UPDATE:Norges Bank Boosts BlackRock Stake To 7.5% -Filing

November 18 2010 - 11:22AM

Dow Jones News

Norges Bank, the central bank of Norway, became the latest to

report boosting its stake in BlackRock Inc. (BLK) after Bank of

America Corp. (BAC) and PNC Financial Services Group Inc. (PNC)

sold a total of $9.57 billion in a BlackRock secondary offer this

month.

According to a filing with U.S. regulators Thursday, Norges Bank

now owns 9.85 million shares, or 7.5% of BlackRock, one of the

world's largest money managers with $3.45 trillion assets under

management. The last disclosed stake by Norges was 169,629 shares

at the end of 2009, according to data from FactSet.

Norges presumably acquired shares in the secondary offering. The

bank's communications adviser Bunny Nooryani declined to comment,

saying the fund never comments on individual investments.

Norway's central bank investment unit manages the Norwegian

government's global pension fund, previously known as the Oil Fund.

The fund was set up in 1990 to safeguard Norway's oil wealth for

future generations and has a market value of about $506

billion.

The fund in November made its first property investment, buying

a 150-year lease on a 25% stake in the U.K. Crown Estate's

portfolio of properties on Regent Street in London.

A rebound in global stock markets helped boost the fund's

returns to $350 million in the third quarter, its fifth largest

quarterly return ever. It invests roughly 60% of capital in

equities, 35%-40% in fixed-income securities and roughly 5% in real

estate.

Last week, Mizuho Financial Group Inc. (8411.TO) said it bought

3.07 million BlackRock shares for about $500 million, of which 2.45

million shares were from a direct placement with Bank of America,

that was separate from the share placement.

Mizuho, Japan's second largest bank by assets, also signed a

business cooperation agreement with BlackRock to further promote

strategic cooperation between the two firms globally "with

particular emphasis on Japan and Asia to more effectively address

the investment needs of their respective clients," it said in a

statement.

Bank of America, which inherited its BlackRock stake from its

takeover of Merrill Lynch at the peak of the financial crisis, sold

51.24 million shares at $163 apiece, while PNC sold 7.5 million

shares at the same price. Bank of America owns 7.1% and PNC 20.3%

after the sale.

The offering will allow BlackRock to broaden its shareholder

base and have more control over its strategic direction.

Australian brokerage Macquarie Group Ltd. (MQBKY) upgraded

BlackRock Wednesday to outperform from neutral, saying the asset

manager may repurchase its stock, and could become part of the

benchmark Standard & Poor's 500 Index.

BlackRock shares rose 1.2% to $171.00 in recent trading.

-By Amy Or and Anna Molin, Dow Jones Newswires, +1 212 416 3142,

amy.or@dowjones.com

--Erik Holm contributed to this article.

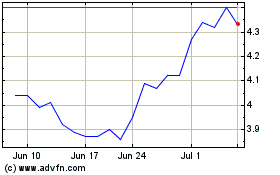

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

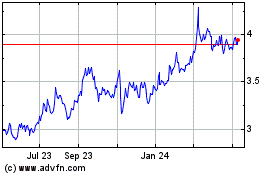

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024