M&T Bank Reaffirmed at Neutral - Analyst Blog

June 24 2011 - 11:36AM

Zacks

We have reiterated our Neutral recommendation on the shares

of M&T Bank Corporation

(MTB) on the back of a detailed analysis of its fundamentals, the

completion of the of the acquisition of Wilmington Trust

Corporation in May, the subsequent partial repay of the TARP dues

and the current economic environment.

M&T’s first quarter operating earnings of $1.67 per share

exceeded the Zacks Consensus Estimate of $1.41. Earnings

significantly expanded from $1.23 earned in the prior-year quarter,

aided by an increase in the net interest income on the back of net

interest margin expansion coupled with substantially lower

provision for credit losses.

Going forward, we believe that the strategic acquisitions should

help to augment earnings. The acquisitions of Provident and

Bradford in the Mid-Atlantic region have proved to be meaningful,

both in terms of the customer base and profitability.

Recently, the company has also completed the acquisition of

Wilmington Trust Corp. The deal added 55 branch locations, 225 ATMs

and $10.7 billion in assets, and is expected to be accretive to the

company’s earnings going forward.

The repayment of the bailout money, though in part, is

essentially a positive step as upon full repayment, M&T can

escape restrictions on both financial and executives’ pay package

flexibility that it was subject to upon being a bailout receiver.

The Treasury holds remaining outstanding M&T CPP preferred

shares totaling $381.5 million.

However, the tepid economic recovery remains a headwind. As a

result, we expect the top line of M&T to experience a somewhat

limited growth in the upcoming quarters. In addition, we are also

concerned about the regulatory issues. The overdraft legislation is

expected to result in a decline in service charges on deposit

accounts.

Additionally, though many aspects of the Dodd-Frank Act remain

subject to rulemaking and will take effect over several years, we

think that the provisions in the legislation, which affect deposit

insurance assessments, payment of interest on demand deposits and

interchange fees, could increase the costs associated with deposits

as well as place limitations on certain revenues that these

deposits may generate.

Hence, risk-reward seems balanced for the stock and the Neutral

recommendation is retained. Additionally, shares of M&T Bank

Corp. currently retain the Zacks #3 Rank, which translates into a

short-term ‘Hold’ rating. Currently, M&T Bank Corp.’s peers

such as Comerica Inc. (CMA) and Fifth

Third Bancorp (FITB) also retain the Zacks #3 Rank.

COMERICA INC (CMA): Free Stock Analysis Report

FIFTH THIRD BK (FITB): Free Stock Analysis Report

M&T BANK CORP (MTB): Free Stock Analysis Report

Zacks Investment Research

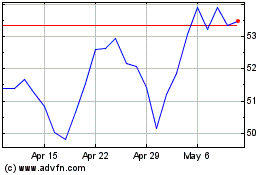

Comerica (NYSE:CMA)

Historical Stock Chart

From May 2024 to Jun 2024

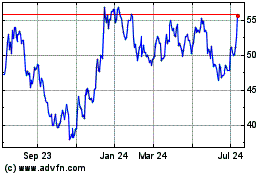

Comerica (NYSE:CMA)

Historical Stock Chart

From Jun 2023 to Jun 2024