Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 17 2022 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of May 2022

Commission File Number 001-33060

DANAOS CORPORATION

(Translation of registrant’s name into English)

Danaos Corporation

c/o Danaos Shipping Co. Ltd.

14 Akti Kondyli

185 45 Piraeus

Greece

Attention: Secretary

011 030 210 419 6480

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): o

Change of Auditor

The Audit Committee of the Board of Directors

of Danaos Corporation (“Danaos” or the “Company”) has appointed Deloitte

Certified Public Accountants, S.A. (“Deloitte”) as the Company’s independent registered public accounting firm.

The appointment of Deloitte was made after a careful and thorough evaluation and request for proposal process and has been approved by

the Audit Committee of the Board of Directors of the Company.

Previous

independent registered public accounting firm

PricewaterhouseCoopers S.A. (“PwC”),

the Company’s prior independent registered public accounting firm, was dismissed by the Audit Committee on May 11, 2022. The decision

to change auditor was not as a result of any disagreement between the Company and PwC on any matter of accounting principles or practices,

financial statement disclosure, or auditing scope or procedures.

The reports of PwC on the Company’s consolidated

financial statements for the fiscal years ended December 31, 2020 and 2021 have contained no adverse opinion or disclaimer of opinion

and were not qualified or modified as to uncertainty, audit scope or accounting principle.

During the fiscal years ended December 31, 2021

and 2020 and the subsequent period through May 11, 2022, there have been no disagreements with PwC on any matter of accounting principles

or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of PwC, would have

caused PwC to make reference thereto in its reports on our financial statements for such years. During the fiscal years ended December

31, 2021 and 2020 and the subsequent period through May 11, 2022 there were no reportable events as the term is described in Item 16F(a)(1)(v)

of Form 20-F.

We have requested that PwC furnish a letter addressed

to the Securities and Exchange Commission stating whether or not PwC agrees with the statements above related to their firm. A copy of

such letter dated May 17, 2022 is filed as Exhibit 99.1 to this report.

New

independent registered public accounting firm

During the fiscal years ended December 31, 2021

and 2020 and the subsequent period through the engagement of Deloitte as of May 17, 2022, neither we, nor anyone acting on our behalf,

consulted with Deloitte regarding (a) the application of accounting principles to a specific

completed or proposed transaction, or the type of audit opinion that might be rendered on our consolidated financial statements,

and either a written report or oral advice was provided to the Company by Deloitte that Deloitte concluded was an important factor considered

by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (b) any matter that was the subject

of a disagreement, as that term is defined in Item 16F(a)(1)(iv) of Form 20-F (and the related instructions thereto) or a reportable event

as set forth in Item 16F(a)(1)(v) of Form 20-F.

***

The Company would like to thank the PwC team for

their services over the past years. The Company is working closely with PwC and Deloitte to ensure a seamless transition.

EXHIBIT LIST

*****

This report on Form 6-K is hereby

incorporated by reference into the Company’s (i) Registration Statement on Form F-3 (Reg. No. 333-237284)

filed with the SEC on March 19, 2020, (ii) the post-effective Amendment to Form F-1 in the Registration Statement on Form F-3

(Reg. No. 333-226096) filed with the SEC on March 6, 2019, (iii) Registration Statement on Form F-3 (Reg.

No. 333-174494) filed with the SEC on May 25, 2011, (iv) Registration Statement on Form F-3 (Reg.

No. 333-147099), the related prospectus supplements filed with the SEC on December 17, 2007, January 16, 2009 and

March 27, 2009, (v) Registration Statement on Form S-8 (Reg. No. 333-233128) filed with the SEC on August 8, 2019 and the

reoffer prospectus, dated August 8, 2019, contained therein, (vi) Registration Statement on Form S-8 (Reg.

No. 333-138449) filed with the SEC on November 6, 2006 and the reoffer prospectus, dated November 6, 2006, contained

therein, (vii) Registration Statement on Form F-3 (Reg. No. 333-169101) filed with the SEC on October 8, 2010, (viii)

Registration Statement on Form F-3 (Reg. No. 333-255984) filed with the SEC on May 10, 2021 and (ix) Registration

Statement on Form F-3 (Reg. No. 333-263299) filed with the SEC on March 4, 2022.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 17, 2022

| |

DANAOS CORPORATION |

| |

|

|

| |

By: |

/s/ Evangelos Chatzis |

| |

Name: |

Evangelos Chatzis |

| |

Title: |

Chief Financial Officer |

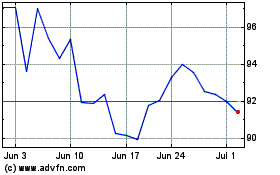

Danaos (NYSE:DAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

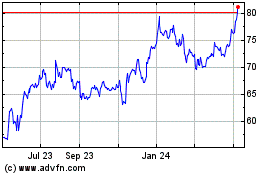

Danaos (NYSE:DAC)

Historical Stock Chart

From Nov 2023 to Nov 2024