Chemed Corporation Responds to Letter from MMI Investments, L.P.

March 16 2009 - 4:18PM

Business Wire

Chemed Corporation (Chemed) (NYSE:CHE), today announced that it

has responded to the letter sent by MMI Investments, L.P. to the

Board of Directors of Chemed on February 12, 2009.

The Company�s response explains that Chemed has carefully

considered MMI�s proposal and that the Board of Directors of Chemed

continues to believe that the interests of the Company�s

stockholders would be best served by maintaining Chemed�s current

corporate structure at this time. Accordingly, Chemed does not

currently intend to pursue a separation of its two businesses,

VITAS and Roto-Rooter, as MMI has proposed.

The full text of the letter that Chemed sent to MMI follows:

March 16, 2009

MMI Investments, L.P. 1370 Avenue of the Americas New York, NY

10019 Attention: Clay Lifflander

Dear Mr. Lifflander:

We welcome MMI�s interest in Chemed. Together with our outside

advisors, our Board of Directors has carefully reviewed the

structural changes proposed by MMI and we have determined to leave

Chemed�s structure unchanged at this time.

Chemed has a long history of creating value for its stockholders

by prudently managing and monetizing its diverse portfolio of

businesses. The Board has recognized the benefits to Chemed and its

stockholders of strategic divestitures, as evidenced by the Dubois

Chemicals, Omnicare, National Sanitary Supply and Patient Care

transactions. The Board�s management has provided stockholders with

solid and consistent returns. Since the announcement of Chemed�s

acquisition of VITAS in December 2003, Chemed�s stock has

appreciated over 121%, at a compounded annual growth rate of over

15%.

As this track record clearly demonstrates, Chemed�s Board of

Directors is always willing to make structural changes to advance

the interests of the Company�s stockholders. Due to our past

success in unlocking value through spin-offs and other strategic

transactions, the Chemed Board regularly discusses strategic

alternatives for VITAS and Roto-Rooter, including their potential

separation. In fact, we began considering this possibility even

prior to completing our acquisition of VITAS.

We agree with the statement in your letter that, �A spin-off of

one of Chemed's businesses would be relatively simple�given

Chemed's discrete operating structure and minimal shared

resources;� however it is important to note that this statement is

true only because the Board has already positioned Chemed�s

businesses to facilitate such a separation. Although we firmly

believe that our two businesses are currently more valuable to

stockholders together than apart, due to our foresight and

planning, we are well-positioned to separate the businesses if and

when the time is right.

Upon receipt of your letter, the Board worked with our outside

financial advisors, Lazard LLC and J.P. Morgan Securities Inc., and

our outside counsel, Cravath, Swaine & Moore LLP, to refresh

our analysis of Chemed�s current structure and to reconsider a

potential separation of the businesses. This recent review

reconfirmed that executing a separation in the current market

environment, including the current state of the equity and credit

markets, would be risky and could impair, rather than create, value

for Chemed�s current stockholders. Value creation through a

spin-off is dependent on either strong capital markets with demand

for small-cap stocks or a vibrant M&A environment. Based on our

analysis, current stock market valuations and, as you termed it,

the �moribund� state of M&A, we believe that creating two

smaller companies could be value destructive to our

stockholders.

In summary, our track record of value-enhancing transactions and

our actions to position VITAS and Roto-Rooter as distinct

standalone entities demonstrates that the Board has long recognized

the merits of the strategy MMI has proposed. We agree that given

the proper economic circumstances a separation could create

substantial shareholder value. However, we firmly believe that now

is not the right time to implement this strategy.

As has been our practice, the Board of Directors of Chemed will

continue to regularly review the benefits and feasibility of

strategies designed to create shareholder value. Once again, thank

you for your input and for your interest in Chemed.

Sincerely,

Kevin J. McNamara

About Chemed

Listed on the New York Stock Exchange and headquartered in

Cincinnati, Ohio, Chemed Corporation (www.chemed.com) operates two

wholly owned subsidiaries: VITAS Healthcare and Roto-Rooter. VITAS

is the nation's largest provider of end-of-life hospice care and

Roto-Rooter is the nation�s leading provider of plumbing and drain

cleaning services.

Forward Looking Statements

Statements in this press release or in other Chemed

communications may relate to future events or Chemed's future

performance. Such statements are forward-looking statements and are

based on present information Chemed has related to its existing

business circumstances. Investors are cautioned that such

forward-looking statements are subject to inherent risk and that

actual results may differ materially from such forward-looking

statements. Further, investors are cautioned that Chemed does not

assume any obligation to update forward-looking statements based on

unanticipated events or changed expectations.

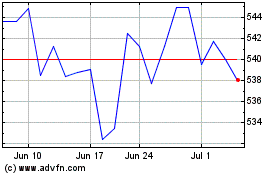

Chemed (NYSE:CHE)

Historical Stock Chart

From May 2024 to Jun 2024

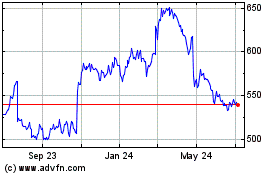

Chemed (NYSE:CHE)

Historical Stock Chart

From Jun 2023 to Jun 2024