Current Report Filing (8-k)

February 25 2022 - 7:20AM

Edgar (US Regulatory)

0000850209

false

0000850209

2022-02-25

2022-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported): February

25, 2022 (February 24, 2022)

Foot Locker, Inc.

(Exact name of registrant as specified in charter)

| New York |

1-10299 |

13-3513936 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 330 West 34th Street, New York, New York 10001 |

| (Address of principal executive offices) (Zip Code) |

| Registrant's telephone number, including area code: (212) 720-3700 |

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.01 per share |

|

FL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results

of Operations and Financial Condition.

On February 25, 2022, Foot Locker,

Inc. (the “Company”) issued a press release (the “Press Release”) announcing its financial and operating results

for the fourth quarter and full-year of 2021. A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form

8-K, which, in its entirety, is incorporated herein by reference.

The Company is hosting a conference

call on February 25, 2022 to discuss its fourth quarter and full-year 2021 financial results, during which the Company will provide an

update on the business.

The Company is making reference

to financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”) in the Press

Release, investor presentation, and conference call. A reconciliation of these non-GAAP financial measures to the nearest comparable GAAP

financial measures is contained in the attached Press Release. The Company believes these non-GAAP financial measures provide useful information

to investors because they allow for a more direct comparison of the Company’s performance for the fourth quarter and full-year of

2021 to the Company’s performance in the comparable prior-year periods. The non-GAAP financial measures are provided in addition

to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. A reconciliation to GAAP is provided

in the Condensed Consolidated Statements of Operations.

The information contained in Item

2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities

Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01. Regulation

FD Disclosure.

Share Repurchase Program

In the Press Release, the Company

also announced, among other things, that its Board of Directors approved a new share repurchase program on February 24, 2022, authorizing

the Company to repurchase up to $1.2 billion of its Common Stock. The new share repurchase program has no expiration date, but may

be terminated by the Board at any time. Shares may be repurchased from time to time under the new share repurchase program through

a variety of methods, which may include open market purchases, privately-negotiated transactions, block trades, accelerated or other structured

share repurchase programs, or other means, all in accordance with the U.S. Securities and Exchange Commission’s (the “SEC”)

rules and other applicable legal requirements. The specific manner, timing, pricing, and amount of any transactions will be subject to

the Company’s discretion and may be based upon prevailing stock prices, general economic and market conditions, legal requirements,

and alternative opportunities that the Company may have for the use or investment of its capital. The Company may also from time to time

establish one or more plans under Rule 10b5-1 of the Exchange Act. The new share repurchase program does not obligate

the Company to acquire any particular amount of Common Stock, and it may be modified, suspended, or discontinued at any time. This authorization

replaced the February 2019 share repurchase program, which had approximately $449.5 million remaining available for repurchases upon its

cancellation.

Investor Presentation

In conjunction

with the Press Release, the Company also made available an investor presentation concerning its financial and operating results for the

fourth quarter and full-year of 2021. The investor presentation, which is available under the “Investor Relations” section

of the Company’s corporate website, located at investors.footlocker-inc.com, is included as Exhibit 99.2 to this Current Report

on Form 8-K, which, in its entirety, is incorporated herein by reference. Information on the Company’s corporate website is not,

and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with

the SEC.

The information contained in Item

7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section

18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into

any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of

the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FOOT LOCKER, INC. |

| |

|

|

| Date: February 25, 2022 |

By: |

/s/ Andrew E. Page |

| |

|

Name: Andrew E. Page

Title: Executive Vice President and

Chief

Financial Officer |

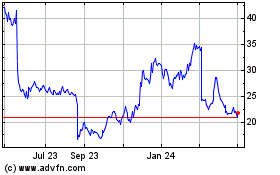

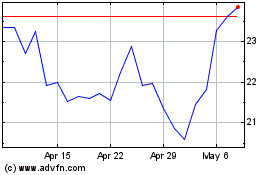

Foot Locker (NYSE:FL)

Historical Stock Chart

From May 2024 to Jun 2024

Foot Locker (NYSE:FL)

Historical Stock Chart

From Jun 2023 to Jun 2024