Filed Pursuant to Rule

424(b)(7)

Registration No. 333-274369

PROSPECTUS SUPPLEMENT

(to Prospectus dated September 6, 2023)

850,000 Shares

Common Stock

Green Brick Partners, Inc.

—————————

The selling stockholder identified in this prospectus supplement is offering

850,000 shares of common stock of Green Brick Partners, Inc. We will not receive any proceeds from the sale of the shares by the selling

stockholder.

Our common stock is listed on the New York Stock Exchange, or the

NYSE, under the symbol “GRBK.” On September 1, 2023, the last reported sale price of our common stock on the NYSE was $50.69

per share.

| |

|

Per Share |

|

|

Total |

|

| Public offering price |

|

$ |

45.75 |

|

|

$ |

38,887,500 |

|

| Underwriting discounts and commissions(1) |

|

$ |

0.12 |

|

|

$ |

102,000 |

|

| Proceeds to selling stockholder, before expenses |

|

$ |

45.63 |

|

|

$ |

38,785,500 |

|

(1) See “Underwriting” for a description of the compensation

payable to the underwriter.

Investment in our securities involves risks, including

those described under “Risk Factors” beginning on page S-5 of this prospectus supplement. You should carefully read and consider

these risk factors and the risk factors included in our periodic reports and other documents that we file with the Securities and Exchange

Commission before investing in our common stock.

Neither the Securities and Exchange Commission nor

any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful

or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of common

stock on or about September 8, 2023.

Goldman Sachs & Co. LLC

The date of this prospectus supplement is September

6, 2023

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

None of us, the selling stockholder or the underwriter

have authorized anyone to provide you with additional or different information from that contained or incorporated by reference in this

prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered to you. None of

us, the selling stockholder or the underwriter take any responsibility for, or can provide any assurance as to the reliability of, any

other information that others may give you. The selling stockholder and the underwriter are offering to sell, and seeking offers to buy,

shares of our common stock only in jurisdictions where offers and sales thereof are permitted. You should assume that the information

appearing in this prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered

to you is accurate only as of their respective dates or on the date or dates that are specified in such documents, and that any information

in documents that we have incorporated by reference is accurate only as of the date of such document incorporated by reference. Our business,

financial condition, liquidity, results of operations and prospects may have changed since those dates.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus are part of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under

this shelf registration process, the selling stockholder may sell the securities described in the accompanying prospectus from time to

time. In this prospectus supplement, we provide you with specific information about the shares of common stock that the selling stockholder

is selling in this offering and about the offering itself. Both this prospectus supplement and the accompanying prospectus include or

incorporate by reference important information about us and other information you should know before investing in the shares of common

stock. This prospectus supplement also adds, updates and changes information contained or incorporated by reference in the accompanying

prospectus. To the extent that any statement we make in this prospectus supplement is inconsistent with the statements made in the accompanying

prospectus, the statements made in the accompanying prospectus are deemed modified or superseded by the statements made in this prospectus

supplement. You should read both this prospectus supplement and the accompanying prospectus, as well as the additional information in

the documents described below under the heading “Where You Can Find More Information,” before investing in the shares of common

stock.

Unless the context otherwise requires, the terms

“Company,” “we,” “us,” “our” and similar terms and “Green Brick” refer to

Green Brick Partners, Inc., and its subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains “forward-looking

statements” within the meaning of the securities laws. These forward-looking statements are subject to a number of risks and uncertainties,

many of which are beyond our control. All statements other than statements of historical facts included or incorporated by reference in

this prospectus supplement, including the statements regarding our strategy, future operations, financial position, estimated revenues,

projected costs, prospects, plans, and objectives, are forward-looking statements. When used in this prospectus supplement, the words

“will,” “believe,” “anticipate,” “plan,” “intend,” “estimate,”

“expect,” “project,” and similar expressions are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words. Although we believe that our plans, intentions, and expectations reflected

in or suggested by the forward-looking statements we make in this prospectus supplement are reasonable, we cannot assure you that these

plans, intentions, or expectations will be achieved. Forward-looking statements included or incorporated by reference in this prospectus

supplement include statements concerning (1) our balance sheet strategy and belief that we have ample liquidity; (2) our goals and strategies

and their anticipated benefits, including expansion into new markets; (3) our intentions and the expected benefits and advantages of our

product and land positioning strategies; (4) our expectations regarding future finished lots, the quality of those lots and the timing

of backlog fulfillment; (5) our beliefs regarding average industry cancellation rates; (6) expectations regarding our industry and our

business in the remainder of 2023 and beyond; (7) the contribution of certain market factors to our growth; (8) our land and lot acquisition

strategy; (9) the sufficiency of our capital resources to support our business strategy and to service our debt; (10) the impact of new

accounting standards and changes in accounting estimates; (11) trends and expectations regarding sales prices, sales orders, cancellations,

construction costs, gross margins, land costs and profitability and future home and finished lot inventories; (12) our future cash needs;

(13) our strategy to utilize leverage to invest in our business; (14) seasonal factors and the impact of seasonality in future quarters;

(15) our expectations regarding access to additional growth capital; (16) our expectations regarding future land revenue recognition;

(17) our ability to adapt to changing market conditions and (18) the disposition of legal claims and related contingencies.

These forward-looking statements reflect our current

views about future events and are subject to risks, uncertainties and assumptions. We wish to caution readers that certain important factors

may have affected and could in the future affect our actual results and could cause actual results to differ significantly from what is

anticipated by our forward-looking statements. These risks include, but are not limited to: (1) general economic conditions in our markets,

seasonality, cyclicality and competition in the homebuilding industry; (2) changes in macroeconomic conditions, including interest and

unemployment rates that could adversely impact demand for new homes or the ability of our buyers to qualify; (3) shortages, delays or

increased costs of raw materials, or increases in our other operating costs, including costs related to labor, real estate taxes and insurance,

which in each case exceed our ability to increase prices; (4) significant periods of inflation or deflation; (5) a shortage of labor,

(6) an inability to acquire land in our markets at anticipated prices or difficulty in obtaining land-use entitlements; (7) our inability

to successfully execute our strategies, including the successful development of our communities within expected timeframes and the growth

and expansion of our Trophy brand; (8) a failure to recruit, retain or develop highly skilled and competent employees; (9) government

regulation risks; (10) the geographic concentration of our operations; (11) adverse changes in the availability or volatility of mortgage

financing; (12) severe weather events or natural disasters; (13) difficulty in obtaining sufficient capital to fund our growth; (14) our

ability to meet our debt service obligations; (15) a decline in the value of our inventories and resulting write-downs of the carrying

value of our real estate assets; (16) our ability to adequately self-insure; (17) changes in accounting standards that adversely affect

our reported earnings or financial condition; and (18) those risks set forth under “Risk Factors” in our Annual Report on

Form 10-K and our Quarterly Reports on Form 10-Q.

SUMMARY

We are a diversified homebuilding and land development

company that operates in Texas, Georgia, and Florida and has a non-controlling interest in a Colorado homebuilder.

We acquire and develop land and lots and build homes through our eight brands of builders. Our core markets are the high growth U.S. metropolitan

areas of Dallas-Fort Worth (“DFW”) and Atlanta, Georgia, as well as the Treasure Coast, Florida area and we recently began

selling homes in Austin, Texas. We are engaged in all aspects of the homebuilding process, including land acquisition and development,

entitlements, design, construction, title and mortgage services, marketing and sales and the creation of brand images at our residential

neighborhoods and master planned communities.

We believe we offer higher quality homes with more

distinctive designs and floor plans than those built by our competitors at comparable prices. Many of our communities are located in premium

in-fill and in-fill-adjacent locations and we seek to enhance homebuyer satisfaction by utilizing high-quality materials and building

well-crafted homes. We seek to maximize value over the long term and operate our business to mitigate risks in the event of a downturn

by controlling costs and quickly reacting to regional and local market trends.

We are a leading lot developer in our markets

and believe that our strict operating discipline provides us with a competitive advantage in seeking to maximize returns while minimizing

risk. As of June 30, 2023, we owned or controlled approximately 26,500 home sites in high-growth submarkets throughout the DFW, Austin,

and Atlanta metropolitan areas and the Treasure Coast, Florida market. We provide finished lots to our subsidiary builders or option lots

from third-party developers for our builders’ homebuilding operations and provide them with construction funding and strategic planning.

Corporate Information

Our principal executive offices are located at 5501

Headquarters Drive, Suite 300 W, Plano Texas, 75024. Our telephone number is (469) 573-6755. Our website address is www.greenbrickpartners.com.

Except for any documents that are incorporated by reference into this prospectus that may be accessed from our website, the information

available on or through our website is not part of this prospectus. Green Brick Partners, Inc. was incorporated under the laws of the

State of Delaware on April 11, 2006.

THE OFFERING

| Shares of common stock offered by the selling stockholder |

850,000 shares of common stock. |

| |

|

| Shares of common stock outstanding after this offering |

45,378,364 shares of common stock. |

| |

|

| Use of proceeds |

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholder. |

| |

|

| NYSE ticker symbol |

Our common stock is listed on the NYSE under the symbol “GRBK.” |

| |

|

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” and any risk factors described in the documents we incorporate by reference, as well as all the other information set forth in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference, before investing in our common stock. |

| |

1 |

Based on amounts outstanding as of August 30, 2023. In addition, as of August 30, 2023, there were (1) 500,000 shares of common stock issuable upon exercise of outstanding stock options, (2) 33,572 shares of common stock issuable upon vesting of time-based and performance-based restricted stock units and (3) 509,380 shares of common stock that are reserved for issuance upon exercise or vesting of awards that may be granted in the future under our 2014 Omnibus Equity Incentive Plan. |

RISK FACTORS

An investment in our common stock involves

a number of risks. You should consider the specific risks described below and in our 2022 Annual Report on Form 10-K and subsequent Reports

on Form 10-Q, as well as the information set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated

by reference herein and therein, before making an investment decision. See “Where You Can Find More Information.” Based on

the information currently known to us, we believe that the information incorporated by reference in this prospectus supplement and the

accompanying prospectus identifies the most significant risk factors affecting us. Each of the risks described in these documents could

materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a partial

or complete loss of your investment. The risks and uncertainties are not limited to those set forth in the risk factors described in these

documents. Additional risks and uncertainties not presently known to us or that we currently believe to be less significant than the risk

factors incorporated by reference herein may also adversely affect our business. In addition, past financial performance may not be a

reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

Risks Related to this Offering and Our

Common Stock

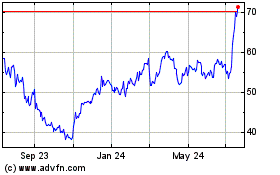

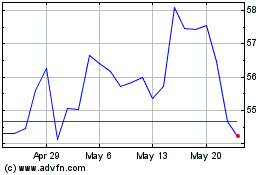

The price of our common stock may continue to be volatile.

The trading price of our common stock is

highly volatile and could be subject to future fluctuations in response to a number of factors beyond our control. In recent years the

stock market has experienced significant price and volume fluctuations. These fluctuations may be unrelated to the operating performance

of particular companies. These broad market fluctuations may cause declines in the market price of our common stock. The price of our

common stock could fluctuate based upon factors that have little or nothing to do with our company or its performance, and those fluctuations

could materially reduce our common stock price. If we fail to meet expectations related to future growth, profitability or other market

expectations, our stock price may decline significantly, which could have a material adverse impact on investor confidence and our stock

price.

Certain large stockholders own a significant percentage of our shares

and exert significant influence over us. Their interests may not coincide with ours and they may make decisions with which we may disagree.

Greenlight Capital, Inc. and its affiliates

(“Greenlight”) collectively beneficially own approximately 31% (or, after giving effect to this offering, approximately 29%)

of the voting power of our common stock. As a result, Greenlight could determine substantially all matters requiring stockholder approval,

including the election of directors and approval of significant corporate transactions, such as a sale or other change of control transaction.

In addition, this concentration of ownership may delay or prevent a change in control of our company and make some transactions more difficult

or impossible without the support of Greenlight. The interests of Greenlight may not always coincide with our interests as a company or

the interests of other stockholders. Accordingly, Greenlight could cause us to enter into transactions or agreements that you would not

approve or make decisions with which you may disagree.

We do not intend to pay dividends on our common stock for the foreseeable

future.

We have not paid any dividends since our

inception and do not anticipate paying any cash dividends on our common stock in the foreseeable future. Any payment of future dividends

will be at the discretion of our Board of Directors (“Board”) and will depend upon, among other things, our earnings, financial

condition, capital requirements, levels of indebtedness, statutory and contractual restrictions applying to the payment of dividends or

contained in our financing instruments and other considerations that the Board deems relevant. Investors must rely on sales of their common

stock after price appreciation, which may never occur, as the only way to realize a return on their investment. Investors seeking cash

dividends should not purchase our common stock.

Greenlight’s shares may be sold into the market in the future,

which could cause the market price of our common stock to decrease significantly.

Immediately after this offering, Greenlight

and its affiliates will beneficially own 13,211,493 shares. These shares are subject to the terms of the lock-up period described elsewhere

in this prospectus supplement and applicable securities laws. See also “Underwriting” for further details of the lock-up arrangements.

Certain affiliates of Greenlight may enter into and perform one or more forward sale transactions with the underwriter or its affiliate,

as dealer, with respect to approximately 2.0 million shares of our common stock (including approximately 1.0 million shares that certain

limited partners of Greenlight-affiliated investment vehicles have elected to have sold). Additional shares controlled by Greenlight may

be sold in similar or other transactions in the future. In particular, limited partners of Greenlight-affiliated investment vehicles have

elected to have sold another approximately 1.0 million shares in the intermediate term, likely within the next sixteen months, subject

to market conditions and legal, regulatory and other restrictions and limitations. These sales plus any other sales of the shares controlled

by Greenlight affiliates, could cause the price of our common stock to decline.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares

of our common stock by the selling stockholder.

SELLING

STOCKHOLDER

The following table sets forth information regarding

the beneficial ownership (as determined under Section 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”))

by the selling stockholder of our shares of common stock as of August 30, 2023, before and after giving effect to this offering by the

selling stockholder, based in part on information provided to us by the selling stockholder. As of August 30, 2023, there were 45,378,364

shares of our common stock, par value $0.01 per share, outstanding.

The shares of common stock held by the selling stockholder

are currently held in a sub-advised fund that is managed by an affiliate of Greenlight. These shares were transferred to the sub-advised

fund from a Greenlight affiliate to the selling stockholder in January 2021. Greenlight affiliates acquired the shares of common stock

in connection with the conversion of equity interests in our predecessor entity, in a public offering by the Company in September 2014.

| |

|

Shares of Common Stock

Beneficially Owned

Prior to Offering |

|

|

Shares of

Common Stock

Offered Hereby |

|

|

Shares of Common

Stock

Beneficially Owned

After the Offering |

|

| Name |

|

Number |

|

|

Percentage |

|

|

Number |

|

|

Number |

|

|

Percentage |

|

| Prelude Structured Alternatives Master Fund, LP (1) |

|

|

850,000 |

|

|

|

1.9 |

% |

|

|

850,000 |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) |

DME Capital Management, LP (“DME Management”) is an investment manager for Prelude Structured Alternatives Master Fund, LP (“Prelude”), and as such has shared voting and dispositive power over all 850,000 shares held by Prelude. DME Advisors GP, LLC (“DME GP”) is the general partner of DME Management, and as such has shared voting and dispositive power over all 850,000 shares held by Prelude. David Einhorn, one of our directors, is the principal of DME GP and DME Management, and as such may be deemed to beneficially own the shares referenced herein. Each of Mr. Einhorn, DME GP and DME Management disclaims beneficial ownership of such shares, except to the extent of any pecuniary interest therein. Does not include any other shares of our common stock that may be held by the selling stockholder in other sub-advised funds in which Greenlight affiliates do not serve as sub-advisors. |

UNDERWRITING

Under the terms and subject

to the conditions contained in an underwriting agreement dated September 6, 2023, the selling stockholder has agreed to sell to Goldman

Sachs & Co. LLC (the “underwriter”), and the underwriter has agreed to purchase from the selling stockholder, 850,000

shares of common stock.

The underwriting agreement provides that

the obligation of the underwriter to purchase the shares included in this offering are subject to approval of legal matters by counsel

and other conditions. The underwriting agreement also provides that the underwriter is obligated to purchase all the shares of common

stock in the offering if any are purchased. The underwriter reserves the right to withdraw, cancel or modify offers to the public and

to reject orders in whole or in part.

The underwriter has advised us and the selling stockholder

that the underwriter proposes initially to offer the shares of common stock to the public in one or more transactions on the NYSE at the

public offering price set forth on the cover page of this prospectus supplement and to dealers at that price less a concession not in

excess of $ per share. After the initial offering, the public offering price, concession or any other term of the offering may be changed.

The following table shows the public offering price,

underwriting discount and proceeds before expenses to the selling stockholder.

| |

|

Per Share |

|

|

Total |

|

| Public offering price |

|

$ |

45.75 |

|

|

$ |

38,887,500 |

|

| Underwriting discount and commissions to be paid by selling

stockholder |

|

$ |

0.12 |

|

|

$ |

102,000 |

|

| Proceeds, before expenses, to the selling stockholder |

|

$ |

45.63 |

|

|

$ |

38,785,500 |

|

The expenses of the offering, not including the underwriting

discount, are estimated at $350,000 and are payable by us. We have agreed to reimburse the underwriter for certain of its expenses.

We have agreed, subject to certain exceptions, to

not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, or file with the SEC a registration statement

under the Securities Act relating to, any shares of our common stock or securities convertible into or exchangeable or exercisable for

any shares of our common stock, or publicly disclose the intention to make any offer, sale, pledge, disposition or filing, without the

prior written consent of the underwriter, for a period of 30 days after the date of this prospectus supplement.

Our executive officers and directors, Greenlight

and the selling stockholder have agreed, subject to certain exceptions, that they will not offer, sell, contract to sell, pledge or otherwise

dispose of, directly or indirectly, any shares of our common stock or securities convertible into or exchangeable or exercisable for any

shares of our common stock, enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement

that transfers, in whole or in part, any of the economic consequences of ownership of our common stock, whether any of these transactions

are to be settled by delivery of our common stock or other securities, in cash or otherwise, or publicly disclose the intention to make

any offer, sale, pledge or disposition, or to enter into any transaction, swap, hedge or other arrangement, without, in each case, the

prior written consent of the underwriter, for a period of 30 days after the date of this prospectus supplement, except that, among other

matters, certain affiliates of Greenlight may enter into and perform one or more forward sale transactions (each, a “forward sale

transaction”) with the underwriter or its affiliate, as dealer, in respect of an aggregate number of shares of our common stock

up to approximately 2.0 million shares, provided that the averaging period used to determine the forward sale price would not

commence before October 5, 2023.

We and the selling stockholder have agreed

to indemnify the underwriter against liabilities under the Securities Act, or contribute to payments that the underwriter may be required

to make in that respect.

Our shares of common stock are listed on the NYSE, under

the symbol “GRBK.”

In connection with the offering the

underwriter may engage in stabilizing transactions, syndicate covering transactions, and passive market making in accordance with Regulation

M under the Exchange Act.

| |

· |

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. |

| |

· |

Short sales involve the sale by the underwriter of a greater number of shares than they are required to purchase in this offering, and a short position represents the amount of such sales that have not been covered by subsequent purchases. The underwriter must cover any such short position by purchasing shares in the open market (“syndicate covering transactions”). A short position is more likely to be created if the underwriter is concerned that there may be downward pressure on the price of the common stock in the open market that could adversely affect investors who purchase in this offering. |

| |

· |

In passive market making, market makers in the common stock who are underwriters or prospective underwriters may, subject to limitations, make bids for or purchases of our common stock until the time, if any, at which a stabilizing bid is made. |

These stabilizing transactions and syndicate

covering transactions may have the effect of raising or maintaining the market price of our common stock or preventing or retarding a

decline in the market price of our common stock. As a result the price of our common stock may be higher than the price that might otherwise

exist in the open market. These may be effected on the NYSE or otherwise and, if commenced, may be discontinued at any time.

A prospectus in electronic format may be made available

on the web sites maintained by the underwriter, or one or more of the selling group members, if any, participating in this offering and

the underwriter participating in this offering may distribute prospectuses electronically. The representatives may agree to allocate a

number of shares to the underwriter and selling group members for sale to their online brokerage account holders. Internet distributions

will be allocated by the underwriter and selling group members that will make internet distributions on the same basis as other allocations.

The underwriter and its respective affiliates

have performed, and may in the future perform, various investment banking, financial advisory, treasury and banking services, and other

services for us, our affiliates and our officers in the ordinary course of business, for which they received, and may receive, customary

fees and reimbursement of expenses. In particular, an affiliate of the underwriter is a lender under our revolving credit facility and

has received customary commitment fees in connection therewith. In addition, in the ordinary course of its business activities, the underwriter

and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative

securities) and financial instruments (including bank loans) for its own account and for the accounts of its customers. Such investments

and securities activities may involve securities and/or instruments of ours or our affiliates. The underwriter and its affiliates may

also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments

and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Notice to prospective investors in the European Economic Area

In relation to each Member State of the European Economic

Area (each a “Relevant State”), no shares of common stock have been offered or will be offered pursuant to the offering to

the public in that Relevant State prior to the publication of a prospectus in relation to the shares of common stock which has been approved

by the competent authority in that Relevant State or, where appropriate, approved in another Relevant State and notified to the competent

authority in that Relevant State, all in accordance with the EU Prospectus Regulation, except that offers of shares of common stock may

be made to the public in that Relevant State at any time under the following exemptions under the EU Prospectus Regulation:

| |

a. |

to any legal entity which is a qualified investor as defined under the EU Prospectus Regulation; |

| |

b. |

to fewer than 150 natural or legal persons (other than qualified investors as defined under the EU Prospectus Regulation), subject to obtaining the prior consent of representatives for any such offer; or |

| |

c. |

in any other circumstances falling within Article 1(4) of the EU Prospectus Regulation, |

provided that no such offer of shares of common stock shall require the

Company or any representative to publish a prospectus pursuant to Article 3 of the EU Prospectus Regulation or supplement a prospectus

pursuant to Article 23 of the EU Prospectus Regulation.

Each person in a Relevant State who initially acquires

any shares of common stock or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and with the Company

and the Managers that it is a qualified investor within the meaning of the EU Prospectus Regulation.

In the case of any shares of common stock being offered

to a financial intermediary as that term is used in Article 5(1) of the EU Prospectus Regulation, each such financial intermediary will

be deemed to have represented, acknowledged and agreed that the shares of common stock acquired by it in the offer have not been acquired

on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances

which may give rise to an offer to the public other than their offer or resale in a Relevant State to qualified investors, in circumstances

in which the prior consent of the representatives has been obtained to each such proposed offer or resale.

For the purposes of this provision, the expression an

“offer to the public” in relation to any shares of common stock in any Relevant State means the communication in any form

and by any means of sufficient information on the terms of the offer and any shares of common stock to be offered so as to enable an investor

to decide to purchase or subscribe for any shares of common stock, and the expression “EU Prospectus Regulation” means Regulation

(EU) 2017/1129.

Notice to prospective investors in the United Kingdom

In relation to the United Kingdom, no shares of common

stock have been offered or will be offered pursuant to the offering to the public in the United Kingdom prior to the publication of a

prospectus in relation to the shares of common stock which has been approved by the competent authority in the United Kingdom except that

offers of shares of common stock may be made to the public in the United Kingdom at any time under the following exemptions under the

UK Prospectus Regulation:

| |

a. |

to any legal entity which is a qualified investor as defined under Article 2 of the UK Prospectus Regulation; |

| |

b. |

to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the UK Prospectus Regulation), subject to obtaining the prior consent of representatives for any such offer; or |

| |

c. |

in any other circumstances falling within Section 86 of the Financial Services and Markets Act 2000, as amended (“FSMA”), |

provided that no such offer of the Shares shall require the Issuer or any

Manager to publish a prospectus pursuant to Section 85 of the FSMA or supplement a prospectus pursuant to Article 23 of the UK Prospectus

Regulation.

Each person in the United Kingdom who initially acquires

any shares of common stock or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and with the Company

and the Managers that it is a qualified investor within the meaning of the UK Prospectus Regulation.

In the case of any shares of common stock being offered

to a financial intermediary as that term is used in Article 5(1) of the UK Prospectus Regulation, each such financial intermediary will

be deemed to have represented, acknowledged and agreed that the shares of common stock acquired by it in the offer have not been acquired

on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances

which may give rise to an offer to the public other than their offer or resale in the United Kingdom to qualified investors, in circumstances

in which the prior consent of the representatives has been obtained to each such proposed offer or resale.

In addition, in the United Kingdom, this document is

for distribution only to persons who (i) have professional experience in matters relating to investments and who qualify as investment

professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended, the “Financial Promotion Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth

companies, unincorporated associations etc.”) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are

persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) in connection

with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together

being referred to as “relevant persons”). This document is directed only at relevant persons and must not be acted on or relied

on by persons who are not relevant persons. Any investment or investment activity to which this document relates is available only to

relevant persons and will be engaged in only with relevant persons.

For the purposes of this provision, the expression an

“offer to the public” in relation to the Shares in the United Kingdom means the communication in any form and by any means

of sufficient information on the terms of the offer and any Shares to be offered so as to enable an investor to decide to purchase or

subscribe for any Shares and the expression “UK Prospectus Regulation” means Regulation (EU) 2017/ 1129 as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Notice to prospective investors in France

Neither this prospectus supplement, the

accompanying prospectus nor any other offering material relating to the shares of common stock described in this prospectus supplement

has been submitted to the clearance procedures of the Autorité des Marchés Financiers or by the competent authority of another

member state of the European Economic Area and notified to the Autorité des Marchés Financiers. The shares of common stock

have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in France. Neither this prospectus

supplement, the accompanying prospectus nor any other offering material relating to the shares has been or will be:

| |

· |

released, issued, distributed or caused to be released, issued or distributed to the public in France; or |

| |

· |

used in connection with any offer for subscription or sale of the shares to the public in France. |

Such offers, sales and distributions

will be made in France only:

| |

· |

to qualified investors (investisseurs qualifiés) and/or to a restricted circle of investors (cercle restreint d’investisseurs), in each case investing for their own account, all as defined in, and in accordance with, articles L.411-2, D.411-1, D.411-2, D.734-1, D.744-1, D.754-1 and D.764-1 of the French Code monétaire et financier; |

| |

· |

to investment services providers authorized to engage in portfolio management on behalf of third parties; or |

| |

· |

in a transaction that, in accordance with article L.411-2-II-1° -or-2° -or 3° of the French Code monétaire et financier and article 211-2 of the General Regulations (Règlement Général) of the Autorité des Marchés Financiers, does not constitute a public offer (appel public à l’épargne). |

The shares of common stock may be resold

directly or indirectly, only in compliance with articles L.411-1, L.411-2, L.412-1 and L.621-8 through L.621-8-3 of the French Code monétaire

et financier.

Notice to prospective investors in Hong Kong

The shares of common stock have not been offered

or sold and will not be offered or sold in Hong Kong, by means of any document, other than (a) to “professional investors”

as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (b) in other circumstances

which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which

do not constitute an offer to the public within the meaning of that Ordinance. No advertisement, invitation or document relating to the

shares of common stock has been or may be issued or has been or may be in the possession of any person for the purposes of issue, whether

in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong

(except if permitted to do so under the securities laws of Hong Kong) other than with respect to shares of common stock which are or are

intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities

and Futures Ordinance and any rules made under that Ordinance.

Notice to prospective investors in Japan

The shares of common stock have not been and will not

be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948, as amended) and, accordingly, will not be

offered or sold, directly or indirectly, in Japan, or for the benefit of any Japanese Person or to others for re-offering or resale, directly

or indirectly, in Japan or to any Japanese Person, except in compliance with all applicable laws, regulations and ministerial guidelines

promulgated by relevant Japanese governmental or regulatory authorities in effect at the relevant time. For the purposes of this paragraph,

“Japanese Person” shall mean any person resident in Japan, including any corporation or other entity organized under the laws

of Japan.

Notice to prospective investors in Canada

The shares of common stock may be sold only

to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106

Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument

31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the share must be made in accordance with

an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces

or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement and the accompanying

prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised

by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory.

The purchaser should refer to any applicable

provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with

a legal advisor. Pursuant to section 3A.3 (or, in the case of securities issued or guaranteed by the government of a non-Canadian jurisdiction,

section 3A.4) of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriter is not required to comply with

the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

Notice to prospective investors in Switzerland

The shares of common stock may not be publicly

offered in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any other stock exchange or regulated

trading facility in Switzerland. This document does not constitute a prospectus within the meaning of, and has been prepared without regard

to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure

standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated

trading facility in Switzerland. Neither this document nor any other offering or marketing material relating to the shares or the offering

may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other offering

or marketing material relating to the offering, the Company or the shares of common stock have been or will be filed with or approved

by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of shares of common stock will not

be supervised by, the Swiss Financial Market Supervisory Authority FINMA (FINMA), and the offer of shares of common stock has not been

and will not be authorized under the Swiss Federal Act on Collective Investment Schemes (“CISA”). The investor protection

afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of shares of common stock.

Notice to prospective investors in Singapore

This prospectus supplement has not been

registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement and any other document or

material in connection with the offer or sale, or invitation for subscription or purchase, of the shares may not be circulated or distributed,

nor may the shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly,

to persons in Singapore other than (i) to an institutional investor (as defined under Section 4A of the Securities and Futures Act, Chapter

289 of Singapore (the “SFA”)) under Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the

SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions

specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision

of the SFA, in each case subject to conditions set forth in the SFA.

Where the shares are subscribed or purchased under

Section 275 of the SFA by a relevant person which is a corporation (which is not an accredited investor (as defined in Section 4A of the

SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each

of whom is an accredited investor, the securities (as defined in Section 239(1) of the SFA) of that corporation shall not be transferable

for 6 months after that corporation has acquired the shares under Section 275 of the SFA except: (1) to an institutional investor under

Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of the SFA), (2) where such transfer arises from an offer

in that corporation’s securities pursuant to Section 275(1A) of the SFA, (3) where no consideration is or will be given for the

transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or (6) as specified in Regulation

32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore (“Regulation 32”)

Where the shares are subscribed or purchased under

Section 275 of the SFA by a relevant person which is a trust (where the trustee is not an accredited investor (as defined in Section 4A

of the SFA)) whose sole purpose is to hold investments and each beneficiary of the trust is an accredited investor, the beneficiaries’

rights and interest (howsoever described) in that trust shall not be transferable for 6 months after that trust has acquired the shares

under Section 275 of the SFA except: (1) to an institutional investor under Section 274 of the SFA or to a relevant person (as defined

in Section 275(2) of the SFA), (2) where such transfer arises from an offer that is made on terms that such rights or interest are acquired

at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction (whether such amount is to

be paid for in cash or by exchange of securities or other assets), (3) where no consideration is or will be given for the transfer, (4)

where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or (6) as specified in Regulation 32.

LEGAL MATTERS

The validity of the shares being offered

pursuant to this prospectus supplement and certain legal matters will be passed upon for us by Greenberg Traurig, P.A., Fort

Lauderdale, Florida. Certain legal matters will be passed upon for the underwriter by Latham & Watkins, LLP.

EXPERTS

The consolidated financial statements of Green Brick

Partners, Inc. as of December 31, 2022 and 2021 and for each of the years in the three-year period ended December 31, 2022 and the effectiveness

of internal control over financial reporting as of December 31, 2022 incorporated in this prospectus supplement by reference from the

Green Brick Partners, Inc. Annual Report on Form 10-K for the year ended December 31, 2022 have been audited by RSM US LLP, an independent

registered public accounting firm, as stated in their reports thereon, incorporated herein by reference, and have been incorporated in

this prospectus supplement in reliance upon such reports and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE

INFORMATION

We file annual, quarterly and current reports, proxy

statements and other information with the SEC, as required by the Exchange Act. You can review our electronically filed reports, proxy

and information statements, and other information regarding us on the SEC’s Internet site at http://www.sec.gov. The information

contained on the SEC’s website is expressly not incorporated by reference into this prospectus supplement. Our SEC filings are also

available on our website, www.greenbrickpartners.com. The information on this website is expressly not incorporated by reference into,

and does not constitute a part of, this prospectus supplement. The information on our website is not incorporated by reference into this

prospectus supplement.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information that we file with the SEC into this prospectus supplement and the accompanying prospectus. This permits us to disclose important

information to you by referencing these filed documents. Any information referenced this way is considered to be a part of this prospectus

supplement and the accompanying prospectus and any information filed by us with the SEC subsequent to the date of this prospectus supplement

automatically will be deemed to update and supersede this information.

We incorporate by

reference the documents listed below that we have previously filed with the SEC (other than any document or portion of any document furnished

or deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K and Item 9.01 related thereto):

| |

|

|

| Commission Filing (File No. 001-33530) |

|

Period Covered or Date of Filing |

|

Annual Report on Form 10-K

|

|

Year Ended December 31, 2022 (including the information in our Definitive Proxy Statement on Schedule 14A for our 2023 Annual Meeting of Stockholders, to the extent incorporated by reference therein) |

|

Quarterly Reports on Form 10-Q

|

|

Quarters ended March 31, 2023 and June 30, 2023 |

|

Current Reports on Form 8-K

|

|

February 16, 2023, May 3, 2023, June 14, 2023 and August 2, 2023 |

| Description of our common stock |

|

Form 8-A filed on June 13, 2007 pursuant to Section 12(b) of the Exchange Act, as updated by the description of our common stock in Exhibit 4.2 to our Annual Report on Form 10-K filed March 1, 2022, and including any amendment or reports filed thereafter for the purpose of updating such description |

We are also incorporating by reference all additional

documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, after the date

of this prospectus supplement and prior to the termination of the offering, other than any document or portion of any document furnished

or deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 on Form 8-K and Item 9.01 related thereto.

We will provide to each person, including any beneficial

owner, to whom a prospectus supplement is delivered, without charge, upon written or oral request, a copy of any or all of the documents

that are incorporated by reference into this prospectus supplement but not delivered with this prospectus supplement, excluding any exhibits

to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this prospectus supplement. You should

direct requests for documents to:

Green Brick Partners, Inc.

5501 Headquarters Drive, Suite 300 W

Plano Texas, 75024

Telephone: (469) 573-6755

PROSPECTUS

GREEN BRICK PARTNERS, INC.

COMMON STOCK

PREFERRED STOCK

DEPOSITARY SHARES

DEBT SECURITIES

WARRANTS

and

SHARES OF COMMON STOCK

Offered by Selling Stockholders

This prospectus relates to common stock, preferred stock (including

convertible preferred stock), depositary shares (including convertible depositary shares), debt securities (including convertible debt

securities) and warrants for common stock, preferred stock or debt securities which we may offer and sell from time to time in one or

more offerings. The selling stockholders may also offer and sell shares of our common stock from time to time. We will not receive any

of the proceeds from the sale of our shares of common stock by the selling stockholders. We or the selling stockholders may sell these

securities to or through underwriters or dealers, directly to investors or through agents. We will specify the prices, amounts and terms

of the securities and the names of any underwriters, dealers or agents in supplements to this prospectus. You should read this prospectus

and each supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a

prospectus supplement.

Our common stock is listed on the New

York Stock Exchange, or the NYSE, under the symbol “GRBK,” and our preferred stock is listed

on the NYSE, under the symbol “GRBK PRA.” If any other securities offered by this prospectus will be listed on a securities

exchange, such listing will be described in the applicable prospectus supplement.

Investment in our securities involves risks, including those described

under “Risk Factors” beginning on page 5 of this prospectus. You should carefully

read and consider these risk factors and the risk factors included in the reports that we file under the Securities Exchange Act of 1934,

as amended, in any prospectus supplement relating to specific offerings of securities and in other documents that we file with the Securities

and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is September 6,

2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

References in this prospectus to “we,”

“us,” “our,” “Green Brick,” or the “Company” mean Green Brick Partners, Inc., a Delaware

corporation, and its consolidated subsidiaries, unless the context otherwise requires.

This prospectus is part of a Registration Statement

on Form S-3, or the Registration Statement, that we filed with the U.S. Securities and Exchange Commission, or SEC, as a “well-known

seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, using the “shelf” registration

process. Under this shelf registration process, we may sell common stock, preferred stock (including convertible preferred stock), depositary

shares (including convertible depositary shares), debt securities (including convertible debt securities) and warrants for common stock,

preferred stock or debt securities from time to time in one or more offerings. In addition, certain of our stockholders may sell shares

of common stock from time to time in one or more offerings.

This prospectus provides you with a general description

of the securities we and the selling stockholders may offer, which is not meant to be a complete description of each security. Each time

we or any selling stockholder offer, issue or sell securities under this prospectus, we will provide a prospectus supplement containing

specific information about the prices, amounts and terms of that offering. The prospectus supplement may also add to, update or change

information contained in this prospectus. You should read both this prospectus and any prospectus supplement, and any related free writing

prospectus that we prepare, together with additional information described below under the headings “Where You Can Find More Information”

and “Incorporation of Certain Information By Reference.” If there is any inconsistency between the information in this prospectus

and any applicable prospectus supplement or any such free writing prospectus, you should rely on the information in the applicable prospectus

supplement or such free writing prospectus.

You should rely only on the information contained

in or incorporated by reference into this prospectus or any applicable prospectus supplement. Neither we nor the selling stockholders

have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you

should not rely on it. Neither we nor the selling stockholders will make an offer of the securities in any jurisdiction where it is unlawful.

You should assume that the information in this prospectus and any applicable prospectus supplement, and any related free writing prospectus

that we prepare, as well as the information in any document incorporated or deemed to be incorporated into this prospectus and any applicable

prospectus supplement, is accurate only as of the date on the front cover of the documents containing the information.

WHERE YOU

CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC, as required by the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). You can review our electronically filed reports, proxy and information statements, and other information regarding us on

the SEC’s Internet site at http://www.sec.gov. The information contained on the SEC’s website is expressly not incorporated

by reference into this prospectus.

Our SEC filings are also available on our website,

www.greenbrickpartners.com. The information on our website is expressly not incorporated by reference into, and does not constitute a

part of, this prospectus.

This prospectus contains summaries of provisions

contained in some of the documents discussed in this prospectus, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to in this prospectus

have been filed or will be filed or incorporated by reference as exhibits to the Registration Statement of which this prospectus is a

part. If any contract, agreement or other document is filed or incorporated by reference as an exhibit to the Registration Statement,

you should read the exhibit for a more complete understanding of the document or matter involved.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

into this prospectus information we file with the SEC in other documents. This means that we can disclose important information to you

by referring to another document we filed with the SEC. The information relating to us contained in this prospectus should be read together

with the information in the documents incorporated by reference.

We incorporate by reference the documents listed

below that we have previously filed with the SEC (other than any document or portion of any document furnished or deemed furnished and

not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K and Item 9.01 related thereto):

| |

|

|

| Commission Filing (File No. 001-33530) |

|

Period Covered or Date of Filing |

|

Annual Report on Form 10-K

|

|

Year Ended December 31, 2022 (including the information in our Definitive Proxy Statement on Schedule 14A for our 2023 Annual Meeting of Stockholders, to the extent incorporated by reference therein) |

|

Quarterly Reports on Form 10-Q

|

|

Quarters ended March 31, 2023 and June 30, 2023 |

|

Current Reports on Form 8-K

|

|

February 16, 2023, May 3, 2023, June 14, 2023 and August 2, 2023 |

| Description of our common stock |

|

Form 8-A filed on June 13, 2007 pursuant to Section 12(b) of the Exchange Act, as updated by the description of our common stock in Exhibit 4.2 to our Annual Report on Form 10-K filed March 1, 2022, and including any amendment or reports filed thereafter for the purpose of updating such description |

We are also incorporating by reference all additional

documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including all such documents filed by us after

the date of this prospectus and prior to effectiveness of the Registration Statement and after the date of this prospectus and prior to

the termination of the offering (other than any document or portion of any document furnished or deemed furnished and not filed in accordance

with SEC rules, including Items 2.02 and 7.01 on Form 8-K and Item 9.01 related thereto).

The information incorporated by reference is considered

to be part of this prospectus, and information that we file later with the SEC and incorporate by reference in this prospectus will automatically

update and supersede this previously filed information, as applicable, including information in previously filed documents or reports

that have been incorporated by reference into this prospectus. Any statement so modified or superseded will not be deemed, except as so

modified or superseded, to constitute a part of this prospectus.

We will provide to each person, including any beneficial

owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated by reference into

this prospectus but not delivered herewith. We will provide such reports or documents upon written or oral request, at no cost to the

requestor. Requests for incorporated reports or documents must be made to:

Green Brick Partners, Inc.

5501 Headquarters Drive, Suite 300 W

Plano Texas, 75024

Telephone: (469) 573-6755

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking

statements” within the meaning of the securities laws. These forward-looking statements are subject to a number of risks and uncertainties,

many of which are beyond our control. All statements other than statements of historical facts included or incorporated by reference in

this prospectus, including the statements under “The Company” and elsewhere in this prospectus regarding our strategy, future

operations, financial position, estimated revenues, projected costs, prospects, plans, and objectives, are forward-looking statements.

When used in this prospectus, the words “will,” “believe,” “anticipate,” “plan,” “intend,”

“estimate,” “expect,” “project,” and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. Although we believe that our plans, intentions,

and expectations reflected in or suggested by the forward-looking statements we make in this prospectus are reasonable, we cannot assure

you that these plans, intentions, or expectations will be achieved. Forward-looking statements in this prospectus and the documents incorporated

by reference into this prospectus include statements concerning (1) our balance sheet strategy and belief that we have ample liquidity;

(2) our goals and strategies and their anticipated benefits, including expansion into new markets; (3) our intentions and the

expected benefits and advantages of our product and land positioning strategies; (4) our expectations regarding future finished lots,

the quality of those lots and the timing of backlog fulfillment; (5) our beliefs regarding average industry cancellation rates; (6) expectations

regarding our industry and our business in the remainder of 2023 and beyond; (7) the contribution of certain market factors to our

growth; (8) our land and lot acquisition strategy; (9) the sufficiency of our capital resources to support our business strategy

and to service our debt; (10) the impact of new accounting standards and changes in accounting estimates; (11) trends and expectations

regarding sales prices, sales orders, cancellations, construction costs, gross margins, land costs and profitability and future home and

finished lot inventories; (12) our future cash needs; (13) our strategy to utilize leverage to invest in our business; (14) seasonal

factors and the impact of seasonality in future quarters; (15) our expectations regarding access to additional growth capital; (16)

our expectations regarding future land revenue recognition; (17) our ability to adapt to changing market conditions and (18) the disposition

of legal claims and related contingencies.

These forward-looking statements reflect our current

views about future events and are subject to risks, uncertainties and assumptions. We wish to caution readers that certain important factors

may have affected and could in the future affect our actual results and could cause actual results to differ significantly from what is

anticipated by our forward-looking statements. These risks include, but are not limited to: (1) general economic conditions in our markets,

seasonality, cyclicality and competition in the homebuilding industry; (2) changes in macroeconomic conditions, including interest

and unemployment rates that could adversely impact demand for new homes or the ability of our buyers to qualify; (3) shortages, delays

or increased costs of raw materials, or increases in our other operating costs, including costs related to labor, real estate taxes and

insurance, which in each case exceed our ability to increase prices; (4) significant periods of inflation or deflation; (5) a shortage

of labor, (6) an inability to acquire land in our markets at anticipated prices or difficulty in obtaining land-use entitlements;

(7) our inability to successfully execute our strategies, including the successful development of our communities within expected

timeframes and the growth and expansion of our Trophy brand; (8) a failure to recruit, retain or develop highly skilled and competent

employees; (9) government regulation risks; (10) the geographic concentration of our operations; (11) adverse changes in the

availability or volatility of mortgage financing; (12) severe weather events or natural disasters; (13) difficulty in obtaining sufficient

capital to fund our growth; (14) our ability to meet our debt service obligations; (15) a decline in the value of our inventories and

resulting write-downs of the carrying value of our real estate assets; (16) our ability to adequately self-insure; (17) changes in accounting

standards that adversely affect our reported earnings or financial condition; and (18) those risks set forth under “Risk Factors”

in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q.

THE COMPANY

Our Business

We are a diversified homebuilding and land development

company. We acquire and develop land and lots and build homes through our eight brands of builders in five major markets. Our core markets

are in the high growth U.S. metropolitan areas of Dallas-Fort Worth (“DFW”) and Austin, Texas, Atlanta, Georgia, as well as

the Treasure Coast, Florida area and Colorado Springs, Colorado. We are engaged in all aspects of the homebuilding process, including

land acquisition and development, entitlements, design, construction, title and mortgage services, marketing and sales and the creation

of brand images at our residential neighborhoods and master planned communities.

We believe we offer higher quality homes with more

distinctive designs and floor plans than those built by our competitors at comparable prices. Many of our communities are located in premium

in-fill and in-fill-adjacent locations and we seek to enhance homebuyer satisfaction by utilizing high-quality materials and building

well-crafted homes. We seek to maximize value over the long term and operate our business to mitigate risks in the event of a downturn

by controlling costs and quickly reacting to regional and local market trends.

We are a leading lot developer in our markets

and believe that our strict operating discipline provides us with a competitive advantage in seeking to maximize returns while minimizing

risk. As of June 30, 2023, we owned or controlled approximately 26,500 home sites in high-growth submarkets throughout the DFW, Austin,

and Atlanta metropolitan areas and the Treasure Coast, Florida market. We provide finished lots to our subsidiary builders or option lots

from third-party developers for our builders’ homebuilding operations and provide them with construction funding and strategic planning.

Corporate Information

Our principal executive offices are located at

5501 Headquarters Drive, Suite 300 W, Plano Texas, 75024. Our telephone number is (469) 573-6755. Our website address is www.greenbrickpartners.com.

Except for any documents that are incorporated by reference into this prospectus that may be accessed from our website, the information

available on or through our website is not part of this prospectus. Green Brick Partners, Inc. was incorporated under the laws of the

State of Delaware on April 11, 2006.

RISK FACTORS

Investing in our securities involves a high degree

of risk that may result in a loss of all or part of your investment. Before making an investment decision, you should carefully review

the risk factors contained under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31,

2022, and any risk factors that we may describe in our other filings with the SEC, including our subsequent Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as other information we include or incorporate by reference in

this prospectus and any accompanying prospectus supplement. If any such risks occur, our business, financial condition or results of operations

could be materially harmed, the market price of our securities could decline and you could lose all or part of your investment.

USE OF PROCEEDS

Unless otherwise indicated in the applicable prospectus

supplement, we anticipate that the net proceeds from the sale of the securities that we may offer under this prospectus and any accompanying

prospectus supplement will be used for general corporate purposes. We will set forth in a prospectus supplement relating to a specific

offering any intended use for the net proceeds received from the sale of securities in that offering. We will have significant discretion

in the use of any net proceeds. Investors will be relying on the judgment of our management regarding the application of the proceeds

of any sale of securities. We may invest the net proceeds temporarily until we use them for their stated purpose. Unless otherwise set

forth in a prospectus supplement, we will not receive any proceeds in the event that the securities are sold by a selling stockholder.

DESCRIPTION

OF CAPITAL STOCK

The following discussion is a summary of the material

terms of our common stock, preferred stock, Charter and bylaws.

Authorized Capital

Our authorized capital stock currently consists

of 100 million shares of common stock, par value $0.01 per share and 5 million shares of preferred stock, par value $0.01 per

share, of which 50,000 shares are designated as 5.75% Series A Cumulative Preferred Stock.

Common Stock

Holders of our common stock are entitled to one

vote for each share held of record on all matters on which stockholders generally are entitled to vote. Holders of our common stock vote

together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable

law.

Holders of our common stock are entitled to receive

dividends when and if declared by our Board of Directors (“Board”) out of funds legally available therefor, subject to any

statutory or contractual restrictions on the payment of dividends and to any restrictions on the payment of dividends imposed by the terms

of any outstanding preferred stock. We do not intend to pay cash dividends on our common stock for the foreseeable future.

In the event of our dissolution, liquidation or

winding up, after payment in full of all amounts required to be paid to creditors and to the holders of preferred stock having liquidation

preferences, if any, the holders of our common stock will be entitled to receive pro rata our remaining assets available for distribution.

The holders of our common stock have no conversion,

preemptive or other subscription rights. There are no redemption or sinking fund provisions applicable to our common stock.

Common Stock Listing

Our common stock is listed on the NYSE under the

symbol “GRBK”.

Blank Check Preferred Stock

Our Board has the authority, subject to any limitations

imposed by law or the NYSE rules, without further action by the stockholders, to issue up to 5 million shares of preferred stock

in one or more series and to fix the rights, preferences, privileges and restrictions of each series of such preferred stock. As described

below, the Board has authorized 50,000 of these shares of preferred stock as Series A Preferred Stock. These rights, preferences and privileges

include, but are not limited to, dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking

fund terms and the number of shares constituting any series or the designation of that series, any or all of which may be greater than

the rights of common stock.

5.75% Series A Preferred Stock

General.

As of June 30, 2023, there were 2,000 shares of our 5.75%

Series A Cumulative Perpetual Preferred Stock, or our Series A Preferred Stock, issued and outstanding. We have issued and outstanding

2,000,000 depositary shares, each representing a 1/1000th fractional interest in a share of Series A Preferred Stock (our “Series

A Depositary Shares”).

Ranking.

The Series A Preferred Stock, represented by the Series

A Depositary Shares, ranks, with respect to dividend rights and rights upon our liquidation, dissolution or winding-up:

| · | Senior to all classes or series of our common stock and to each other class or series of capital stock

issued with terms specifically providing that such class or series of capital stock ranks senior to or on parity with the Series A Preferred

Stock; |

| · | On parity with each class or series of capital stock issued by us with terms specifically providing

that such class or series of capital stock ranks senior to the Series A Preferred Stock; |

| · | Junior to each class or series of capital stock issued by us with terms specifically providing that

such class or series of capital stock ranks senior to the Series A Preferred Stock; and |

| · | Effectively junior to all our existing and future indebtedness and liabilities of our existing or future

subsidiaries. |

Dividends

Holders of Series A Depositary Shares will be entitled

to receive cumulative cash dividends at the rate of 5.75% of the $25,000.00 liquidation preference per share of the Series A Preferred

Stock (equivalent to a $25.00 liquidation preference per depositary share) per year, i.e., $1,437.50 per year per share of the Series