed in millions of EUR

--------------------------------------------

------------------------- BREAKDOWN BY COVERING

----------------------------------------------------------------------

Sales* Seat Units 4th Quarter % Over 4th Quarter % Over 2005 2004

(Under) 2005 2004 (Under) ====================== ====== ======

======= ======== ======== ======= Leather 147.4 138.5 6.4% 653,604

592,042 10.4% % of total 85.2% 82.5% 81.3% 76.7% Fabric 25.6 29.4

(12.9%) 150,027 180,287 (16.8%) % of total 14.8% 17.5% 18.7% 23.3%

Total 173.0 167.9 3.0% 803,631 772,329 4.1%

--------------------------------------------

------------------------- * (Expressed in millions of EUR)

--------------------------------------------

------------------------- BREAKDOWN BY BRAND

----------------------------------------------------------------------

Sales* Seat Units 4th Quarter % Over 4th Quarter % Over 2005 2004

(Under) 2005 2004 (Under) ====================== ====== ======

======= ======== ======== ======= Natuzzi 106.4 130.0 (18.2%)

384,606 511,243 (24.8%) % of total 61.5% 77.4% 47.9% 66.2% Italsofa

66.6 37.9 75.7% 419,025 261,086 60.5% % of total 38.5% 22.6% 52.1%

33.8% TOTAL 173.0 167.9 3.0% 803,631 772,329 4.1%

--------------------------------------------

------------------------- * (Expressed in millions of EUR)

--------------------------------------------

------------------------- *T -0- *T GEOGRAPHIC BREAKDOWN

----------------------------------------------------------------------

Sales* Seat Units Twelve months % Over Twelve months ended % Over

ended on on Dec-05 Dec-04 (Under) Dec-05 Dec-04 (Under)

================== ====== ====== ======= ========== ==========

======= Americas 241.7 279.4 (13.5%) 1,386,329 1,564,901 (11.4%) %

of total 40.6% 42.0% 49.3% 51.0% Europe 313.2 340.1 (7.9%)

1,262,887 1,319,740 (4.3%) % of total 52.7% 51.1% 44.9% 43.0% Rest

of world 39.9 46.0 (13.3%) 162,523 186,330 (12.8%) % of total 6.7%

6.9% 5.8% 6.0% ------------------ ------ ------ ------- ----------

---------- ------- TOTAL 594.8 665.5 (10.6%) 2,811,739 3,070,971

(8.4%) ------------------ ------ ------ ------- ----------

---------- ------- * (Expressed in millions of EUR)

------------------ ------ ------ ------- ---------- ----------

------- BREAKDOWN BY COVERING

----------------------------------------------------------------------

Sales* Seat Units Twelve months % Over Twelve months ended % Over

ended on on Dec-05 Dec-04 (Under) Dec-05 Dec-04 (Under)

================== ====== ====== ======= ========== ==========

======= Leather 498.9 547.9 (8.9%) 2,224,834 2,345,044 (5.1%) % of

total 83.9% 82.3% 79.1% 76.4% Fabric 95.9 117.6 (18.5%) 586,905

725,927 (19.2%) % of total 16.1% 17.7% 20.9% 23.6% Total 594.8

665.5 (10.6%) 2,811,739 3,070,971 (8.4%) ------------------ ------

------ ------- ---------- ---------- ------- * (Expressed in

millions of EUR)

----------------------------------------------------------------------

BREAKDOWN BY BRAND

----------------------------------------------------------------------

Sales* Seat Units Twelve months % Over Twelve months ended % Over

ended on on Dec-05 Dec-04 (Under) Dec-05 Dec-04 (Under)

================== ====== ====== ======= ========== ==========

======= Natuzzi 387.8 507.0 (23.5%) 1,451,341 1,986,461 (26.9%) %

of total 65.2% 76.2% 51.6% 64.7% Italsofa 207.0 158.5 30.6%

1,360,398 1,084,509 25.4% % of total 34.8% 23.8% 48.4% 35.3% TOTAL

594.8 665.5 (10.6%) 2,811,739 3,070,970 (8.4%) ------------------

------ ------ ------- ---------- ---------- ------- * (Expressed in

millions of EUR) *T -0- *T NATUZZI S.P.A. AND SUBSIDIARIES

Unaudited Consolidated Balance Sheet as of December 31, 2005 and

December 31, 2004 (Expressed in millions of EUR) 31-Dec-05

31-Dec-04 --------------------------------------------- ----------

---------- ASSETS Current Assets: Cash and cash equivalents 89.7

87.3 Marketable debt securities 0.0 0.0 Trade receivables, net

123.6 137.6 Other receivables 46.3 41.2 Inventories 115.7 112.6

Unrealized foreign exchange gains 0.0 7.1 Prepaid expenses and

accrued income 2.6 2.4 Deferred income taxes 6.6 1.2

--------------------------------------------- ---------- ----------

Total current assets 384.5 389.4

--------------------------------------------- ---------- ----------

Non-Current Assets: Net property, plant and equipment 262.8 272.0

Other assets 16.6 11.2 Deferred income taxes 1.1 0.6

--------------------------------------------- ---------- ----------

TOTAL ASSETS 665.0 673.2

--------------------------------------------- ---------- ----------

LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities:

Short-term borrowings 7.7 5.6 Current portion of long-term debt 0.4

0.6 Accounts payable-trade 73.5 83.7 Accounts payable-other 24.8

20.3 Unrealized foreign exchange losses 4.8 0.0 Income taxes 3.0

2.5 Salaries, wages and related liabilities 22.1 18.7

--------------------------------------------- ---------- ----------

Total current liabilities 136.3 131.4

--------------------------------------------- ---------- ----------

Long-Term Liabilities: Employees' leaving entitlement 32.3 29.6

Long-term debt 3.6 5.0 Deferred income taxes 0.0 0.4 Deferred

income for capital grants 14.8 12.5 Other liabilities 6.3 5.4

--------------------------------------------- ---------- ----------

Minority Interest 0.7 0.9

--------------------------------------------- ---------- ----------

Shareholders' Equity: Share capital 54.7 54.7 Reserves 42.3 42.3

Additional paid-in capital 8.3 8.3 Retained earnings 365.7 382.7

--------------------------------------------- ---------- ----------

Total shareholders' equity 471.0 488.0

--------------------------------------------- ---------- ----------

Commitments and contingent liabilities 0.0 0.0

--------------------------------------------- ---------- ----------

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 665.0 673.2

-------------------------------------------------------- ----------

*T -0- *T NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated

Statements of Cash Flows as of December 31, 2005 and 2004

(Expressed in millions of EUR) 31- 31- Dec- Dec- 05 04 ------

------ Cash flows from operating activities: Net earnings (losses)

(16.7) 18.4 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

33.0 34.1 Employees' leaving entitlement 2.4 2.6 Deferred income

taxes (6.3) (0.7) Minority interest (0.2) 0.1 (Gain) loss on

disposal of assets (0.2) (3.5) Unrealized foreign exchange (losses)

/ gain 11.9 0.6 Deferred income for capital grants (5.6) (0.9)

Change in assets and liabilities: Receivables, net 10.6 28.1

Inventories (1.6) (16.6) Prepaid expenses and accrued income (0.1)

(0.2) Other assets (1.4) (0.9) Accounts payable (7.4) 6.7 Income

taxes 0.5 (1.7) Salaries, wages and related liabilities 3.3 2.6

Other liabilities 1.0 (0.4)

-------------------------------------------------------- ------

------ Total adjustments 39.9 49.9

-------------------------------------------------------- ------

------ NET CASH PROVIDED BY OPERATING ACTIVITIES 23.2 68.3

-------------------------------------------------------- ------

------ Cash flows from investing activities: Property, plant and

equipment: Additions (20.9) (51.9) Disposals 0.9 9.4 Government

grants received 1.0 0.0 Marketable debt securities: Proceeds from

sales 0.0 0.0 Purchase of business, net of cash acquired (2.0)

(0.1) Disposal of business 0.0 5.5

-------------------------------------------------------- ------

------ NET CASH USED IN INVESTING ACTIVITIES (21.0) (37.1)

-------------------------------------------------------- ------

------ Cash flows from financing activities: Long term debt:

Proceeds 0.5 1.3 Repayments (2.1) (1.3) Short-term borrowings 1.6

1.8 Dividends paid to shareholders (3.8) (7.7) Dividends paid to

minority shareholders 0.0 (0.1)

-------------------------------------------------------- ------

------ NET CASH USED IN FINANCING ACTIVITIES (3.8) (6.0)

-------------------------------------------------------- ------

------ Effect of translation adjustments on cash 4.0 (1.5)

-------------------------------------------------------- ------

------ INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 2.4 23.7

-------------------------------------------------------- ------

------ Cash and cash equivalents, beginning of the year 87.3 63.6

-------------------------------------------------------- ------

------ CASH AND CASH EQUIVALENTS, END OF THE PERIOD 89.7 87.3

-------------------------------------------------------- ------

------ Supplemental disclosure of cash flow information Cash paid

during the year for interest 0.0 1.0

-------------------------------------------------------- ------

------ Cash paid during the year for income taxes 0.0 9.3

-------------------------------------------------------- ------

------ *T

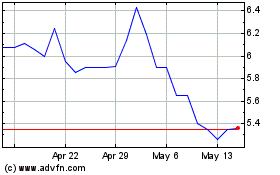

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

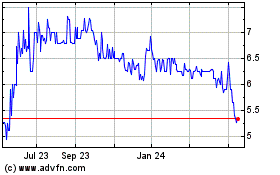

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2023 to Oct 2024