ITT Corporation (NYSE: ITT) today reported fourth quarter 2007

income from continuing operations of $128 million, or 70 cents per

share. Excluding special items and restructuring costs, income from

continuing operations was $172 million, or 94 cents per share, up

29 percent on strong profit performance from each business segment.

Fourth quarter revenue was up 23 percent year-over-year to $2.5

billion on continued robust growth in the Defense segment and

strong international sales in ITT�s commercial segments. Improved

full-year 2007 margin performance across all segments led to record

income from continuing operations of $633 million, or $3.44 per

share. Excluding the impact of special items and restructuring,

income rose to $650 million, or $3.53 per share, up 24 percent over

the prior year. For the full-year 2007, ITT reported record

revenues of $9.0 billion, a 15 percent improvement, driven by

strong double-digit organic revenue growth. This marks the fourth

straight year of double-digit organic revenue growth. �We are proud

of our performance this quarter and for 2007 on the whole � we set

a high bar and cleared it. On top of outstanding operational

performance, we made significant progress on our strategic plan and

effectively realigned and enhanced our portfolio for long-term

success,� said Steve Loranger, ITT�s chairman, president and chief

executive officer. �Our strong operational capability, combined

with a portfolio that is built to weather economic cycles, gives us

confidence heading into 2008. Despite the uncertainty facing the

U.S. market, we believe our team has effectively positioned the

company to have another strong year and meet our goals.� 2008

Outlook ITT is confirming its full-year 2008 earnings forecast in

the range of $3.80 to $3.95 per share, reflecting anticipated 16 to

20 percent earnings growth over 2007 on a comparable basis. The

company expects top-line revenue to be $11.1 billion to $11.3

billion in 2008, approximately 25 percent higher than 2007 revenue.

Revenue growth expectations include mid-single digit organic growth

and full-year revenues of recent acquisitions, including EDO

Corporation and International Motion Control. In November 2007, ITT

announced that effective with its first quarter 2008 earnings

report it would no longer present restructuring costs within

adjusted earnings figures. In anticipation of this change,

projected restructuring costs of $35-45 million are included in

this earnings forecast. Fourth Quarter and Full-Year Business

Segment Results Defense Electronics & Services Fourth quarter

revenue for the Defense segment was up 24 percent to $1.2 billion,

on strong organic growth from the segment�s services businesses.

Fourth quarter operating income for the segment grew to $125

million. Excluding restructuring, operating income was up 32

percent to $129 million. Full-year 2007 revenue for the segment

reached $4.2 billion, up 14 percent over 2006, led by the strong

year-over-year growth of ITT�s Advanced Engineering & Sciences

and Systems businesses. For the full year, operating income for the

segment was $503 million. Excluding restructuring, operating income

was up 25 percent to $512 million, attributable to high performance

on fixed-price contracts and continued focus on operational

efficiency. On Dec. 20, 2007, ITT closed its acquisition of EDO

Corporation. The agreement to purchase EDO was announced in

September 2007 and approved by EDO shareholders at a special

meeting held two days prior to closing. The acquisition was ITT�s

largest in its history and makes ITT a top 10 U.S. defense

contractor, as measured by revenue. Fluid Technology ITT�s Fluid

Technology segment reported fourth quarter revenue of $985 million,

up 18 percent year-over-year and 11 percent organically. Growth in

the segment was driven by strong international sales in commercial

and industrial end markets, which offset weakness in the U.S.

residential market. Fourth quarter segment operating income was

$125 million. Excluding restructuring, operating income grew 18

percent to $145 million year-over-year. For the full-year 2007, the

segment grew 14 percent on revenues of $3.5 billion and generated

operating income of $433 million. Excluding restructuring,

operating income improved 19 percent to $473 million, driven by

ongoing deployment of operational and productivity improvement

initiatives. Motion & Flow Control Fourth quarter revenue for

the segment was up 41 percent to $370 million, which includes

full-quarter revenues of the recently acquired International Motion

Control. Organic growth for the quarter was also strong at 12

percent, on continued strength in the Aerospace Controls and

Friction Technologies businesses. The segment reported fourth

quarter operating income of $38 million. Excluding restructuring

expenses, operating income improved 37 percent to $50 million.

Full-year 2007 revenue for the Motion & Flow Control segment

was $1.3 billion, up 22 percent over 2006. Operating income grew to

$187 million for the year. Excluding restructuring, segment

operating income of $202 million improved 22 percent, benefiting

from continued focus on operational and lean initiatives. Emerging

Markets Progress During the fourth quarter, ITT made significant

progress against its emerging markets growth strategies by opening

three state-of-the-art manufacturing facilities and a new research

and development center. The new sites serving ITT�s commercial

businesses will focus on customizing and building products designed

to meet the specific needs of customers throughout Asia Pacific, as

well as other markets. ITT opened two advanced manufacturing and

assembly centers in China and one in Poland. The Wuxi, China site

will primarily support ITT�s Motion & Flow Control segment. The

Nanjing, China and Poland plants will primarily develop products

for the Fluid Technology segment. The Nanjing facility is a

showcase of ITT technologies as it deploys an advanced industrial

water treatment system enabling the plant to reuse virtually all

the water needed to operate the facility. During the quarter, the

company also opened an ITT Technology Center, in Vadodara, India,

which was established to meet the specific needs of Indian

customers, and eventually global customers. Income Tax Controls In

the fourth quarter, ITT identified a material weakness specifically

related to income tax accounting controls. The company has

initiated remedial steps to enhance controls in this area, and also

performed additional analyses and post-closing procedures that

reasonably assured the reliability of income tax accounts as of

December 31, 2007. This control issue, which will be more fully

discussed in the company�s 10-K, did not result in the restatement

of, or otherwise materially impact, ITT�s financial statements for

any period. Investor Call Today ITT's senior management will host a

conference call for investors today at 9:00 a.m. Eastern Standard

Time to review fourth quarter and full-year performance and answer

questions. The briefing can be monitored live via webcast at the

following address on the company's Web site: www.itt.com/ir. About

ITT Corporation ITT Corporation (www.itt.com) is a diversified

high-technology engineering and manufacturing company dedicated to

creating more livable environments, enabling communications and

providing protection and safety. The company plays an important

role in vital markets including water and fluids management, global

defense and security, and motion and flow control. ITT employs

approximately 40,000 people serving customers in more than 50

countries. Headquartered in White Plains, N.Y., the company

generated $9 billion in 2007 sales. Safe Harbor Statement Certain

material presented herein includes forward-looking statements

intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995 ("the

Act"). These forward-looking statements include statements that

describe the Company's business strategy, outlook, objectives,

plans, intentions or goals, and any discussion of future operating

or financial performance. Whenever used, words such as

"anticipate," "estimate," "expect," "project," "intend," "plan,"

"believe," "target" and other terms of similar meaning are intended

to identify such forward-looking statements. Forward-looking

statements are uncertain and to some extent unpredictable, and

involve known and unknown risks, uncertainties and other important

factors that could cause actual results to differ materially from

those expressed in, or implied from, such forward-looking

statements. Factors that could cause results to differ materially

from those anticipated by the Company include general global

economic conditions, decline in consumer spending, interest and

foreign currency exchange rate fluctuations, availability of

commodities, supplies and raw materials, competition, acquisitions

or divestitures, changes in government defense budgets, employment

and pension matters, contingencies related to actual or alleged

environmental contamination, claims and concerns, intellectual

property matters, personal injury claims, governmental

investigations, tax obligations, and changes in generally accepted

accounting principles. Other factors are more thoroughly set forth

in Item 1. Business, Item 1A. Risk Factors, and Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations - Forward-Looking Statements in the ITT

Corporation Annual Report on Form 10-K for the fiscal year ended

December 31, 2006, and other of its filings with the Securities and

Exchange Commission. The Company undertakes no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise. ITT Corporation Non-GAAP

Reconciliation Reported vs. Organic Revenue / Orders Growth Fourth

Quarter 2007 & 2006 � � � � � � � � � � � ($ Millions) � � � �

� � � � � � � � � � � � � � � � � (As Reported - GAAP) (As Adjusted

- Organic) � � � Sales & Revenues Sales & Revenues Change %

Change Sales & Revenues Acquisition Contribution FX

Contribution Adj. Sales & Revenues Sales & Revenues Change

% Change 3M 2007 3M 2006 2007 vs. 2006 2007 vs. 2006 3M 2007 3M

2007 3M 2007 3M 2007 3M 2006 Adj. 07 vs. 06 Adj. 07 vs. 06 � � �

ITT Corporation - Consolidated 2,528.7 2,051.3 477.4 23.3 % 2,528.7

(108.4 ) (76.5 ) 2,343.8 2,051.3 292.5 14.3 % � Defense Electronics

& Services 1,177.9 952.3 225.6 23.7 % 1,177.9 (52.6 ) (0.2 )

1,125.1 952.3 172.8 18.1 % Communications Systems 222.4 204.0 18.4

9.0 % 222.4 0.0 0.0 222.4 204.0 18.4 9.0 % Space Systems 166.7

156.3 10.4 6.7 % 166.7 0.0 (0.2 ) 166.5 156.3 10.2 6.5 % Advanced

Engineering & Sciences 144.8 89.8 55.0 61.2 % 144.8 (3.4 ) 0.0

141.4 89.8 51.6 57.5 % Electronic Systems 100.4 88.2 12.2 13.8 %

100.4 0.0 0.0 100.4 88.2 12.2 13.8 % Night Vision 125.5 118.4 7.1

6.0 % 125.5 0.0 0.0 125.5 118.4 7.1 6.0 % Systems 372.9 299.0 73.9

24.7 % 372.9 0.0 0.0 372.9 299.0 73.9 24.7 % EDO 49.2 0.0 49.2 NA

49.2 (49.2 ) 0.0 0.0 0.0 0.0 0.0 % � � Fluid Technology 985.2 838.8

146.4 17.5 % 985.2 0.0 (55.0 ) 930.2 838.8 91.4 10.9 % Industrial

Process 192.0 155.7 36.3 23.3 % 192.0 0.0 (1.8 ) 190.2 155.7 34.5

22.2 % Residential and Commercial Water Group 304.2 271.7 32.5 12.0

% 304.2 0.0 (12.8 ) 291.4 271.7 19.7 7.3 % Water & WasteWater

500.9 420.5 80.4 19.1 % 500.9 0.0 (41.2 ) 459.7 420.5 39.2 9.3 % �

� � Motion & Flow Control 370.2 263.1 107.1 40.7 % 370.2 (55.8

) (20.2 ) 294.2 263.1 31.1 11.8 % Aerospace Controls 26.6 20.3 6.3

31.0 % 26.6 (0.7 ) 0.0 25.9 20.3 5.6 27.6 % Flow Control 62.8 51.2

11.6 22.7 % 62.8 (7.9 ) (2.6 ) 52.3 51.2 1.1 2.1 % Friction

Technologies 101.9 75.3 26.6 35.3 % 101.9 0.0 (11.3 ) 90.6 75.3

15.3 20.3 % Energy Absoprption 68.8 22.4 46.4 207.1 % 68.8 (42.3 )

(2.4 ) 24.1 22.4 1.7 7.6 % IMC Controls 16.5 0.0 16.5 0.0 % 16.5

(16.5 ) 0.0 0.0 0.0 0.0 0.0 % Interconnect Solutions 104.8 93.9

10.9 11.6 % 104.8 0.0 (3.9 ) 100.9 93.9 7.0 7.5 % � � Orders Orders

Change % Change Orders Acquisition Contribution FX Contribution

Adj. Orders Orders Change % Change 3M 2007 3M 2006 2007 vs. 2006

2007 vs. 2006 3M 2007 3M 2007 � 3M 2007 � 3M 2007 3M 2006 Adj. 07

vs. 06 Adj. 07 vs. 06 � � Defense Electronics & Services

1,401.6 1,211.7 189.9 16 % 1,401.6 (2.2 ) (0.2 ) 1,399.2 1,211.7

187.5 15.5 % � Fluid Technology 907.7 762.5 145.2 19 % 907.7 0.0

(49.6 ) 858.1 762.5 95.6 12.5 % � Motion & Flow Control 414.9

275.1 139.8 51 % 414.9 (83.7 ) (22.9 ) 308.3 275.1 33.2 12.1 % �

Total Segment Orders 2,720.5 2,243.7 476.8 21 % 2,720.5 (85.9 )

(75.7 ) 2,558.9 2,243.7 315.2 14.0 % � Note: Excludes intercompany

eliminations. ITT Corporation Non-GAAP Reconciliation Reported vs.

Organic Revenue / Orders Growth Full Year 2007 & 2006 � � � � �

� � � � � � ($ Millions) � � � � � � � � � � � � � � � � � � � �

(As Reported - GAAP) (As Adjusted - Organic) � � Sales &

Revenues Sales & Revenues Change % Change Sales & Revenues

Acquisition Contribution FX Contribution Adj. Sales & Revenues

Sales & Revenues Change % Change FY 2007 FY 2006 2007 vs. 2006

2007 vs. 2006 FY 2007 FY 2007 FY 2007 FY 2007 FY 2006 Adj. 07 vs.

06 Adj. 07 vs. 06 � � ITT Corporation - Consolidated 9,003.3

7,807.9 1,195.4 15.3 % 9,003.3 (150.6 ) (198.6 ) 8,654.1 7,807.9

846.2 10.8 % � Defense Electronics & Services 4,176.2 3,659.3

516.9 14.1 % 4,176.2 (54.6 ) (0.6 ) 4,121.0 3,659.3 461.7 12.6 %

Communications Systems 805.4 757.9 47.5 6.3 % 805.4 (0.8 ) 0.0

804.6 757.9 46.7 6.2 % Space Systems 605.8 626.8 (21.0 ) -3.4 %

605.8 0.0 (0.6 ) 605.2 626.8 (21.6 ) -3.4 % Advanced Engineering

& Sciences 480.8 326.8 154.0 47.1 % 480.8 (4.6 ) 0.0 476.2

326.8 149.4 45.7 % Electronic Systems 409.6 371.7 37.9 10.2 % 409.6

0.0 0.0 409.6 371.7 37.9 10.2 % Night Vision 484.7 419.8 64.9 15.5

% 484.7 0.0 0.0 484.7 419.8 64.9 15.5 % Systems 1353.7 1164.3 189.4

16.3 % 1,353.7 0.0 0.0 1,353.7 1,164.3 189.4 16.3 % EDO 49.2 0.0

49.2 NA 49.2 (49.2 ) 0.0 0.0 0.0 0.0 0.0 % � Fluid Technology

3,509.1 3,070.1 439.0 14.3 % 3,509.1 (26.8 ) (138.4 ) 3,343.9

3,070.1 273.8 8.9 % Industrial Process 703.9 595.6 108.3 18.2 %

703.9 0.0 (5.2 ) 698.7 595.6 103.1 17.3 % Residential and

Commercial Water Group 1,183.3 1,086.6 96.7 8.9 % 1,183.3 (1.4 )

(33.7 ) 1,148.2 1,086.6 61.6 5.7 % Water & WasteWater 1,663.3

1,419.2 244.1 17.2 % 1,663.3 (25.4 ) (101.5 ) 1,536.4 1,419.2 117.2

8.3 % � � � Motion & Flow Control 1,332.5 1,092.9 239.6 21.9 %

1,332.5 (69.2 ) (58.7 ) 1,204.6 1,092.9 111.7 10.2 % Aerospace

Controls 101.3 82.7 18.6 22.5 % 101.3 (3.0 ) 0.0 98.3 82.7 15.6

18.9 % Flow Control 251.6 224.4 27.2 12.1 % 251.6 (7.9 ) (9.1 )

234.6 224.4 10.2 4.5 % Friction Technologies 393.4 318.4 75.0 23.6

% 393.4 0.0 (31.9 ) 361.5 318.4 43.1 13.5 % Energy Absoprption

144.3 87.2 57.1 65.5 % 144.3 (42.3 ) (6.7 ) 95.3 87.2 8.1 9.3 % IMC

Controls 16.5 0.0 16.5 0.0 % 16.5 (16.5 ) 0.0 0.0 0.0 0.0 0.0 %

Interconnect Solutions 425.6 380.2 45.4 11.9 % 425.6 0.0 (11.0 )

414.6 380.2 34.4 9.0 % � � Orders Orders Change % Change Orders

Acquisition Contribution FX Contribution Adj. Orders Orders Change

% Change FY 2007 FY 2006 2007 vs. 2006 2007 vs. 2006 FY 2007 FY

2007 FY 2007 FY 2007 FY 2006 Adj. 07 vs. 06 Adj. 07 vs. 06 �

Defense Electronics & Services 4,073.9 4,118.0 (44.1 ) -1 %

4,073.9 (4.2 ) (0.6 ) 4,069.1 4,118.0 (48.9 ) -1.2 % � Fluid

Technology 3,657.1 3,144.1 513.0 16 % 3,657.1 (20.8 ) (139.1 )

3,497.2 3,144.1 353.1 11.2 % � Motion & Flow Control 1,399.3

1,141.4 257.9 23 % 1,399.3 (86.0 ) (63.1 ) 1,250.2 1,141.4 108.8

9.5 % � Total Segment Orders 9,118.1 8,391.7 726.4 9 % 9,118.1

(111.0 ) (205.5 ) 8,801.6 8,391.7 409.9 4.9 % � Note: Excludes

intercompany eliminations. ITT Corporation Non-GAAP Reconciliation

Segment Operating Income & OI Margin Adjusted for Restructuring

Fourth Quarter of 2007 & 2006 � � � � � � � � � � ($ Millions)

� � � � � � � � � � Q4 2007 As Reported Q4 2006 As Reported %

Change 07vs. 06 Q4 2007 As Reported Adjust for 2007 Restructuring

Q4 2007 As Adjusted Q4 2006 As Reported Adjust for 2006

Restructuring Q4 2006 As Adjusted % Change Adj.07 vs. 06 � � Sales

and Revenues: Defense Electronics & Services 1,177.9 952.3

1,177.9 1,177.9 952.3 952.3 Fluid Technology 985.2 838.8 985.2

985.2 838.8 838.8 Motion & Flow Control 370.2 263.1 370.2 370.2

263.1 263.1 Intersegment eliminations (4.6 ) (2.9 ) (4.6 ) (4.6 )

(2.9 ) (2.9 ) Total Sales and Revenues 2,528.7 � 2,051.3 � 2,528.7

� 2,528.7 � 2,051.3 � 2,051.3 � � Operating Margin: Defense

Electronics & Services 10.6 % 10.0 % 10.6 % 10.9 % 10.0 % 10.3

% 60 BP Fluid Technology 12.7 % 12.9 % 12.7 % 14.7 % 12.9 % 14.7 %

- BP Motion & Flow Control 10.3 % 13.6 % 10.3 % 13.6 % 13.6 %

13.9 % (30 ) BP Total Ongoing Segments 11.4 % 11.7 % 11.4 % 12.8 %

11.7 % 12.6 % 20 BP � � Income: Defense Electronics & Services

125.4 95.3 31.6 % 125.4 3.4 128.8 95.3 2.5 97.8 31.7 % Fluid

Technology 125.4 108.2 15.9 % 125.4 19.6 145.0 108.2 15.2 123.4

17.5 % Motion & Flow Control 38.0 � 35.9 � 5.8 % 38.0 � 12.2

50.2 � 35.9 � 0.7 36.6 � 37.2 % Total Segment Operating Income

288.8 � 239.4 � 20.6 % 288.8 � 35.2 324.0 � 239.4 � 18.4 257.8 �

25.7 % ITT Corporation Non-GAAP Reconciliation Segment Operating

Income & OI Margin Adjusted for Restructuring Full Year 2007

& 2006 � � � � � � � � � � ($ Millions) � � � � � � � � � � FY

2007 As Reported FY 2006 As Reported % Change 07vs. 06 FY 2007 As

Reported Adjust for 2007 Restructuring FY 2007 As Adjusted FY 2006

As Reported Adjust for 2006 Restructuring FY 2006 As Adjusted %

Change Adj.07 vs. 06 � Sales and Revenues: Defense Electronics

& Services 4,176.2 3,659.3 4,176.2 4,176.2 3,659.3 3,659.3

Fluid Technology 3,509.1 3,070.1 3,509.1 3,509.1 3,070.1 3,070.1

Motion & Flow Control 1,332.5 1,092.9 1,332.5 1,332.5 1,092.9

1,092.9 Intersegment eliminations (14.5 ) (14.4 ) (14.5 ) (14.5 )

(14.4 ) (14.4 ) Total Sales and Revenues 9,003.3 � 7,807.9 �

9,003.3 � 9,003.3 � 7,807.9 � 7,807.9 � � Operating Margin: Defense

Electronics & Services 12.0 % 11.0 % 12.0 % 12.3 % 11.0 % 11.2

% 110 BP Fluid Technology 12.3 % 12.1 % 12.3 % 13.5 % 12.1 % 12.9 %

60 BP Motion & Flow Control 14.1 % 13.7 % 14.1 % 15.2 % 13.7 %

15.2 % - BP Total Ongoing Segments 12.5 % 11.8 % 12.5 % 13.2 % 11.8

% 12.5 % 70 BP � � Income: Defense Electronics & Services 502.7

404.3 24.3 % 502.7 9.7 512.4 404.3 6.3 410.6 24.8 % Fluid

Technology 432.7 370.6 16.8 % 432.7 39.9 472.6 370.6 26.7 397.3

19.0 % Motion & Flow Control 187.4 � 149.7 � 25.2 % 187.4 �

14.9 202.3 � 149.7 � 16.5 166.2 � 21.7 % Total Segment Operating

Income 1,122.8 � 924.6 � 21.4 % 1,122.8 � 64.5 1,187.3 � 924.6 �

49.5 974.1 � 21.9 % ITT Corporation Non-GAAP Reconciliation

Reported vs. Adjusted Net Income & EPS Fourth Quarter of 2007

& 2006 � � � � � � � � ($ Millions, except EPS and shares) �

Change Percent Change Q4 2007 Q4 2007 Q4 2007 Q4 2006 Q4 2006 Q4

2006 2007 vs. 2006 2007 vs. 2006 As Reported Adjustments As

Adjusted As Reported � Adjustments As Adjusted As Adjusted As

Adjusted � � � � � � � Segment Operating Income 288.8 35.2 #A 324.0

239.4 18.4 #D 257.8 � � Interest Income (Expense) (27.6) - (27.6)

(14.8) - (14.8) Other Income (Expense) (2.8) - (2.8) 0.7 - 0.7

Corporate (Expense) (39.8) (0.2) #A (40.0) (39.7) 1.3 #D (38.4) � �

� � � � Income from Continuing Operations before Tax 218.6 35.0

253.6 185.6 19.7 205.3 � � Income Tax Items (20.0) 20.0 #B - (2.4)

2.2 #E (0.2) Income Tax Expense (70.2) (11.2) #C (81.4) (61.3)

(6.4) #F (67.7) � � � � � � Total Tax Expense (90.2) 8.8 (81.4)

(63.7) (4.2) (67.9) � � � � � � Income from Continuing Operations

128.4 43.8 172.2 121.9 15.5 137.4 � � � � � � � � Diluted EPS from

Continuing Operations 0.70 0.24 0.94 0.65 0.08 0.73 $0.21 28.8% � �

#A - Remove Restructuring Expense of $35.2M and ($0.2M). #B -

Remove Tax Charge of $20.0M and apply structural tax rate impact in

Q4. #C - Remove Tax Benefit on restructuring of ($11.2M). #D -

Remove Restructuring Expense of $18.4M and $1.3M. #E - Remove Tax

Charge of $2.4M and apply structural tax rate impact in Q4. #F -

Remove Tax Benefit on restructuring of ($6.4M). ITT Corporation

Non-GAAP Reconciliation Reported vs. Adjusted Net Income & EPS

Full Year 2007 & 2006 � � � � � � � � ($ Millions, except EPS

and shares) � Change Percent Change FY 2007 FY 2007 FY 2007 FY 2006

FY 2006 FY 2006 2007 vs. 2006 2007 vs. 2006 As Reported Adjustments

� As Adjusted As Reported Adjustments � As Adjusted As Adjusted As

Adjusted � � � � � � � Segment Operating Income 1,122.8 � 64.5 � #A

1,187.3 � 924.6 � 49.5 � #E 974.1 � � � Interest Income (Expense)

(65.3 ) (7.0 ) #B (72.3 ) (60.8 ) (60.8 ) Other Income (Expense)

(13.4 ) - (13.4 ) (12.9 ) - (12.9 ) Corporate (Expense) (145.6 )

1.6 � #A (144.0 ) (123.6 ) 2.2 � #E (121.4 ) � � � � � � Income

from Continuing Operations before Tax 898.5 � 59.1 � 957.6 � 727.3

� 51.7 � 779.0 � � � Income Tax Items 20.6 (20.6 ) #C - 0.2 (0.5 )

#F (0.3 ) Income Tax Expense (286.1 ) (21.2 ) #D (307.3 ) (227.8 )

(16.2 ) #G (244.0 ) � � � � � � Total Tax Expense (265.5 ) (41.8 )

(307.3 ) (227.6 ) (16.7 ) (244.3 ) � � � � � � Income from

Continuing Operations 633.0 � 17.3 � 650.3 � 499.7 � 35.0 � 534.7 �

� � � � � � � � Diluted EPS from Continuing Operations 3.44 � 0.09

� 3.53 � 2.67 � 0.18 � 2.85 � $0.68 23.9 % � � #A - Remove

Restructuring Expense of $64.5M and $1.6M. #B - Remove Interest

Adjustment on Tax Audit Settlement of ($7.0M). #C - Remove Tax

Benefit of ($20.6M). #D - Remove Tax Benefit on restructuring of

($21.2M). #E - Remove Restructuring Expense of $49.5M and $2.2M. #F

- Remove Tax Benefit of ($0.2M) and apply structural tax rate

impact in Q4. #G - Remove Tax Benefit on restructuring of ($16.2M).

ITT Corporation Non-GAAP Reconciliation Cash From Operating

Activities vs. Free Cash Flow 2007 & 2006 � ($ Millions) � � �

� � 2007 2006 � Net Cash - Operating Activities 798.1 780.7 �

Capital Expenditures (239.3 ) (177.1 ) � Cash Payment re

sale/leaseback 44.8 - � Pension Pre-funding, net of tax 50.0 � 82.0

� � Free Cash Flow 653.6 � 685.6 � ITT CORPORATION AND SUBSIDIARIES

CONSOLIDATED CONDENSED INCOME STATEMENTS (In millions, except per

share) (Unaudited) � � Three Months Ended Twelve Months Ended

December 31, December 31, 2007 � 2006 2007 � 2006 � Sales and

revenues $ 2,528.7 $ 2,051.3 � $ 9,003.3 $ 7,807.9 � Costs of sales

and revenues 1,828.1 1,458.9 6,435.0 5,618.4 Selling, general and

administrative expenses 364.2 331.7 1,342.7 1,175.9 Research and

development expenses 52.4 41.3 182.3 160.9 Restructuring and asset

impairment charges, net � 35.0 � 19.7 � � 66.1 � 51.7 Total costs

and expenses 2,279.7 1,851.6 8,026.1 7,006.9 � Operating income

249.0 199.7 977.2 801.0 Interest expense 46.2 25.4 114.9 86.2

Interest income 18.6 10.6 49.6 25.4 Miscellaneous (income) expense,

net � 2.8 � (0.7 ) � 13.4 � 12.9 Income from continuing operations

before income taxes 218.6 185.6 898.5 727.3 Income tax expense �

90.2 � 63.7 � � 265.5 � 227.6 Income from continuing operations

128.4 121.9 633.0 499.7 Discontinued operations, net of tax � 29.9

� 18.9 � � 109.1 � 81.4 Net income $ 158.3 $ 140.8 � $ 742.1 $

581.1 � � � Earnings Per Share: Income from continuing operations:

Basic $ 0.71 $ 0.66 $ 3.51 $ 2.71 Diluted $ 0.70 $ 0.65 $ 3.44 $

2.67 Discontinued operations: Basic $ 0.17 $ 0.10 $ 0.60 $ 0.44

Diluted $ 0.16 $ 0.10 $ 0.59 $ 0.43 Net income: Basic $ 0.88 $ 0.76

$ 4.11 $ 3.15 Diluted $ 0.86 $ 0.75 $ 4.03 $ 3.10 � � Average

Common Shares � Basic 180.5 184.0 180.6 184.3 Average Common Shares

� Diluted 183.9 187.1 184.0 187.4 ITT CORPORATION AND SUBSIDIARIES

CONSOLIDATED CONDENSED BALANCE SHEETS (In millions) (Unaudited) � �

December 31, December 31, 2007 2006 Assets Current Assets: Cash and

cash equivalents $ 1,840.0 $ 937.1 Receivables, net 1,935.0 1,288.9

Inventories, net 890.4 726.5 Assets of discontinued businesses held

for sale 5.0 183.2 Deferred income taxes 110.1 79.8 Other current

assets � 156.3 � 102.8 Total current assets 4,936.8 3,318.3 Plant,

property and equipment, net 980.3 833.0 Deferred income taxes 28.5

136.1 Goodwill, net 3,806.9 2,336.8 Other intangible assets, net

733.0 213.2 Other assets � 1,050.2 � 563.2 Total assets $ 11,535.7

$ 7,400.6 � Liabilities and Shareholders' Equity Current

Liabilities: Accounts payable $ 1,296.8 $ 929.4 Accrued expenses

938.0 839.4 Accrued taxes 40.9 105.6 Notes payable and current

maturities of long-term debt 3,083.0 597.0 Pension and

postretirement benefits 68.5 68.9 Liabilities of discontinued

businesses held for sale 1.0 96.7 Deferred income taxes � 8.2 � 0.2

Total current liabilities 5,436.4 2,637.2 � Pension and

postretirement benefits 764.6 735.5 Long-term debt 483.0 500.4

Other liabilities � 921.0 � 658.1 Total liabilities 7,605.0 4,531.2

� Shareholders' equity � 3,930.7 � 2,869.4 Total liabilities and

shareholders' equity $ 11,535.7 $ 7,400.6 ITT CORPORATION AND

SUBSIDIARIES CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (In

millions) (Unaudited) � Twelve Months Ended December 31, 2007 �

2006 Operating Activities Net income $ 742.1 $ 581.1 Less: Income

from discontinued operations � (109.1 ) � (81.4 ) Income from

continuing operations 633.0 499.7 � Adjustments to income from

continuing operations: Depreciation and amortization 185.4 171.6

Stock-based compensation 34.6 22.9 Restructuring and asset

impairment charges, net 66.1 51.7 Payments for restructuring (51.5

) (43.4 ) Change in receivables (236.7 ) (61.2 ) Change in

inventories 111.8 (101.4 ) Change in accounts payable and accrued

expenses 137.2 246.4 Change in accrued and deferred taxes (34.1 )

30.3 Change in other current and non-current assets (106.0 ) (74.0

) Change in other current and non-current liabilities 47.2 30.7

Other, net � 11.1 � � 7.4 � Net cash � operating activities � 798.1

� � 780.7 � � � Investing Activities Additions to plant, property

and equipment (239.3 ) (177.1 ) Acquisitions, net of cash acquired

(1,780.2 ) (89.5 ) Proceeds from sale of assets and businesses

283.6 226.6 Other, net � 6.8 � � (6.3 ) Net cash � investing

activities � (1,729.1 ) � (46.3 ) � Financing Activities Short-term

debt, net 2,311.9 (155.6 ) Long-term debt repaid (244.2 ) (13.3 )

Long-term debt issued 0.5 0.5 Repurchase of common stock (299.0 )

(210.0 ) Proceeds from issuance of common stock 65.4 69.0 Dividends

paid (96.6 ) (77.6 ) Tax benefit from stock option exercises 15.0

16.7 Other, net � (0.9 ) � 0.1 � Net cash � financing activities �

1,752.1 � � (370.2 ) � Exchange Rate Effects on Cash and Cash

Equivalents 103.0 50.6 Net Cash � Discontinued Operations:

Operating Activities (16.2 ) 80.2 Investing Activities (4.0 ) (9.3

) Financing Activities � (1.0 ) � 0.4 � � Net change in cash and

cash equivalents 902.9 486.1 Cash and cash equivalents � beginning

of year � 937.1 � � 451.0 � Cash and Cash Equivalents � end of

period $ 1,840.0 � $ 937.1 �

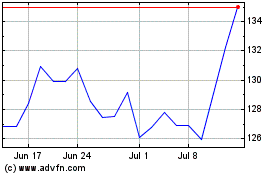

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

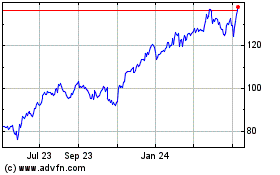

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2023 to Jul 2024