Current Report Filing (8-k)

June 19 2020 - 4:06PM

Edgar (US Regulatory)

0001300514false00013005142020-06-172020-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) June 18, 2020

|

|

|

|

|

|

|

|

|

|

|

LAS VEGAS SANDS CORP.

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

|

|

001-32373

|

|

27-0099920

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

3355 Las Vegas Boulevard South

|

|

|

|

Las Vegas,

|

Nevada

|

89109

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(702) 414-1000

(Registrant's Telephone Number, Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

|

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

Common Stock ($0.001 par value)

|

|

|

|

|

LVS

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

|

|

|

|

|

☐

|

|

|

|

|

|

|

|

|

ITEM 1.01.

|

Entry into a Material Definitive Agreement.

|

On June 18, 2020, Marina Bay Sands Pte. Ltd. (“MBS” or the “Borrower”), a subsidiary of Las Vegas Sands Corp. (the “Company”), entered into an amendment letter (the “Amendment Letter”) with DBS Bank Ltd. (“DBS”), as agent. The Amendment Letter amends the facility agreement originally dated as of June 25, 2012 (as amended, restated, amended and restated, supplemented and otherwise modified, the “Facility Agreement”), among the Borrower, the lenders party thereto, DBS, as the agent, and the other parties thereto. Capitalized terms used and not defined herein are defined in the Facility Agreement.

The Amendment Letter (a) modifies the financial covenant provisions under the Facility Agreement such that the Borrower will not have to comply with the leverage or interest coverage covenants for the financial quarters ending, and including, September 30, 2020 through, and including, December 31, 2021 (the “Waiver Period”); (b) extends to June 30, 2021, the deadline for delivering the Quantity Surveyor’s Construction Costs Estimate and the Construction Schedule, in each case for the MBS expansion project; and (c) permits the Borrower to make dividend payments during the Waiver Period of (i) an unlimited amount if the ratio of its debt to consolidated adjusted EBITDA is lower than or equal to 4.25 to 1 and (ii) up to S$500 million per fiscal year if the ratio of its debt to consolidated adjusted EBITDA is higher than 4.25 to 1, subject to the additional requirements that (a) the aggregate amount of the Borrower’s cash plus Facility B availability is greater than or equal to S$800 million immediately following such dividend payment and (b) the Borrower’s interest coverage ratio is higher than 3.00 to 1. Pursuant to the Amendment Letter, MBS agreed to pay a customary fee by June 19, 2020, to the lenders that consented thereto.

Some of the lenders, agents and arrangers under the Facility Agreement and their respective affiliates have provided, and may provide in the future, investment banking, commercial banking and other financial services for the Company and its subsidiaries in the ordinary course of business, for which they have received and would be expected to receive customary compensation.

The foregoing summary of the Amendment Letter is not complete and is qualified in its entirety by reference to the full and complete text of the Amendment Letter, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

|

|

|

|

|

|

|

ITEM 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

(d)

|

Exhibits

|

|

10.1†

|

|

Amendment Letter, dated June 18, 2020, with respect to the facility agreement, originally dated as of June 25, 2012 (as amended, restated, amended and restated, supplemented and otherwise modified) among Marina Bay Sands Pte. Ltd., the lenders party thereto, DBS Bank Ltd., as the agent, and the other parties thereto

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

† Certain identified information has been excluded from the exhibit because such information is both (i) not material and (ii) would be competitively harmful if publicly disclosed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: June 19, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAS VEGAS SANDS CORP.

|

|

|

|

|

By:

|

/S/ D. ZACHARY HUDSON

|

|

|

|

|

Name: D. Zachary Hudson

Title: Executive Vice President, Global General Counsel and Secretary

|

|

|

|

|

|

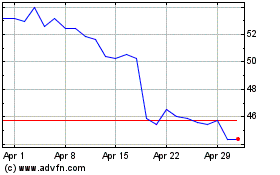

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Aug 2024 to Sep 2024

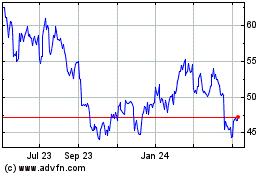

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Sep 2023 to Sep 2024