Macerich Announces Tax Treatment of 2010 Dividends

January 18 2011 - 4:15PM

PR Newswire (US)

SANTA MONICA, Calif.,

Jan. 18, 2011 /PRNewswire/ -- The

Macerich Company (NYSE: MAC) today announced the tax treatment for

dividend distributions taxable in 2010 on its Common Stock.

The 2010 dividend of $2.10 per

share is classified for income tax purposes as follows:

The Macerich Company, Common Stock, CUSIP # 554382101

|

|

|

Record

Date

|

Payable

Date

|

Total

Distribution

per

Share

|

2010

Taxable

Ordinary

Dividends

|

2010

Total

Capital

Gain

Distribution

|

2010

Return

of

Capital

|

|

|

02/16/10

|

03/22/10

|

$0.60

|

$0.162912

|

$0.011964

|

$0.425124

|

|

|

05/10/10

|

06/08/10

|

$0.50

|

$0.135760

|

$0.009970

|

$0.354270

|

|

|

08/20/10

|

09/08/10

|

$0.50

|

$0.135760

|

$0.009970

|

$0.354270

|

|

|

11/12/10

|

12/08/10

|

$0.50

|

$0.135760

|

$0.009970

|

$0.354270

|

|

|

|

|

|

|

|

|

|

Macerich is a fully integrated self-managed and

self-administered real estate investment trust, which focuses on

the acquisition, leasing, management, development and redevelopment

of regional malls throughout the United

States. Macerich now owns approximately 73 million

square feet of gross leaseable area consisting primarily of

interests in 71 regional malls. Additional information about

Macerich can be obtained from the Company's Web site at

www.macerich.com.

SOURCE Macerich Company

Copyright 2011 PR Newswire

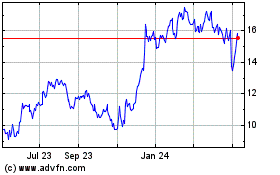

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

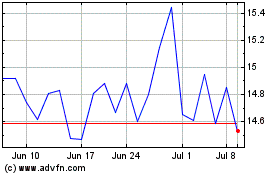

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024