Form PX14A6G - Notice of exempt solicitation submitted by non-management

February 02 2024 - 4:47PM

Edgar (US Regulatory)

SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: MAXIMUS Inc.

NAME OF PERSON RELYING ON EXEMPTION: SOC Investment Group

ADDRESS OF PERSON RELYING ON EXEMPTION: 1900 L Street, Suite 900, Washington, D.C. 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

____________________________________________________________________________________________________________________________________________________________________________________

February 2, 2024

To MAXIMUS Shareholders:

We urge you to vote FOR Proposal #4, Shareholder Proposal Regarding Commission of a Third Party Assessment on Company's Commitment to Freedom of Association and Collective Bargaining Rights at MAXIMUS’s annual shareholder meeting on March 12, 2024. Like similar resolutions that shareholders have filed over the past two years at companies including Starbucks, Apple, and Amazon, Proposal 4 asks the MAXIMUS Board of Directors to:

[Commission] and oversee an independent, third-party assessment of MAXIMUS’s adherence, above and beyond legal compliance, to its stated commitment to workers’ freedom of association and collective bargaining rights as contained in the United Nations Guiding Principles on Business and Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, and as explicitly referenced in the company’s Human Rights Principles.

Instead of engaging with investors to better understand what characteristics such an assessment should have in order to satisfy their concerns, MAXIMUS has cynically sought to pre-empt the proponents by initiating an “assessment” by a biased law firm that has recently represented the Company in employment-related litigation. Moreover, since our unsuccessful engagement with MAXIMUS, the U.S. Department of Health and Human Services has announced that it is recompeting the $6.6 billion Contact Center Operations (CCO) contract with the Centers for Medicare and Medicaid Services (CMS) to operate call centers for Medicare and the Affordable Care Act.1 HHS also signaled its intention to require a labor harmony provision – a common method that the government uses to ensure uninterrupted service due to threats of labor disruption – in this contract.2 In FY2023, this contract accounted for 15.7% ($770 million) of Maximus’ global revenue.3 Therefore, shareholders have every reason to reject MAXIMUS’s

attempt to evade genuine scrutiny of its practices, and insist that the Board undertake a bona fide assessment.

The SOC Investment Group works with pension funds sponsored by unions affiliated with the Strategic Organizing Center (SOC), a coalition of unions representing millions of members, to enhance long-term shareholder value through active ownership. These

funds have over $250 billion in assets under management and are substantial MAXIMUS shareholders.

1 U.S. Department of Health and Human Services, “Statement from Secretary Xavier Becerra and CMS Administrator Chiquita Brooks-LaSure on the CMS Call Center Contract,” Dec. 15, 2023.

2 CMS, “Contact Center Operations – Request for Information,” Notice ID A230119. https://sam.gov/opp/7c4e9a33081d44049ded7360ae9ec7c9/view

3 Revenue percentage calculated based on revenues of $770,352,735 received in FY2023 and Maximus’s FY2023 revenue of $4.9 billion. See USASpending.gov.

MAXIMUS’s Human Rights Policy

MAXIMUS states in its Human Rights Principles that “[r]especting human rights means more than simply following particular rules or laws. Being aware of and considering human rights means making a shared commitment to hold each other accountable to the highest standards of business conduct.”4 We agree, and further note that MAXIMUS specifically identifies Freedom of Association as a subject toward which it recognizes its responsibilities. Nevertheless, over the past two years, MAXIMUS has allegedly

taken actions that appear inconsistent with its policy commitment. Any such misalignment between Company policy and practice would be concerning, and this apparent misalignment creates potentially significant risks to MAXIMUS’s operations and profitability.

MAXIMUS’s Response to Employees’ Collective Action

Several years ago, MAXIMUS workers began to organize with the Communication Workers of America (CWA), seeking to address concerns including a living wage, better career advancement opportunities, and affordable health care.5 During the COVID pandemic, these concerns expanded to include the ability of workers to work from home, the availability of personal protective equipment, and social distancing in the workplace for services that could not be delivered over home phone lines.6

MAXIMUS workers began a series of walkouts and strikes, and over the past two years there have been six such strikes, including a November 2023 strike in which 700 workers participated across eight worksites and effectively shut down call centers in Hattiesburg, Mississippi and Bogalusa, Louisiana.7

In response to this activity, MAXIMUS has taken actions that have resulted in the filing of multiple Unfair Labor Practice charges against it, including nine which are currently outstanding (meaning that the Regional Director for the National Labor Relations Board has not determined if the charges have merit). The outstanding ULP charges against the company include allegations that it discharged employees in retaliation for engaging in protected concerted activity and union activity (including speaking out against racial disparities at Maximus), and threatened employees with layoff and worksite closure in connection with employee protected union activity; granting special benefits to non-striking employees while depriving strikers of those same benefits because they chose to engage in strike activity; coerced and threatened a union supporter; summoned the police on workers while they were engaging in a lawful strike and disciplined an employee in retaliation for participating in the strike; and retaliated and

discriminated against a union supporter.8 Two charges that were filed in 2021 were determined to have merit, resulting in a complaint issued by Region 15 of the NLRB, and resulted in a settlement of the complaint.9

4 MAXIMUS, Inc., MAXIMUS Human Rights Principles, https://maximus.com/sites/default/files/documents/MAXIMUS_Human-Rights-Statement_2020.pdf

5 Sarah Jones, “A Distinctly American Irony” New York Magazine, February 2, 2020 https://nymag.com/intelligencer/2020/02/for-maximus-inequality-is-big-business.html

6 Communications Workers of America, “Workers Demand That MAXIMUS Take More Proactive Steps to Protect Employees from Coronavirus” March 18, 2020. https://cwa-union.org/news/releases/workers-demand-maximus-take-more-proactive-steps-protect-employees-coronavirus-

7 Communications Workers of America, “Maximus Workers Organizing With CWA Stage Largest Federal Call Center Strike in History,” Nov. 16, 2023. https://cwa-union.org/news/maximus-workers-organizing-cwa-stage-largest-federal-call-center-strike-history#:~:text=Maximus%20Workers%20Organizing%20With%20CWA%20Stage%20Largest%20Federal%20Call%20Center%20Strike%20in%20History,-November%2016%2C%202023&text=Last%20week%2C%20700%20call%20center,call%20center%20strike%20in%20history.

Growing Investor Concern Over Human Capital Management, Freedom of Association, and Collective Bargaining

Increasingly, investors are calling on companies to recognize the importance workforce issues have to the sustainability of an enterprise. Over the past three years, shareholder proposals addressing freedom of association and collective bargaining concerns have been submitted at many companies, including Amazon, Apple, Starbucks, Wells Fargo, and CVS Health.10 These proposals have received considerable support from shareholders, notably including a majority of votes cast by Starbucks shareholders in

support of an independent, unbiased third-party assessment proposal last year.

More broadly, independent academic research has shown the presence of unions correlates positively with human capital management practices including low turnover, improved diversity, investment in training, and with low levels of legal and regulatory violations, conditions that have been consistently found to improve productivity and boost performance.11 Conversely, companies that actively oppose unionization experience significant declines in productivity and survival relative to companies that are less opposed, with the evidence indicating that “the overall negative effects are driven by manager’s or owner’s dislike of working with unions rather than economic costs of unions.”12

MAXIMUS’s “Assessment” is an Attempt to Pre-Empt Shareholder Action

Our proposal asks MAXIMUS to commission an assessment of the alignment between its human rights policy commitments and its practices by an independent and unbiased third party. When we spoke to MAXIMUS representatives about our proposal, they informed us that they were already undertaking such an assessment and shared the name of the assessor with us, which we learned to be a management-side labor law firm with an extensive union avoidance practice. This firm’s website includes

services such as “Maintaining Union-Free Status,” in which it states that “[w]e also conduct employee relations “audits … to suggest realistic actions that should both improve morale and help avert a serious, costly union-organizing effort. The expense of such an ‘audit’ in terms of both dollars and valuable management time is negligible when compared with the cost of overcoming a union-organizing drive.” This website further states that “[e]mployers frequently err by assuming that supervisors fully understand what union representation means to an operation and that they are steadfastly opposed to unionization. We have found that it is well worth the effort to effectively drive these points home, provide real-life examples and shape training so that the supervisors are appropriately motivated.”

8 Case #15-CA-292735; Case #15-CA-301668; Case #05-CA-301812; Case #05-CA-301812; Case #15-CA-305277; Case #15-CA-306438; Case #15-CA-318724

9 Case #’s 15-CA-240635 and 15-CA-258452

10 Committee on Workers’ Capital, Voting for Labour Rights: How the World’s Largest Asset Managers Measures up in Proxy Season 2023. https://www.workerscapital.org/our-resources/voting-for-labour-rights-how-the-worlds-largest-asset-managers-measured-up-in-proxy-season-2023/

11 Sandra Lawson and Tanja Boskovic, The making of long-term capitalism, BlackRock, 2022 pg. 19 https://www.blackrock.com/corporate/literature/whitepaper/the-making-of-long-term-capitalism.pdf ; Marina Severinovsky, The Value of Human Capital for Investors, Schroders, December 2022, pgs. 14-15; Justin Wolfers and Jan Zilinsky, “Higher Wages for Low-Income Workers Lead to Higher Productivity” Peterson Institute for International Economics, January 13th, 2015 https://www.piie.com/blogs/realtime-economic-issues-watch/higherwages-low-income-workers-lead-higher-productivity ; Trillium Asset Management, The Investor Case for Supporting Worker Organizing Rights, July 2022, pgs.4-9 https://www.trilliuminvest.com/news-views/the-investor-case-for-supporting-worker-organizing-rights ; Committee on Workers’ Capital, Shared Prosperity: The Investor Case for Freedom of Association and Collective Bargaining, November 2022 pgs.33-41. https://www.workerscapital.org/our-resources/shared-prosperity-the-investor-case-for-freedom-of-association-and-collective-bargaining/

12 Sean Wang and Samuel Young, “Unionization, Employer Opposition, and Establishment Closure” December 12, 2022 https://www.census.gov/content/dam/Census/newsroom/press-kits/2023/assa/unionization-employer-opposition-preview.pdf

Clearly, this entity is not unbiased with respect to freedom of association and collective bargaining, and on that basis alone would not be a suitable assessor. But it is important to also note that this firm represented MAXIMUS in an employment discrimination matter last year. We do not believe that a law firm that has represented MAXIMUS in the past -- and may do so in the future -- can provide the sort of “independent” assessment that we are seeking.

Conclusion

Despite our efforts to engage with MAXIMUS, which would very likely have resulted in our withdrawing this proposal if a bona fide independent assessment were actually underway, the Company has seemed determined to stick with its clearly biased and non-independent assessor. Given the developments with the CCO contract discussed above, we believe that MAXIMUS risks not only further disruptions of its operations as more employees exercise their right to free association, but also the loss of existing clients and future business if it develops a reputation for inviting labor disputes or hostility toward unions. By voting FOR Proposal 4 at MAXIMUS’s March 12, 2024 annual general meeting, shareholders will send a clear message of support for a genuine assessment of the Company’s practices, and reject management’s attempt to substitute a biased white-washing in its place.

THIS IS NOT A PROXY SOLICITATION AND NO PROXY CARDS WILL BE ACCEPTED. Please execute and return your proxy card according to MAXIMUS’ instructions.

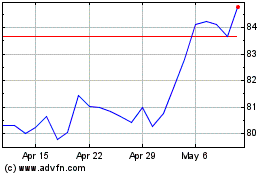

MAXIMUS (NYSE:MMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

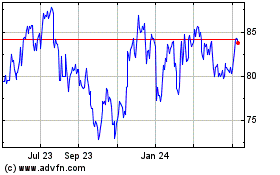

MAXIMUS (NYSE:MMS)

Historical Stock Chart

From Apr 2023 to Apr 2024