Hersha Hospitality Completes Acquisition of the Marriott Courtyard Hotel Los Angeles Westside

May 23 2011 - 8:00AM

Business Wire

Hersha Hospitality Trust (NYSE: HT), owner of upscale and

mid-priced hotels in major metropolitan markets, announced that the

Company has completed the acquisition of the 260 room Marriott

Courtyard Westside in Los Angeles (Culver City), CA for $47.5

million, or $182,500 per key, including closing costs and fees. The

hotel was completely renovated and reopened as the Courtyard

Westside in 2008 and includes approximately 11,000 square feet of

meeting space.

This hotel is Hersha’s first property in Los Angeles and is

located in western Los Angeles County near the intersection of two

major freeways, I-405 and I-10. The Courtyard Westside is

surrounded by abundant commercial and leisure demand generators

including large concentrations of Class A office space, high end

retailers, entertainment venues and production studios. It is also

proximate to the Los Angeles International Airport, Venice Beach,

the Santa Monica Pier and the Los Angeles Convention Center.

The Los Angeles hotel market has displayed favorable dynamics,

with 15% year over year growth in Revenue per Available Room (or

RevPAR) year to date through April. Since 1995, Los Angeles has

offered the second highest RevPAR growth in the country, behind

only New York. Additionally, the market average RevPAR is still

approximately 17% below its 2008 peak.

The total purchase price represents a first year economic

capitalization rate of approximately 8.3% and an expected

stabilized capitalization rate of approximately 11%.

About Hersha Hospitality Trust

Hersha Hospitality Trust is a self-advised real estate

investment trust, which owns interests in 79 hotels, totaling

10,702 rooms, primarily along the Northeast Corridor from Boston,

MA to Washington DC. Hersha also owns hotels in Northern California

and Scottsdale, Arizona. Hersha focuses on upscale, mid-priced and

extended stay hotels in major metropolitan markets.

Forward Looking Statement

Certain matters within this press release are discussed using

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, and, as such, may involve

known and unknown risks, uncertainties and other factors that may

cause the actual results or performance to differ from those

projected in the forward-looking statement. For a description of

these factors, please review the information under the heading

“Risk Factors” in Hersha Hospitality Trust’s filings with the SEC,

including its Annual Report on Form 10-K for the year ended

December 31, 2010.

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From May 2024 to Jun 2024

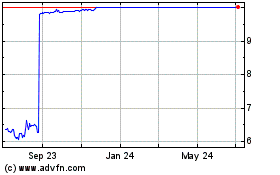

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Jun 2023 to Jun 2024