- The partnership between Vocalink and

Cámara de Compensación Electrónica allows for the processing

of 24/7 real-time payments, bulk payments and checks.

- This total modernization of Peru’s

existing electronic payments platform will enable banks to develop

new payment services for consumers and businesses.

International payment systems provider Vocalink, a Mastercard

company, has today signed a contract with Peru’s automated clearing

house, Cámara de Compensación Electrónica (CCE) to fully modernize

the Peruvian electronic payments infrastructure. This deal will see

the creation of a new integrated and comprehensive payment service

that will deliver processing of electronic payments (checks, bulk

and real-time) 24/7 x 365 days of the year.

The announcement marks a major development for Peru’s payment

infrastructure. The migration will support an upgrade to the

existing system to support the clearing and settlement of

electronic payment methods including checks. In addition, this will

include an implementation of Vocalink’s new Immediate Payments

Solution (IPS) which will process and credit transfers in

real-time, as well as enabling users to send and receive payments

from their mobile phones using just a phone number, without the

need to supply the recipients’ bank details. The modernized

payments platform will significantly contribute to the reduction of

the country’s reliance on cash and drive a more digital

economy.

The updated electronic payment platform will set the bar for the

payments sector in Latin America, providing consumers, businesses,

the government and financial institutions with the opportunity to

choose the way in which they pay and get paid. This new platform

will also drive greater efficiencies across the economy, enhanced

availability and security for its users and enable further

innovation between payment systems.

Vocalink’s track record of national payment systems includes the

implementation of Faster Payments in the UK and the launch of The

Clearing House’s RTP® - the transformative real-time payment system

in the US - which was an evolution of Vocalink’s highly successful

and reliable systems developed for the UK, Singapore and

Thailand.

Adrián F. Revilla Vergara, Chairman of the Board of Cámara de

Compensación Electrónica, said:

“Once complete, I believe that the platform will not only be one

of the most comprehensive real-time payment systems in Latin

America but it will be in-line with the best in the world. Our aim

is to provide a solution from which innovative new services can be

launched to power Peru’s economy, and it is our belief that

Vocalink and their proven experience in the design, development and

delivery of real-time national payments infrastructure, makes them

the ideal partner.”

Cesar Ferreyros, CEO of Cámara de Compensación Electrónica,

said:

“Today’s contract signing with Vocalink represents a significant

milestone in our effort to provide a state-of-the-art real-time

payments solution in Peru. Peru’s whole economy will significantly

benefit from the introduction of a new payments platform, as it

impacts all stakeholders from consumers, small businesses through

to the government and financial institutions. Benefits will include

more efficient payment of salaries, insurance payouts, loans, small

business invoicing and person-to-person payments. In addition,

competition within the financial services industry will be

stimulated, as well as greater productivity of money, with a higher

volume of transactions processed within the same elapsed

timeframe.

“Once completed, customers will be able to pay or receive money

in real-time from any financial institution, allowing millions of

people and businesses to make anytime instant payments. Vocalink’s

proven track record of rapid and effective development of real-time

payments systems will ensure that Peru is at the forefront of

payments innovation globally.”

Paul Stoddart, Chief Executive Officer at Vocalink, a

Mastercard company, commented:

“We look forward to working with such a respected and impressive

partner as Cámara de Compensación Electrónica, to deliver a service

that will transform the payments landscape in Peru. The new

real-time solution will provide a platform for innovation to

support the country’s economy.

“The partnership is Vocalink’s first fully managed service in

Latin America, which will ensure that we continue to provide our

payments expertise long after we have implemented the new

infrastructure. We are committed to developing further partnerships

around the world to build global, ubiquitous real-time

payments.”

Jorge Noguera, Mastercard Division President for the Andean

Region and the Caribbean, said:

“This deal reinforces Mastercard’s commitment to Peru. It’s an

additional step toward the robustness of the country’s payment

ecosystem, which will foster more innovation, opportunities and

financial inclusion. We are proud to be part of this ongoing

evolution and ready to deliver even more solutions that can

streamline and drive this process.”

Notes to Editors

About Vocalink

A Mastercard company, Vocalink designs, builds and operates

industry-leading bank account-based payment systems. Our

technologies power the UK’s real-time payments, settlements and

direct debit systems, as well as the UK’s network of nearly 70,000

ATMs. In 2017, we processed over 90 percent of salaries, more than

70 percent of household bills and almost all state benefits in the

UK. In addition, our proven real-time bank account-based payment

solutions provide more payment choice to customers in Singapore,

Thailand and the United States. For payment news and insight from

Vocalink visit CONNECT - http://connect.Vocalink.com/

About CCE

CCE is a private service company whose mission is to simplify

the interaction of financial institutions in the interbank payment

system and generating value with safe and efficient transactions

for their customers.

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology

company in the global payments industry. Our global payments

processing network connects consumers, financial institutions,

merchants, governments and businesses in more than 210 countries

and territories. Mastercard products and solutions make

everyday commerce activities - such as shopping, traveling, running

a business and managing finances - easier, more secure and more

efficient for everyone. Follow us on Twitter @MastercardNews,

join the discussion on the Beyond the Transaction Blog and

subscribe for the latest news on the Engagement Bureau.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181212005353/en/

VocalinkEmma HarveySeven

Consultancyemma@seven-consultancy.comorEllie FixterDirector,

External

Communicationsellie.fixter@vocalink.comorMastercardAndrea

DenadaiAndrea.denadai@mastercard.com

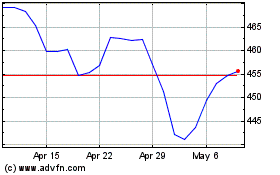

MasterCard (NYSE:MA)

Historical Stock Chart

From Oct 2024 to Nov 2024

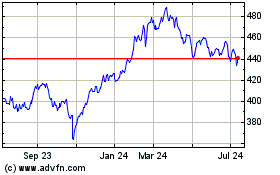

MasterCard (NYSE:MA)

Historical Stock Chart

From Nov 2023 to Nov 2024