- Earnings excluding special items are $0.63 per share, up 19

percent, and up 21 percent excluding adoption of SFAS-123R WHITE

PLAINS, N.Y., April 28 /PRNewswire-FirstCall/ -- ITT Industries,

Inc. (NYSE:ITT) today reported first quarter 2006 net income of

$155.9 million or $0.83 per share, including the net impact of

special items of $37.8 million or $0.20 per share, with the gain on

the sale of ITT's auto tubing and Richter businesses partially

offset by restructuring charges. Excluding special items, earnings

from continuing operations grew 19 percent to $0.63 per share over

the first quarter 2005. Excluding the ($0.01) per share impact of

the adoption of SFAS - 123R, earnings grew 21 percent to $0.64 per

share. First quarter 2006 revenue was $1.89 billion, up 7 percent

over the period last year. "The first quarter has given us good

momentum for the year, with revenue growth of 7 percent and organic

revenue growth of 8 percent, and with income, margin and order

growth in all four segments," said Steve Loranger, Chairman,

President and Chief Executive Officer. "Fluid Technology and

Defense continue to lead our revenue growth, with revenue gains of

9 and 7 percent, respectively, and organic revenue growth of 11 and

7 percent, respectively. The Motion & Flow Control segment

demonstrated outstanding operating performance, increasing

operating margins by 130 basis points over the first quarter of

2005, excluding restructuring. Additionally, we are pleased that

restructuring moves taken over the last year are having a real

impact in our Electronic Components business, which grew orders by

15 percent, revenue by 7 percent and operating income by 69 percent

in the first quarter, excluding restructuring." "We expect

sustained strength in the year ahead, particularly in Defense and

the Water and Wastewater businesses," Loranger said. "Company-wide

revenue growth, order growth, and operating improvements are a

testament to the strength of our management team. We will continue

to use ITT's Management System to strengthen our market leadership

positions and expand corporate-wide sourcing and lean initiatives

to support our long-term growth objectives." 2006 Outlook "We laid

out an aggressive growth plan for 2006 and expect to deliver on

that commitment," Loranger added. "Based on our strong start for

the year, we are raising our full-year earnings forecast excluding

special items from a range of $2.89 - $2.96 to $2.91 - $2.97 per

share, up 12 - 15 percent compared to 2005, including the estimated

($0.09) per share impact from the adoption of SFAS-123R. Excluding

the impact of the adoption of SFAS-123R, our outlook for full year

2006 earnings from continuing operations excluding special items

would be up 16 - 18 percent. We're also raising the mid-point of

our full- year revenue guidance by $50 million, from a range of

$7.82 - $7.97 billion to $7.90 - $8.01 billion." Primary Business

Results Fluid Technology * First quarter 2006 Fluid Technology

revenue was $685.7 million, up $55.6 million or 9 percent; organic

revenues grew 11 percent over the period in 2005, led by Water and

Wastewater and Industrial/Biopharm. Operating income was $63.3

million, including the impact of restructuring. Excluding

restructuring, operating income was up 10 percent to $67.3 million.

* Order activity remains robust in this segment, with double digit

organic order growth in Water/Wastewater, Industrial/Biopharm and

Building Trades. Segment organic orders grew 12 percent in the

quarter. * Growth was particularly strong in the wastewater

business, with 14 percent growth in organic revenue and 17 percent

growth in organic orders. ITT's Flygt group is preparing to

introduce a new series of large pumps incorporating the company's

N-pump technology, extending the N-pump's energy-saving and

life-cycle cost advantages through its wastewater products. This

month, Flygt also introduced a new line of dewatering pumps using

N-pump technology. * In the first quarter, ITT was awarded the

contract to provide pumps and systems for the 2008 Summer Olympic

Kayaking venue in Beijing. The course will be designed to move

5,000 gallons of water/second over the 500-meter course. It is the

fourth summer Olympic kayaking course powered by ITT Fluid

Technology products. Defense Electronics & Services * ITT's

Defense Electronics & Services segment reported first quarter

revenues of $831.1 million, up 7 percent over the same period in

2005. Operating income for the segment was $95.8 million, including

the impact of restructuring. Excluding restructuring, operating

income was up 26 percent in the quarter to $97.8 million. Higher

volume, better yields and contract performance drove Defense

operating margin up 180 basis points in the first quarter,

excluding restructuring. * Order activity remains strong, with

order growth of 45 percent in the quarter, led by Aerospace

Communications, Night Vision, Systems and Space, increasing ITT's

Defense backlog by 10 percent to $3.9 billion. Order growth in

Defense is expected to continue outpacing revenue growth through

2006. * The growth at Defense is being led by Aerospace

Communications, which has more than tripled its production rate for

its SINCGARS tactical radios over the last year. During the first

quarter, ITT received a U.S. Army order for 60,000 additional

radios valued at more than $400 million, extending the growth

visibility in this important product line. The company also

foresees greater potential for international sales of SINCGARS, as

coalition partners and allies upgrade their communications to be

compatible with U.S. forces. * ITT's Systems division continues to

grow revenues due to increased outsourcing of services by the U.S.

Department of Defense. Revenues were up 17 percent in the first

quarter, and orders grew 42 percent. Motion & Flow Control *

First quarter revenues for ITT's Motion & Flow Control segment

were $188.3 million, down 1 percent from the first quarter last

year, primarily due to the negative impact of foreign currency

translation. On an organic basis, Motion & Flow Control

revenues grew 5 percent. First quarter operating income for the

segment was $35.9 million, including the impact of restructuring

charges. Excluding restructuring, operating income for this segment

was $38.2 million, up 6 percent, and segment operating margin grew

130 basis points on higher volumes and operating improvements at

Leisure Marine, Friction Materials and Aerospace Controls. * Order

activity levels are robust, with 7 percent order growth and 13

percent organic order growth over the same period last year, driven

primarily in Friction Materials and Leisure Marine. * Aerospace

Controls, which produces fuel valves and other components,

continues to benefit from the upturn in the aerospace market, with

organic revenue growth of 18 percent. Electronic Components * First

quarter revenues for the Electronic Components segment were $185

million, up 7 percent over the same period in 2005. Organic revenue

grew 10 percent, with growth in cellular handsets, transportation,

auto and industrial markets. Operating income for the first quarter

was $7.5 million including the impact of restructuring charges.

Excluding restructuring, operating income was $14.2 million, up 69

percent over the first quarter last year, and operating margins

grew 290 basis points, primarily driven by restructuring actions

and other operational improvements made over the last year, as well

as higher volumes. * Order intake at Electronic Components was at

the highest level since the third quarter 2000, up 15 percent over

the first quarter last year, and up 18 percent on an organic basis.

This is primarily attributable to growth in the cellular handset

market. The segment's book-to-bill ratio stood at 1.12. * The

process to prepare Electronic Components' Switches business for

disposition is underway. The company will continue to improve and

manage the business to create value until a disposition is

completed. About ITT Industries ITT Industries, Inc.

(http://www.itt.com/) supplies advanced technology products and

services in key markets including: fluid and water management

including water treatment; defense communication, opto-electronics,

information technology and services; electronic interconnects and

switches; and other specialty products. Headquartered in White

Plains, NY, the company generated $7.4 billion in 2005 sales. In

addition to the New York Stock Exchange, ITT Industries stock is

traded on the Pacific, Paris, London and Frankfurt exchanges. For

free B-roll/video content about ITT Industries, please log onto

http://www.thenewsmarket.com/ITT to preview and request video. You

can receive broadcast-standard video quality digitally or by tape

from this site. Registration and video are free to the media. "Safe

Harbor Statement" under the Private Securities Litigation Reform

Act of 1995 ("the Act"): Certain material presented herein includes

forward-looking statements intended to qualify for the safe harbor

from liability established by the Act. These forward-looking

statements include statements that describe the Company's business

strategy, outlook, objectives, plans, intentions or goals, and any

discussion of future operating or financial performance. Whenever

used, words such as "anticipate," "estimate," "expect," "project,"

"intend," "plan," "believe," "target" and other terms of similar

meaning are intended to identify such forward-looking statements.

Forward-looking statements are uncertain and to some extent

unpredictable, and involve known and unknown risks, uncertainties

and other important factors that could cause actual results to

differ materially from those expressed in, or implied from, such

forward-looking statements. Factors that could cause results to

differ materially from those anticipated by the Company include

general global economic conditions, decline in consumer spending,

interest and foreign currency exchange rate fluctuations,

availability of commodities, supplies and raw materials,

competition, acquisitions or divestitures, changes in government

defense budgets, employment and pension matters, contingencies

related to actual or alleged environmental contamination, claims

and concerns, intellectual property matters, personal injury

claims, governmental investigations, tax obligations, and changes

in generally accepted accounting principles. Other factors are more

thoroughly set forth in Item 1. Business, Item 1A. Risk Factors,

and Item 7. Management's Discussion and Analysis of Financial

Condition and Results of Operations - Forward-Looking Statements in

the ITT Industries, Inc. Annual Report on Form 10-K for the fiscal

year ended December 31, 2005, and other of its filings with the

Securities and Exchange Commission. The Company undertakes no

obligation to update any forward- looking statements, whether as a

result of new information, future events or otherwise. ITT

INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED CONDENSED INCOME

STATEMENTS (In millions, except per share) (Unaudited) Three Months

Ended March 31, 2006 2005 Sales and revenues $1,886.7 $1,765.9

Costs of sales and revenues 1,383.5 1,296.4 Selling, general and

administrative expenses 270.3 262.9 Research and development

expenses 42.7 44.3 Restructuring and asset impairment charges 15.1

18.4 Total costs and expenses 1,711.6 1,622.0 Operating income

175.1 143.9 Interest expense 19.9 20.1 Interest income 3.7 14.2

Miscellaneous expense 5.3 5.0 Income from continuing operations

before income taxes 153.6 133.0 Income tax expense 46.1 11.6 Income

from continuing operations 107.5 121.4 Discontinued operations,

including tax expense/(benefit) of $7.4, $ (3.1) in each period

48.4 (4.9) Net income $155.9 $116.5 Earnings Per Share: Income from

continuing operations: Basic $0.58 $0.66 Diluted $0.57 $0.64

Discontinued operations: Basic $0.26 $(0.03) Diluted $0.26 $(0.02)

Net income: Basic $0.84 $0.63 Diluted $0.83 $0.62 Average Common

Shares - Basic 184.6 184.6 Average Common Shares - Diluted 187.8

188.5 ITT INDUSTRIES, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (In millions) (Unaudited) March 31, December 31, 2006 2005

Assets Current Assets: Cash and cash equivalents $623.8 $451.0

Receivables, net 1,317.3 1,268.1 Inventories, net 707.0 661.3

Current assets of discontinued operations - 256.9 Deferred income

taxes 73.2 73.6 Other current assets 102.9 69.9 Total current

assets 2,824.2 2,780.8 Plant, property and equipment, net 829.3

837.0 Deferred income taxes 90.0 87.5 Goodwill, net 2,284.8 2,249.1

Other intangible assets, net 210.4 214.8 Other assets 985.4 894.2

Total assets $7,224.1 $7,063.4 Liabilities and Shareholders' Equity

Current Liabilities: Accounts payable $816.8 $797.2 Accrued

expenses 785.5 745.8 Accrued taxes 167.4 187.1 Current liabilities

of discontinued operations - 77.9 Notes payable and current

maturities of long-term debt 819.5 751.4 Other current liabilities

8.0 8.3 Total current liabilities 2,597.2 2,567.7 Pension and

postretirement benefits 735.4 733.8 Long-term debt 514.4 516.3

Other liabilities 515.9 522.2 Total liabilities 4,362.9 4,340.0

Shareholders' equity 2,861.2 2,723.4 Total liabilities and

shareholders' equity $7,224.1 $7,063.4 ITT INDUSTRIES, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions)

(Unaudited) Three Months Ended March 31, 2006 2005 Operating

Activities Net income $155.9 $116.5 (Income) loss from discontinued

operations (48.4) 4.9 Income from continuing operations 107.5 121.4

Adjustments to income from continuing operations: Depreciation and

amortization 50.7 49.5 Restructuring and asset impairment charges

15.1 18.4 Payments for restructuring (18.1) (9.6) Change in

receivables (40.3) (82.5) Change in inventories (45.2) (17.3)

Change in accounts payable and accrued expenses 25.7 55.4 Change in

accrued and deferred taxes (29.7) (12.5) Change in other current

and non-current assets (113.2) (110.5) Change in other non-current

liabilities (6.6) (5.2) Other, net 11.1 0.2 Net cash - operating

activities (43.0) 7.3 Investing Activities Additions to plant,

property and equipment (29.7) (26.4) Acquisitions, net of cash

acquired (23.7) (1.2) Proceeds from sale of assets and businesses

225.3 3.6 Other, net (1.6) 0.2 Net cash - investing activities

170.3 (23.8) Financing Activities Short-term debt, net 67.0 179.3

Long-term debt repaid (0.6) (3.4) Long-term debt issued - 0.4

Repurchase of common stock (68.8) (82.4) Proceeds from issuance of

common stock 36.9 35.7 Dividends paid (16.6) (33.2) Other, net 7.5

(0.3) Net cash - financing activities 25.4 96.1 Exchange Rate

Effects on Cash and Cash Equivalents 6.7 (9.2) Net Cash -

Discontinued Operations Operating 15.6 4.5 Net Cash - Discontinued

Operations Investing (2.2) (1.5) Net change in cash and cash

equivalents 172.8 73.4 Cash and cash equivalents - beginning of

year 451.0 262.9 Cash and Cash Equivalents - end of period $623.8

$336.3 ITT Industries Non-GAAP Press Release Reconciliation

Reported vs. Organic Revenue / Orders Growth First Quarter 2006

& 2005 ($ Millions) (As Reported - GAAP) Sales & Sales

& Revenues Revenues Change % Change 3M 2006 3M 2005 2006 vs.

2005 2006 vs. 2005 ITT Industries - Consolidated 1,886.7 1,765.9

120.8 7% Fluid Technology 685.7 630.1 55.6 9% Wastewater 246.3

222.1 24.2 11% Defense Electronics & Services 831.1 775.7 55.4

7% Electronic Components 185.0 173.7 11.3 7% Motion & Flow

Control 188.3 190.0 (1.7) -1% Aerospace Controls 21.4 18.2 3.2 18%

Orders Orders Change % Change 3M 2006 3M 2005 2006 vs. 2005 2006

vs. 2005 ITT Industries - Consolidated 2,378.6 1,897.0 481.6 25%

Defense Electronics & Services 1,213.6 835.9 377.7 45% Fluid

Technology 762.3 698.1 64.2 9% Water Wastewater 513.3 478.1 35.2 7%

Wastewater 291.2 258.6 32.6 13% Industrial Biopharm 162.9 145.9

17.0 12% Building Trades 97.3 83.9 13.4 16% Motion & Flow

Control 196.0 182.9 13.1 7% Electronic Components 206.7 180.1 26.6

15% Orders Sales Orders / Sales 3M 2006 3M 2006 Book-to-Bill

Electronic Components 206.7 185.0 1.12 (As Adjusted - Organic)

Sales & Acquisition FX Adj. Sales & Revenues Contribution

Contribution Revenues 3M 2006 3M 2006 3M 2006 3M 2006 ITT

Industries - Consolidated 1,886.7 (4.6) 33.9 1,916.0 Fluid

Technology 685.7 (4.6) 17.6 698.7 Wastewater 246.3 (4.6) 11.3 253.0

Defense Electronics & Services 831.1 0.0 0.0 831.1 Electronic

Components 185.0 0.0 5.7 190.7 Motion & Flow Control 188.3 0.0

10.7 199.0 Aerospace Controls 21.4 0.0 0.0 21.4 Acquisition FX

Orders Contribution Contribution Adj. Orders 3M 2006 3M 2006 3M

2006 3M 2006 ITT Industries - Consolidated 2,378.6 (2.7) 34.6

2,410.5 Defense Electronics & Services 1,213.6 0.0 - 1,213.6

Fluid Technology 762.3 (2.7) 19.1 778.7 Water Wastewater 513.3

(2.7) 20.6 531.2 Wastewater 291.2 (2.7) 12.9 301.4 Industrial

Biopharm 162.9 0.0 (0.6) 162.3 Building Trades 97.3 0.0 (0.5) 96.8

Motion & Flow Control 196.0 0.0 9.8 205.8 Electronic Components

206.7 0.0 5.5 212.2 Sales & Revenues Change % Change 3M 2005

Adj. 06 vs. 05 Adj. 06 vs. 05 ITT Industries - Consolidated 1,765.9

150.1 8% Fluid Technology 630.1 68.6 11% Wastewater 222.1 30.9 14%

Defense Electronics & Services 775.7 55.4 7.1% Electronic

Components 173.7 17.0 10% Motion & Flow Control 190.0 9.0 5%

Aerospace Controls 18.2 3.2 18% Orders Change % Change 3M 2005 Adj.

06 vs. 05 Adj. 06 vs. 05 ITT Industries - Consolidated 1,897.0

513.5 27% Defense Electronics & Services 835.9 377.7 45% Fluid

Technology 698.1 80.6 12% Water Wastewater 478.1 53.1 11%

Wastewater 258.6 42.8 17% Industrial Biopharm 145.9 16.4 11%

Building Trades 83.9 12.9 15% Motion & Flow Control 182.9 22.9

13% Electronic Components 180.1 32.1 18% ITT Industries Non-GAAP

Press Release Reconciliation Segment Operating Income & OI

Margin Adjusted for Restructuring First Quarter of 2006 & 2005

($ Millions) % Adjust Q1 2006 Q1 2005 Change Q1 2006 for 2006 As As

06 vs. As Restruc- Reported Reported 05 Reported turing Sales and

Revenues: Electronic Components 185.0 173.7 185.0 Defense

Electronics & Services 831.1 775.7 831.1 Fluid Technology 685.7

630.1 685.7 Motion & Flow Control 188.3 190.0 188.3

Intersegment eliminations (3.4) (3.6) (3.4) Total Ongoing segments

1,886.7 1,765.9 1,886.7 Dispositions and other - - - Total Sales

and Revenues 1,886.7 1,765.9 1,886.7 Operating Margin: Electronic

Components 4.1% 0.6% 4.1% Defense Electronics & Services 11.5%

10.0% 11.5% Fluid Technology 9.2% 8.7% 9.2% Motion & Flow

Control 19.1% 16.6% 19.1% Total Ongoing Segments 10.7% 9.3% 10.7%

Income: Electronic Components 7.5 1.1 581.8% 7.5 6.7 Defense

Electronics & Services 95.8 77.8 23.1% 95.8 2.0 Fluid

Technology 63.3 54.6 15.9% 63.3 4.0 Motion & Flow Control 35.9

31.6 13.6% 35.9 2.3 Total Segment Operating Income 202.5 165.1

22.7% 202.5 15.0 Adjust for Q1 2006 Q1 2005 2005 Q1 % Change As As

Restruc- 2005 As Adj. 06 Adjusted Reported turing Adjusted vs. 05

Sales and Revenues: Electronic Components 185.0 173.7 173.7 Defense

Electronics & Services 831.1 775.7 775.7 Fluid Technology 685.7

630.1 630.1 Motion & Flow Control 188.3 190.0 190.0

Intersegment eliminations (3.4) (3.6) (3.6) Total Ongoing segments

1,886.7 1,765.9 1,765.9 Dispositions and other - - - Total Sales

and Revenues 1,886.7 1,765.9 1,765.9 Operating Margin: Electronic

Components 7.7% 0.6% 4.8% 290 BP Defense Electronics & Services

11.8% 10.0% 10.0% 180 BP Fluid Technology 9.8% 8.7% 9.7% 10 BP

Motion & Flow Control 20.3% 16.6% 19.0% 130 BP Total Ongoing

Segments 11.5% 9.3% 10.4% 110 BP Income: Electronic Components 14.2

1.1 7.3 8.4 69.0% Defense Electronics & Services 97.8 77.8 0.0

77.8 25.7% Fluid Technology 67.3 54.6 6.5 61.1 10.1% Motion &

Flow Control 38.2 31.6 4.5 36.1 5.8% Total Segment Operating Income

217.5 165.1 18.3 183.4 18.6% ITT Industries Non-GAAP Press Release

Reconciliation Reported vs. Adjusted Net Income & EPS First

Quarter of 2006 & 2005 ($ Millions, except EPS and shares) Q1

2006 Q1 2006 Q1 2006 Q1 2005 As Reported Adjustments As Adjusted As

Reported Segment Operating Income 202.5 15.0 #A 217.5 165.1

Interest Income (Expense) (16.2) - (16.2) (5.9) Other Income

(Expense) (5.3) - (5.3) (5.0) Gain on sale of Assets - - - -

Corporate (Expense) (27.4) 0.1 #A (27.3) (21.2) Income from

Continuing Operations before Tax 153.6 15.1 168.7 133.0 Income Tax

Items - - Income Tax Expense (46.1) (4.5)#B (50.6) (11.6) Total Tax

Expense (46.1) (4.5) (50.6) (11.6) Income from Continuing

Operations 107.5 10.6 118.1 121.4 Income from Discontinued

Operations 48.4 (48.4)#C 0.0 (4.9) Net Income 155.9 (37.8) 118.1

116.5 Diluted EPS 0.83 (0.20) 0.63 0.62 Stock Option Expenses 0.01

Diluted EPS Excluding Stock Option Expense 0.64 Percent Change

Change Q1 2005 Q1 2005 2006 vs. 2005 2006 vs. 2005 Adjustments As

Adjusted As Adjusted As Adjusted Segment Operating Income 18.3 #D

183.4 Interest Income (Expense) (5.6)#E (11.5) Other Income

(Expense) - (5.0) Gain on sale of Assets - - Corporate (Expense)

(0.6)#F (21.8) Income from Continuing Operations before Tax 12.1

145.1 Income Tax Items (29.6)#G (29.6) Income Tax Expense (3.8)#H

(15.4) Total Tax Expense (33.4) (45.0) Income from Continuing

Operations (21.3) 100.1 Income from Discontinued Operations 4.9 #I

- Net Income (16.4) 100.1 18.0 17.9% Diluted EPS (0.09) 0.53 $0.10

18.9% Stock Option Expenses - Diluted EPS Excluding Stock Option

Expense 0.53 $0.11 20.6% #A - Remove Restructuring Expense of

$15.1M. #B - Remove Tax Benefit on Special Items of ($4.5M). #C -

Remove D.O. Income of ($48.4M). #D - Remove Restructuring Expense

of $18.3M. #E - Remove Interest Income due to Tax Refund ($5.6M).

#F - Remove Other Refund ($0.6M). #G - Remove Tax Refund of

($29.6M). #H - Remove Tax Benefit on Special Items of ($3.8M). #I -

Remove D.O. expense of $4.9M. DATASOURCE: ITT Industries, Inc.

CONTACT: Tom Glover of ITT Industries, Inc., +1-914-641-2160, Web

site: http://www.itt.com/

Copyright

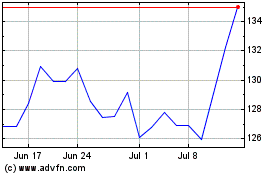

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2024 to Jul 2024

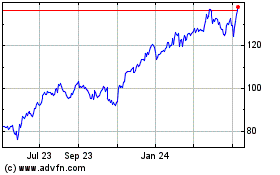

ITT (NYSE:ITT)

Historical Stock Chart

From Jul 2023 to Jul 2024