Wall Street was a heavy user of the Federal Reserve's

extraordinary credit facilities during the financial crisis, Fed

data released Wednesday showed.

Goldman Sachs Group Inc. (GS), for instance, tapped the Fed's

Primary Dealer Credit Facility 84 times. Morgan Stanley (MS)

borrowed from the facility 212 times between March 2008 and March

2009, an indication of how close Wall Street's second-largest

investment bank came to the brink of collapse.

The Fed created the Primary Dealer Credit Facility, or PDCF, to

provide discount-window loans to investment banks, a privilege

previously reserved for more tightly regulated commercial banks.

Eventually, both Goldman Sachs and Morgan Stanley were granted

bank-holding company status.

Commercial banks also were big users of the facilities, often

through their investment-banking arms.

"Historically, those that hit the discount window didn't come

back. It's interesting that a lot of these brokers [that borrowed

from the facility] are still around today. It has less of a

stigma," said Sandler O'Neill + Partners analyst Jeff Harte.

Citigroup Inc. (C) used the PDCF almost daily through its

investment-banking unit, borrowing as much as $17.9 billion in late

November 2008, around the time the government stepped in to prevent

Citi's cardiac arrest. The use tapered off in April 2009.

Bank of America Corp. (BAC) used the PDCF nearly every trading

day from Sept. 18, 2008, to May 12, 2009, more than 1,000 times in

total. The bank's single biggest use of the facility was for $11

billion in October 2008.

From the PDCF, J.P. Morgan Chase & Co. (JPM) appeared to use

the funding as a parent company far fewer times than rivals, only

using it once in September 2008 and twice in October 2008. However,

Bear Stearns & Co. used the facility almost daily from April

2008 to late June 2008, after J.P. Morgan had bought the collapsing

investment bank in March of that year.

Spokesmen for several banks said the program helped the U.S.

financial system. Goldman spokesman Michael DuVally said, "In late

2008, many of the U.S. funding markets were clearly broken. The Fed

took essential steps to fix these markets and its actions were very

successful."

A Morgan Stanley spokesman also said, "the loans, which were

fully collateralized to the requirements of each Fed facility, were

fully repaid."

Citigroup said, "Citi's usage of these programs was appropriate

at the time."

Bank of America spokesman Robert Stickler said, "We have repaid,

with interest, all of the borrowings except some of those whose

terms have not expired."

Foreign Banks

Foreign banks also appear on the list of those using the PDCF

multiple times, including Barclays PLC (BCS, BARC.LN), BNP Paribas

(BNPQY, BNP.FR), Mizuho Financial Group Inc.'s (MFG, 8411.TO) U.S.

securities unit, and UBS AG (UBS, UBSN.VX).

Among those using it only once were Deutsche Bank AG (DB,

DBK.XE), Daiwa Securities Co.'s (DSEEY, 8601.TO) Daiwa Securities

America, and Commerzbank AG's (CRZBY, CBK.XE) Dresdner

Kleinwort.

Among the banks that acted as primary dealers in 2008, HSBC

Holdings PLC (HBC, HSBA.LN) doesn't appear on the list of those

that used the facility.

Primary dealers trade U.S. government securities with the Fed

and basically act as a global distribution network for Treasury

securities.

Other Lending Programs

The Federal Reserve in December 2007 began announcing a series

of emergency programs aimed at easing a severe credit crunch. The

Term Auction Facility, or TAF, for instance, allowed banks to bid

for loans without the stigma associated with the Fed's discount

window.

Citi accessed TAF through its two banking charters 26 times

between January 2008 and July 2009; its largest TAF loan was $15

billion.

Bank of America tapped TAF 15 times from October 2008 to May

2009. The first time it took $2.2 billion in September 2008 and

every other time the loan was for $15 billion.

J.P. Morgan used the TAF seven times, with the largest loan

being $15 billion in February 2009. Chief Executive Jamie Dimon had

told investors in 2009 that the bank used TAF "at the request of

the Federal Reserve to help motivate others to use the system."

Another facility, the Term Securities Lending Facility, or TSLF,

loaned up to $200 billion in Treasury securities to investment

banks for 28-day periods.

Citigroup used the TSLF 65 times, and its largest single

borrowing under that program was for $10 billion, in May 2009. J.P.

Morgan used the TSLF 23 times, never taking more than $5 billion at

a time.

Bank of America used the TSLF 23 times, with the high-water mark

an $8.75 billion loan. Morgan Stanley also used the TSLF 34 program

times and its largest single loan was $10 billion.

Shares of large banks were up in afternoon trading Wednesday

amid a generally buoyant market. Shares of Citigroup were up 2.5%

to $4.30, J.P. Morgan rose 1.8% to $38.09, Goldman Sachs shares

were up 1.6% to $158.73 and Morgan Stanley rose 1.8% to $24.91.

-By Liz Moyer, Brett Philbin, Dave Benoit and Matthias Rieker,

Dow Jones Newswires; 212-416-2512; liz.moyer@dowjones.com

--Maya Jackson Randall contributed to this article.

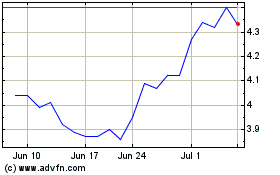

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

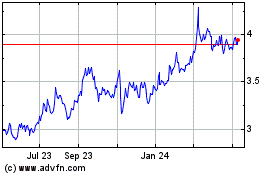

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024