0000763744FALSE00007637442024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 30, 2024

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 30, 2024, the Company issued a press release announcing select preliminary, unaudited fourth quarter 2023 results. A copy of the press release is attached hereto as Exhibit 99.1.

The foregoing information is furnished pursuant to item 2.02, "Results of Operations and Financial Condition." Such information, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Index:

99.1 Press Release dated January 30, 2024

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | January 30, 2024 |

Exhibit 99.1 | | | | | | | | |

FOR IMMEDIATE RELEASE | | |

Contact: Lillian D. Etzkorn, CFO |

Phone: (574) 336-7659 |

E Mail: LCII@lci1.com |

| |

LCI Industries Reports Preliminary Fourth Quarter 2023 Results

ELKHART, Ind., January 30, 2024 – LCI Industries (NYSE: LCII), which, through its wholly-owned subsidiary, Lippert Components, Inc. ("Lippert"), supplies, domestically and internationally, a broad array of highly engineered components for the leading original equipment manufacturers ("OEMs") in the recreation and transportation markets, and the related aftermarkets of those industries, today provided select preliminary, unaudited financial results ranges for the fourth quarter of 2023.

The Company expects net sales in the fourth quarter of 2023 to be in the range of $832 million to $842 million, compared to net sales of $894 million in the fourth quarter of 2022, and loss per diluted share to be in the range of $0.04 to $0.14, compared to a loss of $0.68 per diluted share for the fourth quarter of 2022.

“As RV and marine OEMs took action during the fourth quarter to further normalize industry inventories, our results were adversely impacted by lower than expected production levels at the OEMs, including longer shutdowns at pontoon manufacturers within the marine industry. While marine production has continued to be soft as we begin 2024, RV production has shown a slow and modest start returning from the holiday shutdowns and is outpacing January 2023 levels. We expect an improving trend for RV with February orders looking stronger year-over-year, as retail shows are giving off positive sentiment,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer. “The strength of our diversification strategy, coupled with our tenured leadership and continued focus on operational excellence and customer experience, has proven critical as we navigate these near-term challenges. We remain acutely focused on taking non-strategic costs out of our business and leveraging our flexible capacity to support margin improvements. At the same time, we are delivering solid growth and performance in our Aftermarket segment and other adjacent businesses to offset weakness in the RV and marine industries. We believe our business is built to withstand these near-term pressures, and we plan to continue to invest strategically and are confident in the mid- to long-term profitable growth of our business.”

The financial result ranges included in this release are preliminary, unaudited, and are estimates based on information available to Company management as of the date of this release. These preliminary estimates are subject to change, including as a result of the completion of year-end accounting and financial reporting and audit procedures. The Company's actual results may differ materially from these preliminary estimated financial results due to a number of factors, including those that may result from the completion of our financial close process. The Company expects to report complete results for the fourth quarter and full year 2023 on February 13, 2024.

Conference Call & Webcast

LCI Industries will also host a conference call on Tuesday, February 13, 2024, at 8:30 a.m. ET to discuss the results and other business matters.

The conference call can be accessed by dialing (833) 470-1428 for participants in the U.S. and (929) 526-1599 for participants outside the U.S. using the required access code 216951. Due to the high volume

of companies reporting earnings at this time, please be prepared for hold times of up to 15 minutes when dialing in to the call. A live webcast of the call will be available on the LCI Industries website at investors.lci1.com.

A replay of the conference call will be available for two weeks by dialing (866) 813-9403 for participants in the U.S. and (44) 204-525-0658 for those outside the U.S. and referencing access code 584031. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About LCI Industries

LCI Industries, through its wholly-owned subsidiary, Lippert, supplies, domestically and internationally, a broad array of highly engineered components for the leading OEMs in the recreation, transportation products, and housing markets, consisting primarily of recreational vehicles and adjacent industries, including boats; buses; trailers used to haul boats, livestock, equipment, and other cargo; trucks; trains; manufactured homes; and modular housing. The Company also supplies engineered components to the related aftermarkets of these industries, primarily by selling to retail dealers, wholesale distributors, and service centers, as well as direct to retail customers via the Internet. Lippert's products include steel chassis and related components; axles and suspension solutions; slide-out mechanisms and solutions; thermoformed bath, kitchen, and other products; vinyl, aluminum, and frameless windows; manual, electric, and hydraulic stabilizer and leveling systems; entry, luggage, patio, and ramp doors; furniture and mattresses; electric and manual entry steps; awnings and awning accessories; towing products; truck accessories; electronic components; appliances; air conditioners; televisions and sound systems; tankless water heaters; and other accessories. Additional information about Lippert and its products can be found at www.lippert.com.

Forward-Looking Statements

This press release contains certain "forward-looking statements" with respect to preliminary estimated financial results for the fourth quarter of 2023, production levels, orders and other factors in early 2024, financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company's common stock, the impact of legal proceedings, and other matters. Statements in this press release that are not historical facts are "forward-looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those relating to preliminary estimated financial results for the fourth quarter of 2023, production levels, orders and other factors in early 2024, future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices, and industry trends, whenever they occur in this press release are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this press release, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disasters on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the

industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices, and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company's subsequent filings with the Securities and Exchange Commission. Readers of this press release are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

Source: LCI Industries

Lillian Etzkorn, CFO, (574) 336-7659, LCII@lci1.com

v3.24.0.1

Cover

|

Jan. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

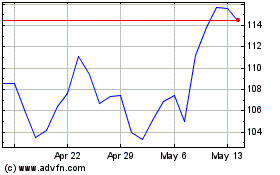

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Mar 2024 to Apr 2024

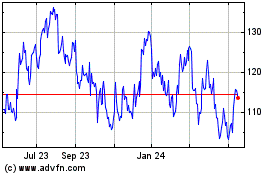

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Apr 2023 to Apr 2024