EDISON EQUITY RESEARCH - DULUTH METALS

October 29 2014 - 5:54PM

InvestorsHub NewsWire

EDISON EQUITY RESEARCH:

DULUTH METALS - ROYAL GOLD US$175M

GOLD STREAMING AGREEMENT

Duluth’s PFS highlights the Twin Metals Minnesota (TMM) project as

an economically viable Tier 1 asset at reasonable long-term

commodity price forecasts. With Antofagasta recently deciding not

to increase its ownership and reverting to a conventional 40%

funding equity interest, options for TMM’s development lead to an

increased focus on the Barclays strategic review currently

underway. Finding a suitable Tier 1 asset developer capable of

funding multi-billion dollar projects is limited to a small pool of

large mining companies. Recent M&A activity in the copper space

highlights such companies are buying Tier 1 assets to fit

longer-term growth profiles.

Duluth Metals is a TSX-listed Canadian company focused on

investigating the Twin Metals Minnesota

copper-nickel-cobalt-platinum-palladium-gold-silver project held in

JV with Antofagasta (40%) and exploring for similar deposits in NE

Minnesota, US.

To view our full report, please click here:

http://www.edisoninvestmentresearch.com/research/report/duluth-metals9

Click here to view all of Edison Investment

Research’s published reports

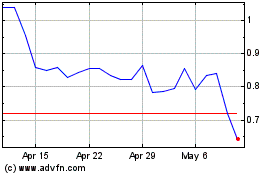

Desktop Metal (NYSE:DM)

Historical Stock Chart

From May 2024 to Jun 2024

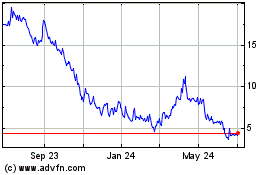

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Jun 2023 to Jun 2024