Johnson & Johnson, J.M. Smucker, Best Buy: Stocks That Defined The Week

August 30 2019 - 6:56PM

Dow Jones News

By Francesca Fontana

J.M. Smucker Co.

Sales are suddenly not so sweet for J.M. Smucker. The causes?

Coffee, peanut butter and pet food. The company said falling prices

for coffee and peanut butter, two of its key products, dragged

sales down in its latest quarter. Smucker's pet-food business faced

significant competition as other pet-food makers lowered prices for

higher-end products to draw in consumers. Smucker bought the

producer of the Rachael Ray Nutrish pet-food brand last year for

$1.7 billion. Its rival General Mills Inc. has been expanding

distribution of Blue Buffalo pet food products. Shares fell 8.2%

Tuesday.

Altria Group Inc.

Two tobacco giants struggling with shrinking demand for their

core product are trying to think beyond cigarettes. Altria and

Philip Morris International Inc. are in advanced talks to merge,

The Wall Street Journal reported Tuesday, in a deal that would

reunite businesses that split apart in 2008. They still hold the

same portfolio of cigarettes, including Marlboro. But both

companies have been struggling with declining cigarette

consumption. They plan to jointly start selling a cigarette

alternative in September. Altria shares added 1.3% Wednesday, and

Philip Morris shares gained 3.7%.

Best Buy Co.

Best Buy can't buy a break from the U.S.-China trade war. Its

shares fell 8% Thursday after the electronics retailer cited

tariffs as a factor in disappointing second-quarter sales and a

narrowing of its revenue forecast for the year. Chief Executive

Officer Corie Barry, who took over the top job in June, said

Chinese-made goods account for about 60% of the company's cost of

goods sold, but that there are ways to significantly reduce the

share affected by tariffs. "We're actively engaged in mitigation

efforts to minimize the impact on consumers and our business," Ms.

Barry said.

Bristol-Myers Squibb Co.

Bristol-Myers Squibb took a big step toward acquiring Celgene

Corp. on Monday as the two pharmaceutical companies found a buyer

for a skin treatment. Amgen Inc. agreed to buy the psoriasis

treatment Otezla from Celgene for $13.4 billion in cash. The

decision came after the U.S. Federal Trade Commission raised

anticompetitive concerns related to anti-inflammatory drugs, of

which Otezla is an example. Analysts at JP Morgan Chase JPMorgan

Chase & Co. said in a note to clients there aren't any

additional FTC concerns on the horizon related to the merger with

Celgene. Bristol-Myers shares rose 3.3% Monday.

Dollar Tree Inc.

Some air went out of Dollar Tree after executives blamed a

global helium shortage for some sales weakness in the most recent

quarter. Dollar-store chains Dollar Tree and Dollar General Corp.

both said Thursday that lower-income shoppers who continue to spend

helped sales rise during the quarter, but lost balloon sales during

Mother's Day and Father's Day reduced comparable sales by 0.4%,

said Dollar Tree Chief Executive Officer Gary Philbin on a call

with analysts. Dollar Tree shares fell 1.9% Thursday while rival

Dollar General's shares soared 10.7%.

Papa John's International Inc.

The pizza maker recruited its new boss from the world of roast

beef. Papa John's hired Arby's President Rob Lynch Tuesday as its

chief executive, the company's second change at the top in less

than two years. Mr. Lynch said he was eager to push the chain past

controversy surrounding founder and former CEO John Schnatter and

refocus on its reputation for variety and fresh ingredients. Mr.

Schnatter left Papa John's board in March after using a racial

slur. Shares rose 9.5% after the announcement.

Johnson & Johnson

The opioid legal bills are piling up at big drug companies.

Johnson & Johnson shares rose 1.4% after a judge ruled the

drugmaker must pay $572 million for contributing to an

opioid-addiction crisis in Oklahoma. OxyContin maker Purdue Pharma

LP and its owners, the Sackler family, are in separate talks with

state and local governments to resolve more than 2,000 opioid

cases, The Wall Street Journal reported.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

August 30, 2019 18:41 ET (22:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

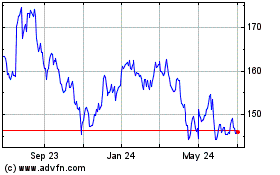

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

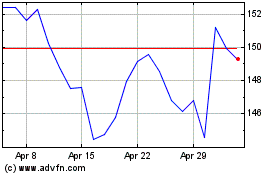

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Sep 2023 to Sep 2024