false000168722900016872292023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 26, 2023

Invitation Homes Inc.

(Exact Name of Registrant as Specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

Maryland | | 001-38004 | | 90-0939055 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| | | | | | |

| | | | | | |

1717 Main Street, Suite 2000

Dallas, Texas 75201

(Address of principal executive offices, including zip code)

(972) 421-3600

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

|

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| | | | |

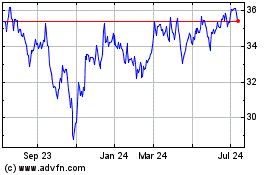

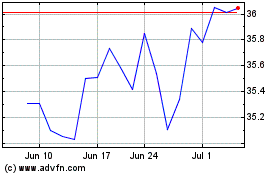

Common stock, $0.01 par value | | INVH | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On July 26, 2023, Invitation Homes Inc. (the “Company”) issued a press release announcing the results of the Company’s operations for the quarter ended June 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| Press Release of Invitation Homes Inc. dated July 26, 2023, announcing results for the quarter ended June 30, 2023. |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| INVITATION HOMES INC. |

| | |

| By: | /s/ Mark A. Solls |

| | Name: | Mark A. Solls |

| | Title: | Executive Vice President, Secretary and Chief Legal Officer |

| | Date: | July 26, 2023 |

Table of Contents

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 2

Earnings Press Release

Invitation Homes Reports Second Quarter 2023 Results

Dallas, TX, July 26, 2023 — Invitation Homes Inc. (NYSE: INVH) ("Invitation Homes" or the "Company"), the nation's premier single-family home leasing company, today announced its Q2 2023 financial and operating results, along with an increase to the Company's 2023 full year guidance.

In addition, Invitation Homes also announced today that on July 18, 2023, the Company acquired a premier portfolio of nearly 1,900 homes for approximately $650 million. The Company funded the transaction primarily with cash on hand, with the remainder funded by the Company's previously undrawn revolving credit facility. Additional details of the transaction will be discussed on tomorrow's earnings conference call.

Second Quarter 2023 Highlights

•Year over year, total revenues increased 7.7% to $600 million, property operating and maintenance costs increased 12.1% to $214 million, net income available to common stockholders increased 24.3% to $138 million, and net income per diluted common share increased 23.9% to $0.22.

•Year over year, Core FFO per share increased 5.3% to $0.44, and AFFO per share increased 6.8% to $0.38.

•Same Store NOI increased 3.6% year over year on 5.9% Same Store Core Revenues growth and 11.2% Same Store Core Operating Expenses growth.

•Revenue collections were approximately 99% of the Company's historical average collection rate. Same Store Bad Debt was 1.5% of gross rental revenue, an improvement of approximately 50 basis points from Q1 2023.

•Same Store Average Occupancy was 97.6%, down 20 basis points from Q1 2023 as the Company continued to make progress on its lease compliance backlog.

•Same Store new lease rent growth of 7.3% and Same Store renewal rent growth of 6.9% drove Same Store blended rent growth of 7.0%.

•Acquisitions by the Company and the Company's joint ventures totaled 276 homes for $88 million, primarily from the Company's builder partners, while dispositions totaled 378 homes for $141 million.

Chief Executive Officer Dallas Tanner comments:

"We're pleased to report second quarter results that demonstrate strong progress for the first half of 2023. Robust demand for our homes continued into the peak leasing season, with Same Store Average Occupancy remaining high at 97.6% and Same Store blended rental rate growth at 7.0% year over year. As a result of solid year-to-date execution by our teams and our continued expectations that supply and demand fundamentals will remain favorable, we are raising our 2023 full year guidance, including an increase of 25 basis points at the midpoint for our Same Store NOI growth guidance and an increase of $0.01 at the midpoint for our Core FFO per share and AFFO per share guidance.

"In addition, we're excited by our recent portfolio acquisition that adds nearly 1,900 homes that are among the best located and highest quality within our portfolio today. We believe this acquisition's attractive entry point and high-growth outlook align well with our disciplined investment approach, providing further evidence of the benefits of our multichannel acquisition strategy, industry-leading scale, and best-in-class platform. Looking ahead, we believe these newly acquired homes will help drive strong NOI growth and value creation, and we remain committed as ever to sourcing focused and value-additive external growth opportunities."

Glossary & Reconciliations of Non-GAAP Financial and Other Operating Measures

Financial and operating measures found in the Earnings Release and Supplemental Information include certain measures used by Invitation Homes management that are measures not defined under accounting principles generally accepted in the United States ("GAAP"). These measures are defined herein and, as applicable, reconciled to the most comparable GAAP measures.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 3

Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income, FFO, Core FFO, and AFFO Per Share — Diluted |

| | | | | | | | | | | | | |

| | Q2 2023 | | Q2 2022 | | | | YTD 2023 | | YTD 2022 | | | |

| Net income | | $ | 0.22 | | | $ | 0.18 | | | | | $ | 0.42 | | | $ | 0.33 | | | | |

| FFO | | 0.42 | | | 0.39 | | | | | 0.83 | | | 0.77 | | | | |

| Core FFO | | 0.44 | | | 0.42 | | | | | 0.88 | | | 0.82 | | | | |

| AFFO | | 0.38 | | | 0.36 | | | | | 0.76 | | | 0.71 | | | | |

| | | | | | | | | | | | | |

Net Income

Net income per share for Q2 2023 was $0.22, compared to net income per share of $0.18 for Q2 2022. Total revenues and total property operating and maintenance expenses for Q2 2023 were $600 million and $214 million, respectively, compared to $557 million and $191 million, respectively, in Q2 2022.

Net income per share YTD 2023 was $0.42, compared to net income per share of $0.33 for YTD 2022. Total revenues and total property operating and maintenance expenses for YTD 2023 were $1,190 million and $422 million, respectively, compared to $1,090 million and $373 million, respectively, for YTD 2022.

Core FFO

Year over year, Core FFO per share for Q2 2023 increased 5.3% to $0.44, primarily due to NOI growth. Year over year, Core FFO per share for YTD 2023 increased 7.4% to $0.88, primarily due to NOI growth.

AFFO

Year over year, AFFO per share for Q2 2023 increased 6.8% to $0.38, primarily due to the increase in Core FFO per share described above. Year over year, AFFO per share for YTD 2023 increased 7.9% to $0.76, primarily due to the increase in Core FFO per share described above.

Operating Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Operating Results Snapshot |

| | | | | | | | | | | | | |

| Number of homes in Same Store Portfolio: | | 76,593 | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Q2 2023 | | Q2 2022 | | | | | YTD 2023 | | YTD 2022 | | |

| Core Revenues growth (year over year) | | 5.9 | % | | | | | | | 6.9 | % | | | | |

| Core Operating Expenses growth (year over year) | | 11.2 | % | | | | | | | 12.5 | % | | | | |

| NOI growth (year over year) | | 3.6 | % | | | | | | | 4.4 | % | | | | |

| | | | | | | | | | | | | |

| Average Occupancy | | 97.6 | % | | 98.0 | % | | | | | 97.7 | % | | 98.1 | % | | |

| Bad Debt % of gross rental revenue | | 1.5 | % | | 0.5 | % | | | | | 1.7 | % | | 1.1 | % | | |

| Turnover Rate | | 6.6 | % | | 5.9 | % | | | | | 11.7 | % | | 10.6 | % | | |

| | | | | | | | | | | | | |

| Rental Rate Growth (lease-over-lease): | | | | | | | | | | | | | |

| Renewals | | 6.9 | % | | 10.2 | % | | | | | 7.4 | % | | 9.9 | % | | |

| New Leases | | 7.3 | % | | 16.2 | % | | | | | 6.5 | % | | 15.5 | % | | |

| Blended | | 7.0 | % | | 11.6 | % | | | | | 7.1 | % | | 11.3 | % | | |

| | | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue Collections Update |

| | | | | | | | | | | | | |

| | | Q2 2023 | | | Q1 2023 | | Q4 2022 | | Q3 2022 | | Pre-COVID Average (2) | |

Revenues collected % of revenues due: (1) | | | | | | | | | | | | | |

| Revenues collected in same month billed | | | 93 | % | | | 93 | % | | 91 | % | | 91 | % | | 96 | % | |

| Late collections of prior month billings | | | 5 | % | | | 5 | % | | 6 | % | | 6 | % | | 3 | % | |

| Total collections | | | 98 | % | | | 98 | % | | 97 | % | | 97 | % | | 99 | % | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Includes both rental revenues and other property income. Rent is considered to be due based on the terms of the original lease, not based on a payment plan if one is in place. Security deposits retained to offset rents due are not included as revenue collected.

(2)Represents the period from October 2019 to March 2020.

Same Store NOI

For the Same Store Portfolio of 76,593 homes, Same Store NOI for Q2 2023 increased 3.6% year over year on Same Store Core Revenues growth of 5.9% and Same Store Core Operating Expenses growth of 11.2%.

YTD 2023 Same Store NOI increased 4.4% year over year on Same Store Core Revenues growth of 6.9% and Same Store Core Operating Expenses growth of 12.5%.

Same Store Core Revenues

Same Store Core Revenues growth for Q2 2023 of 5.9% year over year was primarily driven by a 7.4% increase in Average Monthly Rent and a 7.3% increase in other income, net of resident recoveries, partially offset by a 40 basis points year over year decline in Average Occupancy and a 100 basis points year over year increase in Bad Debt as a percentage of gross rental revenue. Bad Debt was 1.5% of gross rental revenue for Q2 2023, an improvement of approximately 50 basis points from Q1 2023 as a result of continued progress in working through the Company's lease compliance backlog.

YTD 2023 Same Store Core Revenues growth of 6.9% year over year was primarily driven by a 7.9% increase in Average Monthly Rent and a 7.5% increase in other income, net of resident recoveries, partially offset by a 40 basis point year over year decline in Average Occupancy and a 60 basis point year over year increase in Bad Debt as a percentage of gross rental revenue.

Same Store Core Operating Expenses

Same Store Core Operating Expenses for Q2 2023 increased 11.2% year over year. The largest contributors to the year over year increase include an increase in property tax expense due to an expected year over year increase in property taxes in addition to the underaccrual of property tax expense in the first three quarters of 2022, as well as an increase in turnover expenses, net of resident recoveries, and an increase in utilities and property administrative expenses, net of resident recoveries. The increases in the latter two expense categories were expected primarily as a result of continued progress in working through the Company's lease compliance backlog.

YTD 2023 Same Store Core Operating Expenses increased 12.5% year over year, primarily driven by the year over year increases described above.

Investment Management Activity

Acquisitions for Q2 2023 totaled 276 homes for $88 million, primarily sourced from the Company's builder partners. This included 188 wholly owned homes for $61 million in addition to 88 homes for $27 million in the Company's joint ventures. Dispositions for Q2 2023 included 361 wholly owned homes for gross proceeds of $134 million and 17 homes for gross proceeds of $7 million in the Company's joint ventures.

Year to date through June 30, 2023, the Company acquired 470 homes for $155 million, including 369 wholly owned homes for $123 million and 101 homes for $32 million in the Company's joint ventures. The company also sold 675 homes for

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 5

$242 million, including 645 wholly owned homes for $229 million and 30 homes for $13 million in the Company's joint ventures.

Subsequent to quarter end on July 18, 2023, the Company acquired a premier portfolio of nearly 1,900 homes for approximately $650 million (the "Portfolio Acquisition"). Additional details of the transaction will be discussed on tomorrow's earnings conference call.

Balance Sheet and Capital Markets Activity

As of June 30, 2023, the Company had $1,414 million in available liquidity through a combination of unrestricted cash and undrawn capacity on its revolving credit facility. The Company's total indebtedness as of June 30, 2023 was $7,823 million, consisting of $5,775 million of unsecured debt and $2,048 million of secured debt. Net debt / TTM adjusted EBITDAre was 5.3x at June 30, 2023, down from 5.7x as of December 31, 2022.

Subsequent to quarter end on July 18, 2023, the Company funded the Portfolio Acquisition primarily with cash on hand, with the remainder funded by the Company's previously undrawn revolving credit facility.

Dividend

As previously announced on July 21, 2023, the Company's Board of Directors declared a quarterly cash dividend of $0.26 per share of common stock. The dividend will be paid on or before August 25, 2023, to stockholders of record as of the close of business on August 8, 2023.

FY 2023 Guidance Update

The Company does not provide guidance for the most comparable GAAP financial measures of net income (loss), total revenues, and property operating and maintenance expense. Additionally, a reconciliation of the forward-looking non-GAAP financial measures of Core FFO per share, AFFO per share, Same Store Core Revenues growth, Same Store Core Operating Expenses growth, and Same Store NOI growth to the comparable GAAP financial measures cannot be provided without unreasonable effort because the Company is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net (gain)/loss on sale of previously depreciated real estate assets, share-based compensation, casualty loss, non-Same Store revenues, and non-Same Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on the Company's GAAP results for the guidance period.

Full year 2023 guidance revisions are outlined in the table below:

| | | | | | | | | | | | | | | | | | | | |

FY 2023 Guidance |

| | | | | | | | |

| | Current FY 2023 Guidance | | | Previous FY 2023 Guidance | | | |

| Core FFO per share — diluted | | $1.75 to $1.81 | | | $1.73 to $1.81 | | | |

| AFFO per share — diluted | | $1.45 to $1.51 | | | $1.43 to $1.51 | | | |

| | | | | | | | |

| Same Store Core Revenues growth | | 5.75% to 6.75% | | | 5.25% to 6.25% | | | |

| Same Store Core Operating Expenses growth | | 8.5% to 9.5% | | | 7.5% to 9.5% | | | |

| Same Store NOI growth | | 4.5% to 5.5% | | | 4.0% to 5.5% | | | |

| | | | | | | | |

| Wholly owned acquisitions | | $800 million to $900 million | | | $250 million to $300 million | | | |

| JV acquisitions | | $100 million to $300 million | | | $100 million to $300 million | | | |

| Wholly owned dispositions | | $425 million to $475 million | | | $250 million to $300 million | | | |

| | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 6

Earnings Conference Call Information

Invitation Homes has scheduled a conference call at 11:00 a.m. Eastern Time on July 27, 2023, to discuss results for the second quarter of 2023. The domestic dial-in number is 1-888-330-2384, and the international dial-in number is 1-240-789-2701. The conference ID is 7714113. A live audio webcast may be accessed at www.invh.com. A replay of the call will be available through August 24, 2023, and can be accessed by calling 1-800-770-2030 (domestic) or 1-647-362-9199 (international) and using the playback ID 7714113, or by using the link at www.invh.com.

Supplemental Information

The full text of the Earnings Release and Supplemental Information referenced in this release are available on Invitation Homes' Investor Relations website at www.invh.com.

About Invitation Homes

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools. The company's mission, "Together with you, we make a house a home," reflects its commitment to providing homes where individuals and families can thrive and high-touch service that continuously enhances residents' living experiences.

| | | | | | | | | | | |

| Investor Relations Contact | | Media Relations Contact |

| | | |

| Scott McLaughlin | | Kristi DesJarlais |

| 844.456.INVH (4684) | | 972.421.3587 |

| IR@InvitationHomes.com | | Media@InvitationHomes.com |

| | | |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which include, but are not limited to, statements related to the Company's expectations regarding the performance of the Company's business, its financial results, its liquidity and capital resources, and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “guidance,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks inherent to the single-family rental industry and the Company's business model, macroeconomic factors beyond the Company's control, competition in identifying and acquiring properties, competition in the leasing market for quality residents, increasing property taxes, homeowners’ association and insurance costs, poor resident selection and defaults and non-renewals by the Company's residents, the Company's dependence on third parties for key services, risks related to the evaluation of properties, performance of the Company's information technology systems, risks related to the Company's indebtedness, and risks related to the potential negative impact of unfavorable global and United States economic conditions (including inflation and rising interest rates), uncertainty in financial markets (including as a result of recent bank failures and events affecting financial institutions), geopolitical tensions, natural disasters, climate change, and public health crises on the Company’s financial condition, results of operations, cash flows, business, associates, and residents. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The Company believes these factors include, but are not limited to, those described under Part I. Item 1A. “Risk Factors” of its Annual Report on Form 10-K for the year ended December 31, 2022 (the "Annual Report"), as such factors may be updated from time to time in the Company's periodic filings with the Securities and Exchange Commission (the "SEC"), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release, in the Annual Report, and in the Company's other periodic filings. The forward-looking statements speak only as of the date of this press release, and the Company expressly disclaims any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 7

| | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

($ in thousands, except shares and per share data) | | | | | |

| | | | | |

| | June 30, 2023 | | December 31, 2022 | |

| | (unaudited) | | | |

| Assets: | | | | | |

| Investments in single-family residential properties, net | | $ | 16,789,641 | | | $ | 17,030,374 | | |

| Cash and cash equivalents | | 414,292 | | | 262,870 | | |

| Restricted cash | | 205,241 | | | 191,057 | | |

| Goodwill | | 258,207 | | | 258,207 | | |

| Investments in unconsolidated joint ventures | | 267,446 | | | 280,571 | | |

| Other assets, net | | 607,428 | | | 513,629 | | |

| Total assets | | $ | 18,542,255 | | | $ | 18,536,708 | | |

| | | | | |

| Liabilities: | | | | | |

| Mortgage loans, net | | $ | 1,636,505 | | | $ | 1,645,795 | | |

| Secured term loan, net | | 401,406 | | | 401,530 | | |

| Unsecured notes, net | | 2,520,017 | | | 2,518,185 | | |

| Term loan facilities, net | | 3,207,635 | | | 3,203,567 | | |

| Revolving facility | | — | | | — | | |

| Accounts payable and accrued expenses | | 241,129 | | | 198,423 | | |

| Resident security deposits | | 177,008 | | | 175,552 | | |

| Other liabilities | | 75,847 | | | 70,025 | | |

| Total liabilities | | 8,259,547 | | | 8,213,077 | | |

| | | | | |

| Equity: | | | | | |

| Stockholders' equity | | | | | |

| Preferred stock, $0.01 par value per share, 900,000,000 shares authorized, none outstanding as of June 30, 2023 and December 31, 2022 | | — | | | — | | |

| Common stock, $0.01 par value per share, 9,000,000,000 shares authorized, 611,956,170 and 611,411,382 outstanding as of June 30, 2023 and December 31, 2022, respectively | | 6,120 | | | 6,114 | | |

| Additional paid-in capital | | 11,141,829 | | | 11,138,463 | | |

| Accumulated deficit | | (1,011,060) | | | (951,220) | | |

| Accumulated other comprehensive income | | 112,984 | | | 97,985 | | |

| Total stockholders' equity | | 10,249,873 | | | 10,291,342 | | |

| Non-controlling interests | | 32,835 | | | 32,289 | | |

| Total equity | | 10,282,708 | | | 10,323,631 | | |

| Total liabilities and equity | | $ | 18,542,255 | | | $ | 18,536,708 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Operations |

| ($ in thousands, except shares and per share amounts) (unaudited) | | |

| | | | | | | | | | | |

| | Q2 2023 | | Q2 2022 | | | YTD 2023 | | YTD 2022 | | |

| | | | | | | | | | | |

Revenues: | | | | | | | | | | | |

Rental revenues | | $ | 543,185 | | | $ | 505,936 | | | | $ | 1,078,402 | | | $ | 989,931 | | | |

Other property income | | 53,739 | | | 48,605 | | | | 105,037 | | | 94,809 | | | |

| Management fee revenues | | 3,448 | | | 2,759 | | | | 6,823 | | | 4,870 | | | |

| Total revenues | | 600,372 | | | 557,300 | | | | 1,190,262 | | | 1,089,610 | | | |

| | | | | | | | | | | |

Expenses: | | | | | | | | | | | |

Property operating and maintenance | | 213,808 | | | 190,680 | | | | 422,305 | | | 372,949 | | | |

Property management expense | | 23,580 | | | 21,814 | | | | 47,164 | | | 42,781 | | | |

General and administrative | | 19,791 | | | 19,342 | | | | 37,243 | | | 36,981 | | | |

Interest expense | | 78,625 | | | 74,840 | | | | 156,672 | | | 149,229 | | | |

Depreciation and amortization | | 165,759 | | | 158,572 | | | | 330,432 | | | 314,368 | | | |

Impairment and other | | 1,868 | | | 1,355 | | | | 3,031 | | | 2,870 | | | |

Total expenses | | 503,431 | | | 466,603 | | | | 996,847 | | | 919,178 | | | |

| | | | | | | | | | | |

| Gains (losses) on investments in equity securities, net | | 524 | | | (172) | | | | 612 | | | (3,204) | | | |

| Other, net | | (3,941) | | | (3,827) | | | | (5,435) | | | (3,233) | | | |

| Gain on sale of property, net of tax | | 46,788 | | | 27,508 | | | | 76,459 | | | 45,534 | | | |

| Losses from investments in unconsolidated joint ventures | | (2,030) | | | (2,701) | | | | (6,185) | | | (5,021) | | | |

| | | | | | | | | | | |

Net income | | 138,282 | | | 111,505 | | | | 258,866 | | | 204,508 | | | |

| Net income attributable to non-controlling interests | | (418) | | | (542) | | | | (760) | | | (930) | | | |

| | | | | | | | | | | |

Net income attributable to common stockholders | | 137,864 | | | 110,963 | | | | 258,106 | | | 203,578 | | | |

Net income available to participating securities | | (166) | | | (148) | | | | (337) | | | (368) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Net income available to common stockholders — basic and diluted | | $ | 137,698 | | | $ | 110,815 | | | | $ | 257,769 | | | $ | 203,210 | | | |

| | | | | | | | | | | |

| Weighted average common shares outstanding — basic | | 611,954,347 | | | 610,331,643 | | | | 611,772,406 | | | 608,381,768 | | | |

| Weighted average common shares outstanding — diluted | | 613,316,499 | | | 611,620,475 | | | | 612,941,399 | | | 609,775,270 | | | |

| | | | | | | | | | | |

Net income per common share — basic | | $ | 0.23 | | | $ | 0.18 | | | | $ | 0.42 | | | $ | 0.33 | | | |

Net income per common share — diluted | | $ | 0.22 | | | $ | 0.18 | | | | $ | 0.42 | | | $ | 0.33 | | | |

| | | | | | | | | | | |

| Dividends declared per common share | | $ | 0.26 | | | $ | 0.22 | | | | $ | 0.52 | | | $ | 0.44 | | | |

| | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 9

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of FFO, Core FFO, and AFFO |

($ in thousands, except shares and per share amounts) (unaudited) | | |

| | | | | | | | | | | |

FFO Reconciliation | | Q2 2023 | | Q2 2022 | | | YTD 2023 | | YTD 2022 | | |

| Net income available to common stockholders | | $ | 137,698 | | | $ | 110,815 | | | | $ | 257,769 | | | $ | 203,210 | | | |

| Net income available to participating securities | | 166 | | | 148 | | | | 337 | | | 368 | | | |

| Non-controlling interests | | 418 | | | 542 | | | | 760 | | | 930 | | | |

| Depreciation and amortization on real estate assets | | 163,022 | | | 156,433 | | | | 325,106 | | | 310,073 | | | |

| Impairment on depreciated real estate investments | | 81 | | | 36 | | | | 259 | | | 137 | | | |

| Net gain on sale of previously depreciated investments in real estate | | (46,788) | | | (27,508) | | | | (76,459) | | | (45,534) | | | |

| Depreciation and net gain on sale of investments in unconsolidated joint ventures | | 2,193 | | | 916 | | | | 4,314 | | | 1,416 | | | |

FFO | | $ | 256,790 | | | $ | 241,382 | | | | $ | 512,086 | | | $ | 470,600 | | | |

| | | | | | | | | | | |

Core FFO Reconciliation | | Q2 2023 | | Q2 2022 | | | YTD 2023 | | YTD 2022 | | |

FFO | | $ | 256,790 | | | $ | 241,382 | | | | $ | 512,086 | | | $ | 470,600 | | | |

Non-cash interest expense related to amortization of deferred financing costs, loan discounts, and non-cash interest expense from derivatives (1) | | 7,182 | | | 6,498 | | | | 16,314 | | | 12,968 | | | |

Share-based compensation expense | | 6,066 | | | 7,989 | | | | 12,564 | | | 14,635 | | | |

| | | | | | | | | | | |

Severance expense | | 371 | | | 189 | | | | 524 | | | 207 | | | |

Casualty losses, net (1) | | 1,797 | | | 1,319 | | | | 2,785 | | | 2,733 | | | |

| (Gains) losses on investments in equity securities, net | | (524) | | | 172 | | | | (612) | | | 3,204 | | | |

Core FFO | | $ | 271,682 | | | $ | 257,549 | | | | $ | 543,661 | | | $ | 504,347 | | | |

| | | | | | | | | | | |

AFFO Reconciliation | | Q2 2023 | | Q2 2022 | | | YTD 2023 | | YTD 2022 | | |

Core FFO | | $ | 271,682 | | | $ | 257,549 | | | | $ | 543,661 | | | $ | 504,347 | | | |

Recurring capital expenditures (1) | | (36,400) | | | (37,544) | | | | (73,693) | | | (70,374) | | | |

| AFFO | | $ | 235,282 | | | $ | 220,005 | | | | $ | 469,968 | | | $ | 433,973 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income available to common stockholders | | | | | | | | | | | |

| Weighted average common shares outstanding — diluted | | 613,316,499 | | | 611,620,475 | | | | 612,941,399 | | | 609,775,270 | | | |

| | | | | | | | | | | |

| Net income per common share — diluted | | $ | 0.22 | | | $ | 0.18 | | | | $ | 0.42 | | | $ | 0.33 | | | |

| | | | | | | | | | | |

| FFO, Core FFO, and AFFO | | | | | | | | | | | |

| Weighted average common shares and OP Units outstanding — diluted | | 615,384,953 | | | 614,569,431 | | | | 614,961,840 | | | 612,648,238 | | | |

| | | | | | | | | | | |

| FFO per share — diluted | | $ | 0.42 | | | $ | 0.39 | | | | $ | 0.83 | | | $ | 0.77 | | | |

| | | | | | | | | | | |

| Core FFO per share — diluted | | $ | 0.44 | | | $ | 0.42 | | | | $ | 0.88 | | | $ | 0.82 | | | |

| | | | | | | | | | | |

| AFFO per share — diluted | | $ | 0.38 | | | $ | 0.36 | | | | $ | 0.76 | | | $ | 0.71 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)Includes the Company's share from unconsolidated joint ventures.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 10

Supplemental Schedule 2(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diluted Shares Outstanding |

| (unaudited) | | | | | | | | | |

| | | | | | | | | |

| Weighted Average Amounts for Net Income | | Q2 2023 | | Q2 2022 | | YTD 2023 | | YTD 2022 | |

| Common shares — basic | | 611,954,347 | | | 610,331,643 | | | 611,772,406 | | | 608,381,768 | | |

| Shares potentially issuable from vesting/conversion of equity-based awards | | 1,362,152 | | | 1,288,832 | | | 1,168,993 | | | 1,393,502 | | |

| Total common shares — diluted | | 613,316,499 | | | 611,620,475 | | | 612,941,399 | | | 609,775,270 | | |

| | | | | | | | | |

| Weighted average amounts for FFO, Core FFO, and AFFO | | Q2 2023 | | Q2 2022 | | YTD 2023 | | YTD 2022 | |

| Common shares — basic | | 611,954,347 | | | 610,331,643 | | | 611,772,406 | | | 608,381,768 | | |

| OP units — basic | | 1,863,192 | | | 2,770,970 | | | 1,801,329 | | | 2,655,270 | | |

| Shares potentially issuable from vesting/conversion of equity-based awards | | 1,567,414 | | | 1,466,818 | | | 1,388,105 | | | 1,611,200 | | |

| Total common shares and units — diluted | | 615,384,953 | | | 614,569,431 | | | 614,961,840 | | | 612,648,238 | | |

| | | | | | | | | |

| Period end amounts for Core FFO and AFFO | | June 30, 2023 | | | | | | | |

| Common shares | | 611,956,170 | | | | | | | | |

| OP units | | 1,869,483 | | | | | | | | |

| Shares potentially issuable from vesting/conversion of equity-based awards | | 1,567,826 | | | | | | | | |

Total common shares and units — diluted | | 615,393,479 | | | | | | | | |

| | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 11

Supplemental Schedule 2(b)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt Structure and Leverage Ratios — As of June 30, 2023 | |

| ($ in thousands) (unaudited) |

| | | | | | | | | |

| | | | | | Wtd Avg | | Wtd Avg | |

| | | | | | Interest | | Years to | |

| Debt Structure | | Balance | | % of Total | | Rate (1) | | Maturity (2) | |

| Secured: | | | | | | | | | |

Fixed (3) | | $ | 1,396,123 | | | 17.9 | % | | 4.0 | % | | 5.1 | | |

| Floating — swapped to fixed | | 652,229 | | | 8.3 | % | | 4.2 | % | | 2.5 | | |

| Floating | | — | | | — | % | | — | % | | — | | |

| Total secured | | 2,048,352 | | | 26.2 | % | | 4.1 | % | | 4.3 | | |

| | | | | | | | | |

| Unsecured: | | | | | | | | | |

| Fixed | | 2,550,000 | | | 32.6 | % | | 2.8 | % | | 8.1 | | |

| Floating — swapped to fixed | | 3,167,771 | | | 40.5 | % | | 4.0 | % | | 3.3 | | |

| Floating | | 57,229 | | | 0.7 | % | | 6.5 | % | | 6.0 | | |

| Total unsecured | | 5,775,000 | | | 73.8 | % | | 3.5 | % | | 5.5 | | |

| | | | | | | | | |

| Total Debt: | | | | | | | | | |

Fixed + floating swapped to fixed (3) | | 7,766,123 | | | 99.3 | % | | 3.6 | % | | 5.1 | | |

| Floating | | 57,229 | | | 0.7 | % | | 6.5 | % | | 6.0 | | |

| Total debt | | 7,823,352 | | | 100.0 | % | | 3.6 | % | | 5.1 | | |

| Discount/amortization on Note Payable | | (12,715) | | | | | | | | |

| Deferred financing costs, net | | (45,074) | | | | | | | | |

| Total debt per Balance Sheet | | 7,765,563 | | | | | | | | |

| Retained and repurchased certificates | | (88,229) | | | | | | | | |

Cash, ex-security deposits and letters of credit (4) | | (439,306) | | | | | | | | |

| Deferred financing costs, net | | 45,074 | | | | | | | | |

| Unamortized discount on note payable | | 12,715 | | | | | | | | |

| Net debt | | $ | 7,295,817 | | | | | | | | |

| | | | | | | | | |

| Leverage Ratios | | June 30, 2023 | | | | | | | |

Net Debt / TTM Adjusted EBITDAre | | 5.3 | x | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Ratings | | Ratings | | Outlook | | | | | | | |

| Fitch Ratings | | BBB | | Stable | | | | | | | |

| Moody's Investors Service | | Baa3 | | Positive | | | | | | | |

| S&P Global Ratings | | BBB | | Stable | | | | | | | |

| | | | | | | | | | | |

Unsecured Facilities Covenant Compliance (5) | | Unsecured Public Bond Covenant Compliance (6) | |

| | Actual | | Requirement | | | | Actual | | Requirement | |

| Total leverage ratio | | 30.5 | % | | ≤ 60% | | Aggregate debt ratio | | 35.0 | % | | ≤ 65% | |

| Secured leverage ratio | | 8.4 | % | | ≤ 45% | | Secured debt ratio | | 8.9 | % | | ≤ 40% | |

| Unencumbered leverage ratio | | 26.8 | % | | ≤ 60% | | Unencumbered assets ratio | | 323.5 | % | | ≥ 150% | |

| Fixed charge coverage ratio | | 4.6x | | ≥ 1.5x | | Debt service ratio | | 4.8x | | ≥ 1.5x | |

| Unsecured interest coverage ratio | | 6.1x | | ≥ 1.75x | | | | | | | |

| | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 12

Supplemental Schedule 2(b) (Continued)

(1)Includes the impact of interest rate swaps in place and effective as of June 30, 2023.

(2)Assumes all extension options are exercised.

(3)For the purposes of this table, IH 2019-1, a twelve-year secured term loan reaching final maturity in 2031 that bears interest at a fixed rate for the first 11 years and a floating rate in the twelfth year, is reflected as fixed rate debt.

(4)Represents cash and cash equivalents and the portion of restricted cash that excludes security deposits and letters of credit.

(5)Covenant calculations are specifically defined in the Company's Amended and Restated Revolving Credit and Term Loan Agreement, and summarized in the "Glossary and Reconciliations" section below. For the purpose of calculating property value in applicable covenant metrics, properties owned for at least one year are valued by dividing NOI by a 6% capitalization rate (the market standard for residential loans), and properties owned for less than one year are valued at either their gross book value or by dividing NOI by a 6% capitalization rate.

(6)Covenant calculations are specifically defined in the Company's Supplemental Indentures to the Base Indenture for its Senior Notes, which are summarized in the "Glossary and Reconciliations" section below. Property values for the purpose of applicable covenant metrics are calculated based on undepreciated book value.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 13

Supplemental Schedule 2(c)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt Maturity Schedule — As of June 30, 2023 |

| ($ in thousands) (unaudited) | | | | | | | | | | | |

| | | | | | Revolving | | | | | |

| | Secured | | Unsecured | | Credit | | | | % of | |

Debt Maturities, with Extensions (1) | | Debt | | Debt | | Facility | | Balance | | Total | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| 2023 | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | — | % | |

| 2024 | | — | | | — | | | — | | | — | | | — | % | |

| 2025 | | — | | | — | | | — | | | — | | | — | % | |

| 2026 | | 652,229 | | | 2,500,000 | | | — | | | 3,152,229 | | | 40.2 | % | |

| 2027 | | 992,994 | | | — | | | — | | | 992,994 | | | 12.7 | % | |

| 2028 | | — | | | 750,000 | | | — | | | 750,000 | | | 9.6 | % | |

| 2029 | | — | | | 725,000 | | | — | | | 725,000 | | | 9.3 | % | |

| 2030 | | — | | | — | | | — | | | — | | | — | % | |

| 2031 | | 403,129 | | | 650,000 | | | — | | | 1,053,129 | | | 13.5 | % | |

| 2032 | | — | | | 600,000 | | | — | | | 600,000 | | | 7.7 | % | |

| 2033 | | — | | | — | | | — | | | — | | | — | % | |

| 2034 | | — | | | 400,000 | | | — | | | 400,000 | | | 5.1 | % | |

| 2035 | | — | | | — | | | — | | | — | | | — | % | |

| 2036 | | — | | | 150,000 | | | — | | | 150,000 | | | 1.9 | % | |

| | 2,048,352 | | | 5,775,000 | | | — | | | 7,823,352 | | | 100.0 | % | |

| Unamortized discount on note payable | | (1,408) | | | (11,307) | | | — | | | (12,715) | | | | |

| Deferred financing costs, net | | (9,033) | | | (36,041) | | | — | | | (45,074) | | | | |

| Total per Balance Sheet | | $ | 2,037,911 | | | $ | 5,727,652 | | | $ | — | | | $ | 7,765,563 | | | | |

| | . | | | | | | | | | |

(1)Assumes all extension options are exercised.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 14

Supplemental Schedule 3(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary of Operating Information by Home Portfolio |

| ($ in thousands) (unaudited) |

| | | | | | | | | | | | | |

| Number of Homes, period-end | | Q2 2023 | | | | | | | | | | | |

| Total Portfolio | | 82,837 | | | | | | | | | | | | |

| Same Store Portfolio | | 76,593 | | | | | | | | | | | | |

| Same Store % of Total | | 92.5 | % | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Core Revenues | | Q2 2023 | | Q2 2022 | | Change YoY | | YTD 2023 | | YTD 2022 | | Change YoY | |

| Total Portfolio | | $ | 564,148 | | | $ | 525,147 | | | 7.4 | % | | $ | 1,118,697 | | | $ | 1,026,584 | | | 9.0 | % | |

| Same Store Portfolio | | 523,031 | | | 493,681 | | | 5.9 | % | | 1,037,110 | | | 970,481 | | | 6.9 | % | |

| | | | | | | | | | | | | |

| Core Operating Expenses | | Q2 2023 | | Q2 2022 | | Change YoY | | YTD 2023 | | YTD 2022 | | Change YoY | |

| Total Portfolio | | $ | 181,032 | | | $ | 161,286 | | | 12.2 | % | | $ | 357,563 | | | $ | 314,793 | | | 13.6 | % | |

| Same Store Portfolio | | 167,673 | | | 150,764 | | | 11.2 | % | | 330,928 | | | 294,031 | | | 12.5 | % | |

| | | | | | | | | | | | | |

| Net Operating Income | | Q2 2023 | | Q2 2022 | | Change YoY | | YTD 2023 | | YTD 2022 | | Change YoY | |

| Total Portfolio | | $ | 383,116 | | | $ | 363,861 | | | 5.3 | % | | $ | 761,134 | | | $ | 711,791 | | | 6.9 | % | |

| Same Store Portfolio | | 355,358 | | | 342,917 | | | 3.6 | % | | 706,182 | | | 676,450 | | | 4.4 | % | |

| | | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 15

Supplemental Schedule 3(b)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Portfolio Core Operating Detail |

| ($ in thousands) (unaudited) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | Change | | | | Change | | | | | | | | Change | |

| Q2 2023 | | Q2 2022 | | | YoY | | Q1 2023 | | Seq | | | | YTD 2023 | | YTD 2022 | | YoY | |

| Revenues: | | | | | | | | | | | | | | | | | | | |

Rental revenues (1) | $ | 504,085 | | | $ | 476,020 | | | | 5.9 | % | | $ | 496,525 | | | 1.5 | % | | | | $ | 1,000,610 | | | $ | 936,527 | | | 6.8 | % | |

Other property income, net (1)(2) | 18,946 | | | 17,661 | | | | 7.3 | % | | 17,554 | | | 7.9 | % | | | | 36,500 | | | 33,954 | | | 7.5 | % | |

| Core Revenues | 523,031 | | | 493,681 | | | | 5.9 | % | | 514,079 | | | 1.7 | % | | | | 1,037,110 | | | 970,481 | | | 6.9 | % | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Fixed Expenses: | | | | | | | | | | | | | | | | | | | |

Property taxes (3) | 86,392 | | | 77,671 | | | | 11.2 | % | | 86,419 | | | — | % | | | | 172,811 | | | 155,330 | | | 11.3 | % | |

Insurance expenses (4) | 10,339 | | | 8,717 | | | | 18.6 | % | | 9,135 | | | 13.2 | % | | | | 19,474 | | | 17,334 | | | 12.3 | % | |

| HOA expenses | 10,212 | | | 9,137 | | | | 11.8 | % | | 9,576 | | | 6.6 | % | | | | 19,788 | | | 18,119 | | | 9.2 | % | |

| | | | | | | | | | | | | | | | | | | |

| Controllable Expenses: | | | | | | | | | | | | | | | | | | | |

Repairs and maintenance, net (5) | 21,674 | | | 23,065 | | | | (6.0) | % | | 21,644 | | | 0.1 | % | | | | 43,318 | | | 43,072 | | | 0.6 | % | |

| Personnel, leasing and marketing | 21,988 | | | 19,971 | | | | 10.1 | % | | 21,590 | | | 1.8 | % | | | | 43,578 | | | 38,213 | | | 14.0 | % | |

Turnover, net (5)(6) | 11,249 | | | 8,241 | | | | 36.5 | % | | 8,886 | | | 26.6 | % | | | | 20,135 | | | 14,357 | | | 40.2 | % | |

Utilities and property administrative, net (5)(7) | 5,819 | | | 3,962 | | | | 46.9 | % | | 6,005 | | | (3.1) | % | | | | 11,824 | | | 7,606 | | | 55.5 | % | |

| Core Operating Expenses | 167,673 | | | 150,764 | | | | 11.2 | % | | 163,255 | | | 2.7 | % | | | | 330,928 | | | 294,031 | | | 12.5 | % | |

| | | | | | | | | | | | | | | | | | | |

| Net Operating Income | $ | 355,358 | | | $ | 342,917 | | | | 3.6 | % | | $ | 350,824 | | | 1.3 | % | | | | $ | 706,182 | | | $ | 676,450 | | | 4.4 | % | |

| | | | | | | | | | | | | | | | | | | |

(1)All rental revenues and other property income are reflected net of Bad Debt, which as a percentage of gross rental revenue, increased by 100 basis points from Q2 2022 to Q2 2023.

(2)Represents other property income net of all resident recoveries, which are reimbursements of charges for which residents are responsible. Same Store resident recoveries totaled $30,491, $27,857, $29,694, $60,185, and $55,291 for Q2 2023, Q2 2022, Q1 2023, YTD 2023, and YTD 2022, respectively.

(3)For Q2 2023, the year over year increase to property tax expense was primarily a result of an expected year over year increase in property taxes, in addition to the underaccrual of property tax expense in the first three quarters of 2022.

(4)As previously disclosed, the Company's annual insurance policy renewed on March 1, 2023, reflecting a full year 2023 growth rate for same store insurance expense of approximately 16%.

(5)These expenses are presented net of applicable resident recoveries.

(6)For Q2 2023, the year over year increase to turnover expense, net, was primarily attributable to higher resident turnover as a result of continued progress in working through the Company's lease compliance backlog.

(7)For Q2 2023, the year over year increase to utilities and property administrative expense, net, was primarily attributable to higher lease compliance costs as a result of continued progress in working through the Company's lease compliance backlog.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 16

Supplemental Schedule 3(c)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Quarterly Operating Trends |

| (unaudited) |

| | | | | | | | | | | | |

| | Q2 2023 | | Q1 2023 | | | Q4 2022 | | Q3 2022 | | Q2 2022 | |

| | | | | | | | | | | | |

| Average Occupancy | | 97.6 | % | | 97.8 | % | | | 97.3 | % | | 97.5 | % | | 98.0 | % | |

| Turnover Rate | | 6.6 | % | | 5.1 | % | | | 5.4 | % | | 6.2 | % | | 5.9 | % | |

| Trailing four quarters Turnover Rate | | 23.3 | % | | 22.6 | % | | | 22.2 | % | | N/A | | N/A | |

| Average Monthly Rent | | $ | 2,285 | | | $ | 2,254 | | | | $ | 2,225 | | | $ | 2,183 | | | $ | 2,127 | | |

| Rental Rate Growth (lease-over-lease): | | | | | | | | | | | | |

| Renewals | | 6.9 | % | | 8.0 | % | | | 9.9 | % | | 10.1 | % | | 10.2 | % | |

| New leases | | 7.3 | % | | 5.7 | % | | | 7.1 | % | | 15.2 | % | | 16.2 | % | |

| Blended | | 7.0 | % | | 7.3 | % | | | 9.0 | % | | 11.4 | % | | 11.6 | % | |

| | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 17

Supplemental Schedule 4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Wholly Owned Portfolio Characteristics — As of and for the Quarter Ended June 30, 2023 (1) |

| (unaudited) | | | | | | | | | | | |

| | | | | | | | | | | |

| | Number of Homes | | Average Occupancy | | Average Monthly Rent | | Average Monthly Rent PSF | | Percent of Revenue | |

| Western United States: | | | | | | | | | | | |

| Southern California | | 7,684 | | | 96.7 | % | | $ | 2,935 | | | $ | 1.73 | | | 11.3 | % | |

| Northern California | | 4,386 | | | 97.0 | % | | 2,624 | | | 1.67 | | | 6.1 | % | |

| Seattle | | 4,060 | | | 97.9 | % | | 2,760 | | | 1.43 | | | 6.0 | % | |

| Phoenix | | 8,889 | | | 97.5 | % | | 1,965 | | | 1.17 | | | 9.5 | % | |

| Las Vegas | | 3,167 | | | 96.1 | % | | 2,146 | | | 1.09 | | | 3.6 | % | |

| Denver | | 2,615 | | | 97.4 | % | | 2,451 | | | 1.33 | | | 3.5 | % | |

| Western US Subtotal | | 30,801 | | | 97.1 | % | | 2,465 | | | 1.41 | | | 40.0 | % | |

| | | | | | | | | | | |

| Florida: | | | | | | | | | | | |

| South Florida | | 8,386 | | | 97.4 | % | | 2,834 | | | 1.52 | | | 12.5 | % | |

| Tampa | | 8,695 | | | 96.9 | % | | 2,184 | | | 1.17 | | | 10.2 | % | |

| Orlando | | 6,536 | | | 97.2 | % | | 2,131 | | | 1.14 | | | 7.5 | % | |

| Jacksonville | | 1,928 | | | 97.1 | % | | 2,104 | | | 1.06 | | | 2.2 | % | |

| Florida Subtotal | | 25,545 | | | 97.2 | % | | 2,379 | | | 1.27 | | | 32.4 | % | |

| | | | | | | | | | | |

| Southeast United States: | | | | | | | | | | | |

| Atlanta | | 12,619 | | | 96.3 | % | | 1,925 | | | 0.93 | | | 12.6 | % | |

| Carolinas | | 5,348 | | | 97.5 | % | | 1,957 | | | 0.92 | | | 5.5 | % | |

| Southeast US Subtotal | | 17,967 | | | 96.6 | % | | 1,935 | | | 0.93 | | | 18.1 | % | |

| | | | | | | | | | | |

| Texas: | | | | | | | | | | | |

| Houston | | 2,075 | | | 96.1 | % | | 1,814 | | | 0.93 | | | 2.0 | % | |

| Dallas | | 2,849 | | | 96.0 | % | | 2,159 | | | 1.05 | | | 3.3 | % | |

| Texas Subtotal | | 4,924 | | | 96.0 | % | | 2,013 | | | 1.00 | | | 5.3 | % | |

| | | | | | | | | | | |

| Midwest United States: | | | | | | | | | | | |

| Chicago | | 2,508 | | | 97.6 | % | | 2,269 | | | 1.41 | | | 2.9 | % | |

| Minneapolis | | 1,092 | | | 96.7 | % | | 2,226 | | | 1.13 | | | 1.3 | % | |

| Midwest US Subtotal | | 3,600 | | | 97.3 | % | | 2,256 | | | 1.32 | | | 4.2 | % | |

| | | | | | | | | | | |

| Total / Average | | 82,837 | | | 97.0 | % | | $ | 2,288 | | | $ | 1.22 | | | 100.0 | % | |

| Same Store Total / Average | | 76,593 | | | 97.6 | % | | $ | 2,285 | | | $ | 1.22 | | | 92.7 | % | |

| | | | | | | | | | | |

(1)All data is for the total wholly owned portfolio, unless otherwise noted.

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 18

Supplemental Schedule 5(a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Core Revenues Growth Summary — YoY Quarter |

| ($ in thousands, except avg. monthly rent) (unaudited) |

| | | | | | | | | |

| | | | Avg. Monthly Rent | | Average Occupancy | | Core Revenues | |

| YoY, Q2 2023 | | # Homes | | Q2 2023 | | Q2 2022 | | Change | | Q2 2023 | | Q2 2022 | | Change | | Q2 2023 | | Q2 2022 | | Change | |

| Western United States: | | | | | | | | | | | | | | | | | | | | | |

| Southern California | | 7,432 | | | $ | 2,940 | | | $ | 2,781 | | | 5.7 | % | | 97.7 | % | | 98.4 | % | | (0.7) | % | | $ | 62,955 | | | $ | 60,924 | | | 3.3 | % | |

| Northern California | | 3,871 | | | 2,597 | | | 2,468 | | | 5.2 | % | | 97.7 | % | | 98.2 | % | | (0.5) | % | | 29,696 | | | 29,156 | | | 1.9 | % | |

| Seattle | | 3,665 | | | 2,759 | | | 2,592 | | | 6.4 | % | | 98.2 | % | | 98.4 | % | | (0.2) | % | | 30,103 | | | 28,873 | | | 4.3 | % | |

| Phoenix | | 8,046 | | | 1,947 | | | 1,794 | | | 8.5 | % | | 97.7 | % | | 98.0 | % | | (0.3) | % | | 48,069 | | | 44,466 | | | 8.1 | % | |

| Las Vegas | | 2,799 | | | 2,144 | | | 2,015 | | | 6.4 | % | | 96.7 | % | | 97.9 | % | | (1.2) | % | | 17,780 | | | 17,107 | | | 3.9 | % | |

| Denver | | 2,142 | | | 2,458 | | | 2,347 | | | 4.7 | % | | 98.3 | % | | 97.5 | % | | 0.8 | % | | 16,009 | | | 15,333 | | | 4.4 | % | |

| Western US Subtotal | | 27,955 | | | 2,467 | | | 2,319 | | | 6.4 | % | | 97.7 | % | | 98.1 | % | | (0.4) | % | | 204,612 | | | 195,859 | | | 4.5 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Florida: | | | | | | | | | | | | | | | | | | | | | |

| South Florida | | 7,804 | | | 2,855 | | | 2,570 | | | 11.1 | % | | 97.9 | % | | 98.4 | % | | (0.5) | % | | 67,163 | | | 60,589 | | | 10.9 | % | |

| Tampa | | 7,989 | | | 2,163 | | | 1,979 | | | 9.3 | % | | 97.7 | % | | 98.2 | % | | (0.5) | % | | 52,689 | | | 48,632 | | | 8.3 | % | |

| Orlando | | 6,087 | | | 2,118 | | | 1,954 | | | 8.4 | % | | 98.0 | % | | 98.1 | % | | (0.1) | % | | 39,575 | | | 36,450 | | | 8.6 | % | |

| Jacksonville | | 1,857 | | | 2,092 | | | 1,956 | | | 7.0 | % | | 97.3 | % | | 97.7 | % | | (0.4) | % | | 11,836 | | | 11,082 | | | 6.8 | % | |

| Florida Subtotal | | 23,737 | | | 2,374 | | | 2,165 | | | 9.7 | % | | 97.8 | % | | 98.2 | % | | (0.4) | % | | 171,263 | | | 156,753 | | | 9.3 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Southeast United States: | | | | | | | | | | | | | | | | | | | | | |

| Atlanta | | 12,015 | | | 1,924 | | | 1,793 | | | 7.3 | % | | 96.9 | % | | 97.8 | % | | (0.9) | % | | 67,793 | | | 65,319 | | | 3.8 | % | |

| Carolinas | | 4,942 | | | 1,953 | | | 1,836 | | | 6.4 | % | | 97.7 | % | | 97.8 | % | | (0.1) | % | | 28,936 | | | 27,729 | | | 4.4 | % | |

| Southeast US Subtotal | | 16,957 | | | 1,932 | | | 1,806 | | | 7.0 | % | | 97.1 | % | | 97.8 | % | | (0.7) | % | | 96,729 | | | 93,048 | | | 4.0 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Texas | | | | | | | | | | | | | | | | | | | | | |

| Houston | | 1,914 | | | 1,812 | | | 1,724 | | | 5.1 | % | | 97.3 | % | | 97.3 | % | | — | % | | 10,562 | | | 10,029 | | | 5.3 | % | |

| Dallas | | 2,449 | | | 2,170 | | | 2,044 | | | 6.2 | % | | 97.1 | % | | 97.3 | % | | (0.2) | % | | 16,045 | | | 15,204 | | | 5.5 | % | |

| Texas Subtotal | | 4,363 | | | 2,013 | | | 1,904 | | | 5.7 | % | | 97.2 | % | | 97.3 | % | | (0.1) | % | | 26,607 | | | 25,233 | | | 5.4 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Midwest United States: | | | | | | | | | | | | | | | | | | | | | |

| Chicago | | 2,494 | | | 2,270 | | | 2,157 | | | 5.2 | % | | 97.9 | % | | 97.9 | % | | — | % | | 16,474 | | | 15,878 | | | 3.8 | % | |

| Minneapolis | | 1,087 | | | 2,226 | | | 2,131 | | | 4.5 | % | | 97.5 | % | | 97.3 | % | | 0.2 | % | | 7,346 | | | 6,910 | | | 6.3 | % | |

| Midwest US Subtotal | | 3,581 | | | 2,257 | | | 2,149 | | | 5.0 | % | | 97.8 | % | | 97.7 | % | | 0.1 | % | | 23,820 | | | 22,788 | | | 4.5 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Total / Average | | 76,593 | | | $ | 2,285 | | | $ | 2,127 | | | 7.4 | % | | 97.6 | % | | 98.0 | % | | (0.4) | % | | $ | 523,031 | | | $ | 493,681 | | | 5.9 | % | |

| | | | | | | | | | | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 19

Supplemental Schedule 5(a) (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Core Revenues Growth Summary — Sequential Quarter |

| ($ in thousands, except avg. monthly rent) (unaudited) |

| | | | | | | | | | |

| | | | Avg. Monthly Rent | | Average Occupancy | | Core Revenues | | |

| Seq, Q2 2023 | | # Homes | | Q2 2023 | | Q1 2023 | | Change | | Q2 2023 | | Q1 2023 | | Change | | Q2 2023 | | Q1 2023 | | Change | | |

| Western United States: | | | | | | | | | | | | | | | | | | | | | | |

| Southern California | | 7,432 | | | $ | 2,940 | | | $ | 2,911 | | | 1.0 | % | | 97.7 | % | | 98.1 | % | | (0.4) | % | | $ | 62,955 | | | $ | 61,589 | | | 2.2 | % | | |

| Northern California | | 3,871 | | | 2,597 | | | 2,577 | | | 0.8 | % | | 97.7 | % | | 98.1 | % | | (0.4) | % | | 29,696 | | | 29,197 | | | 1.7 | % | | |

| Seattle | | 3,665 | | | 2,759 | | | 2,729 | | | 1.1 | % | | 98.2 | % | | 97.4 | % | | 0.8 | % | | 30,103 | | | 29,448 | | | 2.2 | % | | |

| Phoenix | | 8,046 | | | 1,947 | | | 1,918 | | | 1.5 | % | | 97.7 | % | | 98.0 | % | | (0.3) | % | | 48,069 | | | 47,412 | | | 1.4 | % | | |

| Las Vegas | | 2,799 | | | 2,144 | | | 2,131 | | | 0.6 | % | | 96.7 | % | | 96.7 | % | | — | % | | 17,780 | | | 17,273 | | | 2.9 | % | | |

| Denver | | 2,142 | | | 2,458 | | | 2,426 | | | 1.3 | % | | 98.3 | % | | 97.6 | % | | 0.7 | % | | 16,009 | | | 15,808 | | | 1.3 | % | | |

| Western US Subtotal | | 27,955 | | | 2,467 | | | 2,440 | | | 1.1 | % | | 97.7 | % | | 97.8 | % | | (0.1) | % | | 204,612 | | | 200,727 | | | 1.9 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Florida: | | | | | | | | | | | | | | | | | | | | | | |

| South Florida | | 7,804 | | | 2,855 | | | 2,802 | | | 1.9 | % | | 97.9 | % | | 98.0 | % | | (0.1) | % | | 67,163 | | | 65,698 | | | 2.2 | % | | |

| Tampa | | 7,989 | | | 2,163 | | | 2,131 | | | 1.5 | % | | 97.7 | % | | 98.0 | % | | (0.3) | % | | 52,689 | | | 51,881 | | | 1.6 | % | | |

| Orlando | | 6,087 | | | 2,118 | | | 2,085 | | | 1.6 | % | | 98.0 | % | | 98.2 | % | | (0.2) | % | | 39,575 | | | 39,080 | | | 1.3 | % | | |

| Jacksonville | | 1,857 | | | 2,092 | | | 2,063 | | | 1.4 | % | | 97.3 | % | | 97.9 | % | | (0.6) | % | | 11,836 | | | 11,692 | | | 1.2 | % | | |

| Florida Subtotal | | 23,737 | | | 2,374 | | | 2,334 | | | 1.7 | % | | 97.8 | % | | 98.0 | % | | (0.2) | % | | 171,263 | | | 168,351 | | | 1.7 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Southeast United States: | | | | | | | | | | | | | | | | | | | | | | |

| Atlanta | | 12,015 | | | 1,924 | | | 1,898 | | | 1.4 | % | | 96.9 | % | | 97.5 | % | | (0.6) | % | | 67,793 | | | 66,795 | | | 1.5 | % | | |

| Carolinas | | 4,942 | | | 1,953 | | | 1,924 | | | 1.5 | % | | 97.7 | % | | 98.2 | % | | (0.5) | % | | 28,936 | | | 28,523 | | | 1.4 | % | | |

| Southeast US Subtotal | | 16,957 | | | 1,932 | | | 1,906 | | | 1.4 | % | | 97.1 | % | | 97.7 | % | | (0.6) | % | | 96,729 | | | 95,318 | | | 1.5 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Texas | | | | | | | | | | | | | | | | | | | | | | |

| Houston | | 1,914 | | | 1,812 | | | 1,794 | | | 1.0 | % | | 97.3 | % | | 97.4 | % | | (0.1) | % | | 10,562 | | | 10,363 | | | 1.9 | % | | |

| Dallas | | 2,449 | | | 2,170 | | | 2,140 | | | 1.4 | % | | 97.1 | % | | 97.9 | % | | (0.8) | % | | 16,045 | | | 15,907 | | | 0.9 | % | | |

| Texas Subtotal | | 4,363 | | | 2,013 | | | 1,989 | | | 1.2 | % | | 97.2 | % | | 97.7 | % | | (0.5) | % | | 26,607 | | | 26,270 | | | 1.3 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Midwest United States: | | | | | | | | | | | | | | | | | | | | | | |

| Chicago | | 2,494 | | | 2,270 | | | 2,246 | | | 1.1 | % | | 97.9 | % | | 98.1 | % | | (0.2) | % | | 16,474 | | | 16,245 | | | 1.4 | % | | |

| Minneapolis | | 1,087 | | | 2,226 | | | 2,203 | | | 1.0 | % | | 97.5 | % | | 96.7 | % | | 0.8 | % | | 7,346 | | | 7,168 | | | 2.5 | % | | |

| Midwest US Subtotal | | 3,581 | | | 2,257 | | | 2,233 | | | 1.1 | % | | 97.8 | % | | 97.7 | % | | 0.1 | % | | 23,820 | | | 23,413 | | | 1.7 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total / Average | | 76,593 | | | $ | 2,285 | | | $ | 2,254 | | | 1.4 | % | | 97.6 | % | | 97.8 | % | | (0.2) | % | | $ | 523,031 | | | $ | 514,079 | | | 1.7 | % | | |

| | | | | | | | | | | | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 20

Supplemental Schedule 5(a) (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Core Revenues Growth Summary — YTD |

| ($ in thousands, except avg. monthly rent) (unaudited) |

| | | | | | | | | |

| | | | Avg. Monthly Rent | | Average Occupancy | | Core Revenues | |

| YoY, YTD 2023 | | # Homes | | YTD 2023 | | YTD 2022 | | Change | | YTD 2023 | | YTD 2022 | | Change | | YTD 2023 | | YTD 2022 | | Change | |

| Western United States: | | | | | | | | | | | | | | | | | | | | | |

| Southern California | | 7,432 | | | $ | 2,926 | | | $ | 2,764 | | | 5.9 | % | | 97.9 | % | | 98.5 | % | | (0.6) | % | | $ | 124,544 | | | $ | 119,823 | | | 3.9 | % | |

| Northern California | | 3,871 | | | 2,587 | | | 2,441 | | | 6.0 | % | | 97.9 | % | | 98.4 | % | | (0.5) | % | | 58,893 | | | 56,151 | | | 4.9 | % | |

| Seattle | | 3,665 | | | 2,744 | | | 2,565 | | | 7.0 | % | | 97.8 | % | | 98.2 | % | | (0.4) | % | | 59,551 | | | 56,422 | | | 5.5 | % | |

| Phoenix | | 8,046 | | | 1,932 | | | 1,768 | | | 9.3 | % | | 97.9 | % | | 98.1 | % | | (0.2) | % | | 95,481 | | | 87,488 | | | 9.1 | % | |

| Las Vegas | | 2,799 | | | 2,137 | | | 1,987 | | | 7.5 | % | | 96.7 | % | | 98.1 | % | | (1.4) | % | | 35,053 | | | 33,584 | | | 4.4 | % | |

| Denver | | 2,142 | | | 2,442 | | | 2,326 | | | 5.0 | % | | 98.0 | % | | 97.8 | % | | 0.2 | % | | 31,817 | | | 30,257 | | | 5.2 | % | |

| Western US Subtotal | | 27,955 | | | 2,453 | | | 2,296 | | | 6.8 | % | | 97.8 | % | | 98.2 | % | | (0.4) | % | | 405,339 | | 405339 | 383,725 | | | 5.6 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Florida: | | | | | | | | | | | | | | | | | | | | | |

| South Florida | | 7,804 | | | 2,829 | | | 2,530 | | | 11.8 | % | | 98.0 | % | | 98.6 | % | | (0.6) | % | | 132,861 | | | 119,798 | | | 10.9 | % | |

| Tampa | | 7,989 | | | 2,147 | | | 1,952 | | | 10.0 | % | | 97.8 | % | | 98.1 | % | | (0.3) | % | | 104,570 | | | 95,576 | | | 9.4 | % | |

| Orlando | | 6,087 | | | 2,101 | | | 1,930 | | | 8.9 | % | | 98.1 | % | | 98.1 | % | | — | % | | 78,655 | | | 72,000 | | | 9.2 | % | |

| Jacksonville | | 1,857 | | | 2,078 | | | 1,931 | | | 7.6 | % | | 97.6 | % | | 97.8 | % | | (0.2) | % | | 23,528 | | | 21,878 | | | 7.5 | % | |

| Florida Subtotal | | 23,737 | | | 2,354 | | | 2,135 | | | 10.3 | % | | 97.9 | % | | 98.2 | % | | (0.3) | % | | 339,614 | | | 309,252 | | | 9.8 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Southeast United States: | | | | | | | | | | | | | | | | | | | | | |

| Atlanta | | 12,015 | | | 1,911 | | | 1,771 | | | 7.9 | % | | 97.2 | % | | 97.8 | % | | (0.6) | % | | 134,588 | | | 128,184 | | | 5.0 | % | |

| Carolinas | | 4,942 | | | 1,938 | | | 1,818 | | | 6.6 | % | | 98.0 | % | | 97.8 | % | | 0.2 | % | | 57,459 | | | 54,768 | | | 4.9 | % | |

| Southeast US Subtotal | | 16,957 | | | 1,919 | | | 1,785 | | | 7.5 | % | | 97.4 | % | | 97.8 | % | | (0.4) | % | | 192,047 | | | 182,952 | | | 5.0 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Texas | | | | | | | | | | | | | | | | | | | | | |

| Houston | | 1,914 | | | 1,803 | | | 1,709 | | | 5.5 | % | | 97.3 | % | | 97.6 | % | | (0.3) | % | | 20,925 | | | 19,877 | | | 5.3 | % | |

| Dallas | | 2,449 | | | 2,155 | | | 2,018 | | | 6.8 | % | | 97.5 | % | | 97.3 | % | | 0.2 | % | | 31,952 | | | 29,781 | | | 7.3 | % | |

| Texas Subtotal | | 4,363 | | | 2,001 | | | 1,882 | | | 6.3 | % | | 97.4 | % | | 97.4 | % | | — | % | | 52,877 | | | 49,658 | | | 6.5 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Midwest United States: | | | | | | | | | | | | | | | | | | | | | |

| Chicago | | 2,494 | | | 2,258 | | | 2,137 | | | 5.7 | % | | 98.0 | % | | 98.3 | % | | (0.3) | % | | 32,719 | | | 31,235 | | | 4.8 | % | |

| Minneapolis | | 1,087 | | | 2,215 | | | 2,109 | | | 5.0 | % | | 97.1 | % | | 97.2 | % | | (0.1) | % | | 14,514 | | | 13,659 | | | 6.3 | % | |

| Midwest US Subtotal | | 3,581 | | | 2,245 | | | 2,129 | | | 5.4 | % | | 97.7 | % | | 98.0 | % | | (0.3) | % | | 47,233 | | | 44,894 | | | 5.2 | % | |

| | | | | | | | | | | | | | | | | | | | | |

| Total / Average | | 76,593 | | | $ | 2,269 | | | $ | 2,102 | | | 7.9 | % | | 97.7 | % | | 98.1 | % | | (0.4) | % | | $ | 1,037,110 | | | $ | 970,481 | | | 6.9 | % | |

| | | | | | | | | | | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 21

Supplemental Schedule 5(b)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store NOI Growth and Margin Summary — YoY Quarter | | | | |

| ($ in thousands) (unaudited) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Core Revenues | | Core Operating Expenses | | Net Operating Income | | Core NOI Margin | |

| YoY, Q2 2023 | | Q2 2023 | | Q2 2022 | | Change | | Q2 2023 | | Q2 2022 | | Change | | Q2 2023 | | Q2 2022 | | Change | | Q2 2023 | | Q2 2022 | |

| Western United States: | | | | | | | | | | | | | | | | | | | | | | | |

| Southern California | | $ | 62,955 | | | $ | 60,924 | | | 3.3 | % | | $ | 18,457 | | | $ | 16,842 | | | 9.6 | % | | $ | 44,498 | | | $ | 44,082 | | | 0.9 | % | | 70.7 | % | | 72.4 | % | |

| Northern California | | 29,696 | | | 29,156 | | | 1.9 | % | | 7,915 | | | 7,526 | | | 5.2 | % | | 21,781 | | | 21,630 | | | 0.7 | % | | 73.3 | % | | 74.2 | % | |

| Seattle | | 30,103 | | | 28,873 | | | 4.3 | % | | 7,984 | | | 7,454 | | | 7.1 | % | | 22,119 | | | 21,419 | | | 3.3 | % | | 73.5 | % | | 74.2 | % | |

| Phoenix | | 48,069 | | | 44,466 | | | 8.1 | % | | 9,257 | | | 9,180 | | | 0.8 | % | | 38,812 | | | 35,286 | | | 10.0 | % | | 80.7 | % | | 79.4 | % | |

| Las Vegas | | 17,780 | | | 17,107 | | | 3.9 | % | | 4,200 | | | 3,623 | | | 15.9 | % | | 13,580 | | | 13,484 | | | 0.7 | % | | 76.4 | % | | 78.8 | % | |

| Denver | | 16,009 | | | 15,333 | | | 4.4 | % | | 3,112 | | | 3,118 | | | (0.2) | % | | 12,897 | | | 12,215 | | | 5.6 | % | | 80.6 | % | | 79.7 | % | |

| Western US Subtotal | | 204,612 | | | 195,859 | | | 4.5 | % | | 50,925 | | | 47,743 | | | 6.7 | % | | 153,687 | | | 148,116 | | | 3.8 | % | | 75.1 | % | | 75.6 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Florida: | | | | | | | | | | | | | | | | | | | | | | | |

| South Florida | | 67,163 | | | 60,589 | | | 10.9 | % | | 25,623 | | | 23,010 | | | 11.4 | % | | 41,540 | | | 37,579 | | | 10.5 | % | | 61.8 | % | | 62.0 | % | |

| Tampa | | 52,689 | | | 48,632 | | | 8.3 | % | | 20,127 | | | 17,352 | | | 16.0 | % | | 32,562 | | | 31,280 | | | 4.1 | % | | 61.8 | % | | 64.3 | % | |

| Orlando | | 39,575 | | | 36,450 | | | 8.6 | % | | 13,508 | | | 12,113 | | | 11.5 | % | | 26,067 | | | 24,337 | | | 7.1 | % | | 65.9 | % | | 66.8 | % | |

| Jacksonville | | 11,836 | | | 11,082 | | | 6.8 | % | | 4,229 | | | 3,685 | | | 14.8 | % | | 7,607 | | | 7,397 | | | 2.8 | % | | 64.3 | % | | 66.7 | % | |

| Florida Subtotal | | 171,263 | | | 156,753 | | | 9.3 | % | | 63,487 | | | 56,160 | | | 13.0 | % | | 107,776 | | | 100,593 | | | 7.1 | % | | 62.9 | % | | 64.2 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Southeast United States: | | | | | | | | | | | | | | | | | | | | | | | |

| Atlanta | | 67,793 | | | 65,319 | | | 3.8 | % | | 23,804 | | | 19,177 | | | 24.1 | % | | 43,989 | | | 46,142 | | | (4.7) | % | | 64.9 | % | | 70.6 | % | |

| Carolinas | | 28,936 | | | 27,729 | | | 4.4 | % | | 7,708 | | | 7,424 | | | 3.8 | % | | 21,228 | | | 20,305 | | | 4.5 | % | | 73.4 | % | | 73.2 | % | |

| Southeast US Subtotal | | 96,729 | | | 93,048 | | | 4.0 | % | | 31,512 | | | 26,601 | | | 18.5 | % | | 65,217 | | | 66,447 | | | (1.9) | % | | 67.4 | % | | 71.4 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Texas | | | | | | | | | | | | | | | | | | | | | | | |

| Houston | | 10,562 | | | 10,029 | | | 5.3 | % | | 5,170 | | | 4,775 | | | 8.3 | % | | 5,392 | | | 5,254 | | | 2.6 | % | | 51.1 | % | | 52.4 | % | |

| Dallas | | 16,045 | | | 15,204 | | | 5.5 | % | | 6,609 | | | 5,976 | | | 10.6 | % | | 9,436 | | | 9,228 | | | 2.3 | % | | 58.8 | % | | 60.7 | % | |

| Texas Subtotal | | 26,607 | | | 25,233 | | | 5.4 | % | | 11,779 | | | 10,751 | | | 9.6 | % | | 14,828 | | | 14,482 | | | 2.4 | % | | 55.7 | % | | 57.4 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Midwest United States: | | | | | | | | | | | | | | | | | | | | | | | |

| Chicago | | 16,474 | | | 15,878 | | | 3.8 | % | | 7,451 | | | 7,183 | | | 3.7 | % | | 9,023 | | | 8,695 | | | 3.8 | % | | 54.8 | % | | 54.8 | % | |

| Minneapolis | | 7,346 | | | 6,910 | | | 6.3 | % | | 2,519 | | | 2,326 | | | 8.3 | % | | 4,827 | | | 4,584 | | | 5.3 | % | | 65.7 | % | | 66.3 | % | |

| Midwest US Subtotal | | 23,820 | | | 22,788 | | | 4.5 | % | | 9,970 | | | 9,509 | | | 4.8 | % | | 13,850 | | | 13,279 | | | 4.3 | % | | 58.1 | % | | 58.3 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Total / Average | | $ | 523,031 | | | $ | 493,681 | | | 5.9 | % | | $ | 167,673 | | | $ | 150,764 | | | 11.2 | % | | $ | 355,358 | | | $ | 342,917 | | | 3.6 | % | | 67.9 | % | | 69.5 | % | |

| | | | | | | | | | | | | | | | | | | | | | | |

Note: Refer to "Glossary and Reconciliations" for metric definitions and reconciliations of non-GAAP financial measures.

Q2 2023 Earnings Release and Supplemental Information — page 22

Supplemental Schedule 5(b) (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store NOI Growth and Margin Summary — Sequential Quarter | | | | | |

| ($ in thousands) (unaudited) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Core Revenues | | Core Operating Expenses | | Net Operating Income | | Core NOI Margin | | |

| Seq, Q2 2023 | | Q2 2023 | | Q1 2023 | | | Change | | Q2 2023 | | Q1 2023 | | | Change | | Q2 2023 | | Q1 2023 | | | Change | | Q2 2023 | | Q1 2023 | | |

| Western United States: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Southern California | | $ | 62,955 | | | $ | 61,589 | | | | 2.2 | % | | $ | 18,457 | | | $ | 17,879 | | | | 3.2 | % | | $ | 44,498 | | | $ | 43,710 | | | | 1.8 | % | | 70.7 | % | | 71.0 | % | | |

| Northern California | | 29,696 | | | 29,197 | | | | 1.7 | % | | 7,915 | | | 7,958 | | | | (0.5) | % | | 21,781 | | | 21,239 | | | | 2.6 | % | | 73.3 | % | | 72.7 | % | | |

| Seattle | | 30,103 | | | 29,448 | | | | 2.2 | % | | 7,984 | | | 8,251 | | | | (3.2) | % | | 22,119 | | | 21,197 | | | | 4.3 | % | | 73.5 | % | | 72.0 | % | | |

| Phoenix | | 48,069 | | | 47,412 | | | | 1.4 | % | | 9,257 | | | 9,223 | | | | 0.4 | % | | 38,812 | | | 38,189 | | | | 1.6 | % | | 80.7 | % | | 80.5 | % | | |

| Las Vegas | | 17,780 | | | 17,273 | | | | 2.9 | % | | 4,200 | | | 4,182 | | | | 0.4 | % | | 13,580 | | | 13,091 | | | | 3.7 | % | | 76.4 | % | | 75.8 | % | | |

| Denver | | 16,009 | | | 15,808 | | | | 1.3 | % | | 3,112 | | | 2,864 | | | | 8.7 | % | | 12,897 | | | 12,944 | | | | (0.4) | % | | 80.6 | % | | 81.9 | % | | |

| Western US Subtotal | | 204,612 | | | 200,727 | | | | 1.9 | % | | 50,925 | | | 50,357 | | | | 1.1 | % | | 153,687 | | | 150,370 | | | | 2.2 | % | | 75.1 | % | | 74.9 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Florida: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| South Florida | | 67,163 | | | 65,698 | | | | 2.2 | % | | 25,623 | | | 25,282 | | | | 1.3 | % | | 41,540 | | | 40,416 | | | | 2.8 | % | | 61.8 | % | | 61.5 | % | | |

| Tampa | | 52,689 | | | 51,881 | | | | 1.6 | % | | 20,127 | | | 19,275 | | | | 4.4 | % | | 32,562 | | | 32,606 | | | | (0.1) | % | | 61.8 | % | | 62.8 | % | | |

| Orlando | | 39,575 | | | 39,080 | | | | 1.3 | % | | 13,508 | | | 13,099 | | | | 3.1 | % | | 26,067 | | | 25,981 | | | | 0.3 | % | | 65.9 | % | | 66.5 | % | | |

| Jacksonville | | 11,836 | | | 11,692 | | | | 1.2 | % | | 4,229 | | | 3,989 | | | | 6.0 | % | | 7,607 | | | 7,703 | | | | (1.2) | % | | 64.3 | % | | 65.9 | % | | |

| Florida Subtotal | | 171,263 | | | 168,351 | | | | 1.7 | % | | 63,487 | | | 61,645 | | | | 3.0 | % | | 107,776 | | | 106,706 | | | | 1.0 | % | | 62.9 | % | | 63.4 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Southeast United States: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Atlanta | | 67,793 | | | 66,795 | | | | 1.5 | % | | 23,804 | | | 22,075 | | | | 7.8 | % | | 43,989 | | | 44,720 | | | | (1.6) | % | | 64.9 | % | | 67.0 | % | | |

| Carolinas | | 28,936 | | | 28,523 | | | | 1.4 | % | | 7,708 | | | 7,696 | | | | 0.2 | % | | 21,228 | | | 20,827 | | | | 1.9 | % | | 73.4 | % | | 73.0 | % | | |

| Southeast US Subtotal | | 96,729 | | | 95,318 | | | | 1.5 | % | | 31,512 | | | 29,771 | | | | 5.8 | % | | 65,217 | | | 65,547 | | | | (0.5) | % | | 67.4 | % | | 68.8 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Texas | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Houston | | 10,562 | | | 10,363 | | | | 1.9 | % | | 5,170 | | | 5,274 | | | | (2.0) | % | | 5,392 | | | 5,089 | | | | 6.0 | % | | 51.1 | % | | 49.1 | % | | |

| Dallas | | 16,045 | | | 15,907 | | | | 0.9 | % | | 6,609 | | | 6,576 | | | | 0.5 | % | | 9,436 | | | 9,331 | | | | 1.1 | % | | 58.8 | % | | 58.7 | % | | |

| Texas Subtotal | | 26,607 | | | 26,270 | | | | 1.3 | % | | 11,779 | | | 11,850 | | | | (0.6) | % | | 14,828 | | | 14,420 | | | | 2.8 | % | | 55.7 | % | | 54.9 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Midwest United States: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chicago | | 16,474 | | | 16,245 | | | | 1.4 | % | | 7,451 | | | 7,336 | | | | 1.6 | % | | 9,023 | | | 8,909 | | | | 1.3 | % | | 54.8 | % | | 54.8 | % | | |

| Minneapolis | | 7,346 | | | 7,168 | | | | 2.5 | % | | 2,519 | | | 2,296 | | | | 9.7 | % | | 4,827 | | | 4,872 | | | | (0.9) | % | | 65.7 | % | | 68.0 | % | | |

| Midwest US Subtotal | | 23,820 | | | 23,413 | | | | 1.7 | % | | 9,970 | | | 9,632 | | | | 3.5 | % | | 13,850 | | | 13,781 | | | | 0.5 | % | | 58.1 | % | | 58.9 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |