Hersha Hospitality Trust Announces Public Offering of Series B Preferred Shares

May 10 2011 - 4:24PM

Business Wire

Hersha Hospitality Trust (NYSE: HT), owner of upscale, mid-scale

and extended stay hotels in major metropolitan markets, today

announced the commencement of a public offering of Series B

cumulative redeemable preferred shares of beneficial interest, par

value $.01 per share ($25.00 liquidation preference per share).

Hersha intends to grant the underwriters of the offering a 30-day

option to purchase additional Series B preferred shares to cover

over-allotments, if any. Hersha intends to use the net proceeds of

the offering to repay outstanding indebtedness under its revolving

line of credit and for general corporate purposes, including future

acquisitions.

The joint book running managers for the offering are BofA

Merrill Lynch, Barclays Capital, Morgan Stanley and Raymond

James.

A registration statement relating to these preferred shares has

been filed with the U.S. Securities and Exchange Commission and is

effective. This announcement shall not constitute an offer to sell

or a solicitation of an offer to buy Hersha’s securities, nor shall

there be any sale of these securities or a solicitation of an offer

to buy these securities in any state in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state. Offers

for the securities will be made only by means of a prospectus

supplement and accompanying prospectus forming part of the

registration statement. A prospectus supplement and accompanying

prospectus relating to these securities, when available, may be

obtained from: BofA Merrill Lynch, Attn: Syndicate Operations, 100

West 33rd Street, 3rd Floor, New York, NY 10001 or email

dg.prospectus_requests@baml.com; Barclays Capital Inc. c/o

Broadridge Financial Solutions, Attn: Prospectus Department, 1155

Long Island Avenue, Edgewood, NY 11717 or email

Barclaysprospectus@broadridge.com; Morgan Stanley & Co.

Incorporated, Attn: Prospectus Department, 180 Varick Street, 2nd

Floor, New York, NY 10014 or email prospectus@morganstanley.com; or

Raymond James & Associates, Inc., Attn: Prospectus Department,

880 Carillon Parkway, St. Petersburg, FL 33716 or email

prospectus@raymondjames.com.

About Hersha Hospitality Trust

Hersha Hospitality Trust is a self-advised real estate

investment trust, which owns interests in 78 hotels, totaling

10,442 rooms, primarily along the Northeast Corridor from Boston,

MA to Washington DC. Hersha also owns hotels in Northern California

and Scottsdale, Arizona. Hersha focuses on upscale, mid-scale and

extended stay hotels in major metropolitan markets.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, and, as such, may involve known and unknown risks,

uncertainties and other factors that may cause the actual results

or performance to differ from those reflected in the

forward-looking statement. For a description of these factors,

please review the information under the heading “Risk Factors”

included in Hersha Hospitality Trust’s Annual Report on Form 10-K

for the year ended December 31, 2010, filed with the U.S.

Securities Exchange Commission and the prospectus supplement and

accompanying prospectus relating to the offering.

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From May 2024 to Jun 2024

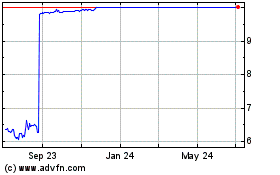

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Jun 2023 to Jun 2024