Statement of Changes in Beneficial Ownership (4)

June 24 2020 - 6:10PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Sienko David C |

2. Issuer Name and Ticker or Trading Symbol

HECLA MINING CO/DE/

[

HL

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

VP and General Counsel |

|

(Last)

(First)

(Middle)

6500 N. MINERAL DRIVE, SUITE 200 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/22/2020 |

|

(Street)

COEUR D'ALENE, ID 83815

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 6/22/2020 | | F | | 15999 (1) | A | $0 | 922004 (2) | D | |

| Common Stock | 6/22/2020 | | J | | 20189 (3) | A | $0 | 20189 | I | By 401(k) Plan |

| Common Stock | 6/22/2020 | | A | | 49505 (4) | A | $3.03 | 119084 (5) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Rights | $0 | 6/22/2020 | | A | | 33003 (6) | | 1/1/2023 | 1/1/2023 | Common Stock | 33003 (7) | $0 | 922004 (8) | D | |

| Explanation of Responses: |

| (1) | Mr. Sienko was awarded (i) 26,235 restricted stock units on June 7, 2017, (ii) 45,692 restricted stock units on June 19, 2018, and (iii) 81,522 restricted stock units on June 21, 2019. The restrictions lapsed on 1/3 of those vesting units (51,150 shares). Mr. Sienko elected to have Hecla Mining Company withhold 15,999 shares to cover his tax liability. |

| (2) | Total consists of 688,154 shares held directly, 119,084 unvested restricted stock units, and 114,766 performance-based shares. |

| (3) | Held as 1,675.046 units in Mr. Sienko's 401(k) account under the Hecla Mining Company Capital Accumulation Plan, and estimated to be 20,189 shares. |

| (4) | Award of restricted stock units that vest as follows: 16,502 shares on June 21, 2021, 16,502 shares on June 21, 2022, and 16,501 shares on June 21, 2023. |

| (5) | Total number of unvested restricted stock units held by Mr. Sienko. |

| (6) | Mr. Sienko was awarded performance rights representing the contingent right to receive between $50,000 and $200,000 worth of Hecla Mining Company common stock based on Hecla Mining Company's Total Shareholder Return performance over the 3-year period (January 1, 2020 to December 31, 2022) relative to our peers. Examples of the potential grant of shares to Mr. Sienko under this plan are as follows: 100th percentile rank among peers = maximum award at 200% of target ($200,000 in stock); 60th percentile rank among peers = target award at grant value ($100,000 in stock); and 50th percentile rank among peers = threshold award at 50% of target ($50,000 in stock). |

| (7) | The number shown in Column 5 of Table II assumes a target payout (i.e., $100,000 worth of common stock), with the common stock valued at the closing price on the day of the award ($3.03). The actual number of shares received (if any) by Mr. Sienko will depend on the Total Shareholder Return performance over the 3-year period and will be determined following the termination of that period. |

| (8) | See footnote #2. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Sienko David C

6500 N. MINERAL DRIVE, SUITE 200

COEUR D'ALENE, ID 83815 |

|

| VP and General Counsel |

|

Signatures

|

| Tami D. Whitman, Attorney-in-Fact for David C. Sienko | | 6/24/2020 |

| **Signature of Reporting Person | Date |

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

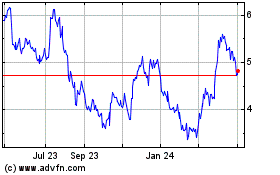

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024