DaVita Completes DSI Acquisition - Analyst Blog

September 06 2011 - 11:40AM

Zacks

DaVita Inc.

(DVA) has completed the

acquisition of DSI Renal Inc. after the Federal Trade

Commission (FTC) gave the anti-trust clearance for the deal. The

merger deal of approximately $690 million was announced on February

4, 2011. Credit Suisse Group (CS) acted as

DaVita’s financial advisor.

However,

FTC’s approval came with the condition that DaVita must sell 30

clinics, most of which were acquired as part of the DSI

merger. DaVita will sell these clinics for about $91 million.

DSI is the fifth largest provider of outpatient dialysis

services in the US, which is one of the main services of DaVita.

The company is one of the leading providers of kidney care in the

US. The acquisition will not only allow the company to expand its

client base, but will also provide access to new areas of work in

the Midwestern, Southern and some Western states.

Acquisition of dialysis centers and businesses that own and

operate dialysis centers, as well as other ancillary services and

strategic initiatives have been DaVita’s preferred business

strategy for

years. As of fiscal 2010, the number of centers with DaVita

increased at a 4-year CAGR of 5.86%. DaVita acquired and opened a

total of 33 centers, closed 2 and sold 1 center during the

first quarter of 2011.

Earnings Review

DaVita reported a second-quarter net

operating income of $114.4 million, or $1.17 per share, which

exceeded the Zacks Consensus Estimate by 3 cents. The earnings were

also higher than $110.4 million or $1.06 per share earned in the

comparable quarter of 2010. The increased income was attributable

to better-than-expected revenues, reduced operating expenses and

strong cash flows of the company.

Further, the Zacks Consensus Estimate for third quarter earnings

is currently at $1.30 per share, up about 13% year-over-year. Of

the 14 firms covering the stock, 7 have revised their

estimates upwards, while 4 downward revisions were witnessed in the

last 30 days.

For 2011, earnings are expected to be about $4.83 per share,

climbing about 10.23% year-over-year. DaVita currently caries a

Zacks #2 Rank, implying a short term Buy rating.

On Friday, the shares of the company closed at $71.36, down

2.65%, on the New York Stock Exchange.

CREDIT SUISSE (CS): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

Zacks Investment Research

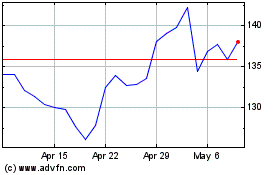

DaVita (NYSE:DVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

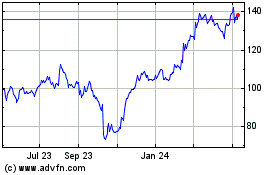

DaVita (NYSE:DVA)

Historical Stock Chart

From Nov 2023 to Nov 2024