Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 07 2024 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of August 2024

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Avenida Dra. Ruth Cardoso,

8501,

30th floor (part), Pinheiros,

São Paulo, SP, 05425-070, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EMBRAER S.A.

NOTICE TO THE MARKET

Embraer S.A. (the “Company”) informs

its shareholders and the market that its subsidiaries Embraer Aircraft Holding Inc. and Embraer Netherlands Finance B.V., as borrowers

(the “Borrowers”), have obtained a revolving credit line in the amount of US$1.0 billion (the “Revolving Credit

Facility”), maturing on August 6, 2029, with 17 international financial institutions. The Revolving Credit Facility is guaranteed

by the Company and certain other subsidiaries of the Company (collectively, the “Guarantors”), and borrowings under

the Revolving Credit Facility will accrue interest at a rate comprised of Adjusted Term SOFR plus a margin ranging from

0.950% to 1.700% per annum, depending on the corporate rating of the Company.

The Borrowers may use borrowings under the Revolving

Credit Facility for general corporate purposes, among others. As of the closing date, no amounts have been borrowed under the Revolving

Credit Facility.

The Revolving Credit Facility is expected to increase

the Company’s liquidity and improve its credit rating, supporting the Company’s liability management strategy.

São Jose dos Campos, August 6, 2024.

Antonio Carlos Garcia

Executive Vice-President and CFO

Certain information contained in this notice to the market may constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the U.S. Securities

Exchange Act of 1934, which may be identified by the use of forward-looking terminology such as “may,” “will,”

or “expect,” or the negatives thereof or other variations thereon or comparable terminology or other forms of projections.

Forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future,

and, accordingly, such results may differ from those expressed in any forward-looking statements.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: August 6, 2024

|

Embraer S.A. |

| |

|

| By: |

|

/s/ Antonio Carlos Garcia |

| |

|

Name: |

|

Antonio Carlos Garcia |

| |

|

Title: |

|

Executive Vice President of Finance and Investor Relations |

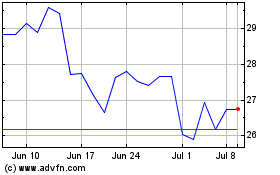

Embraer (NYSE:ERJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

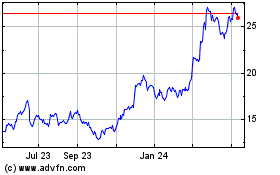

Embraer (NYSE:ERJ)

Historical Stock Chart

From Nov 2023 to Nov 2024