Getty Realty Corp. Announces $225 Million Private Placement of Senior Unsecured Notes

February 22 2022 - 4:10PM

Business Wire

Getty Realty Corp. (NYSE: GTY) (“Getty” or the “Company”)

announced today the private placement of $225 million of senior

unsecured notes, including (i) $100 million of notes priced at a

fixed rate of 3.45% and maturing February 22, 2032, and (ii) $125

million of notes priced at a fixed rate of 3.65% and maturing

January 20, 2033.

The 3.45% notes were funded at closing and proceeds will be used

to repay all amounts outstanding on the Company’s revolving credit

facility and to fund investment activity.

The 3.65% notes will be funded on January 20, 2023 and proceeds

will be used to prepay in full the Company’s $75 million 5.35%

Series B senior unsecured notes due June 2, 2023 and to fund

investment activity.

The senior unsecured notes were issued in a private placement

with affiliates of The Prudential Insurance Company of America

(“Prudential”), American General Life Insurance Company (“AIG”),

Massachusetts Mutual Life Insurance Company (“MassMutual”), and New

York Life Insurance Company (“New York Life”) under substantially

similar terms and conditions as the Company’s existing senior

unsecured notes.

“This financing provides us with long-term, fixed-rate debt

capital to support our continued growth, and accretively refinance

our unsecured notes maturing in June 2023,” said Brian Dickman,

Getty’s Chief Financial Officer. “We’re pleased with the execution

of this transaction, and appreciate the continued support of

Prudential, AIG and Barings, and our new relationship with New York

Life.”

The senior unsecured notes have not been, and will not be,

registered under the U.S. Securities Act of 1933, as amended (the

“Act”) or any state securities laws and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements of the Act and applicable state

securities laws.

This press release is for informational purposes only, does not

constitute an offer to sell or the solicitation of an offer to buy

any security and shall not constitute an offer, solicitation or

sale of any securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Getty Realty Corp.

Getty Realty Corp. is a publicly traded, net lease REIT

specializing in the acquisition, financing and development of

convenience, automotive and other single tenant retail real estate.

As of September 30, 2021, the Company’s portfolio included 1,021

freestanding properties located in 36 states across the United

States and Washington, D.C.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220222006025/en/

Brian Dickman Chief Financial Officer (646) 349-6000 Investor

Relations (516) 349-0598 ir@gettyrealty.com

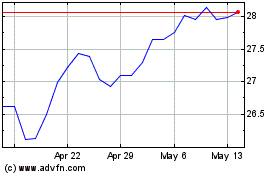

Getty Realty (NYSE:GTY)

Historical Stock Chart

From Oct 2024 to Nov 2024

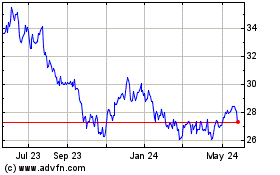

Getty Realty (NYSE:GTY)

Historical Stock Chart

From Nov 2023 to Nov 2024