0001439095

MRC GLOBAL INC.

false

--12-31

Q3

2024

6.5

6.5

0.01

0.01

363,000

363,000

363,000

363,000

363,000

363,000

0.01

0.01

500

500

109,452,863

108,531,564

24,216,330

24,216,330

1

2

1

1

10

3

1

3

5

false

false

false

false

00014390952024-01-012024-09-30

xbrli:shares

00014390952024-10-31

thunderdome:item

iso4217:USD

00014390952024-09-30

00014390952023-12-31

xbrli:pure

iso4217:USDxbrli:shares

00014390952024-07-012024-09-30

00014390952023-07-012023-09-30

00014390952023-01-012023-09-30

0001439095us-gaap:CommonStockMember2023-12-31

0001439095us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001439095us-gaap:RetainedEarningsMember2023-12-31

0001439095us-gaap:TreasuryStockCommonMember2023-12-31

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0001439095us-gaap:CommonStockMember2024-01-012024-03-31

0001439095us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0001439095us-gaap:RetainedEarningsMember2024-01-012024-03-31

0001439095us-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-31

00014390952024-01-012024-03-31

0001439095us-gaap:CommonStockMember2024-03-31

0001439095us-gaap:AdditionalPaidInCapitalMember2024-03-31

0001439095us-gaap:RetainedEarningsMember2024-03-31

0001439095us-gaap:TreasuryStockCommonMember2024-03-31

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-31

00014390952024-03-31

0001439095us-gaap:CommonStockMember2024-04-012024-06-30

0001439095us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-30

0001439095us-gaap:RetainedEarningsMember2024-04-012024-06-30

0001439095us-gaap:TreasuryStockCommonMember2024-04-012024-06-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-30

00014390952024-04-012024-06-30

0001439095us-gaap:CommonStockMember2024-06-30

0001439095us-gaap:AdditionalPaidInCapitalMember2024-06-30

0001439095us-gaap:RetainedEarningsMember2024-06-30

0001439095us-gaap:TreasuryStockCommonMember2024-06-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-30

00014390952024-06-30

0001439095us-gaap:CommonStockMember2024-07-012024-09-30

0001439095us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-30

0001439095us-gaap:RetainedEarningsMember2024-07-012024-09-30

0001439095us-gaap:TreasuryStockCommonMember2024-07-012024-09-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-30

0001439095us-gaap:CommonStockMember2024-09-30

0001439095us-gaap:AdditionalPaidInCapitalMember2024-09-30

0001439095us-gaap:RetainedEarningsMember2024-09-30

0001439095us-gaap:TreasuryStockCommonMember2024-09-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-30

0001439095us-gaap:CommonStockMember2022-12-31

0001439095us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001439095us-gaap:RetainedEarningsMember2022-12-31

0001439095us-gaap:TreasuryStockCommonMember2022-12-31

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

00014390952022-12-31

0001439095us-gaap:CommonStockMember2023-01-012023-03-31

0001439095us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001439095us-gaap:RetainedEarningsMember2023-01-012023-03-31

0001439095us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

00014390952023-01-012023-03-31

0001439095us-gaap:CommonStockMember2023-03-31

0001439095us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001439095us-gaap:RetainedEarningsMember2023-03-31

0001439095us-gaap:TreasuryStockCommonMember2023-03-31

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

00014390952023-03-31

0001439095us-gaap:CommonStockMember2023-04-012023-06-30

0001439095us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001439095us-gaap:RetainedEarningsMember2023-04-012023-06-30

0001439095us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

00014390952023-04-012023-06-30

0001439095us-gaap:CommonStockMember2023-06-30

0001439095us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001439095us-gaap:RetainedEarningsMember2023-06-30

0001439095us-gaap:TreasuryStockCommonMember2023-06-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

00014390952023-06-30

0001439095us-gaap:CommonStockMember2023-07-012023-09-30

0001439095us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0001439095us-gaap:RetainedEarningsMember2023-07-012023-09-30

0001439095us-gaap:TreasuryStockCommonMember2023-07-012023-09-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0001439095us-gaap:CommonStockMember2023-09-30

0001439095us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001439095us-gaap:RetainedEarningsMember2023-09-30

0001439095us-gaap:TreasuryStockCommonMember2023-09-30

0001439095us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

00014390952023-09-30

0001439095mrc:GasUtilitiesMembercountry:US2024-07-012024-09-30

0001439095mrc:GasUtilitiesMembercountry:CA2024-07-012024-09-30

0001439095mrc:GasUtilitiesMembermrc:InternationalMember2024-07-012024-09-30

0001439095mrc:GasUtilitiesMember2024-07-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:US2024-07-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:CA2024-07-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembermrc:InternationalMember2024-07-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMember2024-07-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:US2024-07-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:CA2024-07-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembermrc:InternationalMember2024-07-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMember2024-07-012024-09-30

0001439095country:US2024-07-012024-09-30

0001439095country:CA2024-07-012024-09-30

0001439095mrc:InternationalMember2024-07-012024-09-30

0001439095mrc:GasUtilitiesMembercountry:US2023-07-012023-09-30

0001439095mrc:GasUtilitiesMembercountry:CA2023-07-012023-09-30

0001439095mrc:GasUtilitiesMembermrc:InternationalMember2023-07-012023-09-30

0001439095mrc:GasUtilitiesMember2023-07-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:US2023-07-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:CA2023-07-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembermrc:InternationalMember2023-07-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMember2023-07-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:US2023-07-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:CA2023-07-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembermrc:InternationalMember2023-07-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMember2023-07-012023-09-30

0001439095country:US2023-07-012023-09-30

0001439095country:CA2023-07-012023-09-30

0001439095mrc:InternationalMember2023-07-012023-09-30

0001439095mrc:GasUtilitiesMembercountry:US2024-01-012024-09-30

0001439095mrc:GasUtilitiesMembercountry:CA2024-01-012024-09-30

0001439095mrc:GasUtilitiesMembermrc:InternationalMember2024-01-012024-09-30

0001439095mrc:GasUtilitiesMember2024-01-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:US2024-01-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:CA2024-01-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembermrc:InternationalMember2024-01-012024-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMember2024-01-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:US2024-01-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:CA2024-01-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembermrc:InternationalMember2024-01-012024-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMember2024-01-012024-09-30

0001439095country:US2024-01-012024-09-30

0001439095country:CA2024-01-012024-09-30

0001439095mrc:InternationalMember2024-01-012024-09-30

0001439095mrc:GasUtilitiesMembercountry:US2023-01-012023-09-30

0001439095mrc:GasUtilitiesMembercountry:CA2023-01-012023-09-30

0001439095mrc:GasUtilitiesMembermrc:InternationalMember2023-01-012023-09-30

0001439095mrc:GasUtilitiesMember2023-01-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:US2023-01-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembercountry:CA2023-01-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMembermrc:InternationalMember2023-01-012023-09-30

0001439095mrc:DownstreamIndustrialAndEnergyTransitionMember2023-01-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:US2023-01-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembercountry:CA2023-01-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMembermrc:InternationalMember2023-01-012023-09-30

0001439095mrc:ProductionAndTransmissionInfrastructureMember2023-01-012023-09-30

0001439095country:US2023-01-012023-09-30

0001439095country:CA2023-01-012023-09-30

0001439095mrc:InternationalMember2023-01-012023-09-30

0001439095mrc:ValvesAutomationMeasurementAndInstrumentationMember2024-09-30

0001439095mrc:ValvesAutomationMeasurementAndInstrumentationMember2023-12-31

0001439095mrc:CarbonSteelPipeFittingsAndFlangesMember2024-09-30

0001439095mrc:CarbonSteelPipeFittingsAndFlangesMember2023-12-31

0001439095mrc:GasProductsMember2024-09-30

0001439095mrc:GasProductsMember2023-12-31

0001439095mrc:AllOtherProductsMember2024-09-30

0001439095mrc:AllOtherProductsMember2023-12-31

utr:Y

0001439095srt:MinimumMember2024-09-30

0001439095srt:MaximumMember2024-09-30

0001439095us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-07-012024-09-30

0001439095us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-09-30

0001439095us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-07-012023-09-30

0001439095us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-09-30

0001439095srt:WeightedAverageMember2024-09-30

0001439095us-gaap:SecuredDebtMember2024-09-30

0001439095us-gaap:SecuredDebtMember2023-12-31

0001439095mrc:GlobalAblFacilityMember2024-09-30

0001439095mrc:GlobalAblFacilityMember2023-12-31

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SecuredDebtMember2018-05-31

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SecuredDebtMemberus-gaap:MeasurementInputPrepaymentRateMember2018-05-31

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SecuredDebtMember2024-05-31

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SecuredDebtMember2024-05-012024-05-31

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SecuredDebtMembermrc:LondonInterbankOfferedRateLibor1Member2018-05-012018-05-31

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SecuredDebtMemberus-gaap:BaseRateMember2018-05-012018-05-31

0001439095mrc:GlobalAblFacilityMember2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:US2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:CA2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:NO2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:AU2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:NL2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:GB2021-09-30

0001439095mrc:GlobalAblFacilityMembercountry:BE2021-09-30

0001439095mrc:GlobalAblFacilityMembersrt:MinimumMembercountry:USmrc:LondonInterbankOfferedRateLibor1Member2024-01-012024-09-30

0001439095mrc:GlobalAblFacilityMembersrt:MaximumMembercountry:USmrc:LondonInterbankOfferedRateLibor1Member2024-01-012024-09-30

0001439095mrc:GlobalAblFacilityMembersrt:MinimumMembercountry:CAmrc:BARateMember2024-01-012024-09-30

0001439095mrc:GlobalAblFacilityMembersrt:MaximumMembercountry:CAmrc:BARateMember2024-01-012024-09-30

0001439095mrc:GlobalAblFacilityMembersrt:MinimumMemberus-gaap:NonUsMembermrc:BARateMember2024-01-012024-09-30

0001439095mrc:GlobalAblFacilityMembersrt:MaximumMemberus-gaap:NonUsMembermrc:BARateMember2024-01-012024-09-30

0001439095mrc:SeniorSecuredTermLoanBMember2024-09-30

0001439095mrc:SeniorSecuredTermLoanBMember2023-12-31

0001439095mrc:SeniorSecuredTermLoanBAndGlobalABLFacilityMember2024-09-30

0001439095mrc:SeniorSecuredTermLoanBAndGlobalABLFacilityMember2023-12-31

0001439095us-gaap:SeriesAPreferredStockMember2015-06-30

0001439095us-gaap:SeriesAPreferredStockMember2015-06-012015-06-30

0001439095us-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2024-10-292024-10-29

0001439095mrc:The2011OmnibusIncentivePlanMembersrt:MaximumMember2024-01-012024-09-30

0001439095mrc:The2011OmnibusIncentivePlanMembersrt:DirectorMember2024-01-012024-09-30

0001439095us-gaap:PerformanceSharesMembermrc:The2011OmnibusIncentivePlanMember2024-01-012024-09-30

0001439095us-gaap:RestrictedStockMembermrc:The2011OmnibusIncentivePlanMember2024-01-012024-09-30

0001439095us-gaap:RestrictedStockUnitsRSUMembermrc:The2011OmnibusIncentivePlanMember2024-01-012024-09-30

0001439095us-gaap:AccumulatedTranslationAdjustmentMember2024-09-30

0001439095us-gaap:AccumulatedTranslationAdjustmentMember2023-12-31

0001439095mrc:AccumulatedOtherAdjustmentsAttributableToParentMember2024-09-30

0001439095mrc:AccumulatedOtherAdjustmentsAttributableToParentMember2023-12-31

0001439095mrc:StockOptionsRestrictedStockUnitsAndPerformanceUnitsMember2024-07-012024-09-30

0001439095mrc:StockOptionsRestrictedStockUnitsAndPerformanceUnitsMember2024-01-012024-09-30

0001439095mrc:StockOptionsRestrictedStockUnitsAndPerformanceUnitsMember2023-07-012023-09-30

0001439095mrc:StockOptionsRestrictedStockUnitsAndPerformanceUnitsMember2023-01-012023-09-30

0001439095mrc:UnitedStatesMember2024-07-012024-09-30

0001439095mrc:UnitedStatesMember2023-07-012023-09-30

0001439095mrc:UnitedStatesMember2024-01-012024-09-30

0001439095mrc:UnitedStatesMember2023-01-012023-09-30

0001439095mrc:CanadaMember2024-07-012024-09-30

0001439095mrc:CanadaMember2023-07-012023-09-30

0001439095mrc:CanadaMember2024-01-012024-09-30

0001439095mrc:CanadaMember2023-01-012023-09-30

0001439095mrc:InternationalMember2024-07-012024-09-30

0001439095mrc:InternationalMember2023-07-012023-09-30

0001439095mrc:InternationalMember2024-01-012024-09-30

0001439095mrc:InternationalMember2023-01-012023-09-30

0001439095mrc:UnitedStatesMember2024-09-30

0001439095mrc:UnitedStatesMember2023-12-31

0001439095mrc:CanadaMember2024-09-30

0001439095mrc:CanadaMember2023-12-31

0001439095mrc:InternationalMember2024-09-30

0001439095mrc:InternationalMember2023-12-31

0001439095mrc:LinePipeMember2024-07-012024-09-30

0001439095mrc:LinePipeMember2023-07-012023-09-30

0001439095mrc:LinePipeMember2024-01-012024-09-30

0001439095mrc:LinePipeMember2023-01-012023-09-30

0001439095mrc:CarbonFittingsAndFlangesMember2024-07-012024-09-30

0001439095mrc:CarbonFittingsAndFlangesMember2023-07-012023-09-30

0001439095mrc:CarbonFittingsAndFlangesMember2024-01-012024-09-30

0001439095mrc:CarbonFittingsAndFlangesMember2023-01-012023-09-30

0001439095mrc:CarbonPipeFittingsAndFlangesMember2024-07-012024-09-30

0001439095mrc:CarbonPipeFittingsAndFlangesMember2023-07-012023-09-30

0001439095mrc:CarbonPipeFittingsAndFlangesMember2024-01-012024-09-30

0001439095mrc:CarbonPipeFittingsAndFlangesMember2023-01-012023-09-30

0001439095mrc:ValvesAutomationMeasurementAndInstrumentationMember2024-07-012024-09-30

0001439095mrc:ValvesAutomationMeasurementAndInstrumentationMember2023-07-012023-09-30

0001439095mrc:ValvesAutomationMeasurementAndInstrumentationMember2024-01-012024-09-30

0001439095mrc:ValvesAutomationMeasurementAndInstrumentationMember2023-01-012023-09-30

0001439095mrc:GasProductsMember2024-07-012024-09-30

0001439095mrc:GasProductsMember2023-07-012023-09-30

0001439095mrc:GasProductsMember2024-01-012024-09-30

0001439095mrc:GasProductsMember2023-01-012023-09-30

0001439095mrc:StainlessSteelAndAlloyPipeAndFittingsMember2024-07-012024-09-30

0001439095mrc:StainlessSteelAndAlloyPipeAndFittingsMember2023-07-012023-09-30

0001439095mrc:StainlessSteelAndAlloyPipeAndFittingsMember2024-01-012024-09-30

0001439095mrc:StainlessSteelAndAlloyPipeAndFittingsMember2023-01-012023-09-30

0001439095mrc:GeneralOilfieldProductsMember2024-07-012024-09-30

0001439095mrc:GeneralOilfieldProductsMember2023-07-012023-09-30

0001439095mrc:GeneralOilfieldProductsMember2024-01-012024-09-30

0001439095mrc:GeneralOilfieldProductsMember2023-01-012023-09-30

0001439095us-gaap:InterestRateSwapMember2018-03-012018-03-31

0001439095us-gaap:InterestRateSwapMember2018-03-31

0001439095mrc:LitigationCaseAsbestosClaimsMember2024-09-30

0001439095mrc:CaseJuly27Member2019-07-272019-07-27

0001439095mrc:CasesSettledMember2024-01-012024-09-30

0001439095mrc:Case2July242023Member2023-07-242023-07-24

0001439095mrc:Case3July242023Member2023-07-242023-07-24

0001439095mrc:SeniorSecuredTermLoanBMemberus-gaap:SubsequentEventMember2024-10-29

0001439095mrc:SeniorSecuredTermLoanBMembersrt:MinimumMemberus-gaap:SubsequentEventMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-10-292024-10-29

0001439095mrc:SeniorSecuredTermLoanBMembersrt:MaximumMemberus-gaap:SubsequentEventMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-10-292024-10-29

0001439095mrc:SeniorSecuredTermLoanBMembersrt:MinimumMemberus-gaap:SubsequentEventMemberus-gaap:BaseRateMember2024-10-292024-10-29

0001439095mrc:SeniorSecuredTermLoanBMembersrt:MaximumMemberus-gaap:SubsequentEventMemberus-gaap:BaseRateMember2024-10-292024-10-29

0001439095us-gaap:SubsequentEventMember2024-10-142024-10-29

0001439095us-gaap:PreferredStockMemberus-gaap:SubsequentEventMember2024-10-142024-10-29

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM 10-Q

(Mark One)

| | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | | |

| | FOR THE QUARTERLY PERIOD ENDED September 30, 2024 | |

| | | |

| | OR | |

| | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _______ TO _______ | |

Commission file number: 001-35479

MRC GLOBAL INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5956993 |

| (State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

| 1301 McKinney Street, Suite 2300 Houston, Texas | 77010 |

| (Address of Principal Executive Offices) | (Zip Code) |

(877) 294-7574

(Registrant’s Telephone Number, including Area Code)

________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | MRC | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-Accelerated Filer ☐ Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 85,243,002 shares of the registrant’s common stock (excluding 123,064 unvested restricted shares), par value $0.01 per share, issued and outstanding as of October 31, 2024.

INDEX TO QUARTERLY REPORT ON FORM 10-Q

| Page |

| PART I – FINANCIAL INFORMATION |

| |

|

|

| ITEM 1. |

financial statements (UNAUDITED) |

3 |

| |

|

|

| |

Condensed Consolidated Balance Sheets – SEPTEMBER 30, 2024 AND DECEMBER 31, 2023 |

3 |

| |

|

|

| |

cONdENSED cONSOLIDATED STATEMENTS OF OPERATIONS – THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023 |

4 |

| |

|

|

| |

Condensed Consolidated Statements of cOMPREHENSIVE INCOME – three AND NINE months ended SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023 |

5 |

| |

|

|

| |

Condensed CONSOLIDATED STATEMENTS OF STOCKHOLDERs’ EQUITY – three AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023 |

6 |

| |

|

|

| |

Condensed CONSOLIDATED STATEMENTS OF cash flows – NINE MONTHS ENDEd SEPTEMBER 30, 2024 AND SEPTEMBER 30, 2023 |

7 |

| |

|

|

| |

Notes to the Condensed Consolidated Financial Statements – SEPTEMBER 30, 2024 |

8 |

| |

|

|

| ITEM 2. |

management’s discussion and analysis of financial condition and results of operations |

21 |

| |

|

|

| ITEM 3. |

quantitative and qualitative disclosures about market risk |

38 |

| |

|

|

| ITEM 4. |

controls and procedures |

38 |

| |

|

|

| PART II – OTHER INFORMATION |

| |

|

|

| ITEM 1. |

LEGAL PROCEEDINGS |

39 |

| |

|

|

| ITEM 1a. |

RISK FACTORS |

39 |

| |

|

|

| ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

39 |

| |

|

|

| ITEM 3. |

Defaults Upon Senior Securities |

39 |

| |

|

|

| ITEM 4. |

MINING SAFETY DISCLOSURES |

39 |

| |

|

|

| ITEM 5. |

other information |

39 |

| |

|

|

| ITEM 6. |

Exhibits |

40 |

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

MRC GLOBAL INC.

(in millions, except per share amounts)

| | | September 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| | | | | | | | | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash | | $ | 62 | | | $ | 131 | |

| Accounts receivable, net | | | 478 | | | | 430 | |

| Inventories, net | | | 462 | | | | 560 | |

| Other current assets | | | 41 | | | | 34 | |

| Total current assets | | | 1,043 | | | | 1,155 | |

| | | | | | | | | |

| Long-term assets: | | | | | | | | |

| Operating lease assets | | | 185 | | | | 205 | |

| Property, plant and equipment, net | | | 85 | | | | 78 | |

| Other assets | | | 31 | | | | 21 | |

| | | | | | | | | |

| Intangible assets: | | | | | | | | |

| Goodwill, net | | | 264 | | | | 264 | |

| Other intangible assets, net | | | 148 | | | | 163 | |

| | | $ | 1,756 | | | $ | 1,886 | |

| | | | | | | | | |

| Liabilities and stockholders' equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Trade accounts payable | | $ | 382 | | | $ | 355 | |

| Accrued expenses and other current liabilities | | | 108 | | | | 102 | |

| Operating lease liabilities | | | 34 | | | | 34 | |

| Current portion of debt obligations | | | — | | | | 292 | |

| Total current liabilities | | | 524 | | | | 783 | |

| | | | | | | | | |

| Long-term liabilities: | | | | | | | | |

| Long-term debt | | | 85 | | | | 9 | |

| Operating lease liabilities | | | 167 | | | | 186 | |

| Deferred income taxes | | | 41 | | | | 45 | |

| Other liabilities | | | 27 | | | | 20 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| 6.5% Series A Convertible Perpetual Preferred Stock, $0.01 par value; authorized 363,000 shares; 363,000 shares issued and outstanding | | | 355 | | | | 355 | |

| | | | | | | | | |

| Stockholders' equity: | | | | | | | | |

| Common stock, $0.01 par value per share: 500 million shares authorized, 109,452,863 and 108,531,564 issued, respectively | | | 1 | | | | 1 | |

| Additional paid-in capital | | | 1,774 | | | | 1,768 | |

| Retained deficit | | | (618 | ) | | | (678 | ) |

| Less: Treasury stock at cost: 24,216,330 shares | | | (375 | ) | | | (375 | ) |

| Accumulated other comprehensive loss | | | (225 | ) | | | (228 | ) |

| | | | 557 | | | | 488 | |

| | | $ | 1,756 | | | $ | 1,886 | |

| See notes to condensed consolidated financial statements. |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

MRC GLOBAL INC.

(in millions, except per share amounts)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

$ |

797 |

|

|

$ |

888 |

|

|

$ |

2,435 |

|

|

$ |

2,644 |

|

| Cost of sales |

|

|

637 |

|

|

|

705 |

|

|

|

1,939 |

|

|

|

2,107 |

|

| Gross profit |

|

|

160 |

|

|

|

183 |

|

|

|

496 |

|

|

|

537 |

|

| Selling, general and administrative expenses |

|

|

123 |

|

|

|

126 |

|

|

|

374 |

|

|

|

378 |

|

| Operating income |

|

|

37 |

|

|

|

57 |

|

|

|

122 |

|

|

|

159 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(4 |

) |

|

|

(9 |

) |

|

|

(19 |

) |

|

|

(26 |

) |

| Other, net |

|

|

(1 |

) |

|

|

1 |

|

|

|

(2 |

) |

|

|

(3 |

) |

| Income before income taxes |

|

|

32 |

|

|

|

49 |

|

|

|

101 |

|

|

|

130 |

|

| Income tax expense |

|

|

3 |

|

|

|

14 |

|

|

|

23 |

|

|

|

37 |

|

| Net income |

|

|

29 |

|

|

|

35 |

|

|

|

78 |

|

|

|

93 |

|

| Series A preferred stock dividends |

|

|

6 |

|

|

|

6 |

|

|

|

18 |

|

|

|

18 |

|

| Net income attributable to common stockholders |

|

$ |

23 |

|

|

$ |

29 |

|

|

$ |

60 |

|

|

$ |

75 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share |

|

$ |

0.27 |

|

|

$ |

0.34 |

|

|

$ |

0.71 |

|

|

$ |

0.89 |

|

| Diluted earnings per common share |

|

$ |

0.27 |

|

|

$ |

0.33 |

|

|

$ |

0.70 |

|

|

$ |

0.88 |

|

| Weighted-average common shares, basic |

|

|

85.2 |

|

|

|

84.3 |

|

|

|

85.0 |

|

|

|

84.2 |

|

| Weighted-average common shares, diluted |

|

|

86.2 |

|

|

|

105.9 |

|

|

|

86.2 |

|

|

|

105.8 |

|

See notes to condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

MRC GLOBAL INC.

(in millions)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

29 |

|

|

$ |

35 |

|

|

$ |

78 |

|

|

$ |

93 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

|

7 |

|

|

|

(4 |

) |

|

|

3 |

|

|

|

(4 |

) |

| Total other comprehensive income (loss), net of tax |

|

|

7 |

|

|

|

(4 |

) |

|

|

3 |

|

|

|

(4 |

) |

| Comprehensive income |

|

$ |

36 |

|

|

$ |

31 |

|

|

$ |

81 |

|

|

$ |

89 |

|

See notes to condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (UNAUDITED)

MRC GLOBAL INC.

(in millions)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

Total |

|

| |

|

Common Stock |

|

|

Paid-in |

|

|

Retained |

|

|

Treasury Stock |

|

|

Comprehensive |

|

|

Stockholders' |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Equity |

|

| Balance at December 31, 2023 |

|

|

109 |

|

|

$ |

1 |

|

|

$ |

1,768 |

|

|

$ |

(678 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(228 |

) |

|

$ |

488 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

19 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

19 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5 |

) |

|

|

(5 |

) |

| Shares withheld for taxes |

|

|

- |

|

|

|

- |

|

|

|

(5 |

) |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5 |

) |

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

| Dividends declared on preferred stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

| Balance at March 31, 2024 |

|

|

109 |

|

|

$ |

1 |

|

|

$ |

1,767 |

|

|

$ |

(665 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(233 |

) |

|

$ |

495 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

30 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

30 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

1 |

|

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3 |

|

| Dividends declared on preferred stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

| Balance at June 30, 2024 |

|

|

109 |

|

|

$ |

1 |

|

|

$ |

1,770 |

|

|

$ |

(641 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(232 |

) |

|

$ |

523 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

29 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

29 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7 |

|

|

|

7 |

|

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

| Dividends declared on preferred stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

| Balance at September 30, 2024 |

|

|

109 |

|

|

$ |

1 |

|

|

$ |

1,774 |

|

|

$ |

(618 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(225 |

) |

|

$ |

557 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

Total |

|

| |

|

Common Stock |

|

|

Paid-in |

|

|

Retained |

|

|

Treasury Stock |

|

|

Comprehensive |

|

|

Stockholders' |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

(Deficit) |

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Equity |

|

| Balance at December 31, 2022 |

|

|

108 |

|

|

$ |

1 |

|

|

$ |

1,758 |

|

|

$ |

(768 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(230 |

) |

|

$ |

386 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

34 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

34 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

(1 |

) |

| Shares withheld for taxes |

|

|

- |

|

|

|

- |

|

|

|

(4 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(4 |

) |

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3 |

|

| Dividends declared on preferred stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

| Balance at March 31, 2023 |

|

|

108 |

|

|

$ |

1 |

|

|

$ |

1,757 |

|

|

$ |

(740 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(231 |

) |

|

$ |

412 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

24 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

24 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

1 |

|

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

| Dividends declared on preferred stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

| Balance at June 30, 2023 |

|

|

108 |

|

|

$ |

1 |

|

|

$ |

1,761 |

|

|

$ |

(722 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(230 |

) |

|

$ |

435 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

35 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

35 |

|

| Foreign currency translation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(4 |

) |

|

|

(4 |

) |

| Equity-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3 |

|

| Dividends declared on preferred stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

| Balance at September 30, 2023 |

|

|

108 |

|

|

$ |

1 |

|

|

$ |

1,764 |

|

|

$ |

(693 |

) |

|

|

(24 |

) |

|

$ |

(375 |

) |

|

$ |

(234 |

) |

|

$ |

463 |

|

See notes to condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

MRC GLOBAL INC.

(in millions)

| |

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

78 |

|

|

$ |

93 |

|

| Adjustments to reconcile net income to net cash provided by operations: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

16 |

|

|

|

15 |

|

| Amortization of intangibles |

|

|

15 |

|

|

|

15 |

|

| Equity-based compensation expense |

|

|

11 |

|

|

|

10 |

|

| Deferred income tax (benefit) |

|

|

(6 |

) |

|

|

(3 |

) |

| Other non-cash items |

|

|

5 |

|

|

|

9 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(47 |

) |

|

|

(20 |

) |

| Inventories |

|

|

98 |

|

|

|

(45 |

) |

| Other current assets |

|

|

(3 |

) |

|

|

(4 |

) |

| Accounts payable |

|

|

29 |

|

|

|

27 |

|

| Accrued expenses and other current liabilities |

|

|

1 |

|

|

|

(5 |

) |

| Net cash provided by operations |

|

|

197 |

|

|

|

92 |

|

| |

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Purchases of property, plant and equipment |

|

|

(23 |

) |

|

|

(10 |

) |

| Other investing activities |

|

|

1 |

|

|

|

(2 |

) |

| Net cash used in investing activities |

|

|

(22 |

) |

|

|

(12 |

) |

| |

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Payments on revolving credit facilities |

|

|

(276 |

) |

|

|

(776 |

) |

| Proceeds from revolving credit facilities |

|

|

352 |

|

|

|

743 |

|

| Payments on debt obligations |

|

|

(295 |

) |

|

|

(2 |

) |

| Debt issuance costs paid |

|

|

- |

|

|

|

(1 |

) |

| Dividends paid on preferred stock |

|

|

(18 |

) |

|

|

(18 |

) |

| Repurchases of shares to satisfy tax withholdings |

|

|

(5 |

) |

|

|

(4 |

) |

| Net cash used in financing activities |

|

|

(242 |

) |

|

|

(58 |

) |

| |

|

|

|

|

|

|

|

|

| (Decrease) increase in cash |

|

|

(67 |

) |

|

|

22 |

|

| Effect of foreign exchange rate on cash |

|

|

(2 |

) |

|

|

(2 |

) |

| Cash -- beginning of period |

|

|

131 |

|

|

|

32 |

|

| Cash -- end of period |

|

$ |

62 |

|

|

$ |

52 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

17 |

|

|

$ |

25 |

|

| Cash paid for income taxes |

|

$ |

38 |

|

|

$ |

44 |

|

| See notes to condensed consolidated financial statements. |

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

MRC GLOBAL INC.

NOTE 1 – BACKGROUND AND BASIS OF PRESENTATION

Business Operations: MRC Global Inc. is a holding company headquartered in Houston, Texas. Our wholly owned subsidiaries are global distributors of pipe, valves, fittings (“PVF”) and infrastructure products and services across each of the following sectors:

| ● | | Gas Utilities: gas utilities (storage and distribution of natural gas) |

| ● | | DIET: downstream, industrial and energy transition (crude oil refining, petrochemical and chemical processing, general industrials and energy transition projects) |

| ● | | PTI: production and transmission infrastructure (exploration, production and extraction, gathering, processing and transmission of oil and gas) |

We have service centers in industrial, chemical, gas distribution and hydrocarbon producing and refining areas throughout the United States, Canada, Europe, Asia, Australasia and the Middle East. We obtain products from a broad range of suppliers.

Basis of Presentation: We have prepared our unaudited condensed consolidated financial statements in accordance with Rule 10-01 of Regulation S-X for interim financial statements. These statements do not include all information and footnotes that generally accepted accounting principles ("GAAP") require for complete annual financial statements. However, the information in these statements reflects all normal recurring adjustments that are, in our opinion, necessary for a fair presentation of the results for the interim periods. The results of operations for the three and nine months ended September 30, 2024, are not necessarily indicative of the results that will be realized for the fiscal year ending December 31, 2024. We have derived our condensed consolidated balance sheet as of September 30, 2024, from the audited consolidated financial statements for the year ended December 31, 2023. You should read these condensed consolidated financial statements in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2023.

The condensed consolidated financial statements include the accounts of MRC Global Inc. and its wholly owned and majority owned subsidiaries (collectively referred to as the "Company" or by terms such as "we", "our" or "us"). All intercompany balances and transactions have been eliminated in consolidation.

Recently Issued Accounting Standards: In December 2023, the Financial Accounting Standards Board ("FASB") issued ASU 2023-09, Income Taxes (Topic 740) ("ASU 2023-09"), which aims to enhance the transparency and decision usefulness of income tax disclosures through requiring improvements in those disclosures primarily related to the rate reconciliation and income taxes paid information. This update will be effective for annual periods beginning after December 15, 2024. We are currently evaluating the impacts of the provisions of ASU 2023-09 on our consolidated financial statements.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280) ("ASU 2023-07"), which improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses regularly provided to the chief operating decision maker ("CODM"). This update will be effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. We are currently evaluating the impacts of the provisions of ASU 2023-07 on our consolidated financial statements.

NOTE 2 – REVENUE RECOGNITION

We recognize revenue when we transfer control of promised goods or services to our customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those goods or services. We generally recognize our revenue when products are shipped or delivered to our customers, and payment is due from our customers at the time of billing with a majority of our customers having 30-day terms. We estimate and record returns as a reduction of revenue. Amounts received in advance of shipment are deferred and recognized when the performance obligations are satisfied. Sales taxes collected from customers and remitted to governmental authorities are accounted for on a net basis and, therefore, we exclude these taxes from sales in the accompanying condensed consolidated statements of operations. In some cases, particularly with third party pipe shipments, we consider shipping and handling costs to be separate performance obligations, and as such, we record the revenue and cost of sales when the performance obligation is fulfilled. While a small proportion of our sales, we occasionally recognize revenue under a bill and hold arrangement. Recognition of revenue on bill and hold arrangements occurs when control transfers to the customer provided that the reason for the bill and hold arrangement is substantive, the product is separately identified as belonging to the customer, ready for physical transfer and unavailable to be used or directed to another customer. Cost of sales includes the cost of inventory sold and related items, such as vendor rebates, inventory allowances and reserves and shipping and handling costs associated with inbound and outbound freight, as well as depreciation and amortization of intangible assets.

Our contracts with customers ordinarily involve performance obligations that are one year or less. Therefore, we have applied the optional exemption that permits the omission of information about our unfulfilled performance obligations as of the balance sheet dates.

Contract Balances: Variations in the timing of revenue recognition, invoicing and receipt of payment result in categories of assets and liabilities that include invoiced accounts receivable, uninvoiced accounts receivable, contract assets and deferred revenue (contract liabilities) on the condensed consolidated balance sheets.

Generally, revenue recognition and invoicing occur simultaneously as we transfer control of promised goods or services to our customers. We consider contract assets to be accounts receivable when we have an unconditional right to consideration, and only the passage of time is required before payment is due. In certain cases, particularly those involving customer-specific documentation requirements, invoicing is delayed until we are able to meet the documentation requirements. In these cases, we recognize a contract asset separate from accounts receivable until those requirements are met, and we are able to invoice the customer. Our contract asset balance associated with these requirements as of September 30, 2024, and December 31, 2023, was $17 million and $9 million, respectively. These contract asset balances are included within accounts receivable in the accompanying condensed consolidated balance sheets.

We record contract liabilities, or deferred revenue, when cash payments are received from customers in advance of our performance, including amounts which are refundable. The deferred revenue balance at September 30, 2024 and December 31, 2023 was $6 million and $7 million, respectively. During the three and nine months ended September 30, 2024, we recognized less than $1 million and $6 million, respectively, of the revenue that was deferred as of December 31, 2023. During the three and nine months ended September 30, 2023, we recognized $3 million and $8 million, respectively, of the revenue that was deferred as of December 31, 2022. Deferred revenue balances are included within accrued expenses and other current liabilities in the accompanying condensed consolidated balance sheets.

Disaggregated Revenue: Our disaggregated revenue represents our business of selling PVF to energy and industrial end users across each of the Gas Utilities, DIET, and PTI sectors in each of our reportable segments. Each of our end markets and geographical reportable segments are impacted and influenced by varying factors, including macroeconomic environment, commodity prices, maintenance and capital spending and exploration and production activity. As such, we believe that this information is important in depicting the nature, amount, timing and uncertainty of our revenue from contracts with customers.

The following table presents our revenue disaggregated by revenue source (in millions):

| Three Months Ended |

|

| September 30, |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

U.S. |

|

|

Canada |

|

|

International |

|

|

Total |

|

| 2024: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities |

|

$ |

293 |

|

|

$ |

2 |

|

|

$ |

— |

|

|

$ |

295 |

|

| DIET |

|

|

170 |

|

|

|

9 |

|

|

|

69 |

|

|

|

248 |

|

| PTI |

|

|

181 |

|

|

|

15 |

|

|

|

58 |

|

|

|

254 |

|

| |

|

$ |

644 |

|

|

$ |

26 |

|

|

$ |

127 |

|

|

$ |

797 |

|

| 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities |

|

$ |

311 |

|

|

$ |

2 |

|

|

$ |

1 |

|

|

$ |

314 |

|

| DIET |

|

|

210 |

|

|

|

7 |

|

|

|

62 |

|

|

|

279 |

|

| PTI |

|

|

224 |

|

|

|

29 |

|

|

|

42 |

|

|

|

295 |

|

| |

|

$ |

745 |

|

|

$ |

38 |

|

|

$ |

105 |

|

|

$ |

888 |

|

| Nine Months Ended |

|

| September 30, |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

U.S. |

|

|

Canada |

|

|

International |

|

|

Total |

|

| 2024: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities |

|

$ |

845 |

|

|

$ |

3 |

|

|

$ |

— |

|

|

$ |

848 |

|

| DIET |

|

|

560 |

|

|

|

30 |

|

|

|

202 |

|

|

|

792 |

|

| PTI |

|

|

583 |

|

|

|

55 |

|

|

|

157 |

|

|

|

795 |

|

| |

|

$ |

1,988 |

|

|

$ |

88 |

|

|

$ |

359 |

|

|

$ |

2,435 |

|

| 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities |

|

$ |

938 |

|

|

$ |

4 |

|

|

$ |

2 |

|

|

$ |

944 |

|

| DIET |

|

|

599 |

|

|

|

16 |

|

|

|

187 |

|

|

|

802 |

|

| PTI |

|

|

675 |

|

|

|

98 |

|

|

|

125 |

|

|

|

898 |

|

| |

|

$ |

2,212 |

|

|

$ |

118 |

|

|

$ |

314 |

|

|

$ |

2,644 |

|

NOTE 3 – INVENTORIES

The composition of our inventory is as follows (in millions):

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Finished goods inventory at average cost: |

|

|

|

|

|

|

|

|

| Valves, automation, measurement and instrumentation |

|

$ |

233 |

|

|

$ |

274 |

|

| Carbon steel pipe, fittings and flanges |

|

|

156 |

|

|

|

193 |

|

| Gas products |

|

|

260 |

|

|

|

266 |

|

| All other products |

|

|

109 |

|

|

|

126 |

|

| |

|

|

758 |

|

|

|

859 |

|

| Less: Excess of average cost over LIFO cost (LIFO reserve) |

|

|

(279 |

) |

|

|

(282 |

) |

| Less: Other inventory reserves |

|

|

(17 |

) |

|

|

(17 |

) |

| |

|

$ |

462 |

|

|

$ |

560 |

|

The Company uses the last-in, first-out (“LIFO”) method of valuing U.S. inventories. The use of the LIFO method has the effect of reducing net income during periods of rising inventory costs (inflationary periods) and increasing net income during periods of falling inventory costs (deflationary periods). Valuation of inventory under the LIFO method can be made only at the end of each year based on the inventory levels and costs at that time. Accordingly, we base interim LIFO calculations on management’s estimates of expected year-end inventory levels and costs and these estimates are subject to the final year-end LIFO inventory determination.

NOTE 4 – LEASES

We lease certain distribution centers, warehouses, office space, land, automobiles and equipment. The majority of these leases are classified as operating leases. We recognize operating fixed lease expense and finance lease amortization expense on a straight-line basis over the lease term. Leases with an initial term of 12 months or less are not recorded on the balance sheet.

Many of our facility leases include one or more options to renew, with renewal terms that can extend the lease term from one year to 15 years with a maximum lease term of 30 years, including renewals. The exercise of lease renewal options is at our sole discretion; therefore, renewals to extend the terms of most leases are not included in our right of use (“ROU”) assets and lease liabilities as they are not reasonably certain of exercise. In the case of our regional distribution centers and certain corporate offices, where the renewal is reasonably certain of exercise, we include the renewal period in our lease term. Leases with escalation adjustments based on an index, such as the consumer price index, are expensed based on current rates. Leases with specified escalation steps are expensed based on the total lease obligation ratably over the life of the lease. Leasehold improvements are depreciated over the expected lease term. Non-lease components, such as payment of real estate taxes, maintenance, insurance and other operating expenses, have been excluded from the determination of our lease liability.

As most of our leases do not provide an implicit rate, we use an incremental borrowing rate based on the information available at the commencement date in determining the present value of the lease payments using a portfolio approach. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants.

Expense associated with our operating leases was $14 million and $36 million for the three and nine months ended September 30, 2024, respectively, and $11 million and $31 million for the three and nine months ended September 30, 2023, respectively, which we have classified in selling, general and administrative expenses. For the three and nine months ended September 30, 2024, expense associated with our finance leases was $2 million related to the amortization of ROU Assets, which we have classified in cost of sales, and less than $1 million related to the interest on finance lease liabilities, which we have classified in interest expense. Cash paid for operating leases recognized as liabilities was $9 million and $30 million for the three and nine months ended September 30, 2024, respectively, and $10 million and $30 million for the three and nine months ended September 30, 2023, respectively. Cash paid for finance leases was $1 million for the three and nine months ended September 30, 2024.

The maturity of lease liabilities is as follows (in millions):

| Maturity of Lease Liabilities | | Operating | | | Finance | |

| Remainder of 2024 | | $ | 12 | | | $ | — | |

| 2025 | | | 43 | | | | 2 | |

| 2026 | | | 38 | | | | 2 | |

| 2027 | | | 31 | | | | 2 | |

| 2028 | | | 26 | | | | 2 | |

| After 2028 | | | 136 | | | | 2 | |

| Total lease payments | | | 286 | | | | 10 | |

| Less: Interest | | | (85 | ) | | | (1 | ) |

| Present value of lease liabilities | | $ | 201 | | | $ | 9 | |

The term and discount rate associated with leases are as follows:

| | | September 30, | |

| Operating Lease Term and Discount Rate | | 2024 | |

| Weighted-average remaining lease term (years) | | | | |

| Operating leases | | | 10 | |

| Finance leases | | | 6 | |

| Weighted-average discount rate | | | | |

| Operating leases | | | 6.6 | % |

| Finance leases | | | 6.6 | % |

Amounts maturing after 2028 include expected renewals for leases of regional distribution centers and certain corporate offices through dates up to 2048. Excluding these optional renewals, our weighted-average remaining lease term for operating and finance leases is 6 years and 6 years, respectively.

NOTE 5 – DEBT

The components of our debt are as follows (in millions):

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Senior Secured Term Loan B, net of discount and issuance costs of $0 and $1, respectively |

|

$ |

— |

|

|

$ |

292 |

|

| Global ABL Facility |

|

|

85 |

|

|

|

9 |

|

| |

|

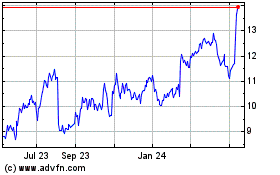

|

85 |

|

|

|

301 |

|

| Less: current portion |

|

|

— |

|

|

|

292 |

|

| |

|

$ |

85 |

|

|

$ |

9 |

|

Senior Secured Term Loan B: The Company had a Senior Secured Term Loan B (the “Prior Term Loan”) with an original principal amount of $400 million, which amortized in equal quarterly installments of 1% per year with the balance payable in September 2024, when the facility was set to mature. In May 2024, the Company repaid the Prior Term Loan in its entirety using a combination of our asset-based lending facility and cash on hand. The outstanding principal balance on the Prior Term Loan at the date of repayment was $292 million. The Company used $216 million of the asset-based lending facility and $76 million cash to repay the Prior Term Loan prior to its maturity. The early repayment of the Prior Term Loan resulted in a loss on early extinguishment of debt of $0.2 million. All security securing the Prior Term Loan was released upon the repayment of the Prior Term Loan. The Prior Term Loan had an applicable interest rate margin of 300 basis points in the case of loans incurring interest based on LIBOR, and 200 basis points in the case of loans incurring interest based on the base rate. Beginning July 1, 2023, the LIBOR interest rate was calculated as the aggregate Chicago Mercantile Exchange ("CME") Term SOFR plus the International Swaps and Derivatives Association (ISDA) credit adjustment spread.

Global ABL Facility: The Company is a party to a multi-currency, global asset-based lending facility (the “Global ABL Facility”), including certain of its subsidiaries, its lenders and Bank of America, N.A. as administrative agent, security trustee and collateral agent. The Global ABL Facility is a revolving credit facility of $750 million, which matures in September 2026. The Global ABL Facility is comprised of $705 million in revolver commitments in the United States, which includes a $30 million sub-limit for Canada, $12 million in Norway, $10 million in Australia, $10.5 million in the Netherlands, $7.5 million in the United Kingdom and $5 million in Belgium. The Global ABL Facility contains an accordion feature that allows us to increase the principal amount of the facility by up to $250 million, subject to securing additional lender commitments. MRC Global Inc. and each of its current and future wholly owned material U.S. subsidiaries guarantee the obligations of our borrower subsidiaries under the Global ABL Facility. Additionally, each of our non-U.S. borrower subsidiaries guarantees the obligations of our other non-U.S. borrower subsidiaries under the Global ABL Facility. Outstanding obligations are generally secured by a first priority security interest in accounts receivable, inventory and related assets. U.S. borrowings under the amended facility bear interest at Term SOFR (as defined in the Global ABL Facility) plus a margin varying between 1.25% and 1.75% based on our fixed charge coverage ratio. Canadian borrowings under the facility bear interest at the Canadian Dollar Bankers' Acceptances Rate ("BA Rate") plus a margin varying between 1.25% and 1.75% based on our fixed charge coverage ratio. Borrowings under our foreign borrower subsidiaries bear interest at a benchmark rate, which varies based on the currency in which such borrowings are made, plus a margin varying between 1.25% and 1.75% based on our fixed charge coverage ratio. Availability is dependent on a borrowing base comprised of a percentage of eligible accounts receivable and inventory, which is subject to redetermination from time to time. Excess Availability, as defined under our Global ABL Facility, was$485 million as of September 30, 2024.

Interest on Borrowings: The interest rates on our outstanding borrowings at September 30, 2024 and December 31, 2023, including amortization of debt issuance costs, were as follows:

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Senior Secured Term Loan B |

|

|

— |

|

|

|

9.08 |

% |

| Global ABL Facility |

|

|

6.52 |

% |

|

|

5.82 |

% |

| Weighted average interest rate |

|

|

6.52 |

% |

|

|

8.98 |

% |

NOTE 6 – INCOME TAXES

For the three months ended September 30, 2024, we earned $32 million before taxes and recorded a provision for income taxes of $3 million resulting in an effective tax rate of 9%. For the nine months ended September 30, 2024, we earned $101 million before taxes and recorded a provision for income taxes of $23 million resulting in an effective tax rate of 23%. Our rates generally differ from the U.S. federal statutory rates of 21% as a result of state income taxes, non-deductible expenses and differing foreign income tax rates. The effective tax rate for the three and nine months ended September 30, 2024 was favorably impacted by a net reduction in the valuation allowance provision, partially offset by foreign losses with no tax benefit due to valuation allowances.

For the three months ended September 30, 2023, we earned $49 million before taxes and recorded a provision for income taxes of $14 million resulting in an effective tax rate of 29%. For the nine months ended September 30, 2023, we earned $130 million before taxes and recorded a provision for income taxes of $37 million resulting in an effective tax rate of 28%. Our rates generally differ from the U.S. federal statutory rates of 21% as a result of state income taxes, non-deductible expenses and differing foreign income tax rates. The effective tax rate for the three and nine months ended September 30, 2023 was higher than the U.S. federal statutory rate due to foreign losses with no tax benefit due to valuation allowances.

NOTE 7 – REDEEMABLE PREFERRED STOCK

Preferred Stock Issuance

In June 2015, we issued 363,000 shares of Series A Convertible Perpetual Preferred Stock (the “Preferred Stock”) and received gross proceeds of $363 million. On October 29, 2024, the Company repurchased all of the outstanding shares of the Preferred Stock for $361 million plus accrued dividends, and all of the Preferred Stock was retired on October 30, 2024. See Note 12 – Subsequent Events. Before its repurchase, the Preferred Stock ranked senior to our common stock with respect to dividend rights and rights on liquidation, winding-up and dissolution. The Preferred Stock had a stated value of $1,000 per share, and holders of Preferred Stock were entitled to cumulative dividends payable quarterly in cash at a rate of 6.50% per annum.