Natural Gas Environment Still Weak - Analyst Blog

February 27 2012 - 12:39PM

Zacks

The U.S. Energy Department's weekly inventory release showed a

larger-than-expected drop in natural gas supplies, as production

remained flat and pipeline imports from Canada declined. However,

this is largely seen as a one-off shot, with warmer-than-normal

temperatures across most of the country restricting the commodity’s

requirement for power burn.

In fact, gas stocks – currently 40% above benchmark levels – are

at their highest point for this time of the year, reflecting low

demand amid robust onshore output.

The Weekly Natural Gas Storage Report – brought out by the

Energy Information Administration (EIA) every Thursday since 2002 –

includes updates on natural gas market prices, the latest storage

level estimates, recent weather data and other market activities or

events.

The report provides an overview of the level of reserves and

their movements, thereby helping investors understand the

demand/supply dynamics of natural gas.

It is an indicator of current gas prices and volatility that

affect businesses of natural gas-weighted companies and related

support plays like Anadarko Petroleum Corporation

(APC), Chesapeake Energy (CHK), Encana

Corporation (ECA), Devon Energy

Corporation (DVN), Nabors Industries

(NBR), Patterson-UTI Energy (PTEN),

Helmerich & Payne (HP) and Halliburton

Company (HAL).

Stockpiles held in underground storage in the lower 48 states

fell by 166 billion cubic feet (Bcf) for the week ended February

17, 2012, above the guidance range (of 160–164 Bcf draw) as per the

analysts surveyed by Platts, the energy information arm of

McGraw-Hill Companies Inc (MHP).

The decrease – the thirteenth consecutive withdrawal of the

2011-2012 winter heating season after stocks hit an all-time high

in mid-November – is also higher than last year’s draw of 102 Bcf

and the 5-year (2007–2011) average drawdown of 145 Bcf for the

reported week.

However, notwithstanding the healthy shrinkage during the past

week, the current storage level – at 2.595 trillion cubic feet

(Tcf) – is up 753 Bcf (40.9%) from last year and 744 Bcf (40.2%)

over the five-year average. With this huge natural gas surplus,

inventories in underground storage are likely to end the winter

close to their highest level of 2.1 Tcf set in 1983.

A supply glut has pressured natural gas prices during the past

year or so, as production from dense rock formations (shale) –

through novel techniques of horizontal drilling and hydraulic

fracturing – remain robust, thereby overwhelming demand.

As a matter of fact, natural gas prices have dropped some 47%

from 2011 peak of about $5.00 per million Btu (MMBtu) in June to

the current level of around $2.65 (referring to spot prices at the

Henry Hub, the benchmark supply point in Louisiana). Incidentally,

prices hit a 10-year low of $2.23 in late January.

To make matters worse, mild winter weather across most of the

country has curbed natural gas demand for heating, indicating a

grossly oversupplied market that continues to pressure commodity

prices in the backdrop of sustained strong production.

This has forced several natural gas players to announce

drilling/volume curtailments. Exploration and production outfits

like Ultra Petroleum Corp. (UPL), Talisman

Energy Inc. (TLM) and Encana have all reduced their 2012

capital budget to minimize investments in development drilling.

On the other hand, Oklahoma-based Chesapeake – the

second-largest U.S. producer of natural gas behind Exxon

Mobil Corp. (XOM) – has opted for production shut-ins to

cope with the weak environment for natural gas that is likely to

prevail during the year.

However, we feel these planned reductions will not be enough to

balance out the massive natural gas supply/demand disparity and

therefore we do not expect much upside in gas prices in the near

term. In other words, there appears no reason to believe that the

supply overhang will subside and natural gas will be out of the

dumpster in 2012.

ANADARKO PETROL (APC): Free Stock Analysis Report

CHESAPEAKE ENGY (CHK): Free Stock Analysis Report

DEVON ENERGY (DVN): Free Stock Analysis Report

ENCANA CORP (ECA): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

HELMERICH&PAYNE (HP): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

NABORS IND (NBR): Free Stock Analysis Report

PATTERSON-UTI (PTEN): Free Stock Analysis Report

TALISMAN ENERGY (TLM): Free Stock Analysis Report

ULTRA PETRO CP (UPL): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

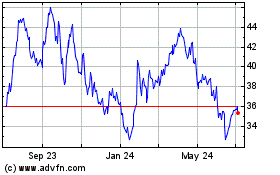

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2024 to May 2024

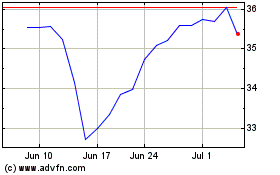

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2023 to May 2024