SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

TRANSACTION STATEMENT UNDER SECTION 13(e) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND

RULE 13e-3 THEREUNDER

Rule 13e-3 Transaction Statement

Under Section 13(e) of the Securities Exchange Act of 1934

HOLLY ENERGY PARTNERS, L.P.

(Name of the Issuer)

Holly Energy

Partners, L.P.

HF Sinclair Corporation

Navajo Pipeline Co., L.P.

Holly Apple Holdings LLC

Holly Logistic Services, L.L.C.

HEP Logistics Holdings, L.P.

(Names of Persons Filing Statement)

Common Units

(Title of

Class of Securities)

435763 10 7

(CUSIP Number of Class of Securities)

|

|

|

| Vaishali S. Bhatia

Executive Vice President, General Counsel and

Secretary HF Sinclair

Corporation 2828 N. Harwood St., Suite 1300

Dallas, Texas 75201 (214)

871-3555 |

|

Vaishali S. Bhatia

Executive Vice President, General Counsel and

Secretary Holly Energy

Partners, L.P. 2828 N. Harwood St., Suite 1300

Dallas, Texas 75201 (214)

871-3555 |

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of

the Persons Filing Statement)

With copies to

|

|

|

| Alan J. Bogdanow

Katherine Terrell Frank

E. Ramey Layne

Vinson & Elkins L.L.P.

Trammell Crow Center 2001

Ross Avenue, Suite 3900 Dallas, Texas 75201

(214) 220-7700 |

|

Hillary H. Holmes

Tull R. Florey Gibson,

Dunn & Crutcher LLP 811 Main Street, Suite 3000

Houston, Texas 77002

(346) 718-6600 |

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☒ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

|

|

|

| b. |

|

☒ |

|

The filing of a registration statement under the Securities Act of 1933. |

|

|

|

| c. |

|

☐ |

|

A tender offer. |

|

|

|

| d. |

|

☐ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are

preliminary copies: ☒

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

Neither the SEC nor any state securities regulatory agency has approved or disapproved the Merger, passed upon the merits or fairness of the Merger or

passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3 (this

“Transaction Statement”), together with the exhibits hereto, is being filed with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), by: (i) Holly Energy Partners, L.P., a Delaware limited partnership (“HEP”) and the issuer of the common units representing limited partner interests in HEP (“HEP Common Units,” and the holders of

HEP Common Units, the “HEP Unitholders”) that are subject to the Rule 13e-3 transaction; (ii) HF Sinclair Corporation, a Delaware corporation (“HF Sinclair”); (iii) Navajo Pipeline

Co., L.P., a Delaware limited partnership and an indirect wholly owned subsidiary of HF Sinclair (“HoldCo”); (iv) Holly Logistic Services, L.L.C., a Delaware limited liability company, the general partner (the “General Partner”)

of HEP Logistics Holdings, L.P. (“HLH”); (v) HLH, a Delaware limited partnership and the general partner of HEP; and (vi) Holly Apple Holdings LLC, a wholly owned subsidiary of HoldCo (“Merger Sub”). Collectively, the

persons filing this Transaction Statement are referred to as the “filing persons.”

This Transaction Statement relates to the Agreement and Plan

of Merger, dated as of August 15, 2023 (as the same may be amended or supplemented from time to time, the “Merger Agreement”), by and among HF Sinclair, HEP, HoldCo, the General Partner, HLH and Merger Sub, pursuant to which Merger

Sub will merge with and into HEP, with HEP surviving as an indirect, wholly owned subsidiary of HF Sinclair (the “Merger”).

Under the terms of

the Merger Agreement, at the effective time of the Merger, each outstanding HEP Common Unit other than the HEP Common Units owned by HF Sinclair, HoldCo, HLH, the General Partner and their respective affiliates, will be converted into the right to

receive (i) 0.315 (the “Exchange Ratio”) shares of common stock, par value $0.01 per share, of HF Sinclair (the “HF Sinclair Common Stock” and such issuance, the “HF Sinclair Stock Issuance”) and (ii) $4.00 in cash,

without interest (the “Cash Consideration” and, together with the shares of HF Sinclair Common Stock to be issued in the Merger, the “Merger Consideration”). The receipt of Merger Consideration in exchange for HEP Common Units

held by the HEP Unitholders other than HF Sinclair and its subsidiaries pursuant to the Merger will be a taxable transaction to U.S. Holders. See “United States Federal Income Tax Consequences” in the Joint Proxy Statement/Prospectus (as

defined below).

The Merger will become effective upon the filing of a properly executed certificate of merger with the Secretary of State of the State of

Delaware or at such later date and time as may be agreed by HF Sinclair and HEP in writing and set forth in the certificate of merger.

HF Sinclair will

not issue any fractional shares in the Merger. Instead, each holder of HEP Common Units that are converted pursuant to the Merger Agreement who otherwise would have received a fraction of a share of HF Sinclair Common Stock will be entitled to

receive, in lieu thereof, a cash payment (without interest and rounded to the nearest cent) in an amount equal to the product of (i) the aggregated amount of the fractional interest in shares of HF Sinclair Common Stock to which such holder

would otherwise be entitled to receive pursuant to the Merger Agreement and (ii) an amount equal to the average of the volume weighted average price per share of HF Sinclair Common Stock on the New York Stock Exchange (the “NYSE”) (as

reported by Bloomberg L.P., or, if not reported therein, in another authoritative source mutually selected by HF Sinclair and the General Partner) on each of the ten consecutive trading days ending with the complete trading day immediately prior to

the closing date of the Merger.

Holders of shares of HF Sinclair Common Stock prior to the Merger will continue to own their existing shares of HF

Sinclair Common Stock. In connection with the Merger, (i) HLH’s non-economic general partner interest in HEP, (ii) HLH’s special general partner interest in HEP (the “Special General

Partner Interest”), and (iii) the HEP Common Units owned by HF Sinclair and its subsidiaries, including HoldCo, will not be cancelled, will not be converted into the Merger Consideration and will remain outstanding following the Merger as

a non-economic general partner interest in HEP, a Special General Partner Interest in HEP and as HEP Common Units, respectively.

The closing of the Merger will take place on the third business day after the satisfaction or waiver of the conditions set forth in the Merger Agreement

(other than conditions that by their nature are to be satisfied at the closing but subject to the satisfaction or waiver of those conditions), or at such other place, date and time as HF Sinclair and HEP may agree.

1

The conflicts committee (the “HF Sinclair Conflicts Committee”) of the board of directors of HF

Sinclair (the “HF Sinclair Board”) has unanimously (i) determined that the Merger Agreement and the various transactions contemplated by the Merger Agreement, including the Merger and the HF Sinclair Stock Issuance (the

“Transactions”), are advisable and in the best interests of HF Sinclair and the HF Sinclair Stockholders, (ii) approved the Merger Agreement and the Transactions, including the Merger and the HF Sinclair Stock Issuance, on the terms

and subject to the conditions set forth in the Merger Agreement, (iii) recommended that the HF Sinclair Board approve the Merger Agreement and the Transactions, including the Merger and the HF Sinclair Stock Issuance, on the terms and subject

to the conditions set forth in the Merger Agreement, and (iv) resolved and recommended that the HF Sinclair Board resolve, to (a) direct that the HF Sinclair Stock Issuance be submitted to a vote of the HF Sinclair Stockholders for

approval at the HF Sinclair Special Meeting and (b) recommend approval of the HF Sinclair Stock Issuance by the HF Sinclair Stockholders at the HF Sinclair Special Meeting (as defined below).

The HF Sinclair Board (acting, in part, based upon the recommendation of the HF Sinclair Conflicts Committee) has unanimously (i) determined that the

Merger Agreement and the Transactions, including the Merger and the HF Sinclair Stock Issuance, are advisable and in the best interests of HF Sinclair and the HF Sinclair Stockholders, (ii) approved the Merger Agreement and the Transactions,

including the Merger and the HF Sinclair Stock Issuance, on the terms and subject to the conditions set forth in the Merger Agreement, (iii) directed that the HF Sinclair Stock Issuance be submitted to a vote of the HF Sinclair Stockholders for

approval at the HF Sinclair Special Meeting and (iv) resolved to recommend approval of the HF Sinclair Stock Issuance by the HF Sinclair Stockholders at the HF Sinclair Special Meeting.

The conflicts committee (the “HEP Conflicts Committee”) of the board of directors of the General Partner (the “GP Board”) has unanimously

and in good faith (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of HEP, including the HEP Unitholders other than HF Sinclair, HoldCo, HLH, the General Partner

and their respective Affiliates (the “HEP Unaffiliated Unitholders”), (ii) approved the Merger Agreement and the transactions contemplated thereby, including the Merger (the foregoing constituting “Special Approval” for all

purposes of the Second Amended and Restated Agreement of Limited Partnership of HEP, dated as of October 31, 2017, as may be further amended, modified or supplemented from time to time, including Section 7.9(a) thereof) on the terms and

subject to the conditions set forth in the Merger Agreement, (iii) recommended that the GP Board approve the Merger Agreement and the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth

in the Merger Agreement, and (iv) resolved and recommended that the GP Board resolve to (a) direct that the Merger Agreement and the Merger be submitted to a vote of the HEP Unitholders for approval and (b) recommend approval of the

Merger Agreement and the Merger by the HEP Unitholders at the HEP Special Meeting (as defined below).

The GP Board (acting, in part, based upon the

recommendation of the HEP Conflicts Committee) has unanimously and in good faith (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of HEP, including the HEP

Unaffiliated Unitholders, (ii) approved the Merger Agreement and the transactions contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, (iii) directed that the Merger

Agreement and the Merger be submitted to a vote of the HEP Unitholders for approval and (iv) resolved to recommend approval of the Merger Agreement and the Merger by the HEP Unitholders at the HEP Special Meeting.

In connection with the Merger, HF Sinclair will hold a special meeting of its stockholders (as the same may be adjourned or postponed, the “HF Sinclair

Special Meeting”), and HEP will hold a special meeting of its unitholders (as the same may be adjourned or postponed, the “HEP Special Meeting”).

At the HF Sinclair Special Meeting, the HF Sinclair Stockholders will be asked to consider and vote on proposals to (i) approve the issuance of shares of

HF Sinclair Common Stock to HEP Unitholders pursuant to the Merger Agreement (the “HF Sinclair Stock Issuance Proposal”) and (ii) approve the adjournment of the HF Sinclair Special Meeting to a later date or dates, if necessary or

appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the HF Sinclair Special Meeting to approve the HF Sinclair Stock Issuance Proposal. The approval by the HF Sinclair Stockholders of the HF Sinclair

Stock Issuance Proposal is required by the NYSE rules relating to issuances of securities to certain related parties.

2

At the HEP Special Meeting, the HEP Unitholders will be asked to consider and vote on proposals to

(i) approve the Merger Agreement and the transactions contemplated thereby (the “Merger Proposal”) and (ii) approve the adjournment of the HEP Special Meeting to a later date or dates, if necessary or appropriate, to solicit

additional proxies in the event there are not sufficient votes at the time of the HEP Special Meeting to approve the Merger Proposal. Pursuant to the Merger Agreement, HF Sinclair has agreed that it will vote, or cause to be voted, all HEP Common

Units then owned beneficially or of record by HF Sinclair or any of its subsidiaries in favor of the Merger Proposal. HF Sinclair currently holds approximately 47% of the issued and outstanding HEP Common Units through its subsidiaries, along with

the non-economic general partner interest and the Special General Partner Interest.

Concurrently with the filing

of this Transaction Statement, HF Sinclair is filing with the SEC a Registration Statement on Form S-4, which includes a joint proxy statement/prospectus of HF Sinclair and HEP (the “Joint Proxy

Statement/Prospectus”) in connection with the Merger Agreement and the transactions contemplated thereby. A copy of the Joint Proxy Statement/Prospectus is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached as Annex A

to the Joint Proxy Statement/Prospectus. All references in this Transaction Statement to Items numbered 1001 to 1016 are references to Items contained in Regulation M-A under the Exchange Act.

Pursuant to General Instruction F to Schedule 13E-3, the information contained in the Joint Proxy

Statement/Prospectus, including all annexes thereto, is expressly incorporated herein by reference in its entirety and responses to each item herein are qualified in their entirety by the information contained in the Joint Proxy Statement/Prospectus

and the annexes thereto. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Joint Proxy Statement/Prospectus of the information

required to be included in response to the items of Schedule 13E-3. As of the date hereof, the Joint Proxy Statement/Prospectus is in preliminary form and is subject to completion. Terms used but not defined in this Transaction Statement have the

meanings given to them in the Joint Proxy Statement/Prospectus. As of the date hereof, the Joint Proxy Statement/Prospectus is in preliminary form and is subject to completion or amendment.

All information concerning HEP contained in, or incorporated by reference into, this Transaction Statement was supplied by HEP. Similarly, all information

concerning any other filing person contained in, or incorporated by reference into, this Transaction Statement was supplied by such filing person.

| ITEM 1. |

SUMMARY TERM SHEET |

Regulation M-A Item 1001

The information set forth in the Joint Proxy Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers”

| ITEM 2. |

SUBJECT COMPANY INFORMATION |

Regulation M-A Item 1002

| (a) |

Name and Address. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet—The Parties”

“The Parties”

| (b) |

Securities. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Special Meeting of HEP Unitholders”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Treatment of HEP Equity Awards”

“Comparative Market Prices and Cash Dividend/Distribution Information”

| (c) |

Trading Market and Price. The information set forth in the Joint Proxy Statement/Prospectus under the

following caption is incorporated herein by reference: |

“Comparative Market Prices and Cash

Dividend/Distribution Information”

3

| (d) |

Dividends. The information set forth in the Joint Proxy Statement/Prospectus under the following caption

is incorporated herein by reference: |

“Comparative Market Prices and Cash Dividend/Distribution

Information”

| (e) |

Prior Public Offerings. The information set forth in the Joint Proxy Statement/Prospectus under the

following caption is incorporated herein by reference: |

“Prior Public Offerings”

| (f) |

Prior Stock Purchases. The information set forth in the Joint Proxy Statement/Prospectus under the

following caption is incorporated herein by reference: |

“Comparative Market Prices and Cash

Dividend/Distribution Information”

| ITEM 3. |

IDENTITY AND BACKGROUND OF FILING PERSON |

Regulation M-A Item 1003

| (a) through (b) |

Name and Address; Business and Background of Entities. HEP is the issuer of the equity securities that

are the subject of the Rule 13e-3 transaction reported hereby. |

The information

set forth in the Joint Proxy Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term

Sheet—The Parties”

“The Parties”

“Where You Can Find More Information”

| (c) |

Business and Background of Natural Persons. The information set forth in the Joint Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Business and Background

of Natural Persons”

“Where You Can Find More Information”

| ITEM 4. |

TERMS OF THE TRANSACTION |

Regulation M-A Item 1004

| (a) |

Material Terms. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Overview of Special Factors”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Resolution of Conflicts of Interest; Standards of Conduct and Modification of Duties”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

4

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP

Board and the Reasons for their Recommendations”

“Special Factors—No Appraisal Rights”

“Special Factors—Listing of HF Sinclair Common Stock to be Issued in the Merger; Delisting and Deregistration of HEP Common

Units”

“Special Factors—Accounting Treatment of the Merger”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Treatment of HEP Equity Awards”

“The Merger Agreement”

“Comparison of the Rights of the HF Sinclair Stockholders and the HEP Unitholders”

“Special Meeting of HF Sinclair Stockholders”

“Special Meeting of HEP Unitholders”

“United States Federal Income Tax Consequences”

“Annex A: Merger Agreement”

| (c) |

Different Terms. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Overview of Special Factors”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Provisions for HEP Unaffiliated Unitholders”

“Special Factors—No Appraisal Rights”

“The Merger Agreement”

“Annex A: Merger Agreement”

| (d) |

Appraisal Rights. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet—No Appraisal Rights”

“Questions and Answers”

“Special Factors—No Appraisal Rights”

| (e) |

Provisions for Unaffiliated Security Holders. The information set forth in the Joint Proxy

Statement/Prospectus under the following caption is incorporated herein by reference: |

“Special

Factors—Provisions for HEP Unaffiliated Unitholders”

| (f) |

Eligibility for Listing or Trading. The information set forth in the Joint Proxy Statement/Prospectus

under the following captions is incorporated herein by reference: |

“Summary Term Sheet—Listing of HF

Sinclair Common Stock to be Issued in the Merger; Delisting and Deregistration of HEP Common Units”

“Special

Factors—Listing of HF Sinclair Common Stock to be Issued in the Merger; Delisting and Deregistration of HEP Common Units”

“The Merger Agreement—NYSE Listing, Delisting and Deregistration”

| ITEM 5. |

PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

Regulation M-A Item 1005

| (a) |

Transactions. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet”

“The Parties”

5

“Special Factors—Interests of Certain Persons in the Merger”

“Past Contacts, Transactions, Negotiations and Agreements”

“Where You Can Find More Information”

| (b) through (c) |

Significant Corporate Events; Negotiations or Contacts. The information set forth in the Joint Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet”

“Special Factors—Overview of Special Factors”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Financing of the Merger”

“Special Factors—Interests of Certain Persons in the Merger”

“The Merger Agreement”

“Past Contacts, Transactions, Negotiations and Agreements”

“Annex A: Merger Agreement”

| (e) |

Agreements Involving the Subject Company’s Securities. The information set forth in the Joint Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet”

“Questions and Answers”

“Special Factors—Effects of the Merger”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Treatment of HEP Equity Awards”

“The Merger Agreement”

“Comparative Market Prices and Cash Dividend/Distribution Information”

“Past Contacts, Transactions, Negotiations and Agreements”

“Where You Can Find More Information”

“Annex A: Merger Agreement”

| ITEM 6. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. |

Regulation M-A Item 1006

| (b) |

Use of Securities Acquired. The information set forth in the Joint Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Overview of Special Factors”

“Special Factors—Effects of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Financing of the Merger”

“Special Factors—Listing of HF Sinclair Common Stock to be Issued in the Merger; Delisting and Deregistration of HEP Common

Units”

“Special Factors—Interests of Certain Persons in the Merger”

“The Merger Agreement”

6

“Annex A: Merger Agreement”

| (c)(1) through (8) |

Plans. The information set forth in the Joint Proxy Statement/Prospectus under the following captions is

incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Comparative Market Prices and Cash Dividend/Distribution Information”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Financing of the Merger”

“Special Factors—Listing of HF Sinclair Common Stock to be Issued in the Merger; Delisting and Deregistration of HEP Common

Units”

“The Merger Agreement”

“Special Meeting of HF Sinclair Stockholders”

“Special Meeting of HEP Unitholders”

“Annex A: Merger Agreement”

| ITEM 7. |

PURPOSES, ALTERNATIVES, REASONS AND EFFECTS |

Regulation M-A Item 1013

| (a) |

Purposes. The information set forth in the Joint Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Interests of Certain Persons in the Merger”

| (b) |

Alternatives. The information set forth in the Joint Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

7

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and

the HF Sinclair Board and their Reasons for the Merger”

“Special Factors—Recommendations of the HEP Conflicts

Committee and the GP Board and the Reasons for their Recommendations”

“Special Factors—Financial Advisor Discussion

Materials Provided to HF Sinclair”

“Special Factors—Opinion of the Financial Advisor to the HEP Conflicts

Committee”

“Annex B: Opinion of Intrepid Partners, LLC”

| (c) |

Reasons. The information set forth in the Joint Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Financial Advisor Discussion Materials Provided to HF Sinclair”

“Special Factors—Opinion of the Financial Advisor to the HEP Conflicts Committee”

“Special Factors—Interests of Certain Persons in the Merger”

“Annex B: Opinion of Intrepid Partners, LLC”

| (d) |

Effects. The information set forth in the Joint Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Financing of the Merger”

“Special Factors—Listing of HF Sinclair Common Stock to be Issued in the Merger; Delisting and Deregistration of HEP Common

Units”

“The Merger Agreement”

“United States Federal Income Tax Consequences”

“Annex A: Merger Agreement”

8

| ITEM 8. |

FAIRNESS OF THE TRANSACTION |

Regulation M-A Item 1014

| (a) through (b) |

Fairness; Factors Considered in Determining Fairness. Barclays Capital, Inc. (“Barclays”) was

not requested to, and it did not, provide to HF Sinclair or any other person any (i) opinion (whether as to the fairness of any consideration, including, without limitation, the Merger Consideration, or otherwise), (ii) valuation of HEP for the

purpose of assessing the fairness of the Merger Consideration to any person, or (iii) recommendation as to how to vote or act on any matters relating to the proposed Merger or otherwise. Barclay’s discussion materials dated August 14,

2023 should not be construed as creating any fiduciary duty on Barclays’ part to HF Sinclair or any other person and such materials are not intended to be, and do not constitute, a recommendation to HF Sinclair or any other person in respect of

the Merger, including as to how any HEP Unitholder should act or vote in respect of the Merger Proposal or as to how any HF Sinclair Stockholder should act or vote in respect of the HF Sinclair Stock Issuance Proposal. |

The information set forth in the Joint Proxy Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Opinion of the Financial Advisor to the HEP Conflicts Committee”

“Special Factors—Financial Advisor Discussion Materials Provided to HF Sinclair”

“Special Factors—Interests of Certain Persons in the Merger”

“Annex B: Opinion of Intrepid Partners, LLC”

| (c) |

Approval of Security Holders. The information set forth in the Joint Proxy Statement/Prospectus under

the following captions is incorporated herein by reference: |

“Questions and Answers”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their Recommendations”

“The Merger Agreement—HEP Unitholder Approval”

“Special Meeting of HEP Unitholders”

| (d) |

Unaffiliated Representative. The information set forth in the Joint Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and their Reasons for the Merger”

“Special Factors—Opinion of the Financial Advisor to the HEP Conflicts Committee”

“Special Factors—Interests of Certain Persons in the Merger”

“The Merger Agreement”

“Annex B: Opinion of Intrepid Partners, LLC”

9

| (e) |

Approval of Directors. The information set forth in the Joint Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their Recommendations”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for

the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

| (f) |

Other Offers. Not Applicable. |

| ITEM 9. |

REPORTS, OPINIONS, APPRAISALS AND CERTAIN NEGOTIATIONS |

Regulation M-A Item 1015

| (a) through (b) |

Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal. The discussion

materials prepared by Barclays and provided to HF Sinclair, the HF Sinclair Conflicts Committee and the HF Sinclair Board, dated as of August 14, 2023, are set forth as Exhibit (c)(2) and incorporated herein by reference. The discussion

materials prepared by Intrepid Partners, LLC and provided to the HEP Conflicts Committee, dated as of June 1, 2023, June 26, 2023, July 13, 2023, July 14, 2023, July 24, 2023, July 27, 2023, August 2, 2023,

August 9, 2023, August 11, 2023 and August 15, 2023 are set forth as Exhibits (c)(3)(A) through (c)(3)(J) hereto and are incorporated herein by reference. |

The information set forth in the Joint Proxy Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term Sheet—Effects of the Merger”

“Summary Term Sheet—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Summary Term Sheet—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Summary Term Sheet—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for

their Recommendations”

“Summary Term Sheet—Financial Advisor Discussion Materials Provided to HF Sinclair”

“Summary Term Sheet—Opinion of the Financial Advisor to the HEP Conflicts Committee”

“Special Factors—Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Opinion of the Financial Advisor to the HEP Conflicts Committee”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Financial Advisor Discussion Materials Provided to HF Sinclair”

“Special Factors—Fees and Expenses”

“Where You Can Find More Information”

“Annex B: Opinion of Intrepid Partners, LLC”

The written opinion of Intrepid Partners, LLC is attached to the Joint Proxy Statement/Prospectus as Annex B and is incorporated herein by

reference.

10

| (c) |

Availability of Documents. The reports, opinions or appraisals referenced in this Item 9 are filed

herewith and will be made available for inspection and copying at the principal executive offices of HF Sinclair and HEP during its regular business hours by any interested equity security holder of HEP Common Units or by any representative who has

been so designated in writing upon written request and at the expense of the requesting security holder. |

| ITEM 10. |

SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION |

Regulation M-A Item 1007

| (a) through (b),(d) |

Source of Funds; Conditions; Borrowed Funds. The information set forth in the Joint Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet—The Merger Consideration”

“Summary Term Sheet—The Merger Agreement”

“Summary Term Sheet—Fees and Expenses”

“Summary Term Sheet—Financing of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their Recommendations”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Fees and Expenses”

“Special Factors—Financing of the Merger”

| (c) |

Expenses. The information set forth in the Joint Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet—Fees and Expenses”

“Summary Term Sheet—Financing of the Merger”

“Special Factors—Fees and Expenses”

“Special Factors—Financing of the Merger”

“Special Meeting of HF Sinclair Stockholders—Solicitation of Proxies”

“Special Meeting of HEP Unitholders—Solicitation of Proxies”

“The Merger Agreement—Effect of Termination; Termination Expenses”

| ITEM 11. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY |

Regulation M-A Item 1008

| (a) through (b) |

Securities Ownership; Securities Transactions. The information set forth in the Joint Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet—The Parties”

“Summary Term Sheet—The Merger”

“The Parties”

“Special Factors—Effects of the Merger”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Treatment of HEP Equity Awards”

“Special Factors—Certain Beneficial Owners of HEP Common Units”

“The Merger Agreement”

“Comparative Market Prices and Cash Dividend/Distribution Information”

| ITEM 12. |

THE SOLICITATION OR RECOMMENDATION |

Regulation M-A Item 1012

| (d) |

Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Joint Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

11

“Questions and Answers”

“Special Meeting of HEP Unitholders”

| (e) |

Recommendations of Others. The information set forth in the Joint Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons of the Parent Entities for the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Interests of Certain Persons in the Merger”

“The Merger Agreement—Conditions to Completion of the Merger”

| ITEM 13. |

FINANCIAL INFORMATION |

Regulation M-A Item 1010

| (a) |

Financial Statements. The information set forth in the Joint Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Special Factors—Effects of the Merger”

“Selected Historical Consolidated Financial Data of HEP”

“Where You Can Find More Information”

HEP’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report

on Form 10-Q for the quarterly period ended June 30, 2023 are incorporated herein by reference.

| (b) |

Pro Forma Information. Not applicable. |

| ITEM 14. |

PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED |

Regulation M-A Item 1009

| (a) through (b) |

Solicitations or Recommendations; Employees and Corporate Assets. The information set forth in the Joint

Proxy Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet”

“Questions and Answers”

“Special Factors—Background of the Merger”

“Special Factors—Position of HF Sinclair, HoldCo and Merger Sub as to the Fairness of the Merger”

“Special Factors—Recommendations of the HF Sinclair Conflicts Committee and the HF Sinclair Board and their Reasons for the

Merger”

“Special Factors—Recommendations of the HEP Conflicts Committee and the GP Board and the Reasons for their

Recommendations”

“Special Factors—Interests of Certain Persons in the Merger”

“Special Factors—Fees and Expenses”

12

| ITEM 15. |

ADDITIONAL INFORMATION |

Regulation M-A Item 1011

| (c) |

Golden Parachute Compensation. The information set forth in the Joint Proxy Statement/Prospectus under

the following caption is incorporated herein by reference. |

“Special Factors—Interests of Certain Persons

in the Merger”

“Special Factors—No Golden Parachute Compensation Payable to the HEP Named Executive Officers in

Connection with the Merger”

| (c) |

Other Material Information. The information set forth in the Joint Proxy Statement/Prospectus, including

all annexes thereto, is incorporated herein by reference. |

Regulation M-A Item 1016

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1) |

|

Joint Proxy Statement/Prospectus of HF Sinclair Corporation and Holly Energy Partners, L.P. (incorporated herein by reference to the Registration

Statement on Form S-4 of HF Sinclair Corporation filed with the SEC concurrently with this Transaction Statement). |

|

|

| (a)(2) |

|

Joint Letter to the Stockholders of HF Sinclair Corporation and the Unitholders of Holly Energy Partners, L.P. (incorporated herein by reference

to the Joint Proxy Statement/Prospectus). |

|

|

| (a)(5) |

|

Form of Proxy Card and Voting Instructions for the HEP Special Meeting (incorporated herein by reference to the Joint Proxy Statement/Prospectus).

|

|

|

| (a)(6) |

|

Notice of Special Meeting of Unitholders of Holly Energy Partners, L.P. (incorporated herein by reference to the Joint Proxy Statement/Prospectus).

|

|

|

| (a)(7) |

|

Press Release of Holly Energy Partners, L.P. dated May

4, 2023 (incorporated herein by reference to Exhibit 99.1 to Holly Energy Partners, L.P.’s Current Report on Form 8-K filed with the SEC on May 4, 2023 (File No.

001-32225)). |

|

|

| (a)(8) |

|

Press Release of HF Sinclair Corporation dated May

4, 2023 (incorporated herein by reference to Exhibit 99.1 to HF Sinclair Corporation’s Current Report on Form 8-K filed with the SEC on May 4, 2023 (File No.

001-41325)). |

|

|

| (a)(9) |

|

Earnings Release of HF Sinclair Corporation dated May

4, 2023 (incorporated herein by reference to Exhibit 99.1 to HF Sinclair Corporation’s Current Report on Form 8-K filed with the SEC on May 4, 2023 (File No.

001-41325)). |

|

|

| (a)(10) |

|

Communication to Employees of Holly Energy Partners, L.P. from the Chief Executive Officer and President of Holly Energy Partners, L.P., dated

May 4, 2023 (incorporated herein by reference to Holly Energy Partners, L.P.’s Communication pursuant to Rule 425 of the Securities Act filed with the SEC on May 4, 2023 (File

No. 001-32225)). |

|

|

| (a)(11) |

|

Communication to Employees of HF Sinclair Corporation from HF Sinclair Corporation, dated May

4, 2023 (incorporated herein by reference to HF Sinclair Corporation’s Communication pursuant to Rule 425 of the Securities Act filed with the SEC on May 4, 2023 (File No. 001-32225)).

|

|

|

| (a)(12) |

|

Excerpt of the Joint Earnings Call Transcript held on May

4, 2023 (incorporated herein by reference to Holly Energy Partners, L.P.’s Communication pursuant to Rule 425 of the Securities Act filed with the SEC on May 5, 2023 (File No. 001-32225)).

|

|

|

| (a)(13) |

|

Letter to certain employees of Holly Energy Partners, L.P., dated August

16, 2023 (incorporated herein by reference to Exhibit 99.1 to Holly Energy Partners, L.P.’s Current Report on Form 8-K filed with the SEC on August

16, 2023 (File No. 001-32225)). |

13

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(14) |

|

Letter to certain employees of HF Sinclair Corporation and Holly Energy Partners, L.P., dated August

16, 2023 (incorporated herein by reference to Exhibit 99.1 to HF Sinclair Corporation’s Current Report on Form 8-K filed with the SEC on August 16, 2023 (File No.

001-41325)). |

|

|

| (a)(15) |

|

Joint Press Release of HF Sinclair Corporation and Holly Energy Partners, L.P., dated August

16, 2023 (incorporated herein by reference to Exhibit 99.1 to HF Sinclair Corporation’s Current Report on Form 8-K filed with the SEC on August 16, 2023 (File No.

001-41325)). |

|

|

| (c)(1) |

|

Opinion of Intrepid Partners, LLC (incorporated herein by reference to Annex B of the Joint Proxy Statement/Prospectus).

|

|

|

| (c)(2) |

|

Discussion materials prepared by Barclays Capital, Inc., dated August 14, 2023, for the Board of Directors of HF Sinclair Corporation. |

|

|

| (c)(3)(A) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated June 1, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(B) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated June 26, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(C) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated July 13, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(D) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated July 14, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(E) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated July 24, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(F) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated July 27, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(G) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated August 2, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(H) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated August 9, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(I) |

|

Discussion materials prepared by Intrepid Partners, LLC, dated August 11, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (c)(3)(J) |

|

Presentation prepared by Intrepid Partners, LLC, dated August 15, 2023, for the Conflicts Committee of the Board of Directors of Holly Logistic Services, L.L.C. |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated August

15, 2023, by and among HF Sinclair Corporation, Navajo Pipeline Co., L.P., Holly Apple Holdings LLC, Holly Energy Partners, L.P., HEP Logistics Holdings, L.P., and Holly Logistic Services, L.L.C. (included as Annex A to the Joint Proxy Statement/Prospectus

and incorporated herein by reference). |

|

|

| (d)(2) |

|

Unitholders Agreement, dated as of August

2, 2021, by and among Holly Energy Partners, L.P., Holly Logistic Services, L.L.C., Navajo Pipeline Co., L.P., The Sinclair Companies, and the unitholders set forth on Schedule I thereto, as may be amended from time to time (incorporated herein by reference

to Exhibit 10.1 to Holly Energy Partners, L.P.’s Current Report on Form 8-K (File No. 001-32225) filed with the SEC on August 3, 2021). |

|

|

| (f)(1) |

|

Second Amended and Restated Agreement of the Limited Partnership of Holly Energy Partners, L.P. (incorporated herein by reference

to Exhibit 3.1 to Holly Energy Partners, L.P.’s Current Report on Form 8-K (File No. 001-32225) filed with the SEC on November 1, 2017). |

|

|

| (f)(2) |

|

Delaware Code Title 6 § 17-212. |

|

|

| (g) |

|

None. |

|

|

| 107 |

|

Filing Fee Table. |

14

SIGNATURES

After due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the

information set forth in this statement is true, complete and correct.

Dated as of September 22, 2023

|

|

|

| HF SINCLAIR CORPORATION |

|

|

| By: |

|

/s/ Atanas H. Atanasov |

| Name: |

|

Atanas H. Atanasov |

| Title: |

|

Executive Vice President and Chief Financial Officer |

|

| NAVAJO PIPELINE CO., L.P. |

|

|

| By: |

|

/s/ Atanas H. Atanasov |

| Name: |

|

Atanas H. Atanasov |

| Title: |

|

Executive Vice President and Chief Financial Officer |

|

| HOLLY APPLE HOLDINGS LLC |

|

|

| By: |

|

/s/ Atanas H. Atanasov |

| Name: |

|

Atanas H. Atanasov |

| Title: |

|

Executive Vice President and Chief Financial Officer |

|

| HOLLY ENERGY PARTNERS, L.P. |

|

|

| By: |

|

HEP LOGISTICS HOLDINGS, L.P., |

|

|

its General Partner |

|

|

| By: |

|

HOLLY LOGISTIC SERVICES, L.L.C., |

|

|

its General Partner |

|

|

| By: |

|

/s/ Michael C. Jennings |

| Name: |

|

Michael C. Jennings |

| Title: |

|

Chief Executive Officer and President |

|

| HOLLY LOGISTIC SERVICES, L.L.C. |

|

|

| By: |

|

/s/ Michael C. Jennings |

| Name: |

|

Michael C. Jennings |

| Title: |

|

Chief Executive Officer and President |

|

| HEP LOGISTICS HOLDINGS, L.P. |

|

|

| By: |

|

HOLLY LOGISTIC SERVICES, L.L.C., |

|

|

its General Partner |

|

|

| By: |

|

/s/ Michael C. Jennings |

| Name: |

|

Michael C. Jennings |

| Title: |

|

Chief Executive Officer and President |

15

Exhibit (c)(2) Board Presentation August 14, 2023

Apple | Proposal Summary Spot Price Initial Offer Initial Offer 1st HEP

Counteroffer DINO Revised Proposal 2nd HEP Counteroffer 2nd DINO Revised Proposal Undisturbed Price Current Price Current Price Current Price Current Price Current Price as of 5/3/23 as of 8/11/23 as of 8/11/23 as of 8/11/23 as of 8/11/23 as of

8/11/23 DINO Spot Price $41.91 $59.34 $59.34 $59.34 $59.34 $59.34 Exchange Ratio 0.3714x 0.3714x 0.3714x 0.3150x 0.3714x 0.3150x Stock Consideration per Unit $15.57 $22.04 $22.04 $18.69 $22.04 $18.69 Cash Consideration per Unit - - 7.00 3.50 4.00

4.00 Total Consideration per Unit $15.57 $22.04 $29.04 $22.19 $26.04 $22.69 Implied Exchange Ratio 0.3714x 0.3714x 0.4894x 0.3740x 0.4388x 0.3824x (1) Premium / (Discount) to Undisturbed Spot Price as of 5/3/23 (2.2%) 38.4% 82.4% 39.4% 63.6% 42.5%

(2) Premium / (Discount) to Spot Price as of 8/11/23 (28.4%) 1.4% 33.6% 2.1% 19.8% 4.4% Total Unaffiliated Units Outstanding (mm) 67.0 67.0 67.0 67.0 67.0 67.0 Total Stock Consideration ($mm) $1,042 $1,476 $1,476 $1,252 $1,476 $1,252 Total Cash

Consideration ($mm) - - 469 234 268 268 Total Consideration ($mm) $1,042 $1,476 $1,945 $1,486 $1,744 $1,520 Total DINO Shares Issued (mm) 24.9 24.9 24.9 21.1 24.9 21.1 30-Day VWAP Initial Offer Initial Offer 1st HEP Counteroffer DINO Revised

Proposal 2nd HEP Counteroffer 2nd DINO Revised Proposal Undisturbed Price Current Price Current Price Current Price Current Price Current Price as of 5/3/23 as of 8/11/23 as of 8/11/23 as of 8/11/23 as of 8/11/23 as of 8/11/23 DINO 30-Day VWAP

$45.97 $50.73 $50.73 $50.73 $50.73 $50.73 Exchange Ratio 0.3714x 0.3714x 0.3714x 0.3150x 0.3714x 0.3150x Stock Consideration per Unit $17.07 $18.84 $18.84 $15.98 $18.84 $15.98 Cash Consideration per Unit - - 7.00 3.50 4.00 4.00 Total Consideration

per Unit $17.07 $18.84 $25.84 $19.48 $22.84 $19.98 Implied Exchange Ratio 0.3714x 0.3714x 0.5094x 0.3840x 0.4502x 0.3938x (3) Premium / (Discount) to Undisturbed 30-Day VWAP as of 5/3/23 - 10.4% 51.4% 14.1% 33.8% 17.0% (4) Premium / (Discount) to

30-Day VWAP as of 8/11/23 (14.7%) (5.8%) 29.2% (2.6%) 14.2% (0.1%) Total Unaffiliated Units Outstanding (mm) 67.0 67.0 67.0 67.0 67.0 67.0 Total Stock Consideration ($mm) $1,143 $1,262 $1,262 $1,070 $1,262 $1,070 Total Cash Consideration ($mm) - -

469 234 268 268 Total Consideration ($mm) $1,143 $1,262 $1,731 $1,305 $1,530 $1,338 Total DINO Shares Issued (mm) 24.9 24.9 24.9 21.1 24.9 21.1 1. Undisturbed Spot Price as of 5/3/23: $15.92 per unit. 2. Spot Price as of 8/11/23: $21.74 per unit. 3.

Undisturbed 30-Day VWAP as of 5/3/23: $17.07 per unit. 4. 30-Day VWAP as of 8/11/23: $20.00 per unit. 1

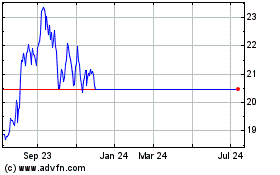

HEP | Relative Trading Performance Trading Performance: Last Twelve

Months (2) Recent Trading HEP - Peer HEP Peer AMZ MLP (3) Performance Median Adj. HEP - AMZ Adj. Median Index (1) 30-Day 33.4% 17.7% 26.2% 13.8% (20.1%) (8.5%) 2.1% 9.5% (8.5%) 3.9% 48.2% OKE/MMP Announcement (5/12/2023) 32.1% 30.2% 22.3% 1.9%

(0.5%) - 20.6% 1.9% 9.7% Initial Offer Announcement (5/3/23) 36.6% 36.4% 27.5% 41.6% (5.9%) 0.1% 1.0% 23.4% 0.1% 9.1% YTD 14.4% 20.0% 22.5% 10.8% (5.6%) (2.6%) 10.4% 29.7% (2.6%) 9.2% 24.4% 20.5% 13.4% 17.2% (22.4%) 3.9% 15.8% 31.9% 3.9% 11.0% Last

Twelve Months (Indexed Price Performance) Initial Offer Announcement (Pre-Market Open on 5/4/2023) OKE / MMP Announcement (5/12/2023) Source: FactSet as of 8/11/2023. 1. Represents trading days. 2. Magellan reflects performance to unaffected date of

Oneok transaction, 5/12/2023. 3. HEP Peers include DKL, NS and PAA. Note: MMP not included in HEP Peer Median. 2

HEP / DINO | Historical Exchange Ratio Analysis Number of DINO shares per

HEP unit “Heads-Up” Exchange Ratio (HEP / DINO) Initial Offer Announcement (Pre-Market Open on 5/4/2023) 2nd HEP Counter (VWAP) (1) 0.4502x 2nd HEP Counter (2) (Spot) 0.4388x 2nd DINO Revised Proposal 0.3824x Current 0.3664x 1-Year VWAP

0.3618x Implied Premium Analysis Implied Premium / Discount to Heads-Up Historical Prices / Heads-Up Exchange Ratio HEP DINO Exchange $21.74 $22.69 $23.91 $26.04 $26.09 $28.26 0.3664x 0.3824x 0.4030x 0.4388x 0.4396x 0.4763x (3) Period ($/unit)

($/share) Ratio - 4.4% 10.0% 19.8% 20.0% 30.0% - 4.4% 10.0% 19.8% 20.0% 30.0% Current (8/11/2023) $21.74 $59.34 0.3664x - 4.4% 10.0% 19.8% 20.0% 30.0% - 4.4% 10.0% 19.8% 20.0% 30.0% Undisturbed Price (5/3/2023) $15.92 $41.91 0.3799x 36.6% 42.5%

50.2% 63.6% 63.9% 77.5% (3.6%) 0.7% 6.1% 15.5% 15.7% 25.4% Offer Price (30-day VWAP as of 5/3/2023) $17.07 $45.97 0.3714x 27.3% 32.9% 40.1% 52.5% 52.8% 65.5% (1.4%) 3.0% 8.5% 18.1% 18.4% 28.2% 5-Day VWAP $20.70 $57.87 0.3577x 5.0% 9.6% 15.5% 25.8%

26.0% 36.5% 2.4% 6.9% 12.7% 22.7% 22.9% 33.2% 10-Day VWAP $20.37 $55.13 0.3694x 6.7% 11.4% 17.4% 27.8% 28.1% 38.8% (0.8%) 3.5% 9.1% 18.8% 19.0% 28.9% 20-Day VWAP $20.14 $52.69 0.3823x 7.9% 12.6% 18.7% 29.3% 29.5% 40.3% (4.2%) 0.0% 5.4% 14.8% 15.0%

24.6% 30-Day VWAP $20.00 $50.73 0.3943x 8.7% 13.4% 19.6% 30.2% 30.4% 41.3% (7.1%) (3.0%) 2.2% 11.3% 11.5% 20.8% 60-Day VWAP $19.18 $46.69 0.4108x 13.4% 18.3% 24.7% 35.8% 36.0% 47.4% (10.8%) (6.9%) (1.9%) 6.8% 7.0% 15.9% 1-Year VWAP $18.32 $50.64

0.3618x 18.7% 23.9% 30.5% 42.1% 42.4% 54.3% 1.3% 5.7% 11.4% 21.3% 21.5% 31.7% 2-Year VWAP $17.96 $44.57 0.4029x 21.1% 26.4% 33.2% 45.0% 45.3% 57.4% (9.1%) (5.1%) 0.0% 8.9% 9.1% 18.2% 5-Year VWAP $19.01 $41.27 0.4605x 14.4% 19.4% 25.8% 37.0% 37.3%

48.7% (20.4%) (17.0%) (12.5%) (4.7%) (4.5%) 3.4% 52-Week High $21.74 $66.19 0.3284x - 4.4% 10.0% 19.8% 20.0% 30.0% 11.5% 16.4% 22.7% 33.6% 33.9% 45.0% Research Analyst Target $20.00 $60.00 0.3333x 8.7% 13.5% 19.6% 30.2% 30.4% 41.3% 9.9% 14.7% 20.9%

31.6% 31.9% 42.9% Source: FactSet as of 8/11/2023. nd nd 2 DINO 2 HEP 1. Reflecting 0.3714x exchange ratio on DINO’s 30-day VWAP of $50.73 as of 8/11/2023 plus $4.00 cash per unit. (4) (2) 2. Reflecting 0.3714x exchange ratio on DINO’s

share price of $59.34 as of 8/11/2023 plus $4.00 cash per unit. Revised Proposal Counterproposal 3. 5-day, 10-day, 20-day, 30-day and 60-day reflecting trading days. 1-year, 2-year and 3-year reflecting calendar days. nd 4. 2 DINO revised proposal

of $22.69 per unit reflecting 0.3150x exchange ratio on DINO’s share price of $59.34 as of 8/11/2023 plus $4.00 cash per unit. 3 Better for HEP Better for DINO

DINO | Relative Valuation (1) EV / EBITDA (EV / EBITDA) 2023E 2024E 2025E

EV / 2023E EBITDA EV / 2024E EBITDA Median: 4.7x 6.5x 6.9x EV / 2025E EBITDA 8.5x 9.0x 8.0x 7.9x 7.3x 6.8x 6.8x 6.9x 6.7x 6.5x 6.6x 5.9x 5.8x 5.4x 5.4x 5.3x 5.2x 6.0x 4.8x 4.9x 4.7x 4.7x 4.6x 4.0x 3.8x 2.8x 3.0x 0.0x (2) Price / Parent CFPS (Price /

Parent CFPS) 2023E 2024E 2025E Price / 2023E Parent CFPS Median: 4.6x 5.9x 7.6x Price / 2024E Parent CFPS Price / 2025E Parent CFPS 8.9x 9.0x 7.8x 7.8x 7.7x 7.6x 7.6x 7.4x 6.6x 6.2x 5.9x 5.9x 5.9x 5.9x 5.6x 5.5x 5.4x 5.3x 6.0x 4.9x 4.7x 4.6x 4.5x

3.9x 3.6x 2.8x 3.0x 0.0x Consolidated Debt / 1. 1x 1.5x 1.6x 1.1x 1.5x 3.1x 0.8x 0.6x (3) 2023E EBITDA Consolidated Net Debt / 2023E 0.7x 1.0x 0.9x 0.7x 0.8x 2.2x 0.4x (0.0)x (4) EBITDA Source: Management projections, company filings, FactSet, and

Wall Street research as of 8/11/2023. 1. DINO EBITDA reflecting management estimates. Peers per FactSet consensus. 2. DINO and peers reflecting FactSet consensus. Adj. CFPS is adjusted to remove third-party distributions to unaffiliated MLP public

unitholders. Adj. CFPS based on Adj. CFFO per share based on shares outstanding from Management projections. Remaining peers calculated from median consensus. 3. Calculated as current Consolidated Debt / Projected Consolidated EBITDA. 4. Calculated

as Consolidated Debt less Cash / Projected Consolidated EBITDA. 4

HEP | Relative Valuation EV / EBITDA Debt + Pref. / EBITDA 2022A 2023E

2023E-2025E Debt + Pref. / 2022A EBITDA 1.7% 3.5% 3.3% 0.4% 3.7% EBITDA CAGR Median: 4.9x 4.1x Debt + Pref. / 2023E EBITDA 7.0x 2023E 2024E 2025E EV / 2023E EBITDA Median: 8.7x 8.2x 8.4x 6.0x 5.6x 5.5x EV / 2024E EBITDA 12.0x 10.3x 5.0x 4.5x 9.9x EV

/ 2025E EBITDA 9.6x 9.3x 9.6x 4.5x 10.0x 9.3x 9.2x 4.3x 8.6x 8.7x 3.7x 8.1x 3.8x 7.8x 4.0x 8.0x 8.0x 7.4x 7.2x 3.5x 3.4x 3.2x 6.9x 3.0x 6.0x 2.0x 4.0x 2.0x 1.0x 0.0x 0.0x Latest Quarterly Distribution Yield Levered FCF Yield LQA DCF 2023E Levered

FCF Yield 2023E 2024E 2025E 1.9x 2.3x 1.4x 1.3x 2.7x Coverage Median: 10.9% 13.9% 13.4% 2024E Levered FCF Yield 20% 12.0% Median: 8.7% 17.5% 2025E Levered FCF Yield 16.4% 16.8% 10.3% 9.6% 14.0% 13.8% 15% 13.4% 13.1% 12.7% 9.0% 7.6% 11.3% 11.9% 7.0%

10.8% 11.1% 10.7% 6.4% 10.1% 10% 6.0% 5% 3.0% NA 0.0% 0% Source: HEP per company filing and DINO Management forecast. Peers per Public filings, FactSet, and Wall Street research as of 8/11/2023. Magellan share price as of the unaffected date of the

Oneok acquisition, 5/12/2023. 5

HEP | Indicative Purchase Price Ratio Analysis Indicative Purchase Price

Ratio Analysis nd nd 2 DINO 2 HEP (1) (2) Revised Proposal Counterproposal ($ in millions, except per share data) DINO SQ HEP SQ 6/30/23 6/30/23 Illutrative Purchase Price Price as of 8/11/23 $59.34 $21.74 $22.69 $23.91 $26.04 $26.09 $28.26 Implied

Premium / (Discount) to HEP Spot Price as of 8/11/23 4% 10% 20% 20% 30% Diluted Shares / Units Oustanding 186.0 126.6 126.6 126.6 126.6 126.6 126.6 Total Equity Value $11,037 $2,752 $2,873 $3,027 $3,297 $3,303 $3,578 Total Debt (Consolidated) 3,214

1,506 1,506 1,506 1,506 1,506 1,506 Preferred Equity - 63 63 63 63 63 63 Non-Controlling Interest 1,452 69 69 69 69 69 69 Cash (Consolidated) (1,204) (8) (8) (8) (8) (8) (8) Enterprise Value $14,499 $4,382 $4,502 $4,657 $4,926 $4,932 $5,207 Public

Units Outstanding 67.0 67.0 67.0 67.0 67.0 67.0 Total Value of Public Units $1,456 $1,520 $1,602 $1,744 $1,747 $1,893 Implied Exchange Ratio 0.3664x 0.3824x 0.4030x 0.4388x 0.4396x 0.4763x Precedent Premium Premium / Discount to: Median Mean Current

8/11/23 - - 4.4% 10.0% 19.8% 20.0% 30.0% 12.6% 13.9% Unaffected Price 41.6% 36.6% 42.5% 50.2% 63.6% 63.9% 77.5% 52-Week High (10.3%) - 4.4% 10.0% 19.8% 20.0% 30.0% Research Analyst Target (1.1%) 8.7% 13.5% 19.6% 30.2% 30.4% 41.3% Trading Comparables

DINO SQ HEP SQ Peer Peer Transaction (3) (3) Enterprise Value as a Multiple of: Data Data Median Mean Comparables EBITDA 2023E $3,030 4.8x $458 9.6x 9.8x 10.2x 10.8x 10.8x 11.4x 8.6x 8.8x 10.1x 2024E 2,662 5.4x 477 9.2x 9.4x 9.8x 10.3x 10.3x 10.9x

8.2x 8.4x 10.1x 2025E 2,698 5.4x 474 9.3x 9.5x 9.8x 10.4x 10.4x 11.0x 8.4x 8.3x Equity Value as a Multiple of: Earnings per Share 2023E $9.15 6.5x $2.08 10.5x 10.9x 11.5x 12.5x 12.6x 13.6x 10.9x 10.7x 2024E 7.58 7.8x 2.36 9.2x 9.6x 10.2x 11.1x 11.1x

12.0x 10.8x 10.4x 2025E 7.75 7.7x 2.44 8.9x 9.3x 9.8x 10.7x 10.7x 11.6x 10.0x 10.1x Yield Analysis: Dividends LQA $1.80 3.0% $1.40 6.4% 6.2% 5.9% 5.4% 5.4% 5.0% 8.6% 8.6% 2023E 1.80 3.0% 1.40 6.4% 6.2% 5.9% 5.4% 5.4% 5.0% 2024E 1.80 3.0% 1.40 6.4%

6.2% 5.9% 5.4% 5.4% 5.0% 2025E 1.80 3.0% 1.40 6.4% 6.2% 5.9% 5.4% 5.4% 5.0% YE Leverage Total Debt / EBITDA 2022A $3,214 0.7x $1,506 3.6x 3.6x 3.6x 3.6x 3.6x 3.6x 4.9x 4.7x 2023E 3,214 1.1x 1,506 3.3x 3.3x 3.3x 3.3x 3.3x 3.3x 4.1x 4.0x Source:

Projections per DINO Management. Market data as of 8/11/2023. Balance sheet data reflect DINO / HEP Q2 2023 10-Q filings. nd 1. 2 DINO revised proposal of $22.69 per unit reflecting 0.3150x exchange ratio on DINO’s share price of $59.34 as of

8/11/2023 plus $4.00 cash per unit. 2. Second HEP counterproposal of $26.04 per unit reflecting 0.3714x exchange ratio on DINO’s share price of $59.34 as of 8/11/2023 plus $4.00 cash per unit. 3. Peers include DKL, MMP, NS and PAA.

6

Appendix

Apple | Proposal Summary Key Events — On May 4, 2023, HF Sinclair

(DINO) offered to acquire all outstanding publicly held common units of Holly Energy Partners (HEP) at a fixed exchange ratio of 0.3714 newly issued shares of DINO Common Stock per each HEP unit w Offer derived using the 30-day volume weighted

average prices for each security as of market close on May 3, 2023 — Following DINO’s initial proposal, ¡ On July 14, 2023, the Conflicts Committee of HEP responded with a counterproposal consisting of 0.3714 exchange ratio plus

$7.00 in cash per HEP unit 1 w The counterproposal implies a total per unit consideration of $24.16 based on DINO’s share price as of 7/14/2023 ¡ On July 21, 2023, DINO responded with a revised proposal comprised of 0.3150 exchange

ratio plus $3.50 in cash 2 w The revised proposal implies a total per unit consideration of $18.92 based on DINO’s share price on 7/21/2023 nd ¡ On July 28, 2023, the Conflicts Committee of HEP responded with a 2 counterproposal

consisting of 0.3714 exchange ratio plus $4.00 in cash per HEP unit 3 nd w The 2 counterproposal implies a total per unit consideration of $23.16 based on DINO’s share price as of 7/28/2023 nd 4¡ On August 11, 2023, DINO responded

with a 2 revised proposal comprised of 0.3150 exchange ratio plus $4.00 in cash per HEP unit nd w The 2 revised proposal implies a total per unit consideration of $22.69 based on DINO’s share price as of 8/11/2023 Summary of Proposals

– Spot Offer Price Implied Premium to HEP Unit Price as of: Total Consideration per Equity Consideration (2) Date Exchange Ratio Cash Consideration Unit HEP Closing Price DINO Closing Price 5/3/23 7/14/23 7/21/23 7/28/23 8/11/23 Proposal (1)

Initial DINO Offer 5/4/23 0.3714x $0.00 $15.57 $15.92 $41.91 (2.2%) N/A N/A N/A N/A 1st HEP Counterproposal 7/14/23 0.3714x $7.00 $24.16 $18.87 $46.21 51.8% 28.0% N/A N/A N/A 1st DINO Revised Proposal 7/21/23 0.3150x $3.50 $18.92 $18.97 $48.96 18.9%

0.3% (0.3%) N/A N/A 2nd HEP Counterproposal 7/28/23 0.3714x $4.00 $23.16 $19.18 $51.60 45.5% 22.8% 22.1% 20.8% N/A 2nd DINO Revised Proposal 8/11/23 0.3150x $4.00 $22.69 $21.74 $59.34 42.5% 20.3% 19.6% 18.3% 4.4% Summary of Proposals – 30-Day

VWAP Offer Price Implied Premium to HEP 30-Day VWAP as of: Total Consideration per Equity Consideration (3) Date Exchange Ratio Cash Consideration Unit (30-Day VWAP) HEP 30-Day VWAP DINO 30-Day VWAP 5/3/23 7/14/23 7/21/23 7/28/23 8/11/23 Proposal

(1) Initial DINO Offer 5/4/23 0.3714x $0.00 $17.07 $17.07 $45.97 (0.0%) N/A N/A N/A N/A 1st HEP Counterproposal 7/14/23 0.3714x $7.00 $23.57 $18.24 $44.62 38.1% 29.2% N/A N/A N/A 1st DINO Revised Proposal 7/21/23 0.3150x $3.50 $17.75 $18.38 $45.24

4.0% (2.7%) (3.4%) N/A N/A 2nd HEP Counterproposal 7/28/23 0.3714x $4.00 $21.14 $18.64 $46.16 23.8% 15.9% 15.0% 13.4% N/A 2nd DINO Revised Proposal 8/11/23 0.3150x $4.00 $19.98 $20.00 $50.73 17.0% 9.5% 8.7% 7.2% (0.1%) 1. Offer delivered pre-market

open on 5/4/23. DINO and HEP closing prices reflecting prices as of unaffected date of 5/3/2023. 2. Total consideration per unit equal to DINO closing price multiplied by exchange ratio, plus cash consideration when applicable. 3. Total

consideration per unit (30-day VWAP) equal to DINO 30-day VWAP multiplied by exchange ratio, plus cash consideration when applicable. 7

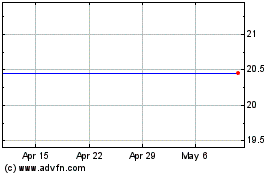

HEP | Equity Analyst Price Targets (1) (2) Research Price Targets

Premium / (Discount) % to Current Price ($ / share) Median Analyst Target Price Premium / (Discount) to: Current Price (8%) (3) Current: Current: $55.41 $15.59 $70.00 30.0% $65.00 Current: $42.73 $60.00 17% 20.0% 22% 12% $50.00 $47.00 10.0% 10%

$40.00 Current: $21.00 0.0% Current $15.25 $30.00 Price: $19.00 $21.74 (3%) $20.00 (10.0%) $17.00 $20.00 $17.00 (8%) Median (22%) Price (20.0%) $10.00 Target: $20.00 $0.00 (30.0%) Analyst 1 Analyst 2 Analyst 3 8/9/2023 8/3/2023 7/11/2023 Analyst

Recommendation 0 2 1 4 Buy ✓ 1 1 3 2 Hold ~ 0 1 0 0 Sell O 1 4 4 6 Source: FactSet as of 8/11/2023. 1. Includes available reports from reputable brokers that have provided a price target. 2. Peer group price targets reflect average analyst

price target. 3. Reflects unaffected price from 5/12/2023 prior to Oneok acquisition. 8

DINO | Equity Analyst Price Targets (1) (2) Research Price Targets

Premium / (Discount) % to Current Price Price Targets ($ / share) Median Analyst Target Price Premium / (Discount) to: Current Price 1% Current: Current: Current: Current: Current: Current: Current: $149.75 $116.64 $139.06 $36.55 $28.28 $49.84

$37.02 $152.00 $125.00 $150.00 $80.00 50% $70.00 40% Median $70.00 Analyst: $63.00 $61.00 $60.00 $60.00 $60.00 30% $56.00 $60.00 $57.00 $54.00 Current 20% DINO: $48.00 $50.00 $59.34 $44.00 8% 7% 18% 10% 1% 2% $37.00 $40.00 Peers 6% (4%) 0% Median:

3% $31.00 (0%) (0%) 1% $30.00 $26.00 (4%) (10%) (6%) (8%) (9%) $20.00 (15%) (20%) $10.00 (30%) (26%) $0.00 (40%) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Analyst 1 Analyst 2 Analyst 3 Analyst 4 Analyst 5 Analyst 6 Analyst 7 Analyst 8 Analyst 9 8/10/23

8/8/23 8/4/23 8/4/23 8/3/23 8/3/23 8/3/23 7/18/23 7/6/23 Analyst Recommendation 9 7 10 0 1 2 3 Buy ✓✓✓✓✓ 2 3 1 3 5 6 1 Hold ~ ~ ~ ~ 0 0 0 0 2 0 0 Sell Source: FactSet as of 8/11/2023. 11 10 11 3 8 8 4 1. Includes

available reports from reputable brokers since Q1’23 earnings release that have provided a price target. 2. Peer group price targets reflect median analyst price target. 9

HEP | Comparable Transaction Analysis Selected MLP Buy-in Transactions

Total Initial Initial Premium Paid Premium Paid - (2) (3) Announced Transaction Enterprise Value Price Premium Final (Days Prior to Initial Ann.) (Days Prior to Final Ann.) EV / FY+1 30-Day 30-Day (1) Date Acquirer Target Value ($MM) Acquirer Target

Offered Offered Price 1-Day 1-Day EBITDA Consideration Process VWAP VWAP 8/17/2022 $3,783 $68,412 $14,229 $34.75 0.0% $41.75 20.1% 24.0% 6.2% 8.2% 8.4x 100% Cash Ann. then Negotiate (4) 7/28/2022 $579 $7,229 $1,690 $15.14 13.4% $17.66 32.3% 11.0%

(3.4%) 9.9% 7.3x Cash and Unit Exchange Ann. then Negotiate 7/6/2022 $131 NA $824 $17.90 (0.3%) $25.00 39.3% 42.8% 2.8% 8.6% 10.3x 100% Cash Ann. then Negotiate 4/22/2022 $400 NA $595 $3.32 0.9% $4.65 41.3% 42.7% 40.9% 40.7% 11.1x 100% Cash Ann.

then Negotiate (5) 2/11/2022 $2,608 $237,598 $9,749 $12.89 0.0% $15.85 23.0% 23.5% 9.6% 11.6% 12.6x 100% Cash Ann. then Negotiate 10/27/2021 $3,466 $16,829 $13,076 $32.57 0.0% $41.11 4.8% 7.6% 4.8% 7.6% 9.7x 100% Unit Exchange Negotiate then Ann.

(6) 8/5/2021 $874 $126,182 $1,694 $13.01 0.0% $15.12 16.2% 8.9% 17.1% 17.2% 9.7x 100% Unit Exchange Ann. then Negotiate (7) 2/5/2021 $1,149 $201,401 $2,872 $12.47 0.0% $14.56 16.7% 18.7% (3.3%) 5.8% 7.4x 100% Unit Exchange Ann. then Negotiate (8)

10/5/2020 $2,829 $74,892 $3,361 $27.31 5.4% $30.95 19.5% 15.1% 0.6% (0.7%) 10.1x 100% Unit Exchange Ann. then Negotiate 7/27/2020 $693 $4,419 $1,312 $8.38 4.5% $8.47 28.1% 29.1% 28.1% 29.1% 7.3x 100% Unit Exchange Negotiate then Ann. 11/26/2018 $536

NA $1,246 $38.00 4.4% $41.00 12.6% 9.5% 12.6% 9.5% 10.6x 100% Cash Negotiate then Ann. 11/8/2018 $8,965 $7,251 $12,230 $43.77 5.0% $50.33 7.6% 14.3% 7.6% 14.3% 11.2x 100% Unit Exchange Negotiate then Ann. 10/18/2018 $1,850 $50,344 $3,660 $40.00

10.7% $42.25 6.0% 10.2% 6.0% 10.2% 10.2x 100% Cash Negotiate then Ann. 9/19/2018 $2,634 $86,611 $6,683 $17.75 0.0% $18.22 2.6% 8.8% 0.5% 1.0% 29.6x 100% Unit Exchange Ann. then Negotiate (9) 8/1/2018 $60,345 $26,932 $80,353 $21.32 5.0% $23.59 11.2%

17.5% 11.2% 17.5% 7.0x 100% Unit Exchange Negotiate then Ann. (10) 5/29/2018 $300 $5,332 $3,262 $21.86 (1.1%) $21.86 (1.1%) 9.2% (1.1%) 9.2% 6.2x 100% Unit Exchange Tender Offer (11) 5/17/2018 $4,779 $123,056 $27,256 $33.10 0.0% $40.00 20.8% 18.4%

5.7% 6.8% 14.3x 100% Unit Exchange Ann. then Negotiate (12) 5/17/2018 $10,010 $121,978 $14,694 $10.08 0.0% $11.48 13.9% 16.4% 2.1% 0.3% 10.1x 100% Unit Exchange Ann. then Negotiate 5/17/2018 $15,105 $29,816 $55,383 $36.94 5.2% $40.89 6.4% 11.2% 6.4%

11.2% 11.8x 100% Unit Exchange Negotiate then Ann. 3/27/2018 $3,224 $3,418 $4,942 $41.34 (0.5%) $35.42 0.6% (8.1%) 0.6% (8.1%) 6.3x 100% Unit Exchange Negotiate then Ann. Source: Price data per FactSet. Transaction value and consideration paid based

on public filings, company press releases, and investor presentations. 1. Transaction value includes only un-affiliated and proportional net debt. 2. Premium paid to initial announcement represents the premium based on the final agreed upon price

relative to the original offer’s unaffected date. 3. Premium paid to final announcement represents the premium based on the final agreed upon price relative to the final announcement’s unaffected date. 4. Initial price offered not yet

disclosed. Transaction value and premium reflect unaffected DINO price as of 7/27/2022. Initial announcement date reflects filing of Schedule 13D/A on June 24, 2022. 5. Shell / Shell Midstream Partners LP based on revised offer announced 7/25/2022.

Premium paid based on closing price prior to original announcement on 2/11/2022. 6. BP / BP Midstream Partners LP based on revised offer announced 12/20/2021. Premium paid based on closing price prior to original announcement on 8/4/2021. 7. Chevron

/ Noble Midstream Partners based on revised offer announced 3/5/2021. Premium paid based on closing price prior to original announcement on 2/4/2021. 8. TC Energy / TC Pipeline based on revised offer announced 12/15/2020. Premium paid based on

closing price prior to original announcement on 10/5/2020. 9. Dominion Energy / Dominion Energy Midstream based on revised offer announced 11/23/2018. Premium paid based on closing price prior to original announcement on 9/8/2018. 10. Reflects the

5/29/18 exchange offer; CVI announced it would exercise the call right on 1/17/19. 11. Enbridge / Spectra premiums based on revised offer announced on 8/24/2018. Enbridge price performance based on original announcement on 5/17/2018. 12. Enbridge /

Enbridge Energy Partners based on revised offer announced 9/18/2018. Enbridge price performance based on original announcement on 5/17/2018. 10

HEP | Comparable Transaction Analysis (Cont’d) Selected MLP Buy-in

Transactions Total Initial Initial Premium Paid Premium Paid (2) (3) Announced Transaction Enterprise Value Price Premium Final (Days Prior to Initial Ann.) (Days Prior to Final Ann.) EV / FY+1 30-Day 30-Day (1) Date Acquirer Target Value ($MM)

Acquirer Target Offered Offered Price 1-Day 1-Day EBITDA Consideration Process VWAP VWAP 11/8/2017 $173 $3,189 $845 $11.80 3.0% $13.92 3.0% 11.5% 3.0% 11.5% 4.6x 100% Unit Exchange Negotiate then Ann. 8/29/2017 $736 NA $736 $14.50 0.4% $16.50 15.2%

12.4% 15.2% 12.4% 12.3x 100% Cash Negotiate then Ann. 5/18/2017 $651 NA $963 $20.00 20.1% $20.00 20.1% 20.4% 20.1% 20.4% 12.3x 100% Cash Tender Offer 4/4/2017 $157 NA $594 $16.80 5.8% $17.30 5.8% 5.6% 5.8% 5.6% 9.1x 100% Cash Tender Offer 3/2/2017

$781 NA $1,470 $18.75 1.9% $19.50 6.0% 5.6% 4.3% 3.4% 9.3x 100% Cash Ann. then Negotiate 1/27/2017 $1,656 $77,129 $1,656 $6.25 (4.6%) $8.00 (8.6%) 1.8% (8.6%) 1.8% 11.0x 100% Cash Negotiate then Ann. 11/1/2016 $5,180 $77,381 $9,684 $15.75 2.9%

$17.00 11.1% 16.0% 6.3% 5.2% 18.0x 100% Cash Ann. then Negotiate Premium Paid Premium Paid (2) (3) Initial (Days Prior to Initial Ann.) (Days Prior to Final Ann.) Premium 30-Day 30-Day EV / FY+1 1-Day 1-Day Offered VWAP VWAP EBITDA Mean 3.0% 13.9%

15.0% 7.5% 10.0% 10.7x Selected MLP Median 0.9% 12.6% 12.4% 5.8% 9.2% 10.1x Transactions From High 20.1% 41.3% 42.8% 40.9% 40.7% 29.6x 2016 - 2023 YTD Low (4.6%) (8.6%) (8.1%) (8.6%) (8.1%) 4.6x Selected Mean 1.9% 10.8% 12.8% 6.0% 8.8% 10.4x 100%

Stock MLP Median 0.0% 9.4% 12.9% 3.9% 8.4% 9.7x Transactions From High 5.4% 28.1% 29.1% 28.1% 29.1% 29.6x 2016 - 2023 YTD Low (1.1%) (1.1%) (8.1%) (3.3%) (8.1%) 4.6x Mean 1.8% 24.2% 22.4% 9.4% 13.7% 9.6x Selected MLP Median 0.0% 21.6% 21.1% 5.5%

9.3% 9.7x Transactions From High 13.4% 41.3% 42.8% 40.9% 40.7% 12.6x 2021 - 2023 YTD Low (0.3%) 4.8% 7.6% (3.4%) 5.8% 7.3x Source: Price data per FactSet. Transaction value and consideration paid based on public filings, company press releases, and

investor presentations. HEP data per DINO Management forecast. 1. Transaction value includes only un-affiliated and proportional net debt. 2. Premium paid to initial announcement represents the premium based on the final agreed upon price relative

to the original offer’s unaffected date. 3. Premium paid to final announcement represents the premium based on the final agreed upon price relative to the final offer’s unaffected date. 11

DINO | Comparable Companies DINO Trading Comparables ($ in millions,