Ocean Tomo 300(TM) Patent Index Outperforms Both S&P 500 and Dow Jones Industrials

December 11 2006 - 11:13AM

PR Newswire (US)

New Ocean Tomo 300(TM) Patent Index Tracking the 'Knowledge

Economy' Outperforms S&P 500 and Dow Jones Industrial Average

through its Sixth Week CHICAGO, Dec. 11 /PRNewswire/ -- Ocean Tomo,

LLC, the Chicago-based provider of diversified intellectual

property-related services, announced the Ocean Tomo 300(TM) Patent

Index, the first equity index based on the value of corporate

intellectual property, concluded trading on December 8 at 5911.28,

outpacing both the S&P 500 and the Dow Jones Industrial Average

since the Index's reconstitution on October 31, 2006. Ocean Tomo

also announced Claymore Securities has licensed the Ocean Tomo

300(TM) Patent Index for a proposed exchange traded fund, the

Claymore/Ocean Tomo Patent ETF (AMEX:OTP) scheduled to be available

on December 15, 2006. Several companies contributing to the

performance of the Index and reflecting the role of intellectual

capital in the economy include: Adtran (NASDAQ:ADTN),

Alberto-Culver (NYSE:ACV), Baker Hughes (NYSE:BHI), Baxter

(NYSE:BAX), Brunswick (NYSE:BC), Cummins Inc. (NYSE:CMI), Cypress

Semiconductor (NYSE:CY), Dril-Quip Inc. (NYSE:DRQ), Ecolab

(NYSE:ECL), Energizer Holdings (NYSE:ENR), Fortune Brands

(NYSE:FO), Gannett (NYSE: GCI), Garmin (NASDAQ:GRMN), Grant Prideco

(NYSE:GRP), Intel (NASDAQ:INTC), Invitrogen (NASDAQ:IVGN), IPSCO

Inc. (NYSE:IPS), Manitowoc Inc. (NYSE:MTW), Pactiv (NYSE:PTV),

Rockwell Automation (NYSE:ROK), Seagate Technology (NYSE: STX),

Superior Energy Services (NYSE:SPN), Thor Industries (NYSE:THO) and

Wm. Wrigley Jr. Co. (NYSE:WWY). Ocean Tomo 300(TM) Patent Index

Rate of Return versus Dow Jones Industrial Average and S&P 500:

November 1 - December 8, 2006* Ocean Tomo 300(TM) Dow Jones S&P

500 Patent Index Industrial Average 2.35% 1.88% 2.32% *Returns are

calculated from close of market on October 31, 2006 to close of

market December 8, 2006, using prices from Bloomberg. About the

Ocean Tomo 300(TM) Patent Index Recognized by The American Stock

Exchange ( http://www.amex.com/ ) as "the first major, broad-based

market equity index to be launched in 35 years," the Ocean Tomo

300(TM) Patent Index is a diversified market-weighted index of 300

companies that own the most valuable patents relative to their book

value. Over a 10-year time period ending October 2006, the Ocean

Tomo 300(TM) Patent Index outperformed the S&P 500 by more than

300 basis points annualized. The Index selection methodology

identifies six companies within each of 50 size and style groups,

reflecting a broad spectrum of market capitalizations and

investment styles, including value, relative value, blend, growth

at a reasonable price (GARP) and growth by decile, that have the

highest ratio of patent value to book value. The analytical engine

used to evaluate the value of each company's patent portfolio is

Ocean Tomo's PatentRatings(TM) software, which calculates the

relative attractiveness of the more than four million patents

issued by the U.S. Patent and Trademark Office since 1983, and

which is widely recognized by the intellectual property valuation

industry. Further details on the Index, its methodology, as well as

a complete list companies in the Index and other materials are

available at http://www.oceantomoindexes.com/ . In addition to the

Captivate(R) Network, daily tracking of the Ocean Tomo 300(TM)

Patent Index is available at numerous media outlets including:

Bloomberg.com (^OTPAT), Bloomberg terminal (OTPAT ),

MarketWatch.com (OTPAT), and Yahoo! Finance (^OTPAT). The Ocean

Tomo 300(TM) Patent Index is patent-pending and was created by and

is a trademark of Ocean Tomo Capital, LLC. Ocean Tomo's

PatentRatings(TM) software is protected by U.S. Patent Number

6,556,992. Ocean Tomo, LLC has granted Claymore Advisors the rights

to license the Ocean Tomo 300(TM) Patent Index for the creation of

the Claymore/Ocean Tomo Patent ETF (AMEX:OTP). The Fund seeks

investment results that correspond generally to the performance,

before the Fund's fees and expenses, to the Ocean Tomo 300(TM)

Patent Index. Claymore Securities, Inc. acts as the distribution

agent for the Fund. Neither Claymore Advisors nor Claymore

Securities has any involvement with the ongoing administration of

the Index. About Ocean Tomo, LLC: Established in 2003, Ocean Tomo,

LLC ( http://www.oceantomo.com/ ) is a fully integrated

intellectual capital merchant banc that specializes in

understanding and leveraging intellectual property assets. The

company provides advice in IP-related mergers and acquisitions,

valuations, expert services, analytics and IP auctions. Ocean Tomo

has offices in Chicago, San Francisco, Palm Beach, Orange County

and Washington, DC. Subsidiaries of Ocean Tomo include: Ocean Tomo

Capital, LLC, publisher of the Ocean Tomo 300(TM) Patent Index

(AMEX:OTPAT); Ocean Tomo Capital Fund, LP -- a $200 million private

equity investment fund; and Ocean Tomo Asset Management, LLC -- an

SEC Registered Investment Advisor offering hedge funds utilizing

IP-based investment strategies. DATASOURCE: Ocean Tomo, LLC

CONTACT: Kristi Stathis for Ocean Tomo, +1-773-294-4360, Web site:

http://www.oceantomoindexes.com/ http://www.oceantomo.com/

Copyright

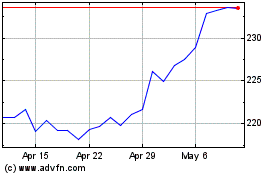

Ecolab (NYSE:ECL)

Historical Stock Chart

From Sep 2024 to Oct 2024

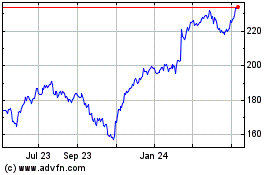

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2023 to Oct 2024