Stock Market News for March 15, 2012 - Market News

March 15 2012 - 5:06AM

Zacks

Markets swung up and down

throughout Wednesday to end at roughly the same level they started

the day at. On a day devoid of events, the markets struggled to

find a definite direction. However, despite the meager gains, the

Dow recorded its sixth-consecutive day of gains, thus also

registering the blue-chip index’s longest-winning streak since

February 2011.

The Dow Jones Industrial Average

(DJI) was up 0.1% to close at 13,194.10. The Standard & Poor

500 (S&P 500) gained a mere 0.1% to finish yesterday’s trading

session almost unchanged at 1,394.28. The tech-laden Nasdaq

Composite Index slipped 0.03% to settle at 3,040.73. The fear-gauge

CBOE Volatility Index (VIX) gained 3.5% to settle at 15.31.

Consolidated volumes on the New York Stock Exchange, the American

Stock Exchange and Nasdaq were 7.45 billion shares, lower than last

year's daily average of 7.84 billion. Declining stocks outpaced the

advancers on the NYSE; as for 72% of the decliners, only 26%

managed to move up. The remaining 2% of the stocks were left

unchanged.

Markets took a pause yesterday

after recording the biggest gains of the year so far on Tuesday.

The biggest rally of the year till now was spurred by a number of

events including encouraging consumer data and the central bank’s

outlook on the economy, which it said was “expanding moderately”.

Meanwhile, a large degree of attention was cornered by JP Morgan

Chase & Co.’s (NYSE:JPM) after it announced a dividend hike and

a share buyback plan worth $150 million. This was a bit of a

surprise, as it came ahead of the Fed’s announcement of its bank

stress test results.

Meanwhile, the central bank

released the results of its stress tests, originally scheduled for

Thursday, after the closing bell on Tuesday. Fifteen of the 19

banks under the scanner passed the Fed’s stress test. Subsequently,

financials posted decent gains, building on the gains already

garnered on Tuesday. The Financial SPDR Select Sector Fund (XLF)

moved up 0.1% yesterday while KBW Bank Index (BKX) jumped 1.3%.

Among the financial stocks, American Express Company (NYSE:AXP),

Bank of America (NYSE:BAC), U.S. Bancorp (NYSE:USB), Deutsche Bank

AG (NYSE:DB) and Wells Fargo & Company (NYSE:WFC) gained 3.5%,

4.1%, 1.5%, 1.5% and 0.1%, respectively.

However, Citigroup, Inc. (NYSE:C)

failed to pass the stress test and these results were reflected

through the 3.4% drop in its share prices yesterday. SunTrust

Banks, Inc. (NYSE:STI), Ally Financial and MetLife, Inc. (NYSE:MET)

were the other three that failed. Shares of Sun Trust jumped 4.6%

but MetLife slumped 5.8%.

Earlier during the day, reports

came in that a quake measuring as much as 6.8 on Richter scale had

struck the northern part of Japan. However, with no news of major

damage, US markets ignored these developments, and sectors like

energy were hardly affected. A little over a year ago on March 11,

2011, the earthquake and the subsequent tsunami had significantly

damaged nuclear plants, eventually affecting the energy sector.

Yesterday, Energy SPDR Select Sector Fund (XLE) slipped by a

percent and stocks including Chevron Corporation (NYSE:CVX), Exxon

Mobil Corporation (NYSE:XOM), ConocoPhillips (NYSE:COP) and

Schlumberger (NYSE:SLB) were down 0.5%, 1.0%, 0.3% and 1.0%,

respectively.

AMER EXPRESS CO (AXP): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

CONOCOPHILLIPS (COP): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

DEUTSCHE BK AG (DB): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

METLIFE INC (MET): Free Stock Analysis Report

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

SUNTRUST BKS (STI): Free Stock Analysis Report

US BANCORP (USB): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

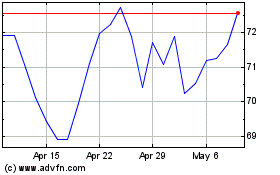

MetLife (NYSE:MET)

Historical Stock Chart

From May 2024 to Jun 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Jun 2023 to Jun 2024