IHS Inc. (NYSE: IHS), a leading global source of critical

information and insight, today reported results for the second

quarter ended May 31, 2011. Revenue for the second

quarter of 2011 totaled $325 million, a 22 percent increase over

second quarter 2010 revenue of $266 million. Net income for the

second quarter of 2011 was $38.7 million, or $0.59 per diluted

share, compared to second quarter 2010 net income of $38.5 million,

or $0.60 per diluted share.

Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation

and Amortization) totaled $95.5 million for the second quarter of

2011, up 16 percent from $82.0 million in the second quarter of

2010. Adjusted earnings per diluted share were $0.83 for the second

quarter of 2011, an increase of 6 percent over the prior-year

period. Adjusted EBITDA and adjusted earnings per share are

non-GAAP (Generally Accepted Accounting Principles) financial

measures used by management to measure operating performance.

Please see the end of this release for more information about these

non-GAAP measures.

“Our top-line growth, both on an organic and all-in basis, is

strong,” said Jerre Stead, IHS chairman and chief executive

officer. “With five acquisitions announced during this past

quarter, and our ongoing investment in scalable platforms, our

company's ability to deliver future profitable growth is the

highest in our history.”

Second Quarter 2011 Details

Revenue for the second quarter of 2011 totaled $325 million, a

22 percent increase over second-quarter 2010 revenue of $266

million. The revenue increase was driven by 7 percent organic

growth, 13 percent acquisitive growth, and 3 percent foreign

currency movements. The subscription-based business grew 8 percent

organically and represented 77 percent of total revenue.

Three Months Ended May

31, Absolute Organic Six Months Ended May

31, Absolute Organic 2011

2010 % change % change

2011 2010 % change

% change

Subscriptionrevenue

$ 250,541 $ 205,722

22%

8% $ 484,313 $ 401,208 21% 8%

Non-subscriptionrevenue

74,576 60,758 23% 3% 135,806 106,007

28% 6% Total revenue $ 325,117 $ 266,480

22%

7% $ 620,119 $ 507,215 22% 8%

The company continued to grow its business overall in all three

regions. The Americas (North and South America) segment increased

its revenue during the second quarter by $28.5 million, or 17

percent, to $196.6 million. The EMEA (Europe, Middle East and

Africa) segment grew its second quarter revenue by $20.4 million,

or 27 percent, to $95.6 million. The APAC (Asia Pacific) segment's

revenue was up $9.8 million, or 42 percent, to $32.9 million.

Adjusted EBITDA for the second quarter of 2011 was $95.5

million, up $13.5 million, or 16 percent, over the prior-year

period. Operating income increased $1.6 million, or 3 percent, to

$51.0 million. Americas' operating income increased $0.4 million,

or 1 percent, to $54.8 million. EMEA's operating income was up $2.3

million, or 13 percent, to $19.6 million. APAC's operating income

grew $2.0 million, or 25 percent, to $9.9 million.

Year-to-Date 2011

Revenue for the six months ended May 31, 2011,

increased $112.9 million, or 22 percent, to $620 million. Organic

revenue growth was 8 percent overall and 8 percent for the

subscription-based portion of the business. Acquisitions added 13

percent, and foreign currency movements increased revenue by 2

percent during the first half of 2011. The Americas segment grew

its revenue during the six months ended May 31, 2011, by

$57.7 million, or 18 percent, to $378 million. The EMEA segment

increased its year-to-date 2011 revenue by $36.6 million, or 26

percent, to $180 million. The APAC segment increased its revenue by

$18.6 million, or 42 percent, to $62 million, during the first half

of 2011.

Adjusted EBITDA for year-to-date 2011 increased $29.3 million,

or 19 percent, to $182 million. Operating income increased $5.2

million, or 6 percent, year-over-year to $91 million. Americas’

operating income was $104.1 million, up $3.0 million, or 3 percent,

over the prior-year period. EMEA grew its year-to-date 2011

operating income to $36.1 million, up $6.1 million, or 20 percent,

over the same period of 2010. APAC’s operating income was $18.1

million, an increase of $4.0 million, or 28 percent, over last

year.

Net income for the six months ended May 31, 2011

increased $4.1 million, or 6 percent, to $69.4 million, or $1.06

per diluted share.

Cash Flows

IHS generated $201 million of cash flow from operations during

the six months ended May 31, 2011, representing a 12

percent increase over last year's $179 million.

Balance Sheet

IHS ended second quarter 2011 with $147 million of cash and cash

equivalents and $295 million of debt.

“Our strong organic growth and robust cash flow generation

allows us to continue our significant investment in the business,”

stated Michael J. Sullivan, executive vice president and chief

financial officer. “We have many investment opportunities which

will deliver profitable growth in the future.”

Outlook (forward-looking statement)

For the year ending November 30, 2011, IHS is increasing both

its revenue and its Adjusted EBITDA guidance and expects:

- All-in revenue in a range of $1.285 to

$1.315 billion; and

- All-in Adjusted EBITDA in a range of

$390 to $398 million.

Additionally, for the year ending November 30, 2011, IHS also

expects:

- Depreciation and amortization expense

to be approximately $86 million;

- Net interest expense of approximately

$8 million;

- Adjusted EPS between $3.33 and

$3.43;

- Stock-based compensation expense to be

approximately $84 million;

- Net pension expense to be approximately

$11 million;

- An adjusted tax rate of approximately

26-27%; and

- Fully diluted shares to be

approximately 66 million.

Finally, in addition to this updated full-year guidance, IHS is

providing insight into its profit expectations for the third

quarter of the year. IHS expects all-in Adjusted EBITDA for the

third quarter of 2011 to be in a range of $97-99 million. Aside

from this one-time look at a quarterly projection, IHS expects to

continue its practice of providing guidance on an annual basis.

The above outlook assumes constant currencies and no further

acquisitions or unanticipated events.

See discussion of Adjusted EBITDA and non-GAAP financial

measures at the end of this release.

As previously announced, IHS will hold a conference call to

discuss second quarter 2011 results on June 22, 2011, at 3:00 p.m.

MDT (5:00 p.m. EDT). The conference call will be simultaneously

webcast on the company's website: www.ihs.com.

Use of Non-GAAP Financial Measures

Non-GAAP results are presented only as a supplement to the

financial statements based on U.S. generally accepted accounting

principles (GAAP). The non-GAAP financial information is provided

to enhance the reader's understanding of our financial performance,

but no non-GAAP measure should be considered in isolation or as a

substitute for financial measures calculated in accordance with

GAAP. Reconciliations of the most directly comparable GAAP measures

to non-GAAP measures, such as Adjusted EBITDA and adjusted earnings

per diluted share, are provided within the schedules attached to

this release.

EBITDA is defined as net income plus or minus net interest plus

income taxes, depreciation and amortization. Adjusted EBITDA

further excludes (i) non-cash items (e.g., stock-based compensation

expense and non-cash pension and post-retirement expense) and (ii)

items that management does not consider to be useful in assessing

our operating performance (e.g., acquisition-related costs,

restructuring charges, income or loss from discontinued operations,

and gain or loss on sale of assets). Adjusted earnings per diluted

share exclude similar items as adjusted EBITDA. None of these

non-GAAP financial measures are recognized terms under GAAP and do

not purport to be an alternative to net income as an indicator of

operating performance or any other GAAP measure.

Management uses these non-GAAP measures in its operational and

financial decision-making, believing that it is useful to eliminate

certain items in order to focus on what it deems to be a more

reliable indicator of ongoing operating performance and our ability

to generate cash flow from operations. As a result, internal

management reports used during monthly operating reviews feature

the adjusted EBITDA and adjusted earnings per diluted share

metrics. Management also believes that investors may find non-GAAP

financial measures useful for the same reasons, although investors

are cautioned that non-GAAP financial measures are not a substitute

for GAAP disclosures. EBITDA, adjusted EBITDA, and adjusted

earnings per diluted share are also used by many of our investors,

research analysts, investment bankers, and lenders to assess our

operating performance. For example, a measure similar to EBITDA is

required by the lenders under our term loan and revolving credit

agreement.

Because not all companies use identical calculations, our

presentation of non-GAAP financial measures may not be comparable

to other similarly-titled measures of other companies. However,

these measures can still be useful in evaluating our performance

against our peer companies because management believes the measures

provide users with valuable insight into key components of GAAP

financial disclosures. For example, a company with greater GAAP net

income may not be as appealing to investors if its net income is

more heavily comprised of gains on asset sales. Likewise,

eliminating the effects of interest income and expense moderates

the impact of a company's capital structure on its performance.

All of the items included in the reconciliation from net income

to adjusted EBITDA are either (i) non-cash items (e.g.,

depreciation and amortization, stock-based compensation, non-cash

pension and post-retirement expense) or (ii) items that we do

not consider to be useful in assessing our operating performance

(e.g., income taxes, acquisition-related costs, restructuring

charges, income or loss from discontinued operations, and gain or

loss on sale of assets). In the case of the non-cash items,

management believes that investors can better assess our operating

performance if the measures are presented without such items

because, unlike cash expenses, these adjustments do not affect our

ability to generate free cash flow or invest in our business. For

example, by eliminating depreciation and amortization from EBITDA,

users can compare operating performance without regard to different

accounting determinations such as useful life. In the case of the

other items, management believes that investors can better assess

operating performance if the measures are presented without these

items because their financial impact does not reflect ongoing

operating performance.

IHS Forward-Looking Statements:

This release may contain forward-looking statements as defined

in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are statements that are not historical

facts. Such statements may include financial projections and

estimates and their underlying assumptions, statements regarding

plans, objectives and expectations with respect to future

operations, products and services, and statements regarding future

performance. Forward-looking statements are generally identified by

the words "expect," "anticipate," "believe," "intend," "estimate,"

"plan" and similar expressions. Although IHS and its management

believe that the expectations reflected in such forward-looking

statements are reasonable, investors are cautioned that

forward-looking information and statements are subject to various

risks and uncertainties-many of which are difficult to predict and

generally beyond the control of IHS-that could cause actual results

and developments to differ materially from those expressed in, or

implied or projected by, the forward-looking information and

statements. These risks and uncertainties include those discussed

or identified by IHS from time to time in its public filings. Other

than as required by applicable law, IHS does not undertake any

obligation to update or revise any forward-looking information or

statements. Please consult our public filings at www.sec.gov or www.ihs.com.

About IHS Inc. (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight

in critical areas that shape today’s business landscape, including

energy and power; design and supply chain; defense, risk and

security; environmental, health and safety (EHS) and

sustainability; country and industry forecasting; and commodities,

pricing and cost. Businesses and governments around the globe rely

on the comprehensive content, expert independent analysis and

flexible delivery methods of IHS to make high-impact decisions and

develop strategies with speed and confidence. IHS has been in

business since 1959 and became a publicly traded company on the New

York Stock Exchange in 2005. Headquartered in Englewood, Colorado,

USA, IHS employs more than 5,100 people in more than 30 countries

around the world.

IHS is a registered trademark of IHS Inc. All other company and

product names may be trademarks of their respective owners.

Copyright © 2011 IHS Inc. All rights reserved.

IHS INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except for share and

per-share amounts)

As of As of May 31, 2011 November

30, 2010 (Unaudited) (Audited) Assets

Current assets: Cash and cash equivalents $ 147,114 $ 200,735

Accounts receivable, net 244,239 256,552 Income tax receivable

6,665 — Deferred subscription costs 47,827 41,449 Deferred income

taxes 34,419 33,532 Other 28,563 20,466 Total current

assets 508,827 552,734 Non-current assets: Property

and equipment, net 117,676 93,193 Intangible assets, net 453,146

384,568 Goodwill, net 1,291,025 1,120,830 Other 8,169 4,377

Total non-current assets 1,870,016 1,602,968

Total assets $ 2,378,843 $ 2,155,702

Liabilities

and stockholders’ equity Current liabilities: Short-term debt $

17,120 $ 19,054 Accounts payable 40,430 35,854 Accrued compensation

33,859 51,233 Accrued royalties 20,161 24,338 Other accrued

expenses 52,891 51,307 Income tax payable — 4,350 Deferred

subscription revenue 492,051 392,132 Total current

liabilities 656,512 578,268 Long-term debt 277,553 275,095 Accrued

pension liability 29,047 25,104 Accrued post-retirement benefits

10,182 10,056 Deferred income taxes 87,344 73,586 Other liabilities

16,680 17,512 Commitments and contingencies Stockholders’ equity:

Class A common stock, $0.01 par value per

share, 160,000,000 sharesauthorized, 67,152,304 and 66,250,283

shares issued, and 64,874,828 and 64,248,547 sharesoutstanding at

May 31, 2011 and November 30, 2010, respectively

672 662 Additional paid-in capital 590,627 541,108

Treasury stock, at cost: 2,277,476 and

2,001,736 shares at May 31, 2011 and November 30,2010,

respectively

(123,804 ) (101,554 ) Retained earnings 929,935 860,497 Accumulated

other comprehensive loss (95,905 ) (124,632 ) Total stockholders’

equity 1,301,525 1,176,081 Total liabilities and

stockholders’ equity $ 2,378,843 $ 2,155,702

IHS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except for per-share

amounts)

(Unaudited)

Three Months Ended May 31, Six Months Ended May

31, 2011 2010

2011 2010 Revenue:

Products $ 276,375 $ 225,440 $ 537,244 $ 438,122 Services 48,742

41,040 82,875 69,093 Total revenue

325,117 266,480 620,119 507,215

Operating expenses: Cost of

revenue: Products 116,533 91,530 226,091 180,653 Services 26,446

21,408 45,072 37,491

Total cost of revenue (includes

stock-basedcompensation expense of $930; $1,325; $1,784 and

$2,757for the three and six months ended May 31, 2011 and2010,

respectively)

142,979 112,938 271,163 218,144

Selling, general and administrative

(includes stock-basedcompensation expense of $18,361; $16,315;

$39,605and $34,185 for the three and six months ended May 31,

2011and 2010, respectively)

105,668 89,059 207,440 173,711 Depreciation and amortization 20,714

14,269 38,915 28,099 Restructuring charges (credits) 702 (82 ) 702

(82 ) Acquisition-related costs 1,243 — 4,549 — Net periodic

pension and post-retirement expense 2,733 1,194 5,465 2,388 Other

expense (income), net 108 (229 ) 613 (1,114 ) Total

operating expenses 274,147 217,149 528,847

421,146

Operating income 50,970 49,331 91,272 86,069

Interest income 306 94 491 198 Interest expense (2,145 ) (295 )

(3,807 ) (660 ) Non-operating expense, net (1,839 ) (201 ) (3,316 )

(462 ) Income from continuing operations before income taxes 49,131

49,130 87,956 85,607 Provision for income taxes (10,401 ) (10,652 )

(18,517 ) (20,180 ) Income from continuing operations 38,730 38,478

69,439 65,427 Loss from discontinued operations, net (8 ) —

(1 ) (126 )

Net income $ 38,722 $ 38,478 $

69,438 $ 65,301 Basic earnings per share:

Income from continuing operations $ 0.60 $ 0.60 $ 1.07 $ 1.03 Loss

from discontinued operations, net $ — $ — $ —

$ — Net income $ 0.60 $ 0.60 $ 1.07 $

1.02

Weighted average shares used in computing

basic earnings pershare

64,952 63,981 64,784 63,759

Diluted earnings per share: Income from continuing operations $

0.59 $ 0.60 $ 1.06 $ 1.01 Loss from discontinued operations, net $

— $ — $ — $ — Net income $ 0.59

$ 0.60 $ 1.06 $ 1.01

Weighted average shares used in computing

diluted earnings pershare

65,547 64,569 65,493 64,498

IHS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended May 31, 2011

2010 Operating activities: Net income $

69,438 $ 65,301 Reconciliation of net income to net cash provided

by operating activities: Depreciation and amortization 38,915

28,099 Stock-based compensation expense 41,389 36,942 Excess tax

benefit from stock-based compensation (8,412 ) (4,674 ) Non-cash

net periodic pension and post-retirement expense 5,207 1,704

Deferred income taxes 2,981 8,893 Change in assets and liabilities:

Accounts receivable, net 32,166 21,161 Other current assets (9,730

) (8,812 ) Accounts payable 1,001 1,992 Accrued expenses (24,365 )

(20,260 ) Income tax payable (7,781 ) (6,394 ) Deferred

subscription revenue 60,105 55,951 Other liabilities 67 (747

)

Net cash provided by operating activities 200,981

179,156

Investing activities: Capital expenditures on

property and equipment (32,531 ) (16,339 ) Acquisitions of

businesses, net of cash acquired (202,745 ) (83,567 ) Intangible

assets acquired (2,985 ) — Change in other assets (2,317 ) (943 )

Settlements of forward contracts (3,170 ) (1,310 )

Net cash used

in investing activities (243,748 ) (102,159 )

Financing

activities: Proceeds from borrowings 335,000 75,000 Repayment

of borrowings (334,601 ) (43,278 ) Payment of debt issuance costs

(6,326 ) — Excess tax benefit from stock-based compensation 8,412

4,674 Proceeds from the exercise of employee stock options 2,144

223 Repurchases of common stock (22,250 ) (22,461 )

Net cash

provided by (used in) financing activities (17,621 ) 14,158

Foreign exchange impact on cash balance 6,767 (12,534

) Net increase (decrease) in cash and cash equivalents (53,621 )

78,621 Cash and cash equivalents at the beginning of the period

200,735 124,201 Cash and cash equivalents at the end

of the period $ 147,114 $ 202,822

IHS INC.

SUPPLEMENTAL REVENUE DISCLOSURE

(In thousands)

(Unaudited)

Three Months Ended May 31, Absolute

Organic Six Months Ended May 31, Absolute

Organic 2011 2010

% change % change 2011

2010 % change % change Revenue by

segment: Americas revenue $ 196,559 $ 168,054 17% 6% $ 377,750

$ 320,022 18% 7% EMEA revenue 95,628 75,248 27% 5% 180,066 143,444

26% 7% APAC revenue 32,930 23,178 42% 19% 62,303

43,749 42% 17%

Total revenue $ 325,117

$ 266,480 22% 7% $ 620,119 $ 507,215 22% 8%

Revenue by transaction type: Subscription revenue $

250,541 $ 205,722 22% 8% $ 484,313 $ 401,208 21% 8% Consulting

revenue 18,953 15,085 26% (5)% 35,469 26,970 32% 3% Transaction

revenue 14,327 12,235 17% 7% 27,665 23,625 17% 7% Other revenue

41,296 33,438 24% 5% 72,672 55,412 31%

7%

Total revenue $ 325,117 $ 266,480 22% 7% $

620,119 $ 507,215 22% 8%

Revenue by

information domain: Energy revenue $ 139,445 $ 123,114 $

261,096 $ 233,049 Product Lifecycle (PLC) revenue 108,493 83,175

210,273 157,909 Security revenue 30,111 26,953 56,931 52,352

Environment revenue 22,568 13,391 43,543 24,598

MacroeconomicForecasting andIntersection

revenue

24,500 19,847 48,276 39,307

Total

revenue $ 325,117 $ 266,480 $ 620,119 $

507,215

IHS INC.

RECONCILIATION OF CONSOLIDATED NON-GAAP

FINANCIAL MEASUREMENTS TO

MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS

(In thousands, except for per-share

amounts)

(Unaudited)

Three Months Ended May 31, Six Months Ended May

31, 2011 2010

2011 2010 Net

income $ 38,722 $ 38,478 $ 69,438 $ 65,301 Interest income (306

) (94 ) (491 ) (198 ) Interest expense 2,145 295 3,807 660

Provision for income taxes 10,401 10,652 18,517 20,180 Depreciation

and amortization 20,714 14,269 38,915 28,099

EBITDA $ 71,676 $ 63,600 $ 130,186 $ 114,042

Stock-based compensation expense 19,291 17,640 41,389 36,942

Restructuring charges (credits) 702 (82 ) 702 (82 )

Acquisition-related costs 1,243 — 4,549 — Non-cash net periodic

pension and post-retirement expense 2,604 853 5,207 1,704 Loss from

discontinued operations, net 8 — 1 126

Adjusted EBITDA $ 95,524 $ 82,011 $ 182,034

$ 152,732

Three Months Ended May

31, Six Months Ended May 31, 2011 2010

2011 2010 Earnings per diluted share $ 0.59 $

0.60 $ 1.06 $ 1.01 Stock-based compensation expense 0.19 0.17 0.41

0.36 Restructuring charges (credits) 0.01 — 0.01 —

Acquisition-related costs 0.02 — 0.05 — Non-cash net periodic

pension and post-retirement expense 0.02 0.01 0.05 0.02 Loss from

discontinued operations, net — — — —

Adjusted earnings per diluted share $ 0.83 $ 0.78

$ 1.58 $ 1.39 Note: Amounts may not sum due to

rounding

Three Months Ended May 31, Six

Months Ended May 31, 2011 2010 2011

2010 Net cash provided by operating activities

121,713 123,744 200,981 179,156 Capital expenditures on property

and equipment (16,990 ) (9,167 ) (32,531 ) (16,339 )

Free cash

flow $ 104,723 $ 114,577 $ 168,450 $

162,817

IHS INC.

RECONCILIATION OF SEGMENT NON-GAAP

FINANCIAL MEASUREMENTS TO

MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASUREMENTS

(In thousands)

(Unaudited)

Three Months Ended May 31, 2011 Americas

EMEA

APAC Shared Services

Total Operating income $

54,786 $ 19,614 $ 9,865 $ (33,295 ) $ 50,970 Adjustments:

Stock-based compensation expense — — — 19,291 19,291 Depreciation

and amortization 15,319 4,798 47 550 20,714 Restructuring charges

(credits) 875 364 — (537 ) 702 Acquisition-related costs 913 330 —

— 1,243

Non-cash net periodic pensionand

post-retirement expense

— — — 2,604 2,604

Adjusted

EBITDA $ 71,893 $ 25,106 $ 9,912 $ (11,387

) $ 95,524

Three Months Ended May 31, 2010

Americas EMEA APAC Shared Services

Total Operating income $ 54,430 $ 17,312 $ 7,875 $

(30,286 ) $ 49,331 Adjustments: Stock-based compensation expense —

— — 17,640 17,640 Depreciation and amortization 9,955 3,758 25 531

14,269 Restructuring charges (credits) (82 ) — — — (82 )

Non-cash net periodic pensionand

post-retirement expense

— — — 853 853

Adjusted

EBITDA $ 64,303 $ 21,070 $ 7,900 $ (11,262

) $ 82,011

Six Months Ended May 31, 2011

Americas EMEA APAC Shared Services

Total Operating income $ 104,105 $ 36,111 $ 18,126 $

(67,070 ) $ 91,272 Adjustments: Stock-based compensation expense —

— — 41,389 41,389 Depreciation and amortization 29,428 8,290 86

1,111 38,915 Restructuring charges (credits) 875 364 — (537 ) 702

Acquisition-related costs 4,147 402 — — 4,549

Non-cash net periodic pensionand

post-retirement expense

— — — 5,207 5,207

Adjusted

EBITDA $ 138,555 $ 45,167 $ 18,212 $

(19,900 ) $ 182,034

Six Months Ended May 31,

2010 Americas EMEA APAC Shared

Services Total Operating income $ 101,098 $

29,993 $ 14,176 $ (59,198 ) $ 86,069 Adjustments: Stock-based

compensation expense — — — 36,942 36,942 Depreciation and

amortization 19,171 7,818 50 1,060 28,099 Restructuring charges

(credits) (82 ) — — — (82 )

Non-cash net periodic pensionand

post-retirement expense

— — — 1,704 1,704

Adjusted

EBITDA $ 120,187 $ 37,811 $ 14,226 $

(19,492 ) $ 152,732

IHS INC.

SUPPLEMENTAL INFORMATION

(In thousands)

(Unaudited)

Three Months Ended May 31, 2011 Three Months Ended

May 31, 2010 Pre-tax

After tax Pre-tax

After tax Stock-based compensation expense $ 19,291 $ 12,476

$ 17,640 $ 11,113 Restructuring charges (credits) $ 702 $ 452 $ (82

) $ (51 ) Acquisition-related costs $ 1,243 $ 1,255 $ — $ —

Non-cash net periodic pension and post-retirement expense $ 2,604 $

1,616 $ 853 $ 529 Loss from discontinued operations, net $ 12 $ 8 $

— $ —

Six Months Ended May 31, 2011 Six Months

Ended May 31, 2010 Pre-tax

After tax Pre-tax

After tax Stock-based compensation

expense $ 41,389 $ 26,787 $ 36,942 $ 23,273 Restructuring charges

(credits) $ 702 $ 452 $ (82 ) $ (51 ) Acquisition-related costs $

4,549 $ 3,477 $ — $ — Non-cash net periodic pension and

post-retirement expense $ 5,207 $ 3,229 $ 1,704 $ 1,056 Loss from

discontinued operations, net $ 1 $ 1 $ 159 $ 126

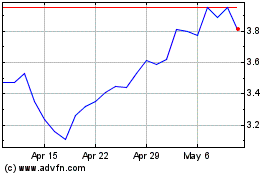

IHS (NYSE:IHS)

Historical Stock Chart

From Jun 2024 to Jul 2024

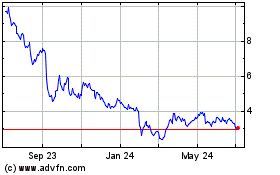

IHS (NYSE:IHS)

Historical Stock Chart

From Jul 2023 to Jul 2024