Kirby Corporation Announces Record 2005 Second Quarter and Six

Months Results, and Raises 2005 Year Guidance - 2005 second quarter

earnings per share were $.72 compared with $.55 earned in the 2004

second quarter HOUSTON, July 27 /PRNewswire-FirstCall/ -- Kirby

Corporation (NYSE:KEX) ("Kirby") today announced record net

earnings for the second quarter ended June 30, 2005 of $18,447,000,

or $.72 per share, compared with $13,778,000, or $.55 per share,

for the second quarter of 2004. The 2005 second quarter net

earnings were above Kirby's published earnings guidance range of

$.65 to $.70 per share, but included a $404,000 net gain after

taxes from the sale of marine equipment and loss on debt

retirement. Consolidated revenues for the 2005 second quarter were

$199,276,000, a 17% increase compared with $170,876,000 for the

2004 second quarter. Kirby reported record net earnings for the

first six months of 2005 of $31,726,000, or $1.24 per share,

compared with $22,798,000, or $.91 per share, for the first six

months of 2004. Consolidated revenues for the first six months of

2005 were $383,720,000, a 17% increase compared with $328,191,000

for the first half of 2004. Marine transportation revenues and

operating income for the 2005 second quarter increased 15% and 23%,

respectively, compared with the second quarter of 2004. For the

first six months of 2005, marine transportation revenues and

operating income increased 15% and 31%, respectively, when compared

with the first six months of 2004. The record results for both 2005

periods reflected continued strong petrochemical and black oil

products volumes, and improved agricultural chemical volumes. The

results were also favorably impacted by higher contract rate

renewals, higher spot market pricing, fuel cost recovery and,

effective January 1, 2005, escalators for labor and the producer

price index on contracts over a year in duration. Ton miles for the

2005 second quarter declined 4% and 2% for the first half when

compared with the corresponding 2004 periods. The slight declines

were due to geographic product mix, more canal and less river

demand, more delays at customers' facilities due to dock

congestion, and a higher number of barges being used for storage

which generated revenue but no ton miles. Diesel engine services

revenues and operating income for the 2005 second quarter increased

31% and 58%, respectively, compared with the 2004 second quarter.

For the first six months of 2005, revenues and operating income

increased 28% and 49%, respectively, compared with the 2004 first

six months. The record diesel engine services results reflected

continued strong marine, offshore oil service, power generation and

railroad markets, as well as the acquisition of Walker Paducah

Corp. in April 2004. The record results were also positively

impacted by modest price increases for both service and parts

during the 2005 first six months. The 2005 second quarter included

a $1,795,000 net gain ($1,113,000 after taxes) from the sale of

marine equipment. Kirby also recognized in the 2005 second quarter

a loss on debt retirement of $1,144,000 ($709,000 after taxes).

Kirby announced on May 31, 2005 the private placement of $200

million of 2005 senior notes with an interest rate equal to the

London Interbank Offered Rate ("LIBOR") plus 0.5%. With the

proceeds, Kirby retired $200 million of 2003 senior notes with an

interest rate of LIBOR plus 1.2%. This transaction will result in

approximately $1,400,000 of annual pre-tax interest savings at the

current $200 million senior note level. The net effect of the gain

on sale of marine equipment and loss on the early extinguishment of

the 2003 senior notes was $404,000 after taxes, or $0.016 per

share. Joe Pyne, Kirby's President and Chief Executive Officer,

commented, "Strong volumes in all of our marine transportation

markets, coupled with rate increases and better operating

conditions allowed us to achieve earnings of $1.24 per share for

the first half of 2005, or 36% above the $.91 we reported for the

first half of 2004. We continue to believe that our customers'

volumes are sustainable at these levels with some modest growth,

which should be positive for our business." Mr. Pyne further

commented, "We are forecasting net earnings for the 2005 third

quarter in the $.65 to $.70 per share range, a 23% to 32% increase

over reported 2004 third quarter net earnings of $.53 per share.

For the 2005 year, we are increasing our net earnings guidance to

$2.50 to $2.60 per share from previous guidance of $2.45 to $2.55.

The current 2005 year guidance reflects a 27% to 32% increase over

the 2004 net earnings of $1.97 per share. Capital spending guidance

for 2005 remains in the $110 to $120 million range and includes

approximately $65 million for the construction of 18 new 30,000

barrel capacity tank barges and 20 new 10,000 barrel capacity tank

barges. In addition, this month we signed contracts for the

construction of twenty-three 30,000 barrel capacity tank barges for

delivery throughout 2006, with the final barge scheduled for

delivery in January 2007." This earnings press release includes

marine transportation performance measures for both the 2005 and

2004 second quarters and first six months. The performance measures

include ton miles, revenues per ton mile, towboats operated and

delay days. Comparable performance measures for the 2004 and 2003

years and quarters are available at Kirby's web site under the

caption Performance Measurements in the Investor Relations section.

Kirby's homepage can be accessed by visiting

http://www.kirbycorp.com/ . A conference call is scheduled at 10:00

a.m. central time tomorrow, Thursday, July 28, 2005, to discuss the

2005 second quarter and first six months, and the outlook for the

2005 third quarter and year. The conference call number is

888-328-2514 for domestic callers and 706-679-3262 for

international callers. The leader's name is Steve Holcomb. An audio

playback will be available at approximately 12:00 p.m. central time

on July 28 through 6:00 p.m. on Friday, August 26, 2005, by dialing

800-642-1687 for domestic callers and 706-645-9291 for

international callers. The conference ID number is 7953576. The

conference call can also be accessed by visiting Kirby's homepage

at http://www.kirbycorp.com/ or at

http://audioevent.mshow.com/247040 . A replay will be available on

each of those web sites following the conference call. The

financial and other information to be discussed in the conference

call is available in this press release and in a Form 8-K filed

with the Securities and Exchange Commission. This press release and

the Form 8-K include a non- GAAP financial measure, EBITDA, which

Kirby defines as net earnings before interest expense, taxes on

income, depreciation and amortization. A reconciliation of EBITDA

for the 2005 and 2004 second quarters and first six months with

GAAP net earnings for the same periods is included in the Condensed

Consolidated Financial Information in this press release. Kirby

Corporation, based in Houston, Texas, operates inland tank barges

and towing vessels, transporting petrochemicals, black oil

products, refined petroleum products and agricultural chemicals

throughout the United States inland waterway system. Through the

diesel engine services segment, Kirby provides after-market service

for large medium-speed and high-speed diesel engines and reduction

gears used in marine, power generation and railroad applications.

Statements contained in this press release with respect to the

future are forward-looking statements. These statements reflect

management's reasonable judgment with respect to future events.

Forward-looking statements involve risks and uncertainties. Actual

results could differ materially from those anticipated as a result

of various factors, including cyclical or other downturns in

demand, significant pricing competition, unanticipated additions to

industry capacity, changes in the Jones Act or in U.S. maritime

policy and practice, fuel costs, interest rates, weather

conditions, and timing, magnitude and number of acquisitions made

by Kirby. Forward-looking statements are based on currently

available information and Kirby assumes no obligation to update any

such statements. A list of additional risk factors can be found in

Kirby's annual report on Form 10-K for the year ended December 31,

2004, filed with the Securities and Exchange Commission. CONFERENCE

CALL INFORMATION Date: Thursday, July 28, 2005 Time: 10:00 a.m.

central time U.S.: 888-328-2514 Int'l: 706-679-3262 Leader: Steve

Holcomb Passcode: Kirby Webcast: http://www.kirbycorp.com/ or

http://audioevent.mshow.com/247040 A summary of the results for the

second quarter and first six months follows: CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS Second Quarter Six Months 2005 2004 2005

2004 (unaudited, $ in thousands except per share amounts) Revenues:

Marine transportation $170,742 $149,065 $327,952 $284,558 Diesel

engine services 28,534 21,811 55,768 43,633 199,276 170,876 383,720

328,191 Costs and expenses: Costs of sales and operating expenses

128,267 108,391 248,194 211,318 Selling, general and administrative

22,228 19,479 43,187 39,444 Taxes, other than on income 2,909 4,150

6,095 7,402 Depreciation and amortization 13,964 13,591 28,945

27,388 Loss (gain) on disposition of assets (1,795) 196 (1,987) 198

165,573 145,807 324,434 285,750 Operating income 33,703 25,069

59,286 42,441 Equity in earnings of marine affiliates 707 494 4

1,316 Loss on debt retirement (1,144) --- (1,144) --- Other expense

(400) (51) (716) (322) Interest expense (3,113) (3,290) (6,259)

(6,664) Earnings before taxes on income 29,753 22,222 51,171 36,771

Provision for taxes on income (11,306) (8,444) (19,445) (13,973)

Net earnings $18,447 $13,778 $31,726 $22,798 Net earnings per share

of common stock: Basic $.74 $.56 $1.27 $.93 Diluted $.72 $.55 $1.24

$.91 Common stock outstanding (in thousands): Basic 24,945 24,434

24,907 24,392 Diluted 25,642 25,093 25,612 25,003 CONDENSED

CONSOLIDATED FINANCIAL INFORMATION Second Quarter Six Months 2005

2004 2005 2004 (unaudited, $ in thousands except per share amounts)

EBITDA: (A) Net earnings $18,447 $13,778 $31,726 $22,798 Interest

expense 3,113 3,290 6,259 6,664 Provision for taxes on income

11,306 8,444 19,445 13,973 Depreciation and amortization 13,964

13,591 28,945 27,388 $46,830 $39,103 $86,375 $70,823 Capital

expenditures $39,540 $32,013 $63,563 $56,060 Acquisitions of

business and marine equipment $7,000 $9,975 $7,000 $11,085 June 30,

2005 2004 (unaudited, $ in thousands) Long-term debt, including

current portion $217,638 $251,453 Stockholders' equity $471,808

$402,622 Debt to capitalization ratio 31.6% 38.4% MARINE

TRANSPORTATION STATEMENTS OF EARNINGS Second Six Quarter Months

2005 2004 2005 2004 (unaudited, $ in thousands) Marine

transportation revenues $170,742 $149,065 $327,952 $284,558 Costs

and expenses: Costs of sales and operating expenses 106,795 92,081

206,447 179,047 Selling, general and administrative 17,260 15,228

33,572 30,732 Taxes, other than on income 2,757 4,049 5,807 7,182

Depreciation and amortization 13,247 12,846 27,522 25,862 140,059

124,204 273,348 242,823 Operating income $30,683 $24,861 $54,604

$41,735 Operating margins 18.0 % 16.7 % 16.7 % 14.7 % DIESEL ENGINE

SERVICES STATEMENTS OF EARNINGS Second Quarter Six Months 2005 2004

2005 2004 (unaudited, $ in thousands) Diesel engine services

revenues $28,534 $21,811 $55,768 $43,633 Costs and expenses: Costs

of sales and operating expenses 21,473 16,233 41,742 32,167

Selling, general and administrative 3,240 3,017 6,350 6,051 Taxes,

other than income 95 91 205 173 Depreciation and amortization 283

286 561 619 25,091 19,627 48,858 39,010 Operating income $3,443

$2,184 $6,910 $4,623 Operating margins 12.1 % 10.0 % 12.4 % 10.6 %

OTHER COSTS AND EXPENSES Second Six Quarter Months 2005 2004 2005

2004 (unaudited, $ in thousands) General corporate expenses $2,218

$1,780 $4,215 $3,719 Loss (gain) on disposition of assets $(1,795)

$196 $(1,987) $198 MARINE TRANSPORTATION PERFORMANCE MEASUREMENTS

Second Quarter Six Months 2005 2004 2005 2004 Ton Miles (in

millions) (B) 4,135 4,321 7,873 8,056 Revenue/Ton Mile (cents/tm)

(C) 4.1 3.5 4.2 3.5 Towboats operated (average) (D) 241 237 241 234

Delay Days (E) 1,790 1,822 5,079 4,181 Average cost per gallon of

fuel consumed $1.55 $1.01 $1.44 $1.00 Tank barges: Active 887 887

Inactive 65 43 Barrel capacities (in millions): Active 16.6 16.3

Inactive 1.2 .8 (A) Kirby has historically evaluated its operating

performance using numerous measures, one of which is EBITDA, a

non-GAAP financial measure. Kirby defines EBITDA as net earnings

before interest expense, taxes on income, depreciation and

amortization. EBITDA is presented because of its wide acceptance as

a financial indicator. EBITDA is one of the performance measures

used in Kirby's incentive bonus plan. EBITDA is also used by rating

agencies in determining Kirby's credit rating and by analysts

publishing research reports on Kirby, as well as by investors and

investment bankers generally in valuing companies. EBITDA is not a

calculation based on generally accepted accounting principles and

should not be considered as an alternative to, but should only be

considered in conjunction with, Kirby's GAAP financial information.

(B) Ton miles indicate fleet productivity by measuring the distance

(in miles) a loaded tank barge is moved. Example: A typical 30,000

barrel tank barge loaded with 3,300 tons of liquid cargo is moved

100 miles, thus generating 330,000 ton miles. (C) Marine

transportation revenues divided by ton miles. Example: Second

quarter 2005 revenues of $170,742,000 divided by 4,135,000,000 ton

miles = 4.1 cents. (D) Towboats operated are the average number of

owned and chartered towboats operated during the period. (E) Delay

days measures the lost time incurred by a tow (towboat and tank

barges) during transit. The measure includes transit delays caused

by weather, lock congestion and other navigational factors.

DATASOURCE: Kirby Corporation CONTACT: Steve Holcomb of Kirby

Corporation, +1-713-435-1135 Web site: http://www.kirbycorp.com/

http://audioevent.mshow.com/247040

Copyright

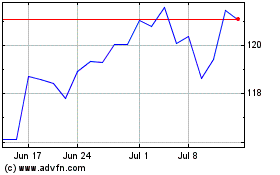

Kirby (NYSE:KEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

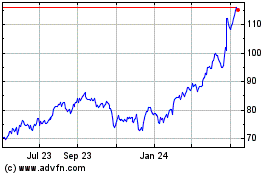

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024