JACKSONVILLE, Fla., July 25 /PRNewswire-FirstCall/ -- Fidelity

National Title Group, Inc. (NYSE:FNT), one of the nation's largest

title insurance companies and a majority-owned, publicly traded

subsidiary of Fidelity National Financial, Inc. (NYSE:FNF), today

reported operating results for the three-month and six-month

periods ended June 30, 2006. 2nd Quarter 2006 2nd Quarter 2005

Total revenue $1.566 billion $1.687 billion Pre-tax margin 11.6%

15.4% Net earnings $116.5 million $160.6 million Net earnings per

share - diluted $0.67 $0.93 Cash flow from operations $221.7

million $332.0 million Return on average equity 18.4% 22.3% Six

Months Ended Six Months Ended June 30, 2006 June 30, 2005 Total

revenue $2.959 billion $2.952 billion Pre-tax margin 10.3% 13.2%

Net earnings $195.6 million $242.9 million Net earnings per share -

diluted $1.13 $1.40 Cash flow from operations $301.9 million $391.2

million Return on average equity 15.6% 17.0% "The second quarter

results were a significant improvement from the seasonally

challenging first quarter," said Chief Executive Officer Raymond R.

Quirk. "Open order volumes have remained consistent since February,

staffing levels are stable, cash flow generation remains strong and

our monthly financial results improved each month during the

quarter. We expect third quarter pre-tax margins and overall

financial results to exceed those of the second quarter." The

following table depicts monthly direct orders opened and closed in

the title and escrow business for the second quarter of both 2006

and 2005: Month Direct Orders Direct Orders Closing % Opened Closed

April 2006 217,700 146,400 67% May 2006 243,000 161,800 67% June

2006 236,500 165,600 70% Second Quarter 2006 697,200 473,800 68%

Month Direct Orders Direct Orders Closing % Opened Closed April

2005 259,600 177,100 68% May 2005 268,700 180,200 67% June 2005

301,200 203,100 67% Second Quarter 2005 829,500 560,400 68% The

following table depicts monthly commercial direct orders opened and

closed in the national commercial divisions for the second quarter

of both 2006 and 2005: Open Closed Commercial Commercial Commercial

Commercial Revenue Fee Per Orders Orders (In thousands) File 2nd

Quarter 2006 14,240 9,064 $68,936 $7,605 2nd Quarter 2005 14,644

8,761 $66,821 $7,627 Fidelity National Title Group, Inc. (NYSE:FNT)

is one of the nation's largest title insurance companies. The

Company's title insurance underwriters -- Fidelity National Title,

Chicago Title, Ticor Title, Security Union Title and Alamo Title --

issue approximately 29 percent of all title insurance policies in

the United States. Through its direct operations and agencies, the

Company provides title insurance in 49 states, the District of

Columbia, Guam, Mexico, Puerto Rico, the U.S. Virgin Islands and

Canada. More information about Fidelity National Title Group can be

found at http://www.fntg.com/ . FNT is a majority-owned subsidiary

of Fidelity National Financial Inc. (NYSE:FNF), number 248 on the

Fortune 500 and a provider of products and outsourced services and

solutions to a variety of industries. More information about FNF

can be found at http://www.fnf.com/ . This press release contains

forward-looking statements that involve a number of risks and

uncertainties. Statements that are not historical facts, including

statements about our beliefs and expectations, are forward-looking

statements. Forward-looking statements are based on management's

beliefs, as well as assumptions made by, and information currently

available to, management. Because such statements are based on

expectations as to future economic performance and are not

statements of fact, actual results may differ materially from those

projected. We undertake no obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise. The risks and uncertainties which forward-looking

statements are subject to include, but are not limited to: changes

in general economic, business and political conditions, including

changes in the financial markets; adverse changes in the level of

real estate activity, which may be caused by, among other things,

high or increasing interest rates, a limited supply of mortgage

funding or a weak U.S. economy; compliance with extensive

regulations; regulatory investigations of the title insurance

industry; our business concentration in the State of California,

the source of over 20% of our title insurance premiums; our

dependence on distributions from our title insurance underwriters

as our main source of cash flow; competition from other title

insurance companies; and other risks detailed in the "Statement

Regarding Forward-Looking Information," "Risk Factors" and other

sections of the Company's Form 10-K and other filings with the

Securities and Exchange Commission. FIDELITY NATIONAL TITLE GROUP,

INC. SUMMARY OF EARNINGS (In thousands, except per share amounts

and order information) Three months ended Six months ended June 30,

June 30, 2006 2005 2006 2005 (Unaudited) (Unaudited) Direct title

premiums $504,532 $561,191 $952,301 $1,017,396 Agency title

premiums 708,714 771,687 1,337,134 1,304,200 Total title premiums

1,213,246 1,332,878 2,289,435 2,321,596 Escrow and other

title-related fees 287,598 300,328 541,657 543,465 Total title and

escrow 1,500,844 1,633,206 2,831,092 2,865,061 Interest and

investment income 46,717 24,576 84,729 45,430 Realized gains and

losses 6,107 18,486 20,613 21,922 Other 11,931 10,945 22,429 20,020

Total revenue 1,565,599 1,687,213 2,958,863 2,952,433 Personnel

costs 466,221 479,943 918,656 904,603 Other operating expenses

242,645 241,358 453,538 451,093 Agent commissions 544,169 595,220

1,032,537 1,005,121 Depreciation and amortization 27,194 24,523

53,431 49,389 Claim loss expense 91,017 86,451 171,738 150,677

Interest expense 12,374 421 23,700 724 Total expenses 1,383,620

1,427,916 2,653,600 2,561,607 Earnings before income taxes 181,979

259,297 305,263 390,826 Income tax expense 64,603 97,774 108,369

146,637 Minority interest 863 945 1,279 1,292 Net earnings $116,513

$160,578 $195,615 $242,897 Net earnings per share - basic $0.67

$0.93 $1.13 $1.40 Net earnings per share - diluted $0.67 $0.93

$1.13 $1.40 Weighted average shares - basic 173,475 173,520 173,475

173,520 Weighted average shares - diluted 173,647 173,520 173,651

173,520 Direct operations orders opened 697,200 829,500 1,381,000

1,577,200 Direct operations orders closed 473,800 560,400 910,100

1,048,900 Fee Per File $1,597 $1,500 $1,566 $1,447 (1) For the 2005

period, net earnings per share is a pro forma presentation based on

the distribution of 173,520 shares on October 17, 2005 FIDELITY

NATIONAL TITLE GROUP, INC. SUMMARY BALANCE SHEET INFORMATION (In

thousands, except per share amounts) June 30, December 31, 2006

2005 Unaudited Cash and investment portfolio $4,098,288 $3,762,895

Goodwill 1,051,523 1,051,526 Title plants 314,832 308,675 Total

assets 6,199,666 5,900,533 Notes payable 573,197 603,262 Reserve

for claim losses 1,130,444 1,063,857 Secured trust deposits

1,001,727 882,602 Total stockholders' equity 2,551,178 2,480,037

Book value per share 14.64 14.23 DATASOURCE: Fidelity National

Title Group, Inc. CONTACT: Daniel Kennedy Murphy, Senior Vice

President, Finance and Investor Relations, Fidelity National

Financial, Inc., +1-904-854-8120, or Web site: http://www.fntg.com/

http://www.fnf.com/

Copyright

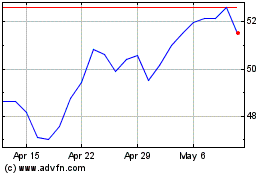

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Oct 2024 to Nov 2024

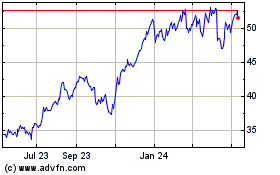

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Nov 2023 to Nov 2024