MeridianLink Product Innovator Named as National Mortgage Professional 40 Under 40 Winner

December 06 2023 - 9:05AM

Business Wire

MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, today announced that its director of product

management for MeridianLink® Mortgage, David Wieczorek, has been

named among the National Mortgage Professional (NMP) 40 Under 40

award recipients. Honorees were chosen based on industry

contributions and impact.

“In every profession, the future is written by the next

generation as they bring fresh perspectives and new energy,” said

Vincent Valvo, CEO and editor-in-chief of National Mortgage

Professional. “NMP asked for your nominations, and you came through

with a diverse and talented selection of 40 people truly unleashing

their talents to better the mortgage industry. Congratulations to

our 40 Under 40 winners.”

Wieczorek has spent the latter half of his 16-year MeridianLink

tenure leading the mortgage solutions division as its director of

product. During this time, he designed the PriceMyLoan product and

pricing engine, seamlessly bridged the MeridianLink® Consumer and

Mortgage LOS functionalities, launched powerful lender

customization and automation tools, and guided the company through

intricate solution updates driven by compliance regulations,

including TRID, HMDA, and the redesigned URLA. He recently oversaw

the launch of MeridianLink® Mortgage Access, a fully integrated POS

solution that helps financial institutions slash application and

approval times for consumers. Under his leadership, the division

has achieved double-digit annualized growth in active mortgage LOS

customers.

“David’s role in shaping mortgage lending offerings at

MeridianLink cannot be overstated, and we are proud to see his work

recognized,” said Devesh Khare, chief product officer at

MeridianLink. “His innovative spirit and tireless contributions to

build a better mortgage experience are a large part of the reason

why MeridianLink Mortgage is the proven, end-to-end LOS that it is

today.”

Lenders choose MeridianLink Mortgage, a cloud-native and 100%

browser-based offering, for its robust and customizable workflow

automation that empowers them to swiftly scale their business. Its

powerful open APIs facilitate seamless integration with a wide

array of trusted vendor partners, enabling customers to build

custom extensions to the LOS. The platform's comprehensive suite of

tools includes a best-in-class native product and pricing engine, a

native electronic document management system, and versatile web

portals catering to both the consumer direct and third-party

origination (TPO) business channels. MeridianLink Mortgage is

designed to streamline the mortgage origination process at every

step, helping lenders reduce costs and decrease their time to

close.

To learn more about MeridianLink Mortgage, visit

https://www.meridianlink.com/products/mortgage.

ABOUT MERIDIANLINK

MeridianLink® (NYSE: MLNK) powers digital lending and account

opening for financial institutions and provides data verification

solutions for consumer reporting agencies. MeridianLink’s scalable,

cloud-based platforms help customers build deeper relationships

with consumers through data-driven, personalized experiences across

the entire lending life cycle.

MeridianLink enables customers to accelerate revenue growth,

reduce risk, and exceed consumer expectations through seamless

digital experiences. Its partner marketplace supports hundreds of

integrations for tailored innovation. For more than 20 years,

MeridianLink has prioritized the democratization of lending for

consumers, businesses, and communities. Learn more at

www.meridianlink.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231206245318/en/

Becky Frost (714) 784-5839 media@meridianlink.com

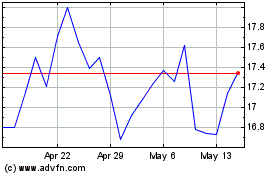

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Apr 2023 to Apr 2024