- Earnings excluding special items are $0.80 per share, up 18

percent, and up 21 percent excluding the impact of the adoption of

SFAS-123R WHITE PLAINS, N.Y., July 28 /PRNewswire-FirstCall/ -- ITT

Corporation (NYSE:ITT) today reported record second quarter 2006

net income of $140.9 million or $0.75 per share, including $8.3

million or $0.05 per share net impact of restructuring and

discontinued operations. Excluding special items, 2006 second

quarter earnings from continuing operations grew 18 percent to

$0.80 per share over the second quarter 2005. Excluding the ($0.02)

per share impact of the adoption of SFAS-123R, earnings for the

quarter grew 21 percent compared to the second quarter of 2005.

Second quarter 2006 revenue was $2.07 billion, up 11 percent over

the same period last year, with organic revenue growth of 10

percent. "Our entire team performed extremely well in the second

quarter, delivering results that surpassed our expectations and

bolstering our confidence for the full year. We are raising our

guidance for the year to reflect this strong performance," said

Steve Loranger, Chairman, President and Chief Executive Officer.

"ITT continues to deliver solid revenue growth, particularly

organic growth. This speaks to our performance in the marketplace,

delivering the products and services demanded by our customers. "I

attribute these results to the capabilities of our management team,

our diverse portfolio, and the strength of the ITT Management

System," Loranger said. "I am pleased that we are delivering

consistent results, quarter after quarter, in spite of the normal

fluctuations in market demand and rising material costs." 2006

Outlook and Beyond "As always, we are closely watching the current

economic climate and its potential effects on our business,"

Loranger added. "We believe we are particularly well positioned in

our Fluid Technology markets to benefit from the growing demand for

water-related products and services. We have well-established

product brands, a large installed base and a growing position in

developing markets like China. Our Defense business continues to

grow because of the critical needs being addressed through our

unique technologies and the broad range of services we provide.

Based on our solid performance through the first half and our

outlook for the rest of the year, we are raising our full-year

earnings forecast excluding special items from a range of $2.91 -

$2.97 to $2.95 - $3.00 per share, up 14 - 16 percent compared to

2005, including the estimated ($0.09) per share impact from the

adoption of SFAS-123R. Excluding the impact of the adoption of

SFAS-123R, our outlook for full year 2006 earnings from continuing

operations excluding special items would be up 17 - 19 percent.

"We're also raising our 2006 full-year revenue guidance from a

range of $7.90 - $8.01 billion to $8.08 - $8.17 billion. Our

performance in the record second quarter and this positive outlook

for the remainder of the year underscores the attractive market

positions we have in both our commercial and defense businesses.

These favorable positions, along with our focus on operational

excellence and a disciplined acquisition strategy, reinforce the

confidence we have in meeting our long term financial goals."

Primary Business Results Fluid Technology -- Second quarter 2006

Fluid Technology revenue was $765.3 million, up $40.6 million or 6

percent; organic revenues grew 4 percent over the same period in

2005, led by the Water/Wastewater Handling and Building Trades

businesses. Operating income was $101.3 million for the second

quarter, including the impact of restructuring. Excluding

restructuring, second quarter operating income was up 9 percent to

$103.3 million. -- Operating margins, excluding restructuring, grew

by 40 basis points in the quarter, as a result of ongoing Value

Based Six Sigma and Lean initiatives. -- Total orders for the

second quarter were up 7%, and organic orders were up 5% compared

to the second quarter of 2005. -- The acquisition of F.B. Leopold,

announced during the quarter, adds an important pre-treatment

component to ITT's already wide range of filtration and treatment

capabilities. Defense Electronics & Services -- ITT's Defense

Electronics & Services segment reported second quarter revenues

of $918.5 million, up 18 percent, over the same period last year,

led by increases in the Services, Electronic Systems,

Communications and Night Vision businesses. -- Higher volume,

better yields and contract performance drove second quarter

operating results. Second quarter operating income for the segment

was $100.6 million, including the impact of restructuring.

Excluding restructuring, operating income was up 19 percent in the

quarter to $101.4 million over the comparative period in 2005. --

The Aerospace Communications business led revenue growth at Defense

in the second quarter. Production increased to a rate of 5,000

Single Channel Ground-Air Radio System (SINCGARS) radios per month

to meet increased demand. In August, the group will achieve the

production milestone of 300,000 radios over the life of the

SINCGARS program. -- Consistent with the variable nature of Defense

orders, second quarter orders declined to $636 million. Our order

activity is expected to be robust in the second half of 2006 and

full-year Defense orders, sales, and operating income are all on

track to show continued strong growth. -- The long-term outlook for

Defense is positive, driven by demand for products featuring ITT's

next-generation technology and the ongoing growth in the

outsourcing of military services such as those provided by ITT.

Motion & Flow Control -- 2006 second quarter revenues for ITT's

Motion & Flow Control segment were $188.1 million, up 4 percent

from the second quarter last year. -- 2006 second quarter operating

income for the segment was $30.9 million, including the impact of

restructuring. Excluding restructuring, operating income for this

segment was $38.1 million, up 1 percent from the same quarter in

2005. -- On an organic basis, Motion & Flow Control orders grew

12 percent compared to the second quarter of 2005, led by 18

percent order growth in Aerospace Controls and 16 percent in

Friction Materials. Aerospace Controls, which produces fuel valves

and other components, continues to benefit from the strength in the

regional and business jet segment. Electronic Components -- 2006

second quarter revenues for the Electronic Components segment were

$200.8 million, up 11 percent over the same period in 2005. Organic

revenue grew 10 percent, fueled by growth in cellular handsets and

transportation markets. Operating income for the second quarter was

$21.3 million. Excluding restructuring, operating income was up 133

percent over the second quarter last year, and operating margins

grew 550 basis points compared to the second quarter of 2005,

primarily driven by volume growth and operational improvements. --

2006 second quarter order intake at Electronic Components exceeded

$200 million for the second consecutive quarter, up 9 percent over

the second quarter of 2005 on an organic basis. This increase is

primarily attributable to growth in the cellular handset market, as

well as the transportation and military/aerospace sectors. The

segment's 2006 second quarter book-to-bill ratio was positive at

1.01. -- The process to prepare Electronic Components' Switches

business for disposition is progressing. Ongoing efforts to improve

and manage the business to create value are yielding results

evident in its performance during the second quarter. About ITT

Corporation ITT Corporation (http://www.itt.com/) supplies advanced

technology products and services in several growth markets. ITT is

a global leader in the transport, treatment and control of water,

wastewater and other fluids. The company plays a vital role in

international security through its defense communications and

electronics products; space surveillance and intelligence systems;

and advanced engineering and related services. It also serves the

growing leisure marine and electronic components market with a wide

range of products. Headquartered in White Plains, NY, the company

generated $7.4 billion in 2005 sales. In addition to the New York

Stock Exchange, NYSE Arca, ITT Corporation stock is traded on the

Paris, London and Frankfurt exchanges. For free B-roll/video

content and logo about ITT Corporation, please log onto

http://www.thenewsmarket.com/ITT to preview and request video. You

can receive broadcast-standard video quality digitally or by tape

from this site. Registration and video are free to the media. "Safe

Harbor Statement" under the Private Securities Litigation Reform

Act of 1995 ("the Act"): Certain material presented herein includes

forward-looking statements intended to qualify for the safe harbor

from liability established by the Act. These forward-looking

statements include statements that describe the Company's business

strategy, outlook, objectives, plans, intentions or goals, and any

discussion of future operating or financial performance. Whenever

used, words such as "anticipate," "estimate," "expect," "project,"

"intend," "plan," "believe," "target" and other terms of similar

meaning are intended to identify such forward-looking statements.

Forward-looking statements are uncertain and to some extent

unpredictable, and involve known and unknown risks, uncertainties

and other important factors that could cause actual results to

differ materially from those expressed in, or implied from, such

forward-looking statements. Factors that could cause results to

differ materially from those anticipated by the Company include

general global economic conditions, decline in consumer spending,

interest and foreign currency exchange rate fluctuations,

availability of commodities, supplies and raw materials,

competition, acquisitions or divestitures, changes in government

defense budgets, employment and pension matters, contingencies

related to actual or alleged environmental contamination, claims

and concerns, intellectual property matters, personal injury

claims, governmental investigations, tax obligations, and changes

in generally accepted accounting principles. Other factors are more

thoroughly set forth in Item 1. Business, Item 1A. Risk Factors,

and Item 7. Management's Discussion and Analysis of Financial

Condition and Results of Operations -- Forward-Looking Statements

in the ITT Industries, Inc. Annual Report on Form 10-K for the

fiscal year ended December 31, 2005, and other of its filings with

the Securities and Exchange Commission. The Company undertakes no

obligation to update any forward- looking statements, whether as a

result of new information, future events or otherwise. ITT

CORPORATION AND SUBSIDIARIES CONSOLIDATED CONDENSED INCOME

STATEMENTS (In millions, except per share) (Unaudited) Three Months

Ended Six Months Ended June 30, June 30, 2006 2005 2006 2005 Sales

and revenues $2,067.9 $1,863.9 $3,954.6 $3,629.8 Costs of sales and

revenues 1,491.9 1,353.0 2,875.4 2,649.4 Selling, general and

administrative expenses 295.5 262.5 565.8 525.4 Research and

development expenses 43.7 44.6 86.4 88.9 Restructuring and asset

impairment charges 10.0 5.7 25.1 24.1 Total costs and expenses

1,841.1 1,665.8 3,552.7 3,287.8 Operating income 226.8 198.1 401.9

342.0 Interest expense 21.5 13.9 41.4 34.0 Interest income 4.8 5.5

8.5 19.7 Miscellaneous expense, net 4.2 5.5 9.5 10.5 Income from

continuing operations before income taxes 205.9 184.2 359.5 317.2

Income tax expense 63.5 53.2 109.6 64.8 Income from continuing

operations 142.4 131.0 249.9 252.4 Discontinued operations,

including tax (benefit)/ expense of $(0.6), $3.2, $6.8 and $0.1 in

each period, respectively (1.5) 6.7 46.9 1.8 Net income $140.9

$137.7 $296.8 $254.2 Earnings Per Share: Income from continuing

operations: Basic $0.77 $0.71 $1.35 $1.37 Diluted $0.76 $0.70 $1.33

$1.34 Discontinued operations: Basic $(0.01) $0.04 $0.26 $0.01

Diluted $(0.01) $0.03 $0.25 $0.01 Net income: Basic $0.76 $0.75

$1.61 $1.38 Diluted $0.75 $0.73 $1.58 $1.35 Average Common Shares -

Basic 184.3 184.5 184.4 184.6 Average Common Shares - Diluted 187.2

188.5 187.5 188.5 ITT CORPORATION AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS (In millions) (Unaudited) June 30, December 31, 2006

2005 Assets Current Assets: Cash and cash equivalents $755.0 $451.0

Receivables, net 1,403.9 1,268.1 Inventories, net 728.3 661.3

Current assets of discontinued operations - 256.9 Deferred income

taxes 74.3 73.6 Other current assets 99.0 69.9 Total current assets

3,060.5 2,780.8 Plant, property and equipment, net 840.1 837.0

Deferred income taxes 90.9 87.5 Goodwill, net 2,348.4 2,249.1 Other

intangible assets, net 209.9 214.8 Other assets 976.5 894.2 Total

assets $7,526.3 $7,063.4 Liabilities and Shareholders' Equity

Current Liabilities: Accounts payable $869.2 $797.2 Accrued

expenses 788.6 745.8 Accrued taxes 147.9 187.1 Current liabilities

of discontinued operations - 77.9 Notes payable and current

maturities of long-term debt 900.1 751.4 Other current liabilities

9.7 8.3 Total current liabilities 2,715.5 2,567.7 Pension and

postretirement benefits 745.9 733.8 Long-term debt 516.2 516.3

Other liabilities 521.7 522.2 Total liabilities 4,499.3 4,340.0

Shareholders' equity 3,027.0 2,723.4 Total liabilities and

shareholders' equity $7,526.3 $7,063.4 ITT CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions)

(Unaudited) Six Months Ended June 30, 2006 2005 Operating

Activities Net income $296.8 $254.2 (Income) loss from discontinued

operations (46.9) (1.8) Income from continuing operations 249.9

252.4 Adjustments to income from continuing operations:

Depreciation and amortization 92.5 96.4 Amortization of stock

compensation 11.0 0.6 Restructuring and asset impairment charges

25.1 24.1 Payments for restructuring (29.6) (21.1) Change in

receivables (120.2) (183.0) Change in inventories (46.8) (29.3)

Change in accounts payable and accrued expenses 64.3 99.4 Change in

accrued and deferred taxes (35.9) 15.6 Change in other current and

non-current assets (94.4) (104.7) Change in other non-current

liabilities 1.0 (2.1) Other, net 4.0 (0.2) Net cash - operating

activities 120.9 148.1 Investing Activities Additions to plant,

property and equipment (64.8) (64.1) Acquisitions, net of cash

acquired (74.0) (1.5) Proceeds from sale of assets and businesses

230.7 7.7 Other, net (6.3) - Net cash - investing activities 85.6

(57.9) Financing Activities Short-term debt, net 147.2 163.5

Long-term debt repaid (1.0) (4.6) Long-term debt issued 0.1 0.4

Repurchase of common stock (130.2) (118.2) Proceeds from issuance

of common stock 50.9 56.3 Dividends paid (37.0) (49.8) Other, net

12.8 (0.1) Net cash - financing activities 42.8 47.5 Exchange Rate

Effects on Cash and Cash Equivalents 28.6 (21.7) Net Cash -

Discontinued Operations Operating Activities 28.3 13.1 Net Cash -

Discontinued Operations Investing Activities (2.2) (7.8) Net change

in cash and cash equivalents 304.0 121.3 Cash and cash equivalents

- beginning of year 451.0 262.9 Cash and Cash Equivalents - end of

period $755.0 $384.2 ITT Corporation Non-GAAP Press Release

Reconciliation Reported vs. Organic Revenue / Orders Growth Second

Quarter 2006 & 2005 ($ Millions) (As Reported - GAAP) Sales

& Sales & % Revenues Revenues Change Change 2006 2006 vs.

vs. 3M 2006 3M 2005 2005 2005 ITT Corporation - Consolidated

2,067.9 1,863.9 204.0 11% Fluid Technology 765.3 724.7 40.6 6%

Defense Electronics & Services 918.5 779.5 139.0 18% Electronic

Components 200.8 181.7 19.1 11% Motion & Flow Control 188.1

181.6 6.5 4% % Orders Orders Change Change 2006 2006 3M 2006 3M

2005 vs. vs. 2005 2005 Fluid Technology 798.0 746.8 51.2 7% Motion

& Flow Control 193.0 172.0 21.0 12% Aerospace Controls 23.9

20.2 3.7 18% Friction Materials 84.6 72.5 12.1 17% Electronic

Components 202.9 185.6 17.3 9% Orders Sales Orders/ Sales 3M 2006

3M 2006 Book-to- Bill Electronic Components 202.9 200.8 1.01 (As

Adjusted - Organic) Acquis- ition FX Adj. Sales & Contri-

Contri- Sales & Sales & % Revenues bution bution Revenues

Revenues Change Change Adj. Adj. 06 06 3M 2006 3M 2006 3M 2006 3M

2006 3M 2005 vs. 05 vs. 05 ITT Corporation - Consolidated 2,067.9

(5.8) (4.8) 2,057.3 1,863.9 193.4 10% Fluid Technology 765.3 (5.8)

(3.8) 755.7 724.7 31.0 4% Defense Electronics & Services 918.5

0.0 (0.1) 918.4 779.5 138.9 18% Electronic Components 200.8 0.0

(0.8) 200.0 181.7 18.3 10% Motion & Flow Control 188.1 0.0

(0.1) 188.0 181.6 6.4 4% Acquis- ition FX Contri- Contri- Adj. %

Orders bution bution Orders Orders Change Change Adj. Adj. 06 06 3M

2006 3M 2006 3M 2006 3M 2006 3M 2005 vs. 05 vs. 05 Fluid Technology

798.0 (6.9) (5.3) 785.8 746.8 39.0 5% Motion & Flow Control

193.0 0.0 (0.5) 192.5 172.0 20.5 12% Aerospace Controls 23.9 0.0 -

23.9 20.2 3.7 18% Friction Materials 84.6 0.0 (0.5) 84.1 72.5 11.6

16% Electronic Components 202.9 0.0 (0.9) 202.0 185.6 16.4 9% ITT

Corporation Non-GAAP Press Release Reconciliation Segment Operating

Income & OI Margin Adjusted for Restructuring Second Quarter of

2006 & 2005 ($ Millions) Adjust Q2 2006 Q2 2005 % Q2 2006 for

2006 Q2 2006 Change As As 06 vs. As Restruc- As Reported Reported

05 Reported turing Adjusted Sales and Revenues: Electronic

Components 200.8 181.7 200.8 200.8 Defense Electronics &

Services 918.5 779.5 918.5 918.5 Fluid Technology 765.3 724.7 765.3

765.3 Motion & Flow Control 188.1 181.6 188.1 188.1

Intersegment eliminations (4.8) (3.5) (4.8) (4.8) Total Ongoing

segments 2,067.9 1,864.0 2,067.9 2,067.9 Dispositions and other - -

- - Total Sales and Revenues 2,067.9 1,864.0 2,067.9 2,067.9

Operating Margin: Electronic Components 10.6% 3.1% 10.6% 10.5%

Defense Electronics & Services 11.0% 10.9% 11.0% 11.0% Fluid

Technology 13.2% 12.9% 13.2% 13.5% Motion & Flow Control 16.4%

20.5% 16.4% 20.3% Total Ongoing Segments 12.3% 11.9% 12.3% 12.8%

Total Ongoing Segments (Excluding impact of SFAS-123R) 13.0%

Income: Electronic Components 21.3 5.7 273.7% 21.3 (0.3) 21.0

Defense Electronics & Services 100.6 84.9 18.5% 100.6 0.8 101.4

Fluid Technology 101.3 93.3 8.6% 101.3 2.0 103.3 Motion & Flow

Control 30.9 37.3 -17.2% 30.9 7.2 38.1 Total Segment Operating

Income 254.1 221.2 14.9% 254.1 9.7 263.8 Impact of SFAS-123R

Adoption 6.1 Total Segment Operating Income (Excluding impact of

SFAS-123R) 269.9 Adjust Q2 2005 for 2005 Q2 2005 % Change Adj. As

Restruc- As 06 vs. Reported turing Adjusted 05 Sales and Revenues:

Electronic Components 181.7 181.7 Defense Electronics &

Services 779.5 779.5 Fluid Technology 724.7 724.7 Motion & Flow

Control 181.6 181.6 Intersegment eliminations (3.5) (3.5) Total

Ongoing segments 1,864.0 1,864.0 Dispositions and other - - Total

Sales and Revenues 1,864.0 1,864.0 Operating Margin: Electronic

Components 3.1% 5.0% 550 BP Defense Electronics & Services

10.9% 10.9% 10 BP Fluid Technology 12.9% 13.1% 40 BP Motion &

Flow Control 20.5% 20.9% (60)BP Total Ongoing Segments 11.9% 12.2%

60 BP Total Ongoing Segments (Excluding impact of SFAS-123R) 12.2%

80 BP Income: Electronic Components 5.7 3.3 9.0 133% Defense

Electronics & Services 84.9 0.0 84.9 19% Fluid Technology 93.3

1.8 95.1 9% Motion & Flow Control 37.3 0.6 37.9 1% Total

Segment Operating Income 221.2 5.7 226.9 16% Impact of SFAS-123R

Adoption Total Segment Operating Income (Excluding impact of

SFAS-123R) 226.9 19% ITT Corporation Non-GAAP Press Release

Reconciliation Reported vs. Adjusted Net Income & EPS Second

Quarter of 2006 & 2005 ($ Millions, except EPS and shares) Q2

2006 Q2 2006 Q2 2006 Q2 2005 Q2 2005 Q2 2005 As Adjust- As As

Adjust- As Reported ments Adjusted Reported ments Adjusted Segment

Operating Income 254.1 9.7 #A 263.8 221.2 5.7 #D 226.9 Interest

Income (Expense) (16.7) - (16.7) (8.4) (3.5)#E (11.9) Other Income

(Expense) (4.2) - (4.2) (5.5) - (5.5) Gain on sale of Assets - - -

- - - Corporate (Expense) (27.3) 0.3 #A (27.0) (23.1) - (23.1)

Income from Continuing Operations before Tax 205.9 10.0 215.9 184.2

2.2 186.4 Income Tax Items - - - - (4.0)#F (4.0) Income Tax Expense

(63.5) (3.2)#B (66.7) (53.2) (0.6)#G (53.8) Total Tax Expense

(63.5) (3.2) (66.7) (53.2) (4.6) (57.8) Income from Continuing

Operations 142.4 6.8 149.2 131.0 (2.4) 128.6 (Loss) Income from

Discontinued Operations (1.5) 1.5 #C 0.0 6.7 (6.7)#H - Net Income

140.9 8.3 149.2 137.7 (9.1) 128.6 Diluted EPS 0.75 0.05 0.80 0.73

(0.05) 0.68 Impact of SFAS-123R Adoption 0.02 0.00 Diluted EPS

Excluding Impact of SFAS-123R Adoption 0.82 0.68 Change Percent

Change 2006 vs. 2005 2006 vs. 2005 As Adjusted As Adjusted Net

Income 20.6 16% Diluted EPS $0.12 18% Impact of SFAS-123R Adoption

Diluted EPS Excluding Impact of SFAS-123R Adoption $0.14 21% #A -

Remove Restructuring Expense of $10.0M ($9.7 + $0.3). #B - Remove

Tax Benefit on Special Items of ($3.2M). #C - Remove D.O. expense

of $1.5M. #D - Remove Restructuring Expense of $5.7M. #E - Remove

Interest Income due to Tax Refund ($3.5M). #F - Remove Tax Refund

of ($4.0M). #G - Remove Tax Benefit on Special Items of ($0.6M). #H

- Remove D.O. income of ($6.7M). DATASOURCE: ITT Corporation

CONTACT: Tom Martin of ITT Corporation, +1-914-641-2157, Web site:

http://www.itt.com/

Copyright

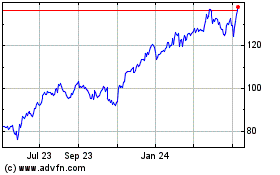

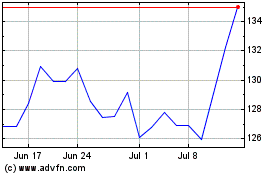

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2023 to Jul 2024