The Hershey Company (NYSE:HSY):

● Earnings per share-diluted of $0.71 as reported and $0.73

adjusted

● Retail takeaway up 4.8% in channels that account for over

80% of the Company’s U.S. business

● Full-year net sales growth of 3-5% expected

● Outlook for 2009 adjusted earnings per share-diluted

increased; to be in the $2.12 to $2.14 range

The Hershey Company (NYSE:HSY) today announced sales and

earnings for the third quarter ended October 4, 2009. Consolidated

net sales were $1,484,118,000 compared with $1,489,609,000 for the

third quarter of 2008. Reported net income for the third quarter of

2009 was $162,023,000 or $0.71 per share-diluted, compared with

$124,538,000 or $0.54 per share-diluted, for the comparable period

of 2008.

For the third quarters of 2009 and 2008, these results, prepared

in accordance with generally accepted accounting principles (GAAP),

include net pre-tax charges of $11.0 million and $31.0 million, or

$0.02 and $0.10 per share-diluted, respectively. These charges were

associated with the Global Supply Chain Transformation (GSCT)

program. Adjusted net income, which excludes these net charges, was

$168,508,000 or $0.73 per share-diluted in the third quarter of

2009, compared with $145,813,000, or $0.64 per share-diluted in the

third quarter of 2008, an increase of 14.1 percent in adjusted

earnings per share-diluted.

For the first nine months of 2009, consolidated net sales were

$3,891,332,000 compared with $3,755,388,000 for the first nine

months of 2008. Reported net income for the first nine months of

2009 was $309,215,000 or $1.35 per share-diluted, compared with

$229,250,000 or $1.00 per share-diluted, for the first nine months

of 2008.

For the first nine months of 2009 and 2008, these results,

prepared in accordance with GAAP, include net pre-tax charges of

$72.7 million and $101.0 million, or $0.19 and $0.30 per share,

respectively. These charges were associated with the GSCT program.

Adjusted net income for the first nine months of 2009, which

excludes these net charges, was $352,465,000, or $1.54 per

share-diluted, compared with $296,680,000 or $1.30 per

share-diluted in 2008, an increase of 18.5 percent in adjusted

earnings per share-diluted.

Total GSCT program costs to date are $602.7 million. The

forecast for total charges related to the program remains $640

million to $665 million and includes the non-cash pension

settlement charges discussed in prior quarters and described in

Appendix A. In 2009, the Company expects to record total GAAP

charges, including possible non-cash pension settlement charges, of

about $0.26 to $0.32 per share-diluted, generating expected GAAP

earnings of $1.80 to $1.88 per share-diluted (see “Note” for GAAP

to adjusted earnings per share-diluted reconciliation).

Third Quarter Performance and

Outlook

“I’m pleased with Hershey’s third quarter results, which were

driven by core brand growth, solid performance within key retail

channels and strong productivity gains,” said David J. West,

President and Chief Executive Officer. “Net sales, down slightly in

the quarter versus the prior year, were in-line with our

expectations as we’re lapping the buy-in related to the August 2008

price increase. Importantly, U.S. retail takeaway for the 12-weeks

ended October 3, 2009, in channels that account for over 80 percent

of our U.S. retail business, was up 4.8 percent. In the channels

measured by syndicated data, U.S. market share was flat for the

12-weeks ended October 3, 2009, and up 0.3 points year-to-date.

These results were driven by the investments we have made behind

our core brands, including advertising, up about 50 percent in the

third quarter.

“Increased levels of in-store programming and merchandising, as

well as outstanding execution at the retail level, continue to

drive our positive marketplace results in the food, convenience and

mass classes of trade. We’ll continue to invest in our brands and

business capabilities and anticipate a solid finish to the

year.

“As anticipated, in the third quarter, net sales gains from the

U.S. pricing action were offset by volume declines associated with

pricing elasticity, the impact of unfavorable foreign currency

exchange rates and previously communicated 2009 mid-year actions to

discontinue certain premium chocolate products. Overall, the

investments we made in selling capabilities were successful in the

quarter and contributed to consumer acceptance of the new higher

everyday, promoted and seasonal price points.

“Adjusted income before interest and income taxes increased 15.8

percent in the third quarter, slightly greater than our

expectations, and resulted in a 280 basis point margin improvement.

The increase was driven by net price realization, supply chain

efficiencies and productivity gains. Offsetting a portion of these

gains were higher commodity and employee-related costs, including

pension expense. Additionally, our earnings growth, as well as our

focus on improving net trading capital, generated strong operating

cash flow in the quarter.

“We are working closely with retail

customers and are monitoring category and Hershey brand performance

given the higher promoted price points of seasonal candy. We’ll

make the necessary consumer investments in the coming weeks and

months to ensure a healthy category and Halloween and Holiday sell

through at the retail level. Halloween-specific seasonal

promotions, merchandising and advertising are currently being

executed in the marketplace. We are also planning an additional

increase in advertising in the fourth quarter and expect full-year

2009 advertising expense to increase about 50 percent versus 2008.

This investment will benefit our everyday and seasonal business in

the near term and into next year, as well as the December launches

of Hershey’s Bliss white chocolate and the introduction of

Hershey’s Special Dark, Almond Joy and York Pieces. These Hershey

favorites, in a crunchy candy shell, are an expansion of the

popular Reese’s Pieces format and will be available in take-home,

resealable, standup pouches. These two launches represent the type

of close-in innovation on our iconic brands that we believe

resonate with consumers in this challenging environment.

“In the fourth quarter, gains from pricing will not be as

significant as the Holiday season is smaller than Halloween.

Additionally, due to timing, we expect shipments of Valentine’s and

Easter seasonal product to be lower in the fourth quarter of 2009

versus 2008. Based on the year-to-date price/volume elasticity

trends and brand-building and marketplace initiatives for the

remainder of the year, we expect 2009 net sales growth to be within

our 3 to 5 percent long-term objective. Over the balance of the

year, we’re accelerating domestic and international investments in

consumer capabilities, customer insights and category management

techniques that will benefit the Company over the long term.

Therefore, we anticipate adjusted earnings per share-diluted for

the full-year to be in the $2.12 to $2.14 range.

“As we look to 2010, we assume the economic environment for

consumers in the U.S. and international markets will continue to be

challenging. We’ll continue to focus on and make appropriate

investments in our core brands and expect 2010 net sales growth to

be within our 3 to 5 percent long-term objective. The sell through

at retail for Halloween will be greatly affected by the remaining

days in the season and will determine our approach to the upcoming

Holiday, Valentine’s and Easter seasons, all of which we expect

will be at the higher seasonal promoted price points. While still

early, for 2010, given our current views of our investments,

marketplace performance and cost structure, we expect growth in

adjusted earnings per share-diluted to be within our long-term

objective of 6 to 8 percent,” West concluded.

Note: In this

release, Hershey has provided income measures excluding certain

items described above, in addition to net income determined in

accordance with GAAP. These non-GAAP financial measures, as shown

in the attached pro forma summary of consolidated statements of

income, are used in evaluating results of operations for internal

purposes. These non-GAAP measures are not intended to replace the

presentation of financial results in accordance with GAAP. Rather,

the Company believes exclusion of such items provides additional

information to investors to facilitate the comparison of past and

present operations.

In 2008, the Company recorded GAAP charges of $130.0 million, or

$0.38 per share-diluted, attributable to the GSCT program and $45.7

million, or $0.13 per share-diluted, related to the impairment of

intangible trademark values, primarily Mauna Loa, recorded in the

fourth quarter of 2008. Additionally, the Company recorded business

realignment and impairment charges of $4.9 million, or $0.01 per

share-diluted, related to the business realignment in Brazil.

In 2009, the Company expects to record total GAAP charges,

including possible non-cash pension settlement charges (see

Appendix A), of about $100 million to $120 million, or $0.26 to

$0.32 per share-diluted.

The GSCT program is expected to result in total pre-tax charges

and non-recurring project implementation costs of $640 million to

$665 million, including possible non-cash pension settlement

charges (see Appendix A) in 2009 and 2010. Total charges include

project management and start-up costs of approximately $60

million.

Below is a reconciliation of GAAP and non-GAAP items to the

Company’s adjusted earnings per share-diluted outlook:

2008

2009

Reported / Expected EPS-Diluted $1.36 $1.80 - $1.88 Total

Business Realignment and Impairment Charges $0.52 $0.26 - $0.32

Adjusted EPS-Diluted * $1.88 -- Expected Adjusted

EPS-Diluted* $2.12 - $2.14

*Excludes business

realignment and impairment charges.

Appendix A

Financial Accounting Standards Board Statement of Financial

Accounting Standards No. 88, Employers’ Accounting for Settlements

and Curtailments of Defined Benefit Pension Plans and for

Termination Benefits (as amended) (now FASB Accounting Standards

Codification 715-30-35) (“SFAS No. 88”) requires pension settlement

charges to be recorded if withdrawals from pension plans in a

calendar year exceed a certain level.

Pension settlement charges are non-cash charges for the Company.

Such charges accelerate the recognition of pension expenses related

to actuarial gains and losses resulting from interest rate changes

and differences in actual versus assumed returns on pension assets.

The Company normally amortizes actuarial gains and losses over a

period of about 13 years.

The GSCT program charges recorded in 2007 and 2008 included

pension settlement charges of approximately $25 million as

employees leaving the Company under the program have withdrawn lump

sums from the defined benefit pension plans. Pension settlement

charges recorded during the first nine months of 2009 totaled

approximately $36.7 million.

In addition to the settlement charges reflected above,

incremental SFAS No. 88 pension settlement charges of $30 million

to $40 million are included in the total GSCT program estimates

based upon the current trends of employee withdrawals, with

approximately $30 million of this amount projected for 2009.

The GSCT program is expected to result in total pre-tax charges

and non-recurring project implementation costs of $640 million to

$665 million, including estimated pension settlement charges in

2009 and 2010.

Safe Harbor

Statement

This release contains statements that are forward-looking. These

statements are made based upon current expectations that are

subject to risk and uncertainty. Actual results may differ

materially from those contained in the forward-looking statements.

Factors that could cause results to differ materially include, but

are not limited to: issues or concerns related to the quality and

safety of our products, ingredients or packaging; changes in raw

material and other costs and selling price increases, including

volume declines associated with pricing elasticity; market demand

for our new and existing products; increased marketplace

competition; political, economic, and/or financial market

conditions; changes in governmental laws and regulations, including

taxes; risks and uncertainties related to our international

operations; the impact of future developments related to the

investigation by government regulators of alleged pricing practices

by members of the confectionery industry, including risks of

subsequent litigation or further government action; pension cost

factors, such as actuarial assumptions, market performance and

employee retirement decisions; our ability to achieve expected

ongoing annual savings from our supply chain transformation and the

implementation of our supply chain transformation within the

anticipated timeframe in accordance with our cost estimates; and

such other matters as discussed in our Annual Report on Form 10-K

for 2008. All information in this press release is as of October

22, 2009. The Company undertakes no duty to update any

forward-looking statement to conform the statement to actual

results or changes in the Company’s expectations.

Live Web Cast

As previously announced, the Company will hold a conference call

with analysts today at 8:30 a.m. Eastern Time. The conference call

will be web cast live via Hershey’s corporate website

www.hersheys.com. Please go to the Investor Relations section of

the website for further details.

The Hershey Company Summary of Consolidated

Statements of Income for the periods ended October 4, 2009

and September 28, 2008 (in thousands except per share amounts)

Third Quarter

Nine Months

2009 2008

2009 2008 Net Sales

$ 1,484,118 $ 1,489,609 $ 3,891,332 $ 3,755,388 Costs and

Expenses: Cost of Sales 895,020 988,380 2,408,716 2,495,196

Selling, Marketing and Administrative 301,466 272,401 874,632

788,962

Business Realignment and

Impairment Charges, net

8,008 8,877 58,750 34,748 Total Costs and Expenses 1,204,494

1,269,658 3,342,098 3,318,906 Income Before Interest and

Income Taxes (EBIT) 279,624 219,951 549,234 436,482 Interest

Expense, net 22,302 24,915 68,932 72,911 Income Before

Income Taxes 257,322 195,036 480,302 363,571 Provision for Income

Taxes 95,299 70,498 171,087 134,321 Net Income $ 162,023 $

124,538 $ 309,215 $ 229,250

Net Income Per Share

- Basic - Common

$ 0.73 $ 0.56 $ 1.39 $ 1.03

- Basic - Class B

$ 0.66 $ 0.51 $ 1.26 $ 0.93

- Diluted - Common

$ 0.71 $ 0.54 $ 1.35 $ 1.00

Shares Outstanding

- Basic - Common

167,299 166,682 166,980 166,696

- Basic - Class B

60,709 60,784 60,710 60,798

- Diluted - Common

229,553 228,670 228,784 228,757 Key Margins: Gross Margin

39.7% 33.6% 38.1% 33.6% EBIT Margin 18.8% 14.8% 14.1% 11.6% Net

Margin 10.9% 8.4% 7.9% 6.1%

The Hershey

Company Pro Forma Summary of Consolidated Statements of

Income for the periods ended October 4, 2009 and September

28, 2008 (in thousands except per share amounts)

Third Quarter Nine Months

2009 2008

2009 2008 Net Sales

$ 1,484,118 $ 1,489,609 $ 3,891,332 $ 3,755,388 Costs and

Expenses: Cost of Sales

893,695

(a)

968,415

(d)

2,400,224

(a)

2,435,050

(d)

Selling, Marketing and Administrative

299,783

(b)

270,213

(e)

869,195

(b)

782,897

(e)

Business Realignment and

Impairment Charges, net

—

(c)

—

(f)

—

(c)

—

(f)

Total Costs and Expenses 1,193,478 1,238,628 3,269,419

3,217,947 Income Before Interest and Income Taxes (EBIT)

290,640 250,981 621,913 537,441 Interest Expense, net 22,302 24,915

68,932 72,911 Income Before Income Taxes 268,338 226,066

552,981 464,530 Provision for Income Taxes 99,830 80,253 200,516

167,850 Adjusted Net Income $ 168,508 $ 145,813 $ 352,465 $

296,680 Adjusted Net Income Per Share

- Basic - Common

$ 0.76 $ 0.66 $ 1.59 $ 1.34

- Basic - Class B

$ 0.68 $ 0.59 $ 1.43 $ 1.21

- Diluted - Common

$ 0.73 $ 0.64 $ 1.54 $ 1.30

Shares Outstanding

- Basic - Common

167,299 166,682 166,980 166,696

- Basic - Class B

60,709 60,784 60,710 60,798

- Diluted - Common

229,553 228,670 228,784 228,757 Key Margins: Adjusted Gross

Margin 39.8% 35.0% 38.3% 35.2% Adjusted EBIT Margin 19.6% 16.8%

16.0% 14.3% Adjusted Net Margin 11.4% 9.8% 9.1% 7.9%

(a) Excludes business realignment and impairment charges of

$1.3 million pre-tax or $.8 million after-tax for the third quarter

and $8.5 million pre-tax or $5.0 million after-tax for the nine

months. (b) Excludes business realignment and impairment charges of

$1.7 million pre-tax or $.9 million after-tax for the third quarter

and $5.4 million pre-tax or $3.2 million after-tax for the nine

months. (c) Excludes business realignment and impairment charges of

$8.0 million pre-tax or $4.8 million after-tax for the third

quarter and $58.8 million pre-tax or $35.1 million after-tax for

the nine months. (d) Excludes business realignment and impairment

charges of $20.0 million pre-tax or $13.9 million after-tax for the

third quarter and $60.1 million pre-tax or $41.3 million after-tax

for the nine months. (e) Excludes business realignment and

impairment charges of $2.2 million pre-tax or $1.4 million

after-tax for the third quarter and $6.1 million pre-tax or $3.7

million after-tax for the nine months. (f) Excludes business

realignment and impairment charges of $8.9 million pre-tax or $6.0

million after-tax for the third quarter and $34.7 million pre-tax

or $22.4 million after-tax for the nine months.

The Hershey Company Consolidated Balance Sheets as

of October 4, 2009 and December 31, 2008 (in thousands of

dollars)

Assets

2009 2008 Cash and

Cash Equivalents $ 119,253 $ 37,103 Accounts Receivable - Trade

(Net) 567,609 455,153 Deferred Income Taxes 31,164 70,903

Inventories 559,318 592,530 Prepaid Expenses and Other 185,293

189,256 Total Current Assets 1,462,637 1,344,945 Net

Plant and Property 1,412,818 1,458,949 Goodwill 567,163 554,677

Other Intangibles 125,345 110,772 Deferred Income Taxes 24,776

13,815 Other Assets 180,368 151,561 Total Assets $ 3,773,107

$ 3,634,719

Liabilities and Stockholders'

Equity

Loans Payable $ 243,021 $ 501,504 Accounts Payable 285,231

249,454 Accrued Liabilities 546,425 504,065 Taxes Payable 33,652

15,189 Total Current Liabilities 1,108,329 1,270,212

Long-Term Debt 1,503,435 1,505,954 Other Long-Term Liabilities

481,105 504,963 Deferred Income Taxes 42,721 3,646 Total

Liabilities 3,135,590 3,284,775 Total Stockholders' Equity

637,517 349,944 Total Liabilities and Stockholders' Equity $

3,773,107 $ 3,634,719

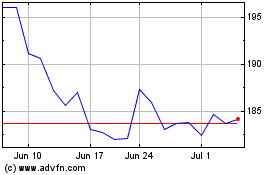

Hershey (NYSE:HSY)

Historical Stock Chart

From Oct 2024 to Nov 2024

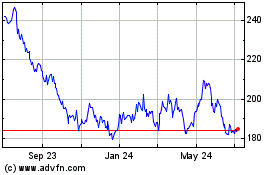

Hershey (NYSE:HSY)

Historical Stock Chart

From Nov 2023 to Nov 2024