KKR to acquire majority position in FGS Global to support long-term growth; FGS to become standalone communications and public affairs consultancy

August 07 2024 - 2:01AM

Business Wire

KKR today announced the acquisition of WPP’s full equity

position in FGS Global (“FGS” or the “Company”), the preeminent

global communications and public affairs consultancy. The proposed

transaction is supported by FGS management, builds on KKR’s initial

minority investment in July 2023, and values FGS at US $1.7

billion. The investment underscores KKR’s deep conviction in FGS’s

vision and strategy to be the leading global communications advisor

helping clients navigate the increasingly complex stakeholder

economy. As a result of the transaction, the equity interest of

FGS’s over 500 employee shareholders will be approximately 26% of

the company.

Since KKR’s initial minority investment in July 2023, FGS has

benefitted from KKR’s access to global resources, network and

expertise in building best-in-class global enterprises. Both KKR

and FGS are focused on enhancing the Company’s growth and extending

its leading position as a global advisor to Boards and C-suites in

business-critical situations. FGS will continue to be a partner-led

firm, managed by the existing leadership team. KKR is committed to

supporting FGS’s ambitious growth plans while ensuring FGS

continues to uphold the highest standards of independence, client

confidentiality and trust.

Philipp Freise, Partner and Co-Head of European Private Equity

at KKR, stated: “Our investment in FGS reflects our strong

commitment to strategic partnerships, where we provide long-term

capital and global resources to entrepreneurial teams and

world-class businesses. We strongly believe in FGS’s strategy and

leadership and have been pleased with our partnership since our

minority investment in July 2023. In today's increasingly complex

stakeholder ecosystems, the value of FGS’s insight, advice and

execution is increasingly essential for organizations to navigate

uncertainty and achieve their goals. We look forward to continuing

our collaboration and helping FGS realize their vision as a global

category leader.”

Alex Geiser, Global CEO of FGS, said: “Our enhanced strategic

partnership with KKR is a clear signal of their confidence in our

ability to scale and enhance our position as the preeminent

consultancy helping leaders successfully navigate the stakeholder

economy. With KKR’s reinforced support, we're poised to accelerate

our growth, attract and empower new talent, and further our

commitment to value creation that benefits all our stakeholders,

especially our clients and employees. Together, we are ideally

positioned to lead growth and innovation of the industry as FGS

moves into its next phase as a standalone firm.”

Roland Rudd, Global Co-Chair of FGS added: “I would like to

thank WPP for their longstanding partnership. I am particularly

grateful to WPP Chair Roberto Quarta and WPP CEO Mark Read for

their support as we have grown FGS Global into what it is today. I

am delighted that KKR is now backing FGS to become the undisputed

global leader in our sector.”

KKR is making the investment in FGS primarily through its

European Fund VI, an $8 billion fund that invests in the growth of

leading businesses by providing access to KKR’s extensive network

and business building resources. Recent investments from the

European Fund VI include OHB, nexeye, Superstruct and Accountor.

One of the core strategies of KKR’s European Private Equity team is

investing alongside founders, entrepreneurs and corporates to

provide flexible capital for strategic partnership transactions.

The FGS investment follows a similar thematic pursued through KKR’s

2021 investment in ERM, the world’s largest global pure play

sustainability consultancy.

The transaction is expected to close by the end of the year,

subject to regulatory approvals and other customary closing

conditions.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR insurance subsidiaries offer

retirement, life and reinsurance products under the management of

Global Atlantic Financial Group. References to KKR’s investments

may include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com. For

additional information about the Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

About FGS

FGS Global is the preeminent global communications and public

affairs consultancy, with approximately 1,400 professionals around

the world, advising clients in navigating complex stakeholder

situations and reputational challenges. FGS was formed from the

combination of Finsbury, The Glover Park Group, Hering Schuppener

and Sard Verbinnen & Co to offer board-level and C-suite

counsel in all aspects of strategic communications — including

corporate reputation, crisis management, and public affairs and is

also the leading force in financial communications worldwide.

FGS offers seamless and integrated support with offices in the

following locations: Abu Dhabi, Amsterdam, Beijing, Berlin, Boston,

Brussels, Calgary, Chicago, Dubai, Dublin, Düsseldorf, Frankfurt,

Hong Kong, Houston, Kingston, London, Los Angeles, Munich, Paris,

Riyadh, San Francisco, Shanghai, Singapore, Tokyo, Toronto,

Washington, D.C., South Florida, Vancouver and Zurich. The firm is

headquartered in New York.

FGS is consistently ranked a Band 1 PR firm for Crisis &

Risk Management and for Litigation Support by Chambers and

Partners. For the second year, FGS was ranked #1 Global M&A PR

firm by Deal Count and Value in 2023 by Mergermarket.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806369145/en/

KKR Julia Leeger/ Miles Radcliffe-Trenner media@kkr.com

FGS Global Dorothy Burwell / Jennifer Loven / Dirk von

Manikowsky mediaglobal@fgsglobal.com

WPP Chris Wade / Richard Oldworth press@wpp.com

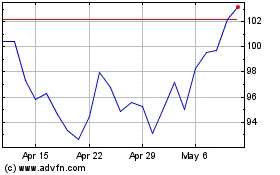

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

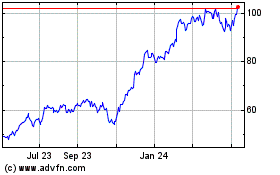

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024