Hersha Hospitality Acquires the Rittenhouse Hotel in Philadelphia, PA

March 02 2012 - 8:30AM

Business Wire

Hersha Hospitality Trust (NYSE: HT), owner of upscale hotels in

urban gateway markets, announced today that the Company acquired an

interest in a mixed-use building, which includes a condominium

interest in the 111-room Rittenhouse Hotel and 44,000 square feet

of retail and office space and a fee interest in an adjacent

parking garage. The total purchase price for the tangible and

intangible assets of the hotel, office, retail and parking garage

is $42.0 million. Including the anticipated renovations, the hotel

portion is valued at $23.9 million or $215,000 per key. The

Rittenhouse Hotel has historically produced the highest revenue per

available room (RevPAR) in the Philadelphia market.

“We are pleased to enhance our presence in the emerging

Philadelphia market with the acquisition of the highly rated

Rittenhouse Hotel,” commented Jay H. Shah, Chief Executive Officer.

“This AAA Five Diamond hotel boasts the largest guestrooms and the

best location in the city. The property is ideally situated on

Philadelphia’s famed Rittenhouse Square, within walking distance to

Center City’s primary corporate demand generators and its premier

retail corridor. Additionally, the hotel affords easy access to the

Convention Center and the City’s numerous arts, cultural, dining

and leisure venues. The property has consistently been the top

performer in the market, and we have identified further

opportunities for enhanced asset management, upgrades and expansion

which should improve operating margins and maximize Hersha’s

investment in the property. The revenue from the adjacent parking

garage and the income from the retail and office leases will also

provide consistent cash flow at the property.”

The hotel features the highly rated Lacroix Restaurant, an

indoor pool, fitness center, 8,500 square feet of business and

social function space and 100 underground parking spaces. Hersha

Hospitality Management has assumed management of the hotel.

Included in the acquisition is 44,000 square feet of retail and

office space. The primary leaseholders include Smith &

Wollensky, Citizens Bank, Prudential, Adolf Biecker Spa &

Salon, and Saxbys Coffee. Hersha is also purchasing the adjacent

fee simple stand-alone parking garage with 300 parking spaces.

With strong, long-term demand fundamentals and limited supply

growth, Philadelphia is poised to be one of the top five growth

markets over the next several years according to PKF Hospitality.

In addition, the Philadelphia Convention Center is expected to have

one of its strongest years in 2012.

The Company has posted a presentation of supplemental

information about the Rittenhouse Hotel acquisition located at

www.hersha.com on the investor relations section under

“Presentations.”

About Hersha Hospitality Trust

Hersha Hospitality Trust is a self-advised real estate

investment trust, which owns 67 hotels in major urban gateway

markets including New York, Washington, Boston, Philadelphia, Los

Angeles and Miami totaling 9,598 rooms. HT follows a highly

selective investment approach and leverages operational advantage

through rigorous and sustainable asset management practices. For

further information on the Company visit our website at

www.hersha.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, and, as such, may involve known and unknown risks,

uncertainties and other factors that may cause the actual results

or performance to differ from those reflected in the

forward-looking statement. For a description of these factors,

please review the information under the heading “Risk Factors”

included in Hersha Hospitality Trust’s Annual Report on Form 10-K

for the year ended December 31, 2011, filed with the U.S.

Securities Exchange Commission and the prospectus supplement and

accompanying prospectus relating to the offering.

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From May 2024 to Jun 2024

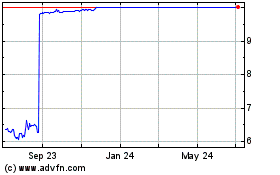

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Jun 2023 to Jun 2024